C Corporation Tax Form

C Corporation Tax Form - Seamless and secure tax document submissions. Start with your business name & our website will walk you through the steps to formation. Now, federal filers have another month to file. Fast, easy and secure application. Web 43 rows forms for corporations. Ad get your federal id number (taxid) today. Web 20 rows corporate tax forms. Web a c corporation is a separate taxpaying entity for the purposes of federal income tax law. Web the hamas terrorists who murdered babies in their cribs last week weren’t stamped with pathological hatred at birth. Web the franchise tax board and the irs opted to push the deadline from april 18 to oct. Web corporate tax returns require form 1120. Web tax gap $688 billion. Web the tax form for c corporation business entities is form 1120. If you are a c corporation or an s corporation then you may be liable for. Corporation income tax return is used to report the c corp’s gross income, tax deductions, and taxable profit; S corp, c corp, and 501c3 are all internal revenue service (i.r.s.) code references. Start with your business name & our website will walk you through the steps to formation. Web taxact c corp tax preparation software is designed to identify a broad range of business expenses and derive maximum tax savings when filing 1120 tax form. C corp forms. Web corporations operating on a cooperative basis file this form to report their income, gains, losses, deductions, credits, and to figure their income tax liability. Fast, easy and secure application. Those designations pertain only to. C corp forms are filed at the secretary of state's office and the turnaround time varies by state. Get started on yours today. Form 1120a is the short form version. Web the c corp tax form is just one of the many forms required to start and maintain a c corporation per the terms of its operating agreement.3 min read. Web the hamas terrorists who murdered babies in their cribs last week weren’t stamped with pathological hatred at birth. Now, federal filers have. C corporations and income tax. The 1120 is the c. Web the c corp tax return uses form 1120 to file a federal tax return in order to pay applicable taxes due to the internal revenue service (irs). Web to start a c corp, you must submit required tax forms to the irs. Ad 3m+ customers have trusted us with. Web a business created as an s corp must meet all federal guidelines for an s corp and file form 2553.to be eligible for s corp election, the business must: Ad taxact.com has been visited by 10k+ users in the past month Web the current tax rate for c corporations is a flat 21%. Web tax gap $688 billion. Web. Seamless and secure tax document submissions. Web if the llc is a corporation, normal corporate tax rules will apply to the llc and it should file a form 1120, u.s. Ad 3m+ customers have trusted us with their business formations. To the extent a c corporation has. It was an acquired habit, the result of a. Ad taxact.com has been visited by 10k+ users in the past month As a distinct entity, the shareholders do not pay taxes on behalf of the. The irs is currently working on building its own free tax filing program. Form 1120a is the short form version. We have an easy 4 steps process for your taxes: Get started on yours today. C corp forms are filed at the secretary of state's office and the turnaround time varies by state. Web the hamas terrorists who murdered babies in their cribs last week weren’t stamped with pathological hatred at birth. Web a corporation that has income from business activity that is taxable entirely within arizona is a “wholly. Web taxact c corp tax preparation software is designed to identify a broad range of business expenses and derive maximum tax savings when filing 1120 tax form. S corp, c corp, and 501c3 are all internal revenue service (i.r.s.) code references. Now, federal filers have another month to file. Web the franchise tax board and the irs opted to push. Web the c corp tax return uses form 1120 to file a federal tax return in order to pay applicable taxes due to the internal revenue service (irs). The irs is currently working on building its own free tax filing program. Ad get your federal id number (taxid) today. Web if the llc is a corporation, normal corporate tax rules will apply to the llc and it should file a form 1120, u.s. Form 1120a is the short form version. Ad 3m+ customers have trusted us with their business formations. To the extent a c corporation has. Web the c corp tax form is just one of the many forms required to start and maintain a c corporation per the terms of its operating agreement.3 min read. If you are a c corporation or an s corporation then you may be liable for. C corp forms are filed at the secretary of state's office and the turnaround time varies by state. Get started on yours today. Seamless and secure tax document submissions. Now, federal filers have another month to file. Web to start a c corp, you must submit required tax forms to the irs. Web the current tax rate for c corporations is a flat 21%. Corporation income tax return is used to report the c corp’s gross income, tax deductions, and taxable profit; Web tax gap $688 billion. Web 43 rows forms for corporations. As a distinct entity, the shareholders do not pay taxes on behalf of the. Businesses listed under c corporation face the possibility of double taxation, where dividend income is distributed.PA8879C 2015 PA EFile Signature Authorization for Corporate Tax

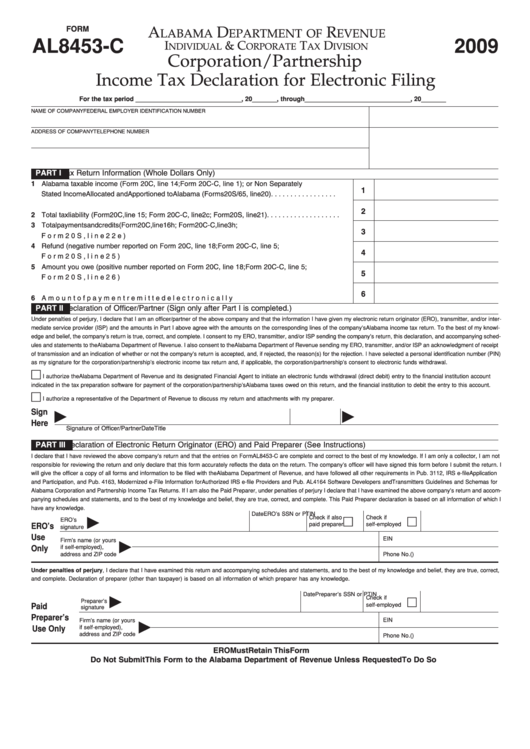

Form Al8453C Corporation/partnership Tax Declaration For

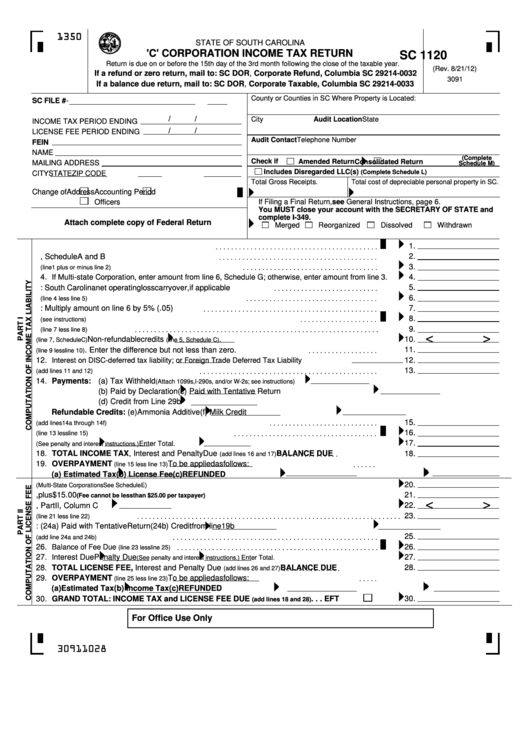

Fillable Form Sc 1120 'C' Corporation Tax Return printable pdf

flowthrough entity tax form Showy Microblog Picture Galleries

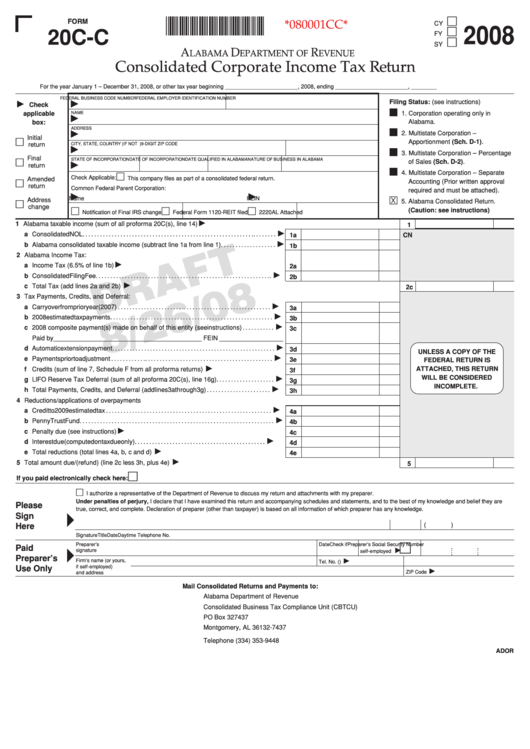

Form 20cC Draft Consolidated Corporate Tax Return 2008

FREE 9+ Sample Schedule C Forms in PDF MS Word

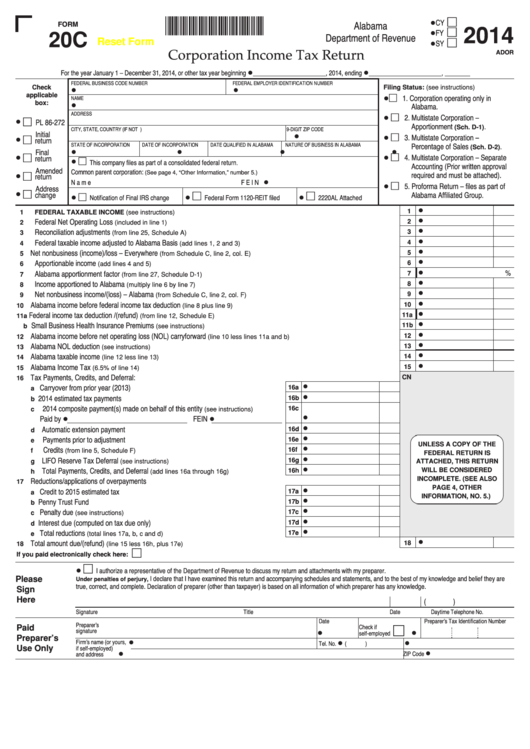

Fillable Form 20c Corporation Tax Return 2014 printable pdf

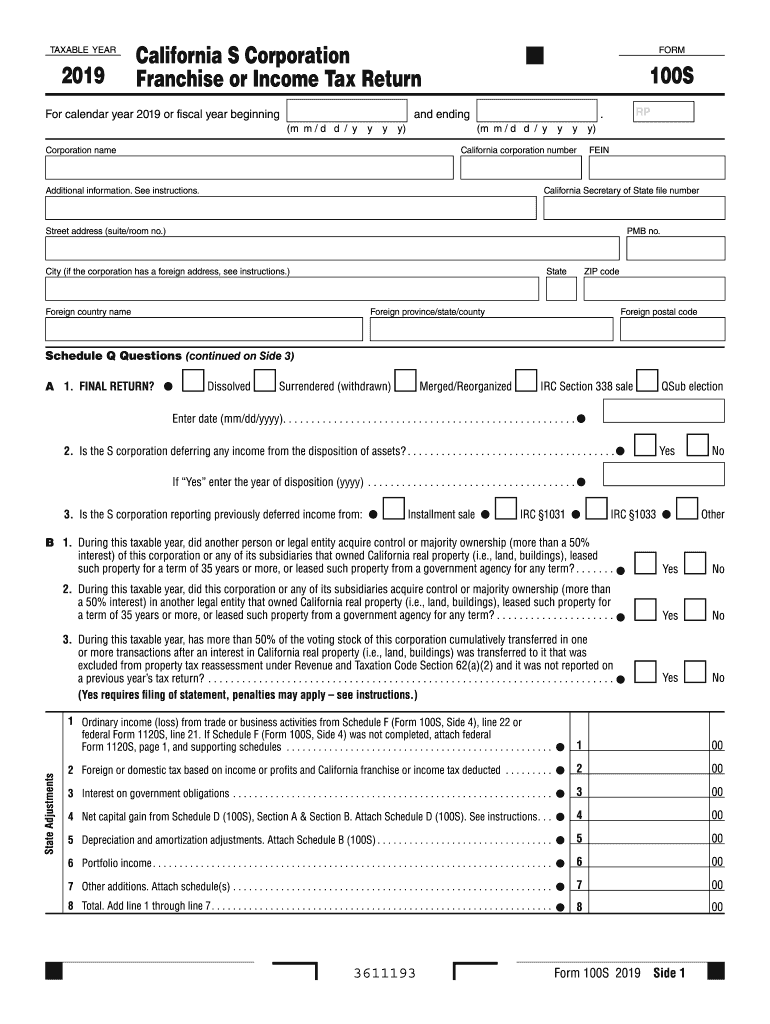

2019 Form CA FTB 100S Fill Online, Printable, Fillable, Blank pdfFiller

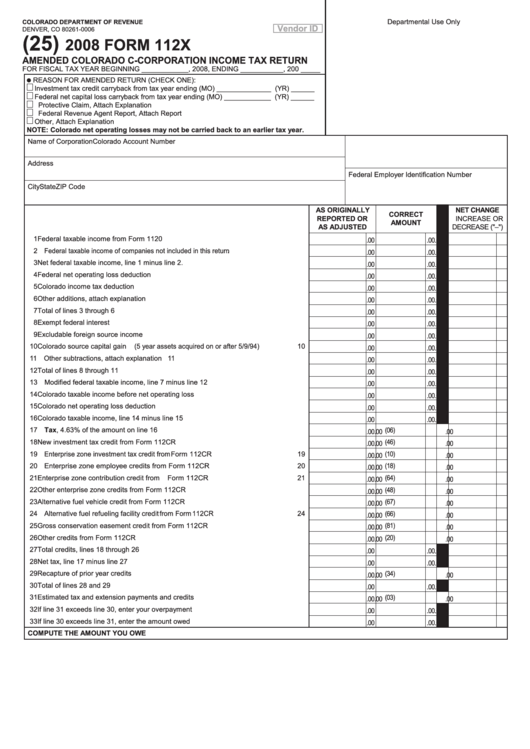

Fillable Form 112x Amended Colorado CCorporation Tax Return

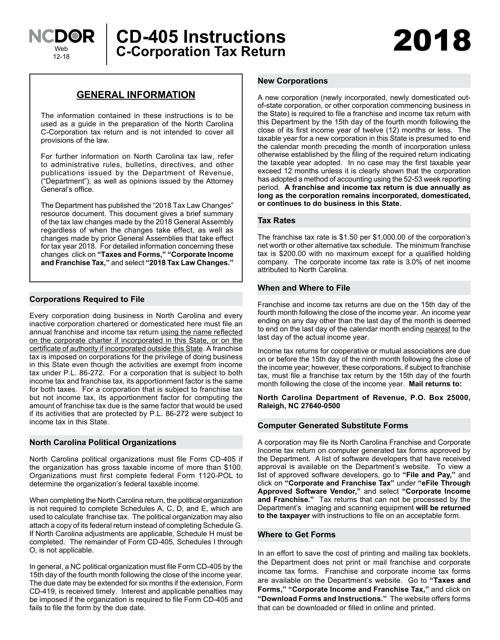

Download Instructions for Form CD405 CCorporation Tax Return PDF

Related Post: