Form 8992 Schedule B

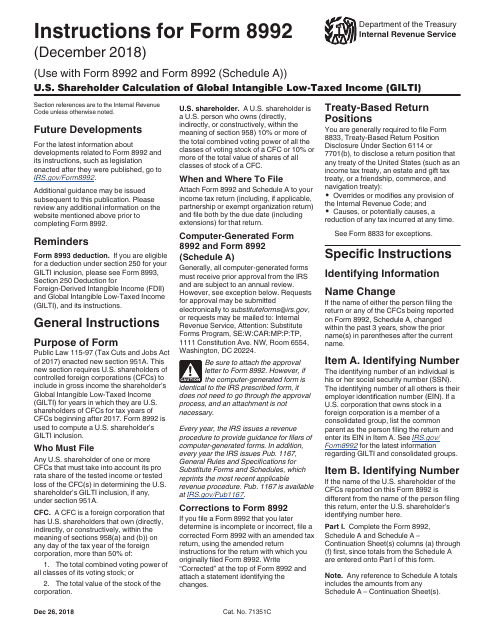

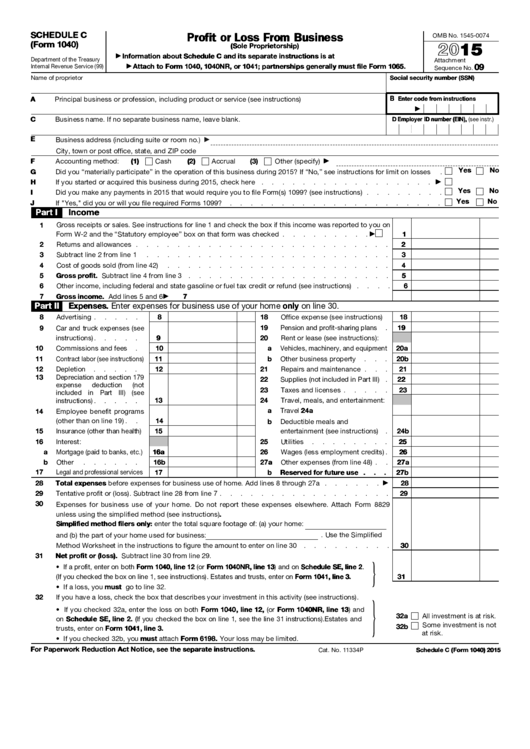

Form 8992 Schedule B - Additionally, a consolidated form 8992 is completed for the consolidated group. Web from form 8992, schedule a, line 1, column (e). December 2022) department of the treasury internal revenue service. Schedule of controlled foreign corporation (cfc) information to. The new form consists of part i, part ii and schedule a. Consolidated group who are u.s. Global intangible low taxed income. Consolidated group who are u.s. Consolidated group, enter the amount from schedule b (form 8992), part ii, column (f), that pertains to the u.s. Web attach schedule b (form 8992) and one consolidated form 8992 to the u.s. Web new form 8992. Date of birth (yyyymmdd) 4. Web draft instructions for form 8992, u.s. Web schedule b (form 8992) (december 2020) department of the treasury internal revenue service. Web schedule b (form 8992) (rev. Schedule of controlled foreign corporation (cfc) information to. Web schedule a (form 8992) (rev. Complete a single schedule b (form 8992) for all members of the u.s. Web a separate form 8992 is completed for each of the u.s. Consolidated group, enter the amount from schedule b (form 8992), part ii, column (f), that pertains to the u.s. Consolidated group who are u.s. Consolidated group, enter the amount from schedule b (form 8992), part ii,. Web attach schedule b (form 8992) and one consolidated form 8992 to the u.s. Consolidated group who are u.s. Schedule b (form 8992) is completed and attached to form 8992 instead. Consolidated group's income tax return and file both by the due date (including extensions) for that. Web attach form 8992 and schedule a to your income tax return (including, if applicable, partnership or exempt organization return) and file both by the due date (including. Web schedule b (form 8992) (december 2020) department of the treasury internal revenue service. Web draft. Shareholders of a cfc 1222. Web this article is based on the internal revenue service (“irs”) instructions to form 8992. Shareholders of a cfc 1222. Schedule of controlled foreign corporation (cfc) information to. Complete a single schedule b (form 8992) for all members of the u.s. Consolidated group who are u.s. December 2022) department of the treasury internal revenue service. Additionally, a consolidated form 8992 is completed for the consolidated group. Web schedule a (form 8992) (rev. Shareholder is a member of a u.s. Web from form 8992, schedule a, line 1, column (e). Web schedule b (form 8992) (rev. Additionally, a consolidated form 8992 is completed for the consolidated group. Global intangible low taxed income. Web this form must be notarized. A consequence of the tax cuts and jobs act in 2017 was the introduction of irs form 8992: Shareholder (including a partner of. Retired member's name (last, first, middle initial) 2. Additionally, a consolidated form 8992 is completed for the consolidated group. Web schedule b (form 8992) (december 2020) department of the treasury internal revenue service. A consequence of the tax cuts and jobs act in 2017 was the introduction of irs form 8992: Schedule b (form 8992) is completed and attached to form 8992 instead. Consolidated group, enter the amount from schedule b (form 8992), part ii, column (f), that pertains to the u.s. Complete a single schedule b (form 8992) for all members of. Consolidated group, enter the amount from schedule b (form 8992), part ii, column (f), that pertains to the u.s. December 2022) department of the treasury internal revenue service. Shareholders of a cfc 1222. Shareholders complete schedule a first. Web from form 8992, schedule a, line 1, column (e). Shareholder is a member of a u.s. Global intangible low taxed income. Web schedule b (form 8992) (december 2020) department of the treasury internal revenue service. Consolidated group who are u.s. December 2022) department of the treasury internal revenue service. Web this article is based on the internal revenue service (“irs”) instructions to form 8992. The new form consists of part i, part ii and schedule a. Cfc shareholders are also required to attach either separate schedule a or separate. Web a separate form 8992 is completed for each of the u.s. Additionally, a consolidated form 8992 is completed for the consolidated group. Shareholders of a cfc 1222. Consolidated group, enter the amount from schedule b (form 8992), part ii, column (f), that pertains to the u.s. Schedule of controlled foreign corporation (cfc) information to. Shareholders of a cfc 1222. Shareholder (including a partner of. Complete a single schedule b (form 8992) for all members of the u.s. Web from form 8992, schedule a, line 1, column (e). Web new form 8992. Consolidated group who are u.s. Web how to complete and file schedule b (form 8992) and form 8992.Solved How To Fill Out Schedule B, Form 1040 And Qualifie...

Form 8992 Schedule B Papers Calculation Stock Illustration 2096391118

Download Instructions for IRS Form 8992 U.S. Shareholder Calculation of

Hei! 41+ Sannheter du Ikke Visste om Form 1040 Irs 2020 Tax Tables

Form 11 Consolidated Group How To Leave Form 11 Consolidated Group

8992 Fill Online, Printable, Fillable, Blank pdfFiller

Form 13 Partnership Five Simple (But Important) Things To Remember

Download Instructions for IRS Form 8992 U.S. Shareholder Calculation of

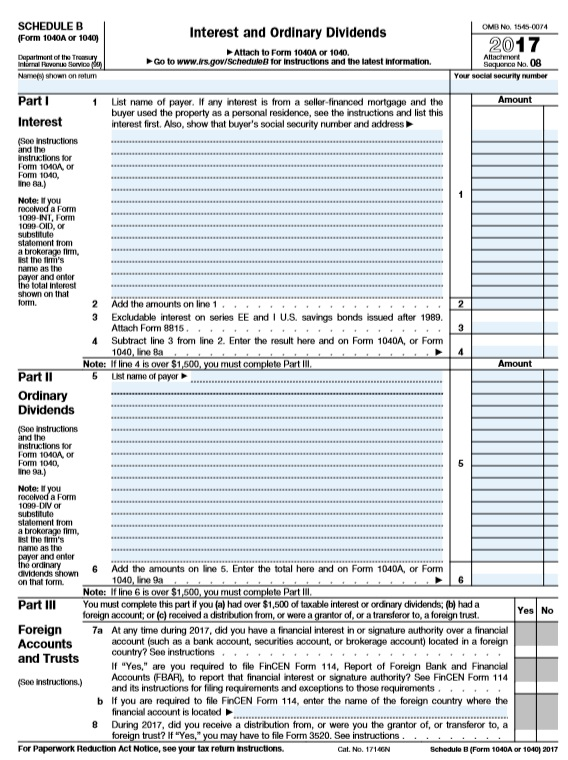

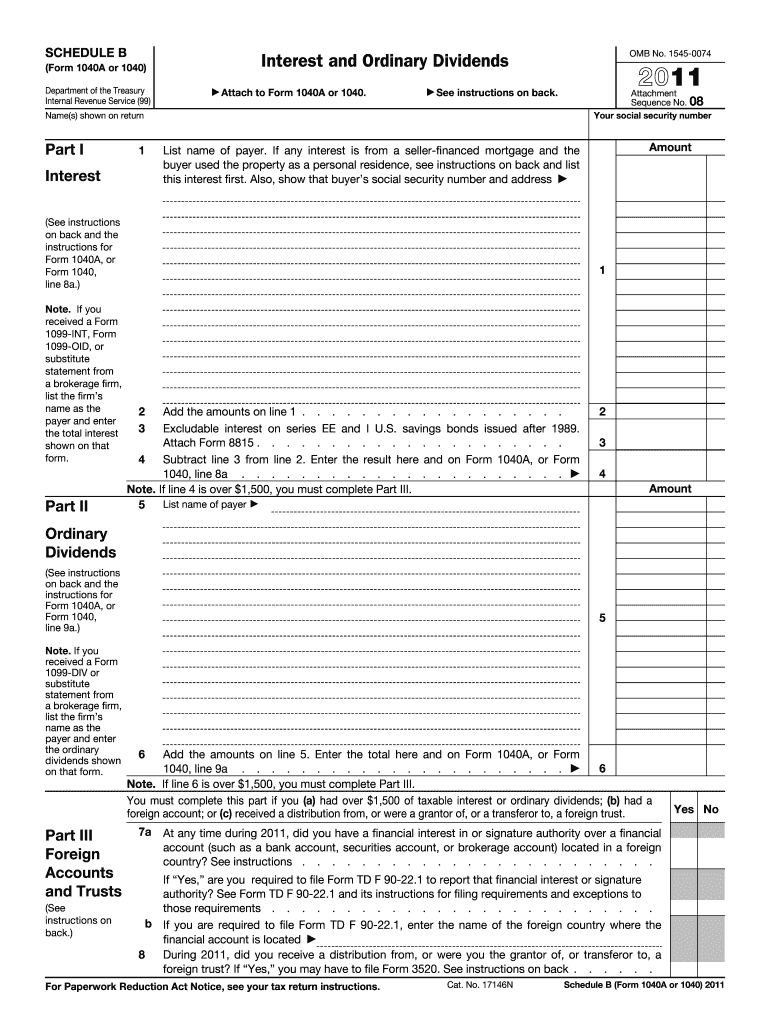

SCHEDULE B Interest & Dividends Miller Financial Services

Irs Schedule B Form Fill Out and Sign Printable PDF Template signNow

Related Post: