Kansas Extension Form

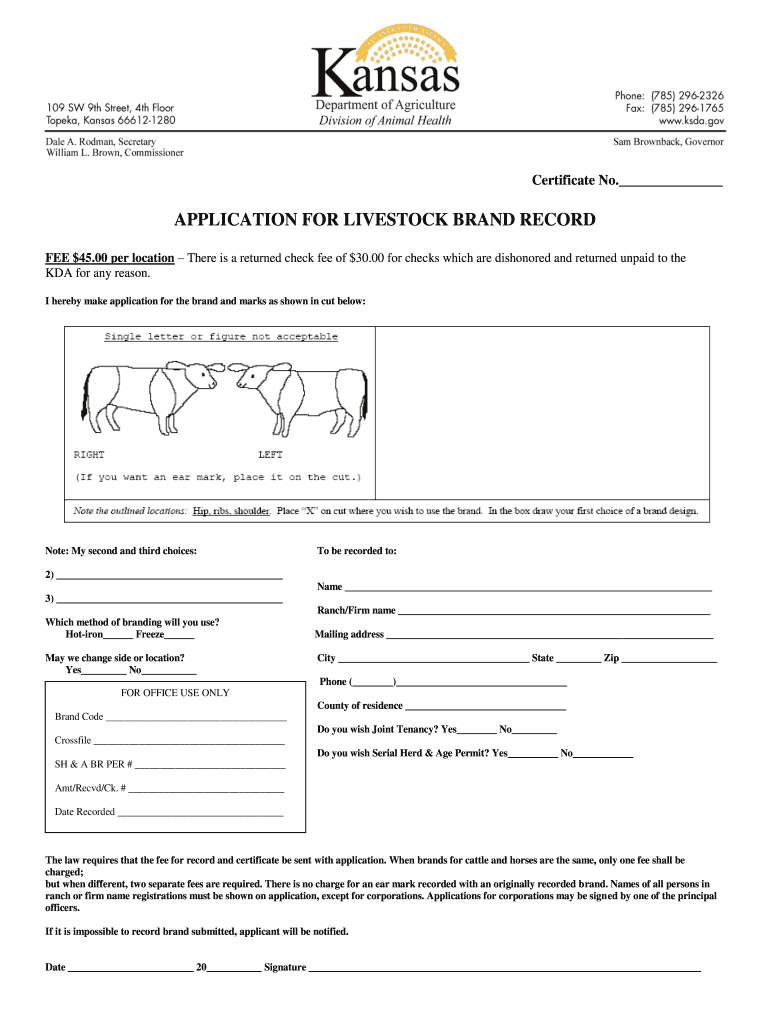

Kansas Extension Form - Effective january 1, 2022, paid tax return preparers must sign any return prepared or partially prepared and must include the. Web enter the amount paid with your request for an extension of time to file. Web form made fillable by eforms relationship to patient. When a due date falls on a saturday, sunday or legal. To pay the tax balance due for an extension, use the. Web extended deadline with kansas tax extension: Check the box on the voucher for extension payment. Taxpayers have until the end of the night monday to meet the irs deadline for filing a late tax return. Web kansas taxpayer protection act. Web no additional forms are required to benefit from the extension. To pay the tax balance due for an extension, use the. Corporation income tax returns are due by april 15 — or by the 15 th day of the 4 th month following the close of the taxable year. The due dates for kansas individual estimated tax payments has not changed. Web enter the amount paid with your request for. The state of kansas follows the federal. When a due date falls on a saturday, sunday or legal. To pay the tax balance due for an extension, use the. When is the due date to file. Web an upcoming virtual workshop series for midwestern farm and ranch women will teach the basics of tax planning for agricultural operations. Corporation income tax returns are due by april 15 — or by the 15 th day of the 4 th month following the close of the taxable year. Fees may be paid by money. Web extension requests must be submitted by april 18th, 2023. To pay the tax balance due for an extension, use the. Taxpayers have until the end. The state of kansas follows the federal. Check the box on the voucher for extension payment. Web does kansas support tax extension for personal income tax return? If you are entitled to a refund, an extension is not required. When is the due date to file. If you are filing a joint return,. When is the due date to file. Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank account What form does the state of kansas require to apply for an extension? When a. You will need to keep a copy of your extension request for your records. Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank account Taxpayers have until the end of the night monday to meet the irs deadline for. To request a refund of tax withheld. Web an upcoming virtual workshop series for midwestern farm and ranch women will teach the basics of tax planning for agricultural operations. Web does kansas support tax extension for personal income tax return? Check the box on the voucher for extension payment. Taxpayers have until the end of the night monday to meet. The due dates for kansas individual estimated tax payments has not changed. To request a refund of tax withheld. Web does kansas support tax extension for personal income tax return? When a due date falls on a saturday, sunday or legal. You will need to keep a copy of your extension request for your records. There is no fee for an extension. If you are entitled to a refund, an extension is not required. To request a refund of tax withheld. You will need to keep a copy of your extension request for your records. The state of kansas follows the federal. If you owe zero tax or you’re due a state tax refund, you do not have. When a due date falls on a saturday, sunday or legal. The due dates for kansas individual estimated tax payments has not changed. Fees may be paid by money. Web does kansas support tax extension for personal income tax return? Web no additional forms are required to benefit from the extension. Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank account Effective january 1, 2022, paid tax return preparers must sign any return prepared or partially prepared and must include the. When a due date falls on a saturday, sunday or legal. When is the due date to file. Web kansas filing due date: If you owe zero tax or you’re due a state tax refund, you do not have. The state of kansas follows the federal. Web kansas does not have a separate extension request form. Check the box on the voucher for extension payment. Corporation income tax returns are due by april 15 — or by the 15 th day of the 4 th month following the close of the taxable year. If you are filing a joint return,. To request a refund of tax withheld. The due dates for kansas individual estimated tax payments has not changed. You will need to keep a copy of your extension request for your records. If you are entitled to a refund, an extension is not required. Web extension requests must be submitted by april 18th, 2023. Web extended deadline with kansas tax extension: Web kansas taxpayer protection act. Web does kansas support tax extension for personal income tax return?Kansas Application Livestock Brand Fill Online, Printable, Fillable

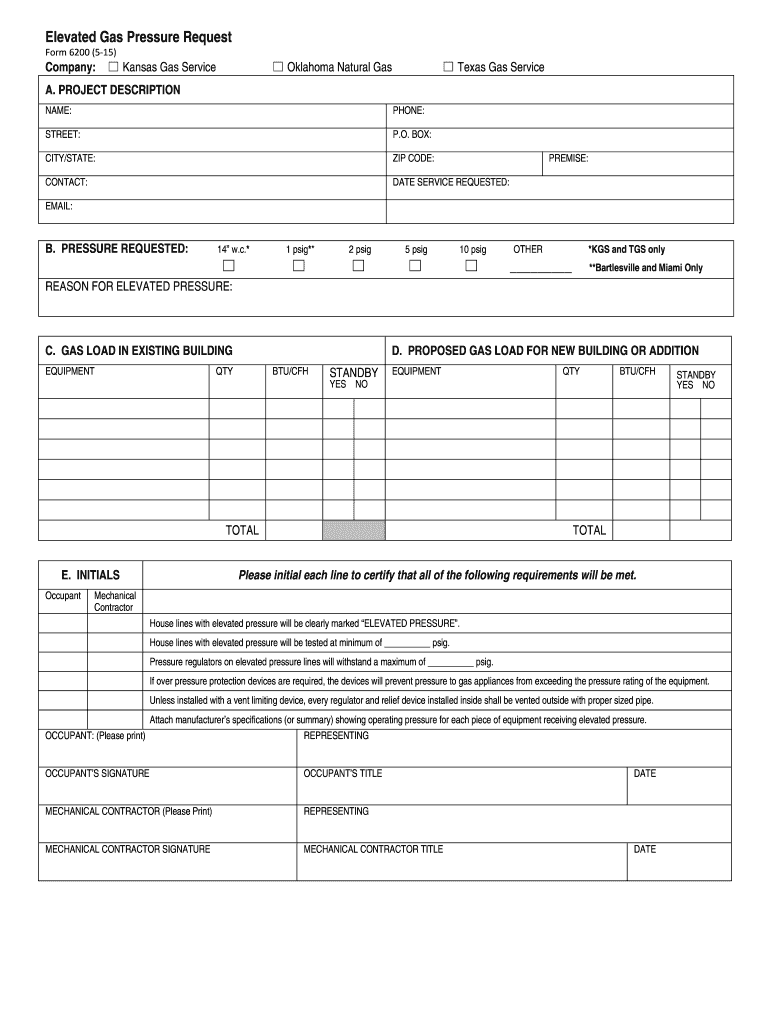

KS Form 6200 20152021 Fill and Sign Printable Template Online US

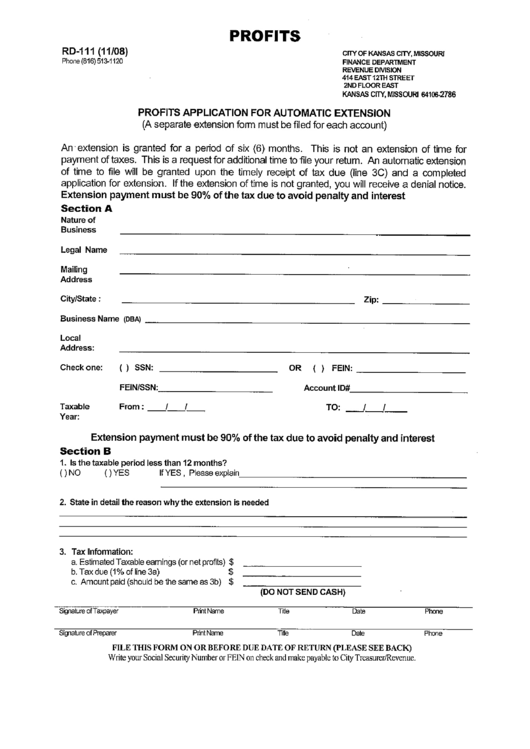

Form Rd111 Prifits Application For Automatic Extension City Of

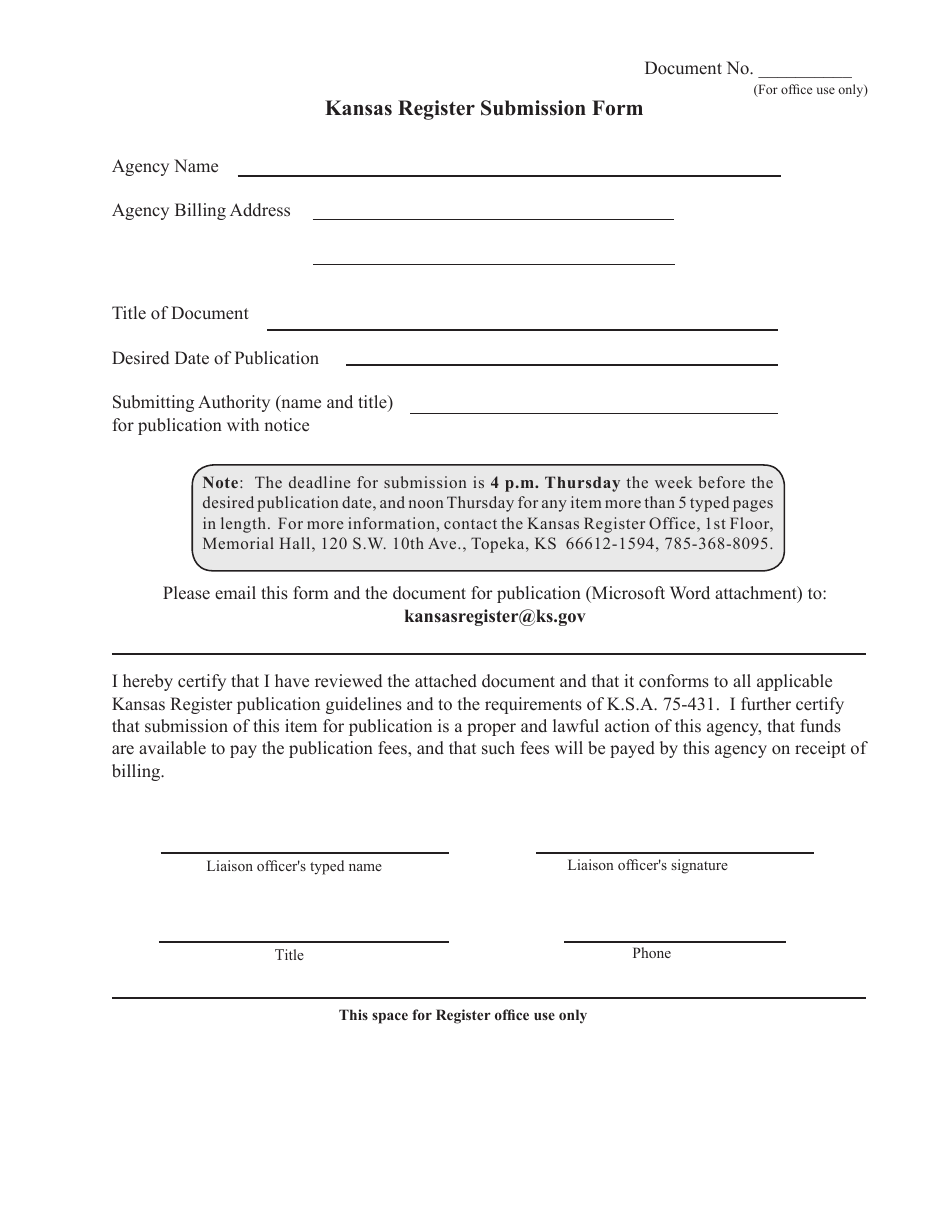

Kansas Kansas Register Submission Form Fill Out, Sign Online and

Residential Lease Extension Form Forms NTIyNw Resume Examples

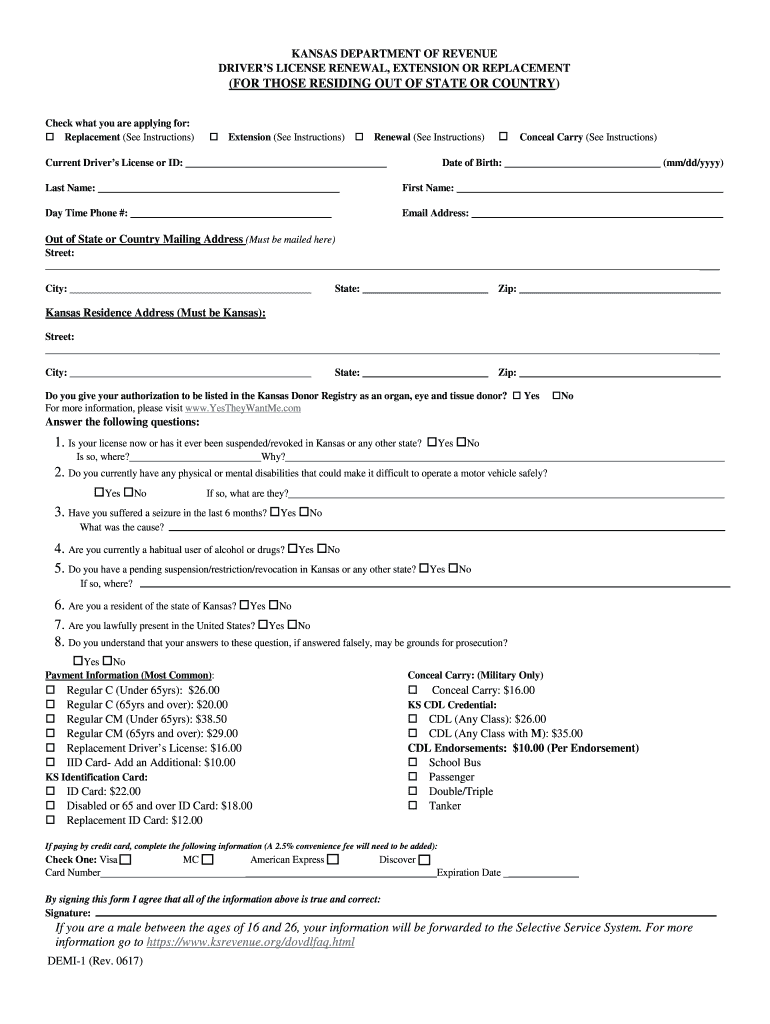

Driver's License Renewal, Extension or Replacement Kansas Form 2017

State Of Kansas Forms Fill Online, Printable, Fillable, Blank pdfFiller

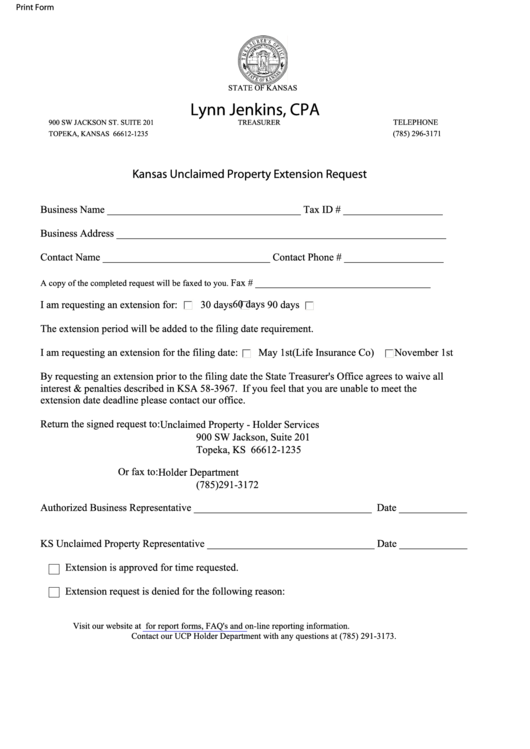

Fillable Kansas Unclaimed Property Extension Request Form printable pdf

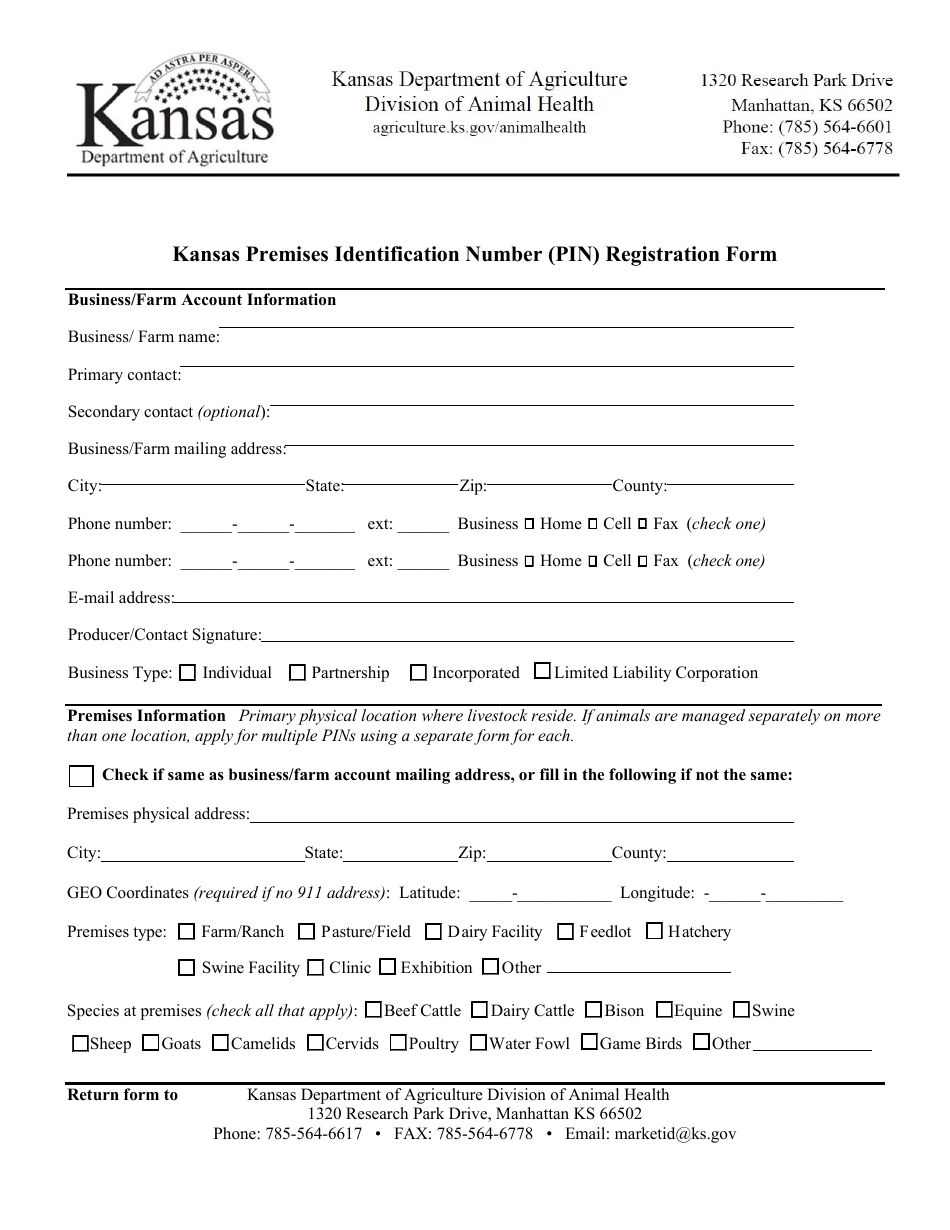

Kansas Kansas Premises Identification Number (Pin) Registration Form

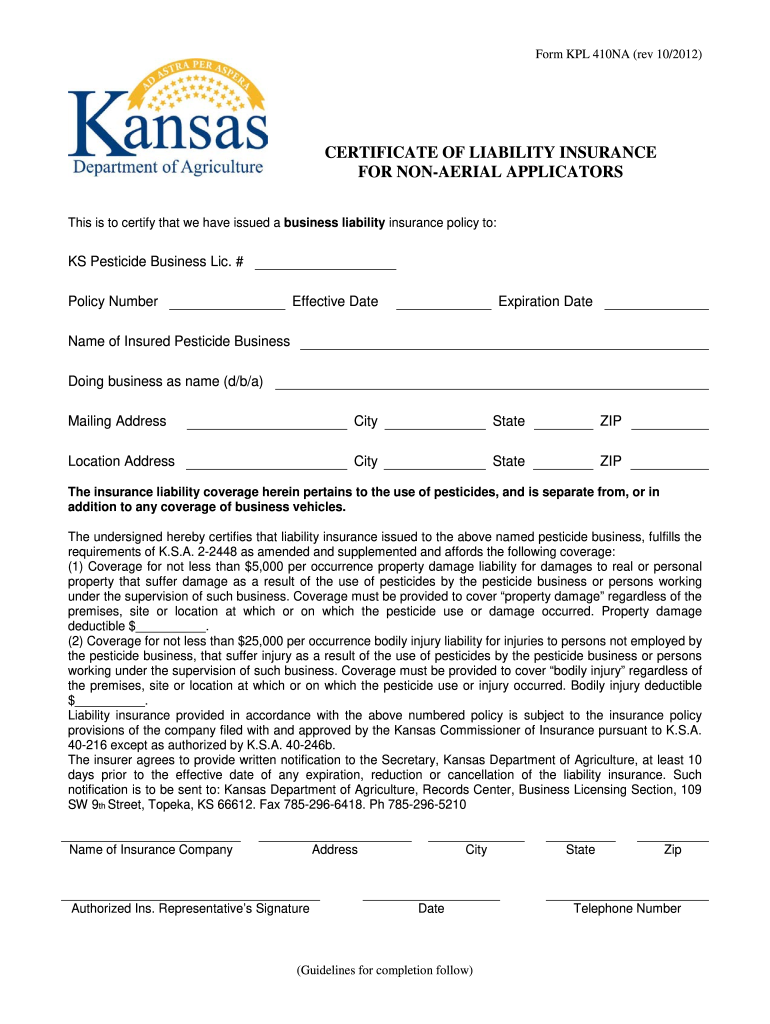

Kansas Form Applicators Print Fill Online, Printable, Fillable, Blank

Related Post: