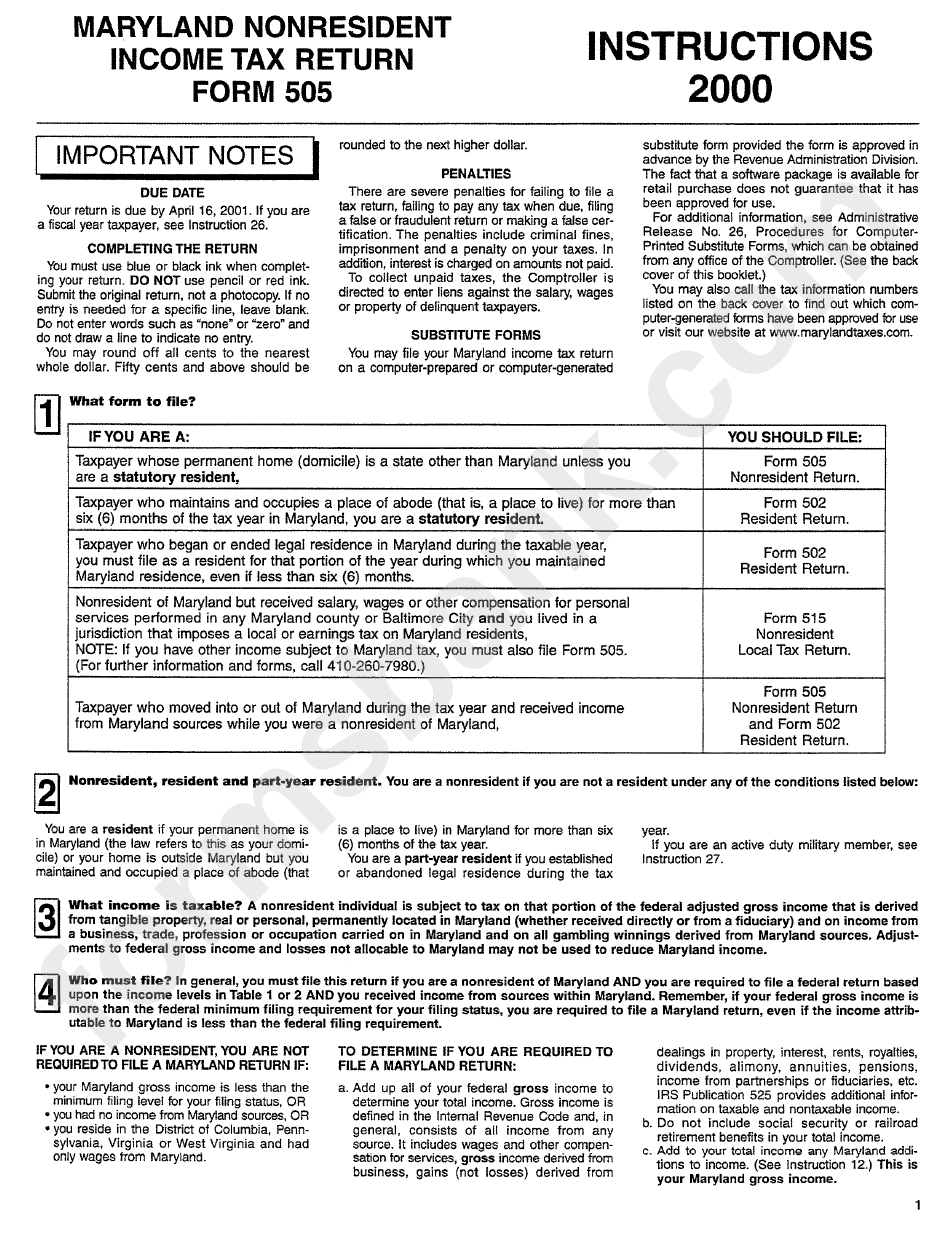

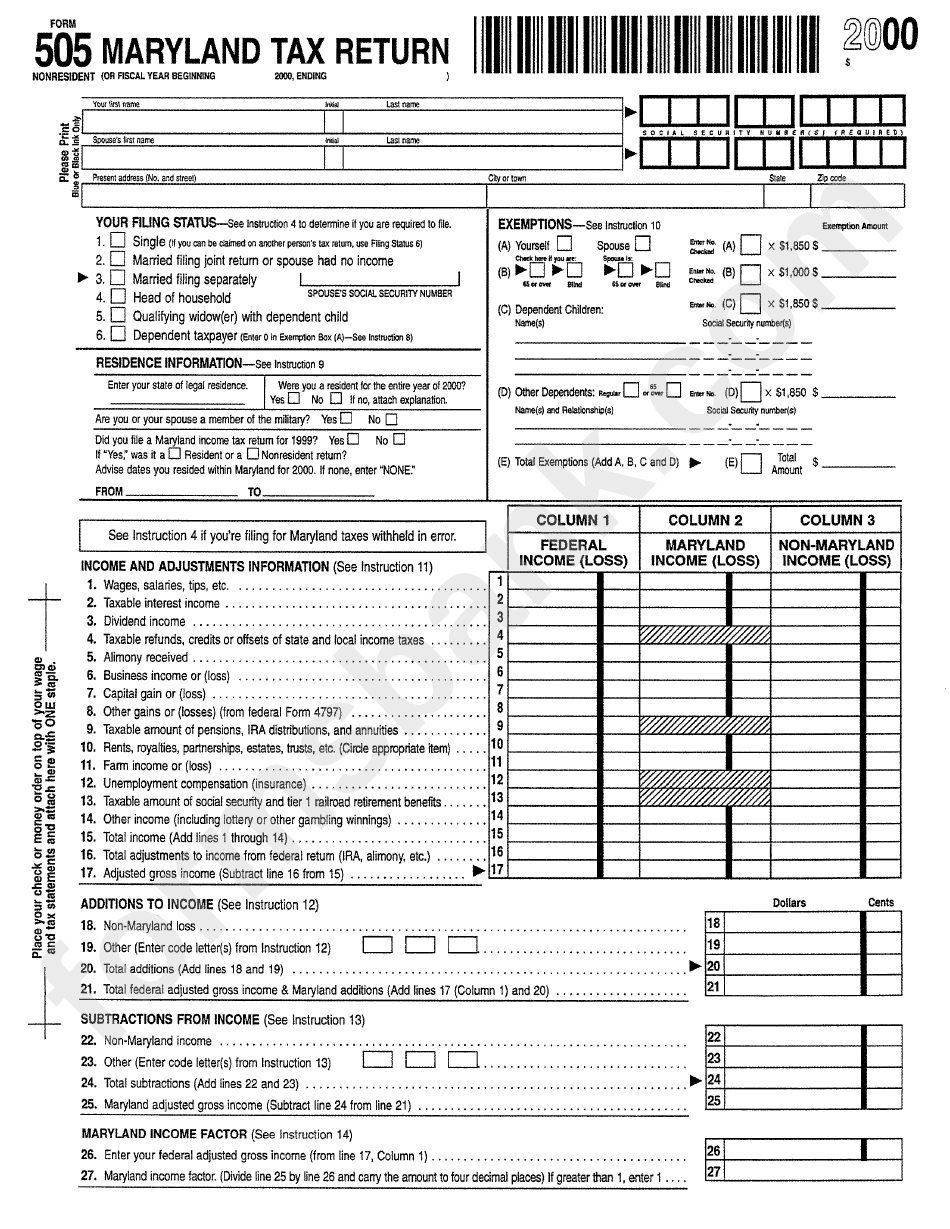

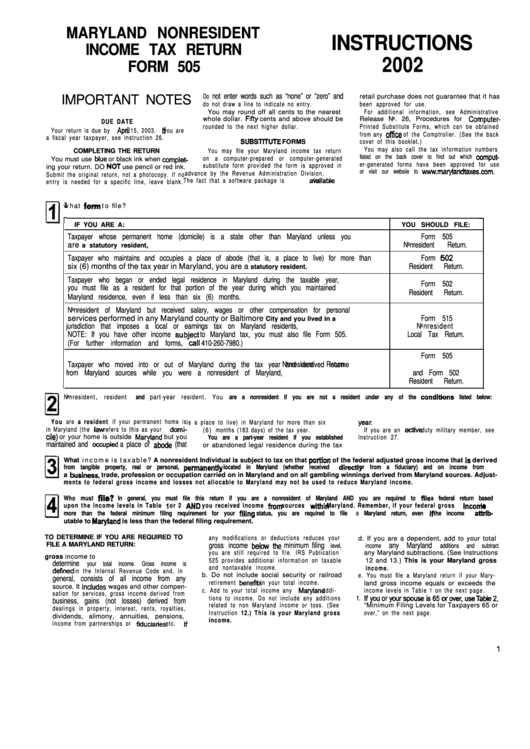

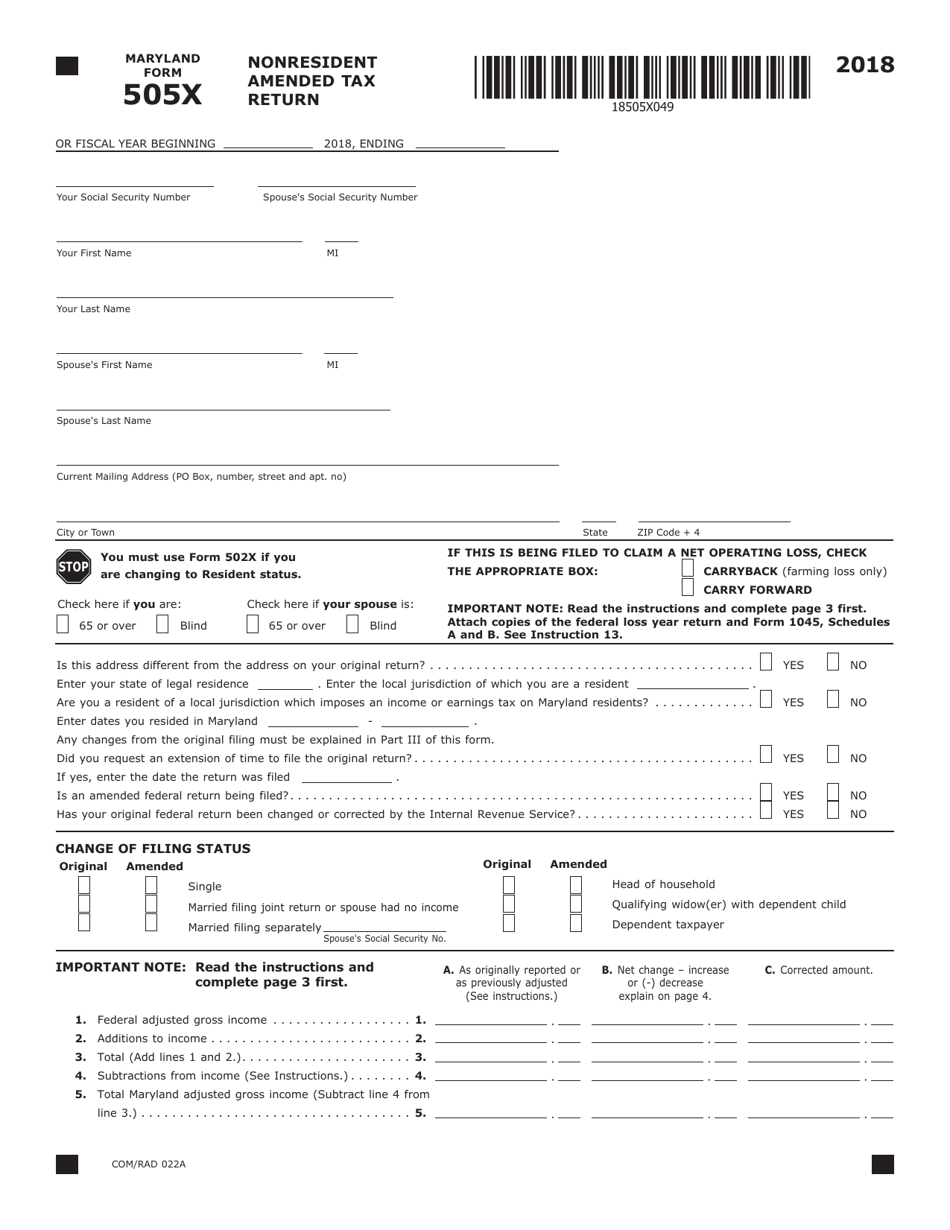

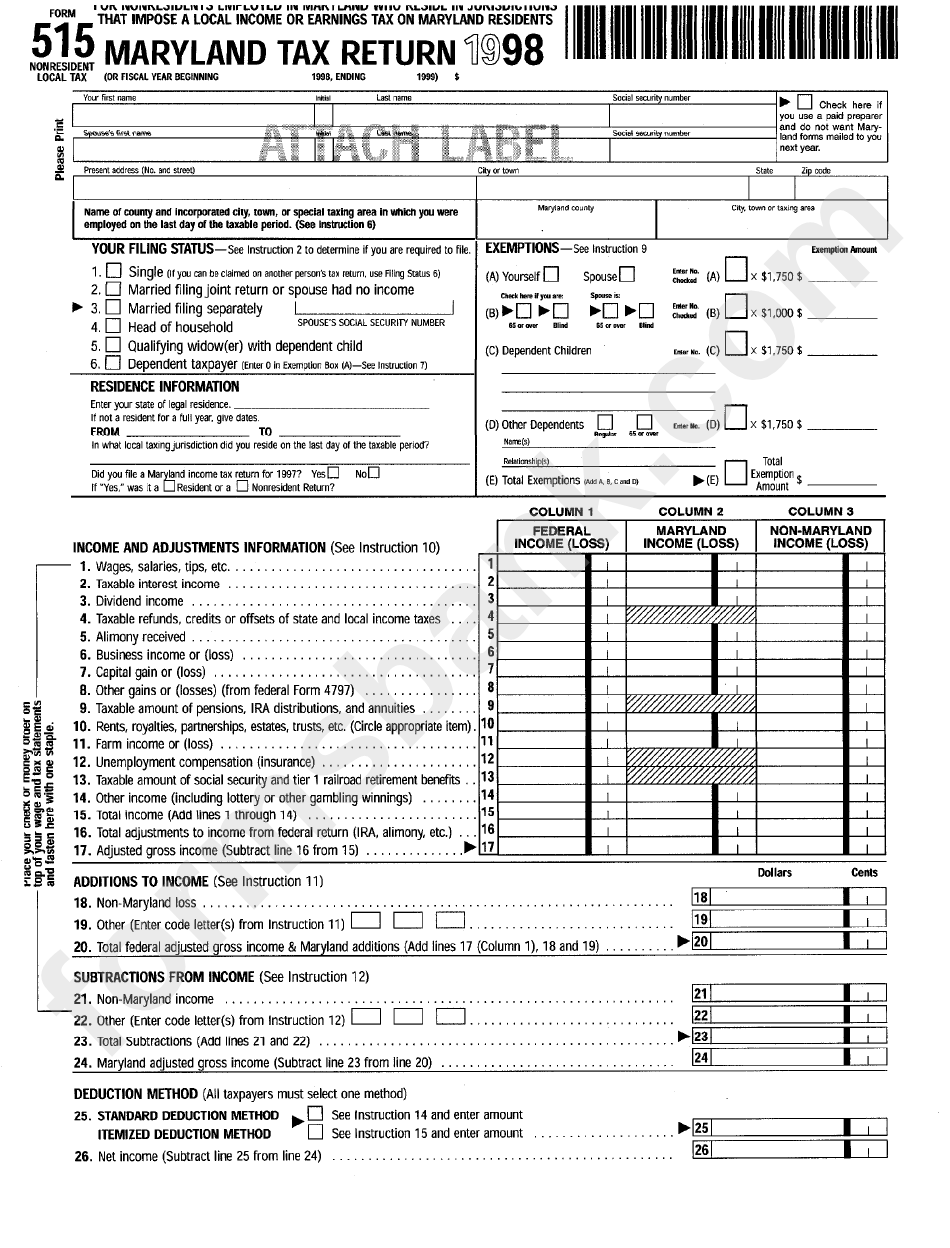

Maryland Form 505 Instructions

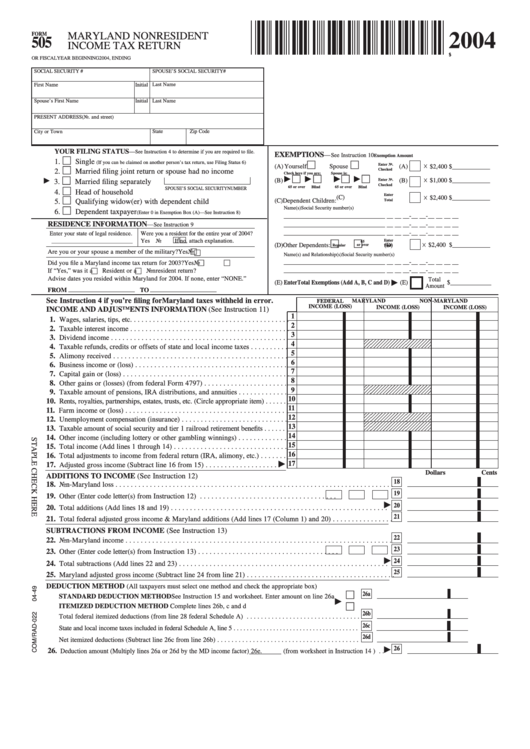

Maryland Form 505 Instructions - If you are using form 505nr with form. Maryland nonresident income tax calculation. Complete, edit or print tax forms instantly. Web 2022 individual income tax instruction booklets. Web if you are a nonresident of maryland, you are required to file form 505 (maryland nonresident income tax return) and form 505nr (maryland nonresident income tax. Web make checks payable to comptroller of maryland. Place form ind pv with attached check/money order. Maryland state and local tax forms and instructions. Section on page 3 of form 505 and its instruction 23 were expanded for taxpayers to authorize the state of maryland to disclose to their. Web maryland 2021 form 505 nonresident income tax return direct deposit of refund (see instruction 22.) be sure the account information is correct. For returns filed without payments, mail your completed return to: Attach to your tax return. • direct deposit of refund. Web 505 nonresident income tax return. Web for tax year 2021, maryland's personal tax rates begin at 2% on the first $1000 of taxable income and increase up to a maximum of 5.75% on incomes exceeding $250,000 (or. Web option 1 (include all) go to the maryland > composite worksheet. Complete, edit or print tax forms instantly. Web we last updated the maryland nonresident income tax return in january 2023, so this is the latest version of form 505, fully updated for tax year 2022. Web 2022 individual income tax instruction booklets. Attach to your tax return. Place form ind pv with attached check/money order. If you are sending a form. Get ready for tax season deadlines by completing any required tax forms today. Web 2022 individual income tax instruction booklets. Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Section on page 3 of form 505 and its instruction 23 were expanded for taxpayers to authorize the state of maryland to disclose to their. Place form ind. Web for tax year 2021, maryland's personal tax rates begin at 2% on the first $1000 of taxable income and increase up to a maximum of 5.75% on incomes exceeding $250,000 (or. Web 2022 individual income tax instruction booklets. Web make checks payable to comptroller of maryland. For returns filed without payments, mail your completed return to: Get ready for. Place form ind pv with attached check/money order. Web make checks payable to comptroller of maryland. Section on page 3 of form 505 and its instruction 23 were expanded for taxpayers to authorize the state of maryland to disclose to their. Get ready for tax season deadlines by completing any required tax forms today. Web option 1 (include all) go. Web if you are a nonresident of maryland, you are required to file form 505 (maryland nonresident income tax return) and form 505nr (maryland nonresident income tax. If you are sending a form. Web 505 nonresident income tax return. Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form. Direct deposit of refund (see instruction 22.) verify that all account information is. Web if you are a nonresident of maryland, you are required to file form 505 (maryland nonresident income tax return) and form 505nr (maryland nonresident income tax. Maryland state and local tax forms and instructions. Return taxpayer who moved into or out of. Section on page 3. Do not attach form ind pv or check/money order to form 505. 505x nonresident amended tax return all forms will be available at www.marylandtaxes.gov. Web 505 nonresident income tax return. Web if you are a nonresident of maryland, you are required to file form 505 (maryland nonresident income tax return) and form 505nr (maryland nonresident income tax. Section on page. Web if you are a nonresident of maryland, you are required to file form 505 (maryland nonresident income tax return) and form 505nr (maryland nonresident income tax. If you are sending a form. Maryland nonresident income tax calculation. Place form ind pv with attached check/money order. Web payment voucher with instructions and worksheet for individuals sending check or money order. Web maryland 2021 form 505 nonresident income tax return direct deposit of refund (see instruction 22.) be sure the account information is correct. Web as a nonresident of maryland, you are required to file a nonresident income tax return form 505 and use form 505nr to calculate your nonresident tax, if you have income. Maryland nonresident income tax calculation. Web option 1 (include all) go to the maryland > composite worksheet. Get ready for tax season deadlines by completing any required tax forms today. Attach to your tax return. Web we last updated the maryland nonresident income tax return in january 2023, so this is the latest version of form 505, fully updated for tax year 2022. Web 2022 individual income tax instruction booklets. Complete, edit or print tax forms instantly. Web if you are a nonresident of maryland, you are required to file form 505 (maryland nonresident income tax return) and form 505nr (maryland nonresident income tax. Complete, edit or print tax forms instantly. If you are using form 505nr with form. Do not attach form ind pv or check/money order to form 505. Web for tax year 2021, maryland's personal tax rates begin at 2% on the first $1000 of taxable income and increase up to a maximum of 5.75% on incomes exceeding $250,000 (or. Web the form pv is a payment voucher you will send with your check or money order for any balance due in the “total amount due” line of your forms 502 and 505, estimated tax. If you are sending a form. 505x nonresident amended tax return all forms will be available at www.marylandtaxes.gov. Return taxpayer who moved into or out of. Direct deposit of refund (see instruction 22.) verify that all account information is. Get ready for tax season deadlines by completing any required tax forms today.Form 505 Maryland Nonresident Tax Return 2000 printable pdf

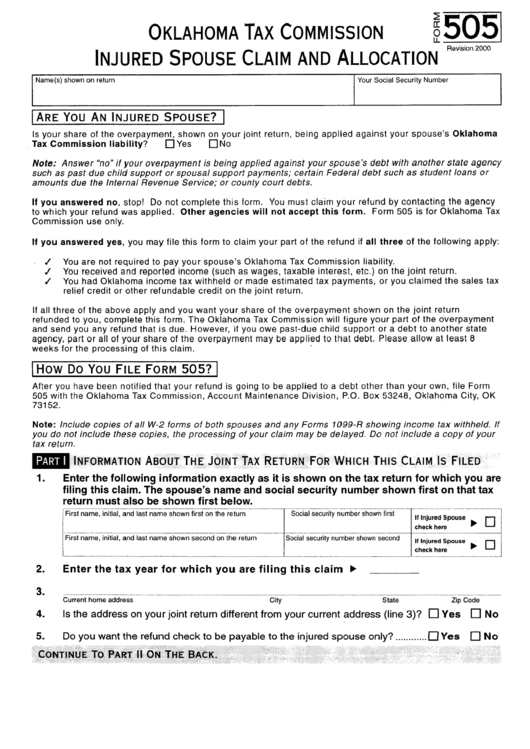

Form 505 Injured Spouse Claim And Allocation printable pdf download

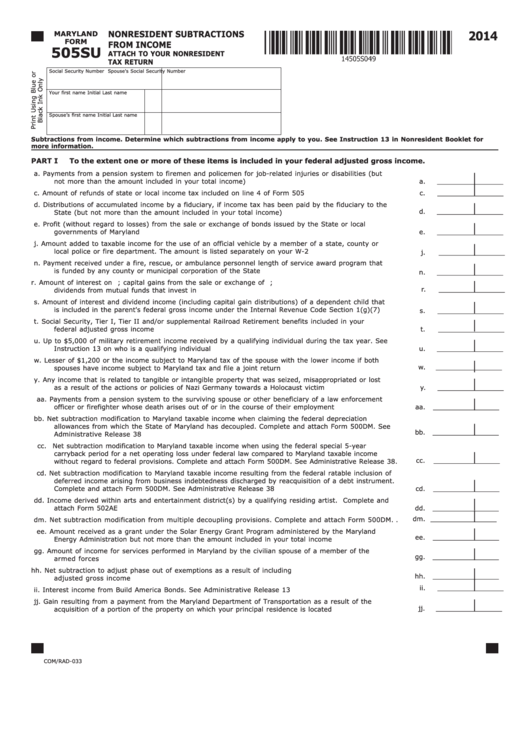

Fillable Maryland Form 505su Nonresident Subtractions From

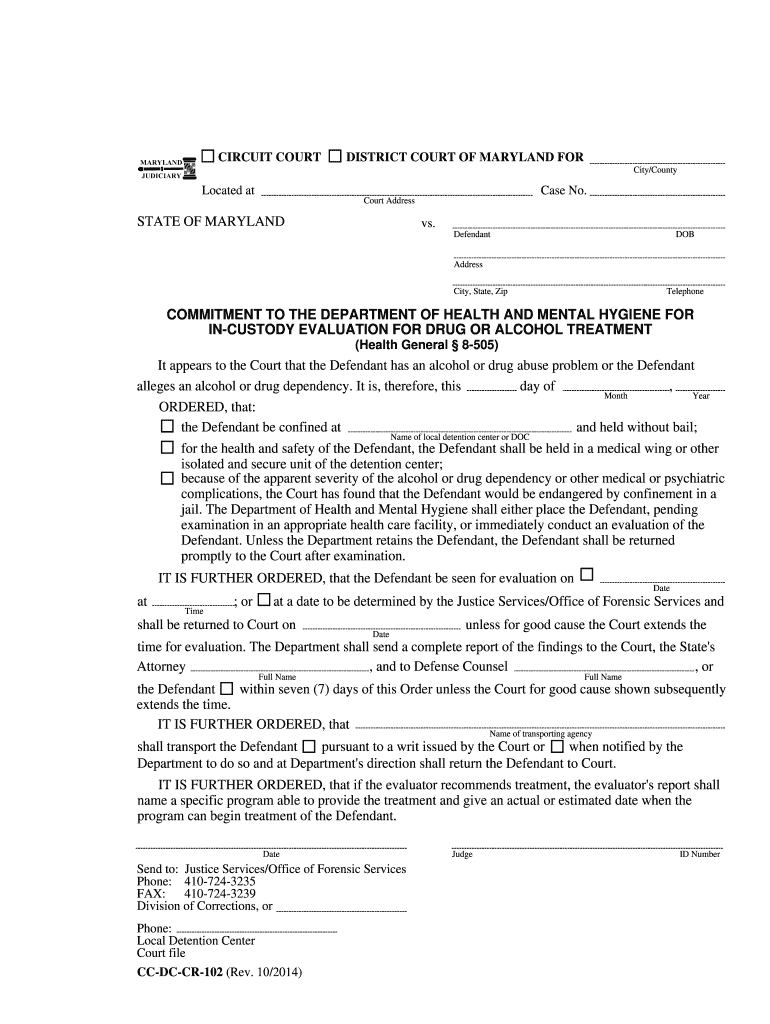

Maryland 8 505 Form Fill Out and Sign Printable PDF Template signNow

Form 505 Nonresident Maryland Tax Return 2000 printable pdf download

Instructions For Maryland Nonresident Tax Return Form 505 2002

Form COM/RAD022A (Maryland Form 505X) Download Fillable PDF or Fill

Fill Form 505 2020 NONRESIDENT TAX RETURN MARYLAND

Fillable Form 515 Maryland Tax Return 1998 printable pdf download

Fillable Form 505 Maryland Nonresident Tax Return 2004

Related Post: