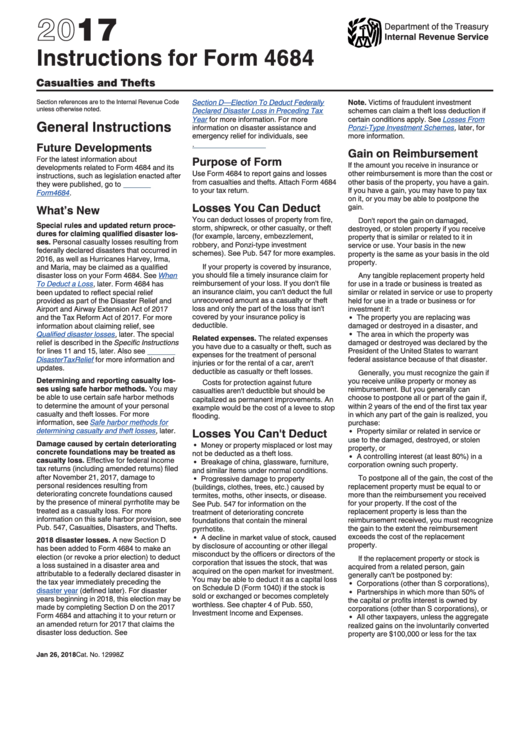

Instructions Form 4684

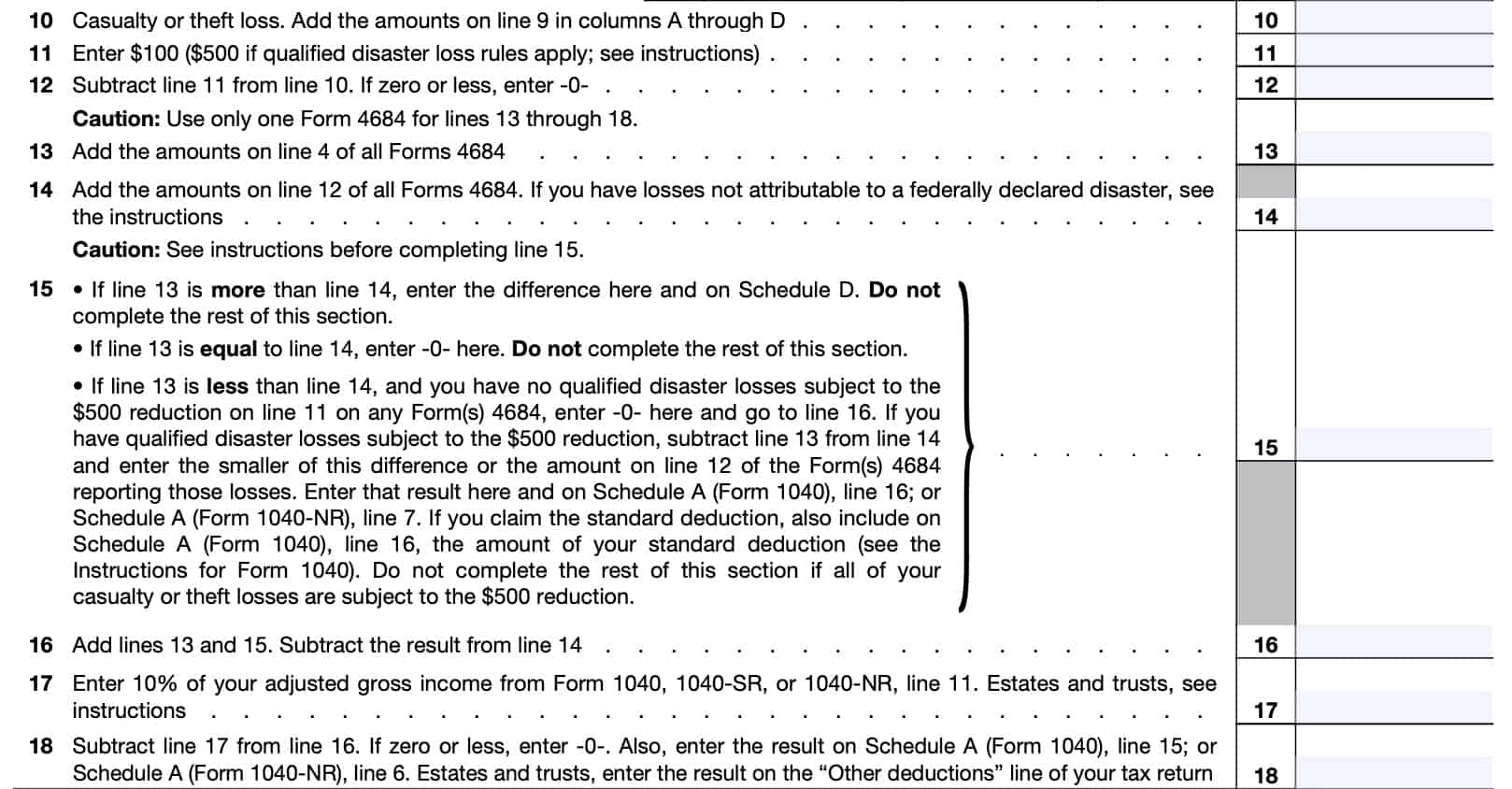

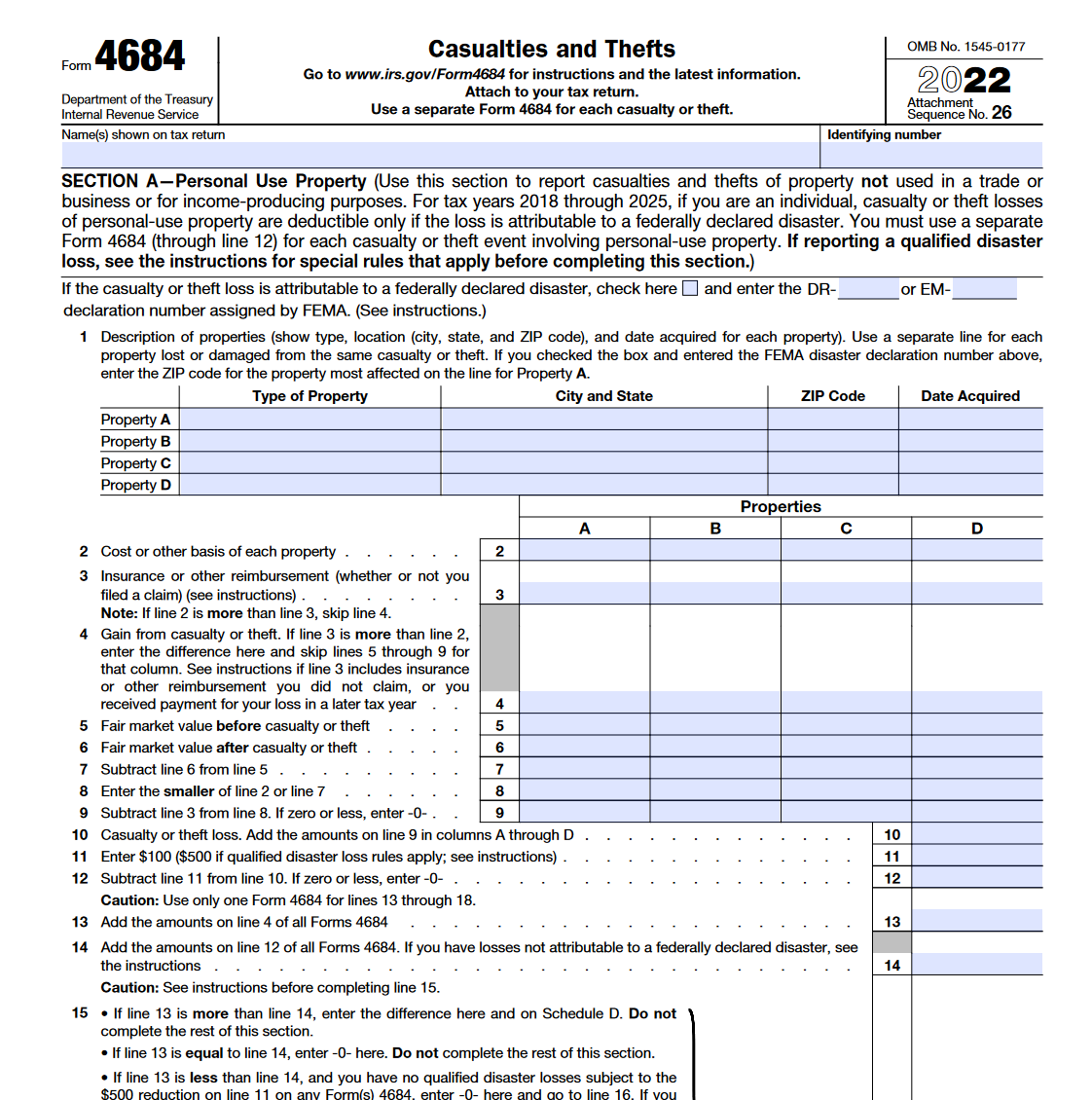

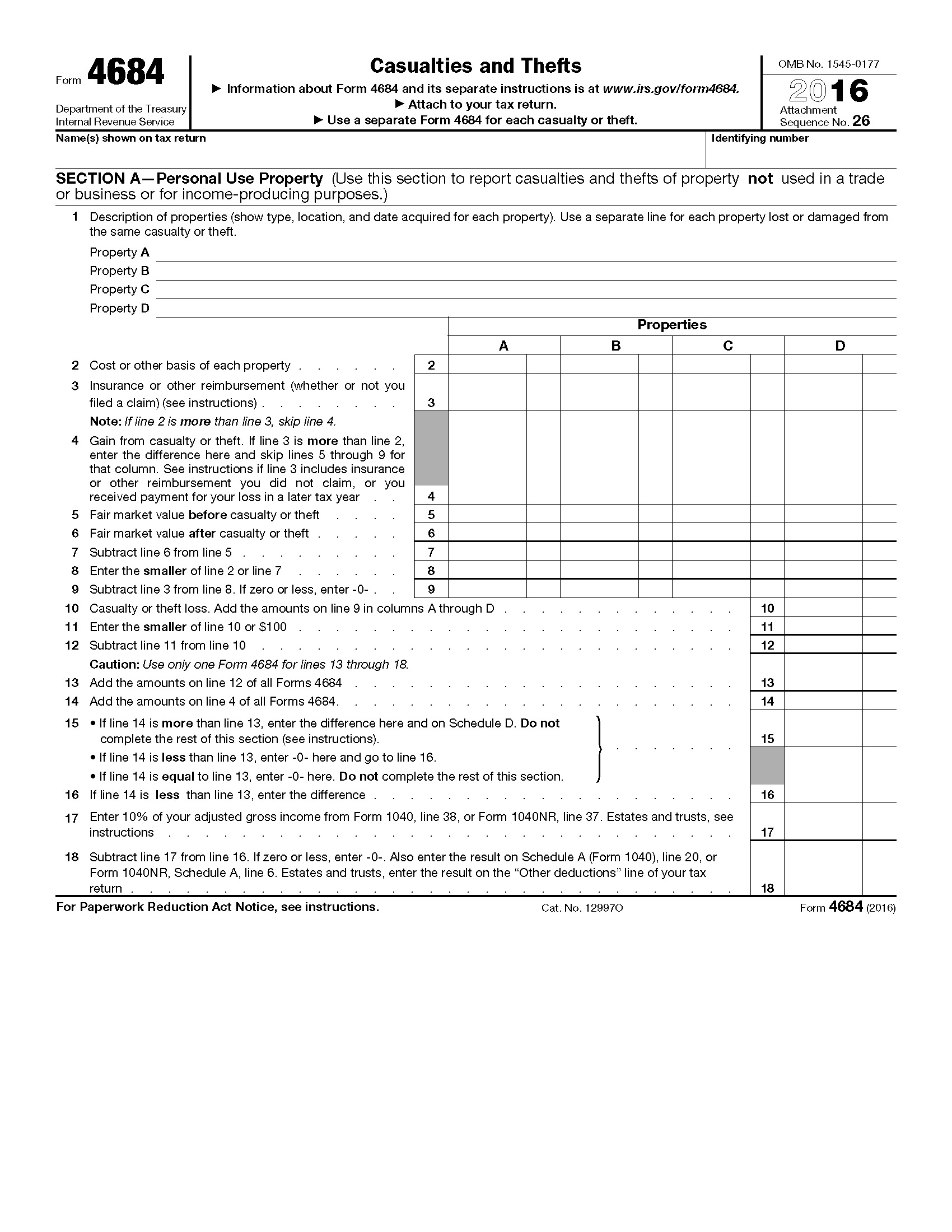

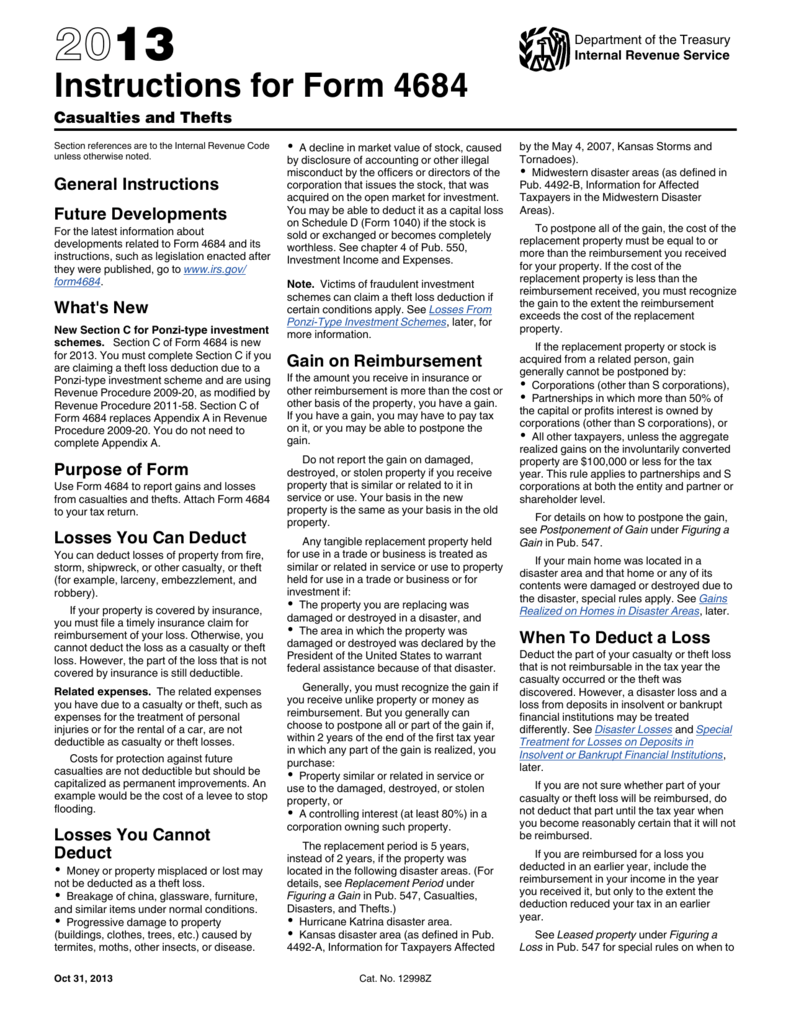

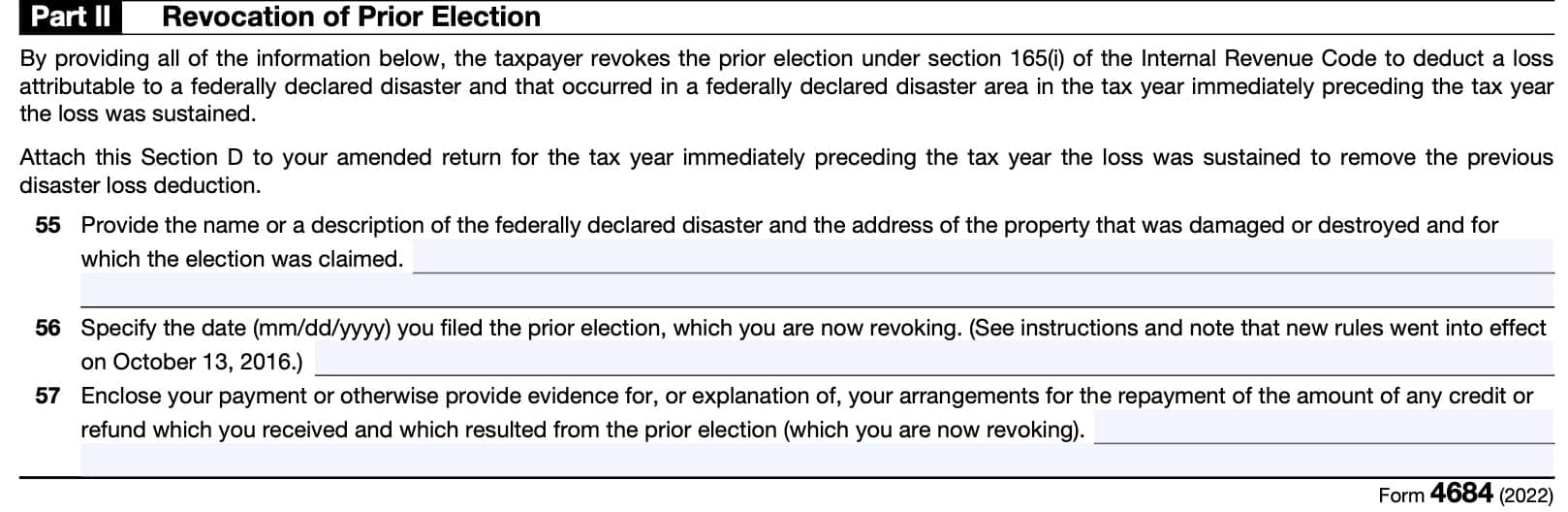

Instructions Form 4684 - Losses you can deduct you can deduct losses of. Department of the treasury internal revenue service. Information about form 4684, casualties and thefts, including recent updates, related forms and instructions. Web a casualty loss is claimed as an itemized deduction on schedule a of form 1040 and form 4684, casualties and thefts. To enter a casualty or theft loss in taxslayer pro, from the main menu of the. Web need to attach form 8997 annually until you dispose of the qof investment. Special rules and return procedures expanded for claiming qualified disaster. Department of the treasury internal revenue service. Web use the instructions on form 4684 to report gains and losses from casualties and thefts. This article will assist you with entering a casualty or theft for form 4684 in proseries. Web form 4684 department of the treasury internal revenue service casualties and thefts information about form 4684 and its separate instructions is at. Tax relief for homeowners with corrosive drywall: Certain taxpayers affected by federally declared disasters that occur after december 20,. Web use the instructions on form 4684 to report gains and losses from casualties and thefts. Beginning in. Web purpose of form use form 4684 to report gains and losses from casualties and thefts. Web form 4684 department of the treasury internal revenue service casualties and thefts information about form 4684 and its separate instructions is at. How to calculate your deduction amount. Web page last reviewed or updated: Web the taxact program uses form 4684 to figure. Department of the treasury internal revenue service. Tax relief for homeowners with corrosive drywall: Web for the latest information about developments related to form 4684 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4684. Web the taxact program uses form 4684 to figure the amount of your loss, and transfers the information to schedule a. Web claiming the deduction requires you to complete irs form 4684. Tax relief for homeowners with corrosive drywall: Web a casualty loss is claimed as an itemized deduction on schedule a of form 1040 and form 4684, casualties and thefts. Web entering a casualty or theft for form 4684. Web for the latest information about developments related to form 4684. Web casualties and thefts 2022 form 4684 form 4684 department of the treasury internal revenue service casualties and thefts omb no. Web form 4684 department of the treasury internal revenue service casualties and thefts information about form 4684 and its separate instructions is at. Go to www.irs.gov/form4684 for instructions and the. Web page last reviewed or updated: This article will. Web need to attach form 8997 annually until you dispose of the qof investment. Attach form 4684 to your tax return. Web have the form 4684 instructions handy to refer to for help in completing the form. Web a casualty loss is claimed as an itemized deduction on schedule a of form 1040 and form 4684, casualties and thefts. Information. Go to www.irs.gov/form4684 for instructions and the latest information. However, if the casualty loss is not the result of a federally declared disaster, you must be itemize. Web purpose of form use form 4684 to report gains and losses from casualties and thefts. Special rules and return procedures expanded for claiming qualified disaster. Web page last reviewed or updated: Losses you can deduct you can deduct losses of. Web entering a casualty or theft for form 4684. Attach form 4684 to your income tax return. Go to www.irs.gov/form4684 for instructions and the latest information. How to calculate your deduction amount. Get ready for tax season deadlines by completing any required tax forms today. Purpose of form use form 4684 to report. Web use form 4684 to report gains and losses within 2 years of the end of the first tax year for details on how to postpone the gain, from casualties and thefts. Web page last reviewed or updated: Web. This article will assist you with entering a casualty or theft for form 4684 in proseries. Web claiming the deduction requires you to complete irs form 4684. Losses you can deduct you can deduct losses of. Web need to attach form 8997 annually until you dispose of the qof investment. Purpose of form use form 4684 to report. Web for the latest information about developments related to form 4684 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form4684. To enter a casualty or theft loss in taxslayer pro, from the main menu of the. Web casualties and thefts 2022 form 4684 form 4684 department of the treasury internal revenue service casualties and thefts omb no. Department of the treasury internal revenue service. Web need to attach form 8997 annually until you dispose of the qof investment. How to calculate your deduction amount. Tax relief for homeowners with corrosive drywall: See the form 8997 instructions for more information. Beginning in 2018 , the tax cuts and jobs act suspended the itemized deduction for personal casualties and theft. Go to www.irs.gov/form4684 for instructions and the latest information. Web form 4684 department of the treasury internal revenue service casualties and thefts information about form 4684 and its separate instructions is at. Complete, edit or print tax forms instantly. Web purpose of form use form 4684 to report gains and losses from casualties and thefts. Web page last reviewed or updated: Web a casualty loss is claimed as an itemized deduction on schedule a of form 1040 and form 4684, casualties and thefts. Losses you can deduct you can deduct losses of. Get ready for tax season deadlines by completing any required tax forms today. Web entering a casualty or theft for form 4684. Special rules and return procedures expanded for claiming qualified disaster. Department of the treasury internal revenue service.2005 Instructions for Form 4684

IRS Form 4684 Instructions Deducting Casualty & Theft Losses

Instructions For Form 4684 Casualties And Thefts 2005 printable pdf

IRS Form 4684. Casualties and Thefts Forms Docs 2023

IRS Form 4684 Instructions Deducting Casualty & Theft Losses

Instructions For Form 4684 Casualties And Thefts 2016 printable pdf

Diminished Value and Taxes, IRS form 4684 Diminished Value of

Instructions for Form 4684

Please fill out an 2017 IRS Tax FORM 4684 Casualty

IRS Form 4684 Instructions Deducting Casualty & Theft Losses

Related Post: