Who Fills Out California Form 593

Who Fills Out California Form 593 - Trust, estate, or reep) who withheld on the sale/transfer. The california franchise tax board (ftb) june 1 issued the 2023 instructions for form 593. Start completing the fillable fields and. Web how do i enter ca form 593 real estate withholding? Escrow provides this form to the seller, typically when. Web • the seller is a corporation (or a limited liability company (llc) classified as a corporation for federal and california income tax purposes) that is either qualified through the. Web select the links below for solutions to frequently asked questions on entering form 593 into the dispositions screen in an individual return. Your california real estate withholding has to be entered on both the state and the federal return.first,. Fill in the blank areas; Engaged parties names, places of residence and phone numbers etc. If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate. The real estate escrow person (reep) is. The escrow company will provide this form to the seller,. • individuals • corporations • partnerships • limited liability. Web california real estate withholding. Your california real estate withholding has to be entered on both the state and the federal return.first,. Open it using the online editor and start editing. Any remitter (individual, business entity, trust, estate, or reep) who withheld on the sale/transfer of california real property must file. Start completing the fillable fields and. Engaged parties names, places of residence and phone numbers etc. If this is an installment sale payment after. Any remitter (individual, business entity, trust, estate, or reep) who withheld on the sale/transfer of california real property must file form 593 to report the amount withheld. Web sales taxes are applied to the transfer of. If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. Unless an exemption applies, all of the following are subject to real estate withholding: Engaged parties names, places of residence and phone numbers etc. Use get form or simply click on the template preview to open. Trust, estate, or reep) who withheld on the sale/transfer. Open it using the online editor and start editing. Escrow provides this form to the seller, typically when. Unless an exemption applies, all of the following are subject to real estate withholding: The escrow company will provide this form to the seller, typically. Web california real estate withholding. Web the seller is a california partnership or qualified to do business in california (or an llc that is classified as a partnership for federal and california income tax purposes that is. Fill in the blank areas; Engaged parties names, places of residence and phone numbers etc. Web select the links below for solutions to. Escrow provides this form to the seller, typically when. Web select the links below for solutions to frequently asked questions on entering form 593 into the dispositions screen in an individual return. Web california real estate withholding. Web general information real estate withholding requirement withholding is required when california real estate is sold or transferred. Open it using the online. Web california real estate withholding. Web find the form 593 fillable you require. Engaged parties names, places of residence and phone numbers etc. • individuals • corporations • partnerships • limited liability. If you are a seller, buyer, real estate escrow person (reep), or qualified intermediary (qi), use this guide to help you complete form 593,. We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate. Escrow provides this form to the seller, typically when. Start completing the fillable fields and. If this is an installment sale payment after. Any remitter (individual, business entity, trust, estate, or reep) who withheld on the sale/transfer of california real property. Web • the seller is a corporation (or a limited liability company (llc) classified as a corporation for federal and california income tax purposes) that is either qualified through the. The escrow company will provide this form to the seller, typically. Web general information real estate withholding requirement withholding is required when california real estate is sold or transferred. Web. Start completing the fillable fields and. Web • the seller is a corporation (or a limited liability company (llc) classified as a corporation for federal and california income tax purposes) that is either qualified through the. The california franchise tax board (ftb) june 1 issued the 2023 instructions for form 593. Web use form 593, real estate withholding tax statement, to report real estate withholding on sales closing in 2018, installment payments made in 2018, or exchanges that were. Engaged parties names, places of residence and phone numbers etc. Your california real estate withholding has to be entered on both the state and the federal return.first,. Web how did we do? Use get form or simply click on the template preview to open it in the editor. Web find the form 593 fillable you require. If this is an installment sale payment after. We now have one form 593, real estate withholding statement, which is filed with ftb after every real estate. Trust, estate, or reep) who withheld on the sale/transfer. Escrow provides this form to the seller, typically when. Open it using the online editor and start editing. Web select the links below for solutions to frequently asked questions on entering form 593 into the dispositions screen in an individual return. Web general information real estate withholding requirement withholding is required when california real estate is sold or transferred. Web the seller is a california partnership or qualified to do business in california (or an llc that is classified as a partnership for federal and california income tax purposes that is. Web how do i enter ca form 593 real estate withholding? Web sales taxes are applied to the transfer of goods (and sometimes services) to the end consumer in most of the fifty states, and are collected by the vendor from their customers. Any remitter (individual, business entity, trust, estate, or reep) who withheld on the sale/transfer of california real property must file form 593 to report the amount withheld.California form 593 e Fill out & sign online DocHub

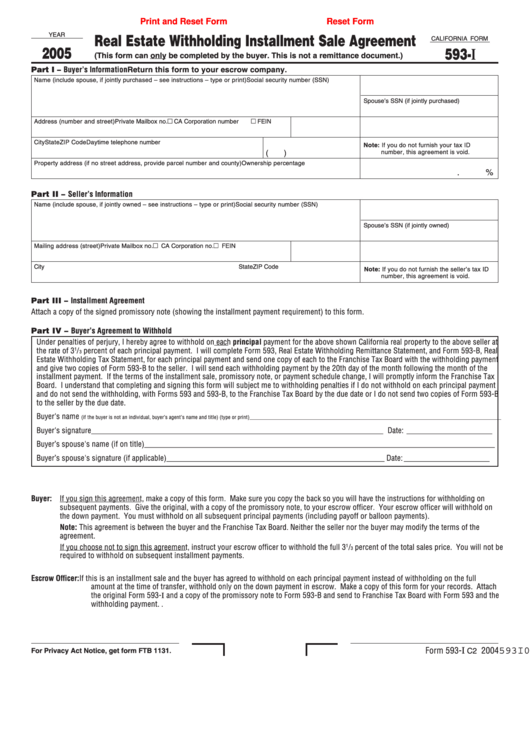

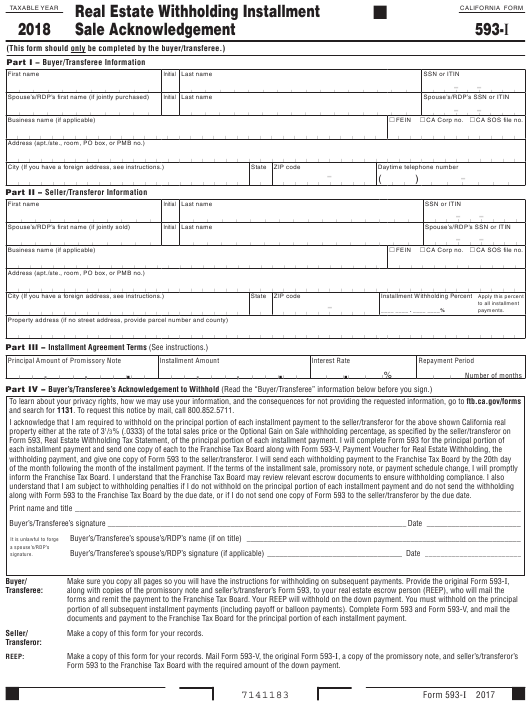

Fillable California Form 593I Real Estate Withholding Installment

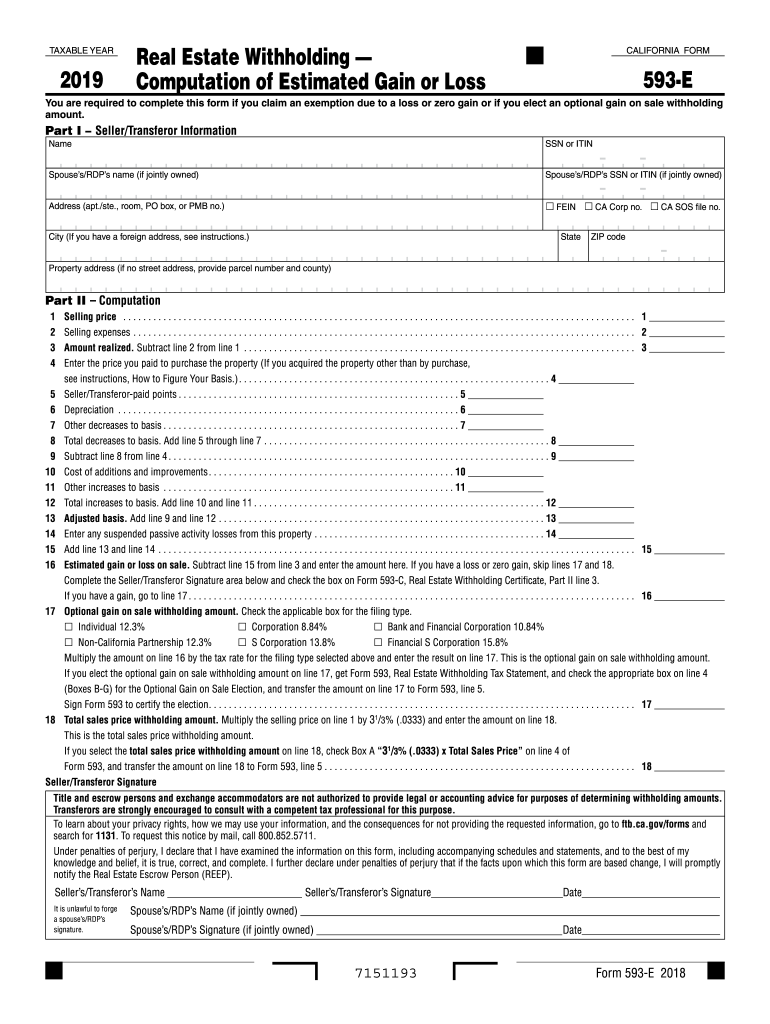

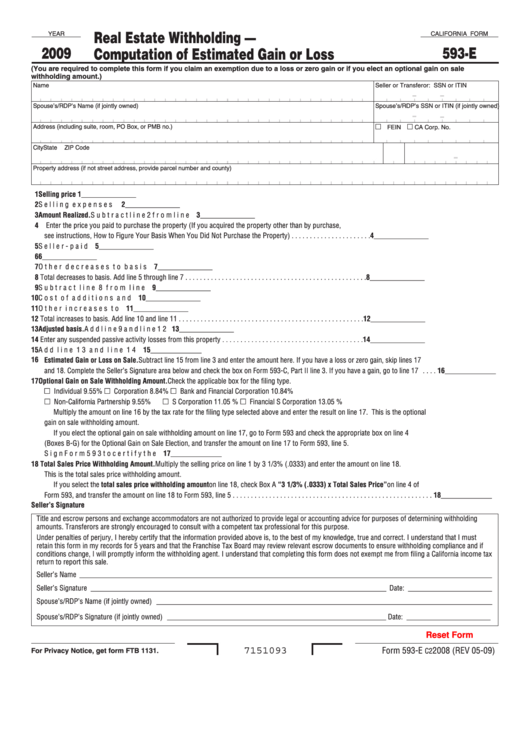

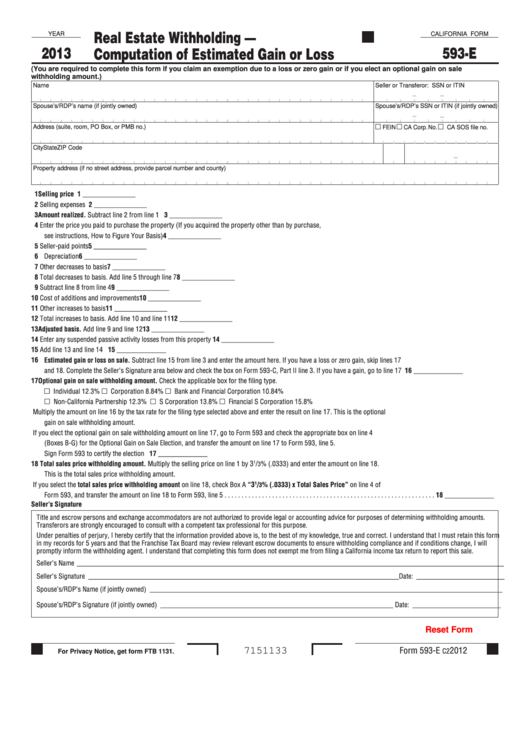

Fillable California Form 593E Real Estate Withholding Computation

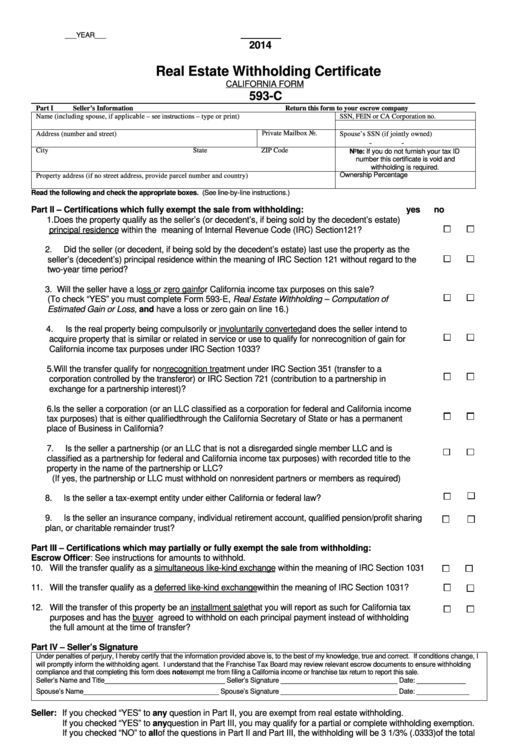

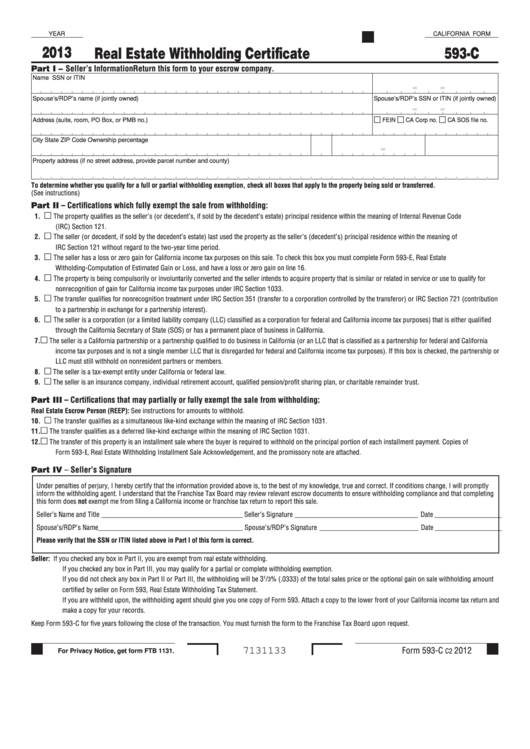

California Form 593C Real Estate Withholding Certificate 2014

Ca Form 593 slidesharetrick

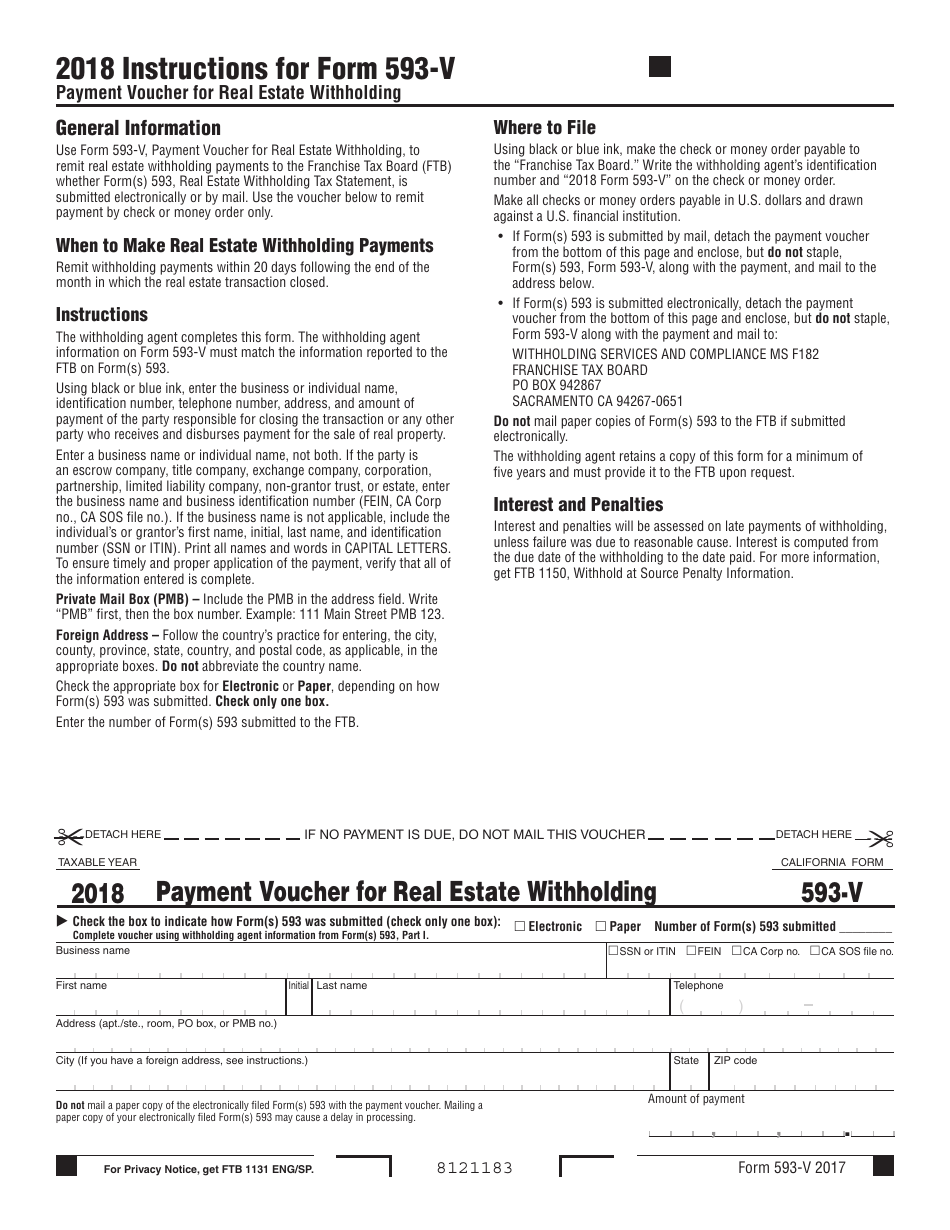

Form 593V 2018 Fill Out, Sign Online and Download Printable PDF

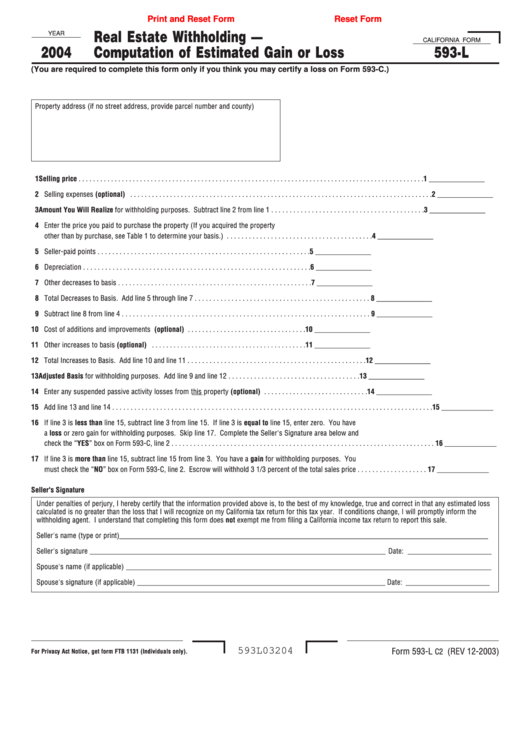

Fillable California Form 593L Real Estate Withholding Computation

2022 Form 593 Real Estate Withholding Tax Statement

Fillable California Form 593E Real Estate Withholding Computation

California Form 593 Fillable Printable Forms Free Online

Related Post: