Arizona State Tax Form

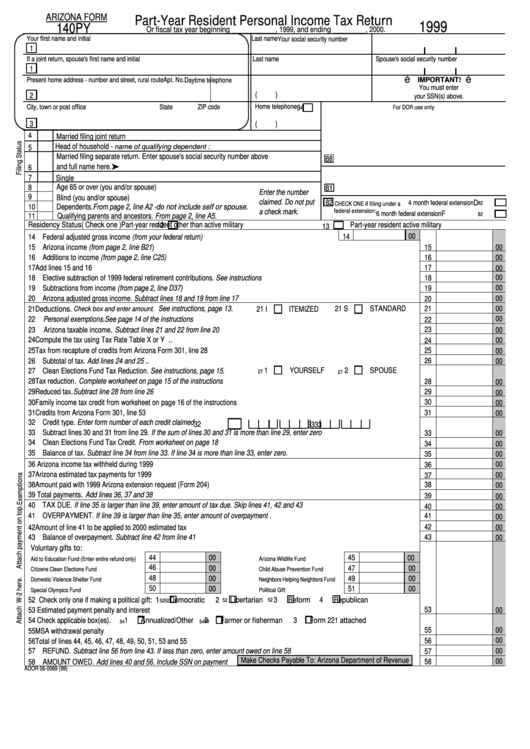

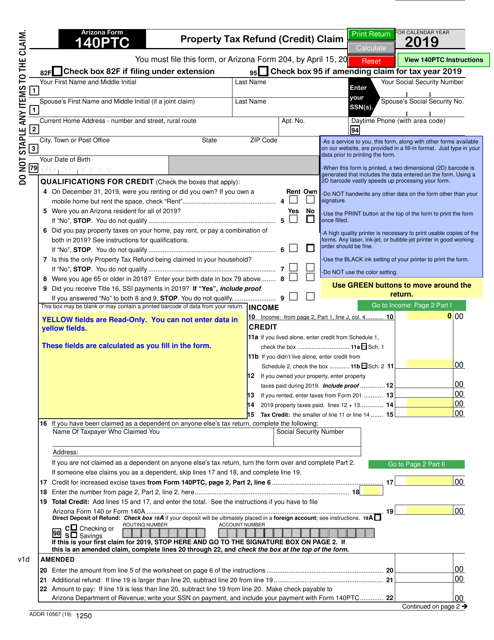

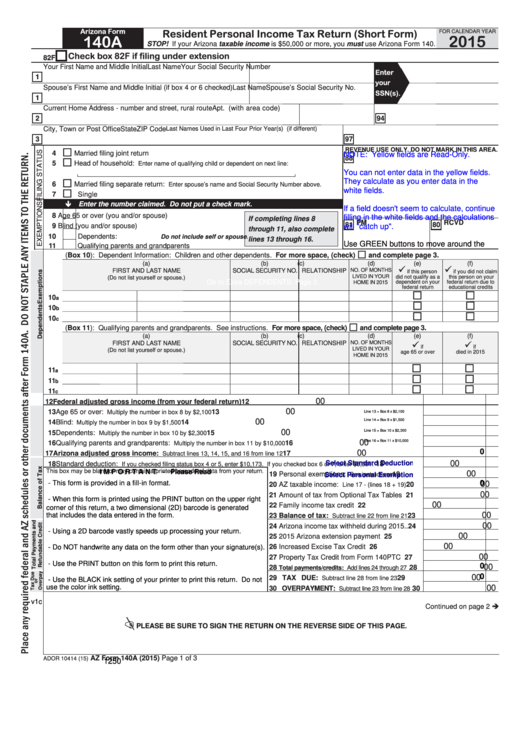

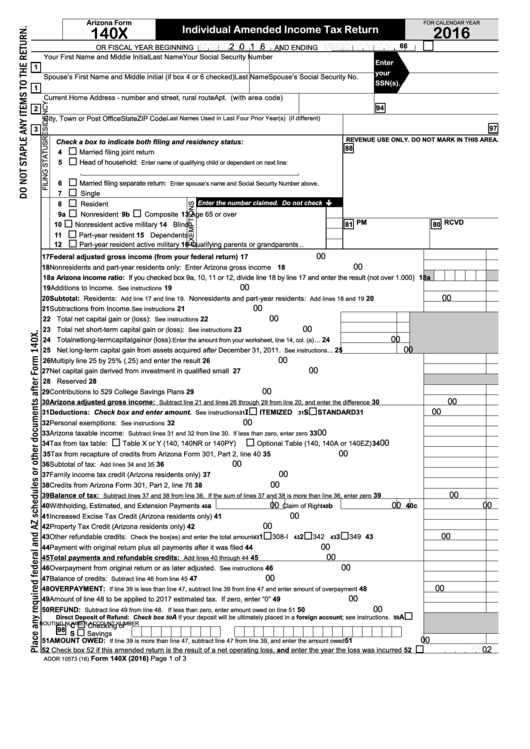

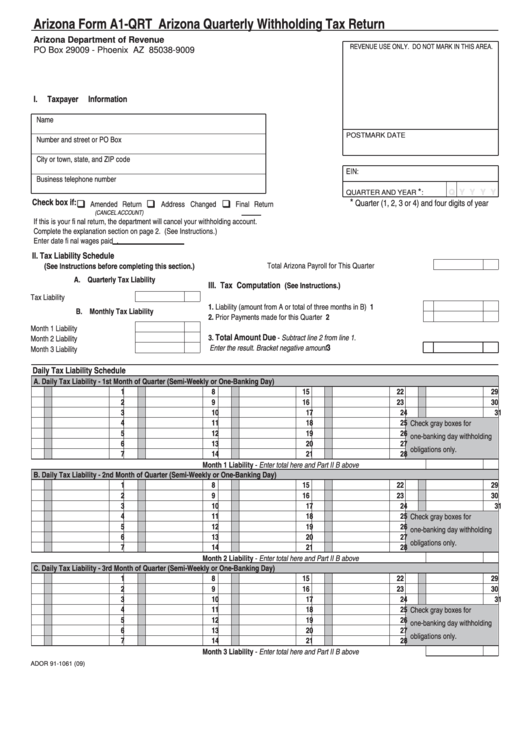

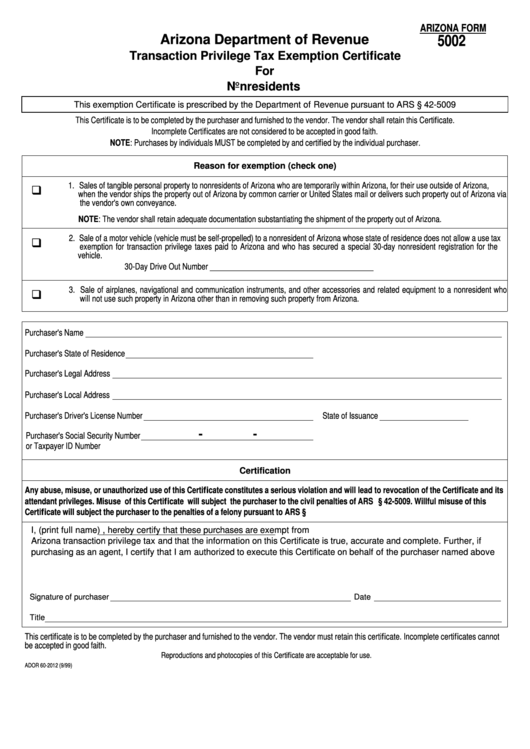

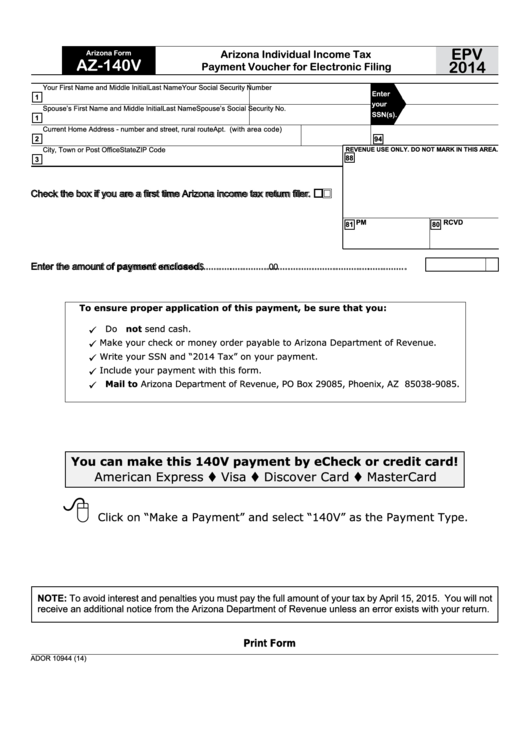

Arizona State Tax Form - Check refund status can only be used for. Web withholding forms : Web 26 rows individual estimated tax payment form: Web arizona income tax forms arizona printable income tax forms 96 pdfs arizona has a state income tax that ranges between 2.55% and 3.34% , which is administered by the. Arizona annual payment withholding tax return: Federal tax return was itemized. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Arizona corporate or partnership income. Web see the arizona tax form instructions for direct deposit. Web state of arizona department of revenue toggle navigation. Instead, a refund will be issued in the form of a check. Web 26 rows corporate tax forms : Web if you have a credit claimed on form 310, 321, 322, 323, or 348 adjust the amounts of credits claimed on the arizona carryover worksheet, column c for that credit. Web read on for six steps to hiring employees in. Instead, a refund will be issued in the form of a check. Web see the arizona tax form instructions for direct deposit. Identify the return you wish to check the refund status for. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Web the irs unveiled more details about direct file, the. Tpt filers are reminded of the following september tpt filing deadlines: Web withholding forms : Check refund status can only be used for. Web see the arizona tax form instructions for direct deposit. Tax credits forms, individual : Web the irs unveiled more details about direct file, the agency's free, electronic tax filing pilot program. Web withholding forms : Starting in 2024, arizona, california, massachusetts and new. Web state of arizona department of revenue toggle navigation. Web income tax filing requirements for tax years ending on or before december 31, 2019, individuals with an adjusted gross income of. Web if you have a credit claimed on form 310, 321, 322, 323, or 348 adjust the amounts of credits claimed on the arizona carryover worksheet, column c for that credit. We last updated the income tax instruction packet in february 2023, so this is the latest version. It was an acquired habit, the result of a. Web arizona income. It was an acquired habit, the result of a. Web the irs unveiled more details about direct file, the agency's free, electronic tax filing pilot program. Web the hamas terrorists who murdered babies in their cribs last week weren’t stamped with pathological hatred at birth. Understand your hiring costs and tax liability. Web packet of instructions and forms for filling. Arizona annual payment withholding tax return: Check refund status can only be used for. Web all arizona taxpayers must file a form 140 with the arizona department of revenue. This form should be completed after. Starting in 2024, arizona, california, massachusetts and new. Your average tax rate is. Find out which product is right for you. Understand your hiring costs and tax liability. Web 26 rows individual estimated tax payment form: Web if you have an arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax. Web packet of instructions and forms for filling out your arizona form 140 tax return. Web see the arizona tax form instructions for direct deposit. Web all arizona taxpayers must file a form 140 with the arizona department of revenue. Web read on for six steps to hiring employees in arizona: Web irs direct file, used only for federal returns,. Arizona corporate or partnership income. Arizona annual payment withholding tax return: Instead, a refund will be issued in the form of a check. Tpt filers are reminded of the following september tpt filing deadlines: Identify the return you wish to check the refund status for. This form is used by residents who file an individual income tax return. Arizona income tax payments for the. Your average tax rate is. For the 2022 tax year (taxes filed in 2023),. Employer's election to not withhold arizona. This form should be completed after. Credit for increased excise taxes: Find out which product is right for you. That were listed on arizona form 140, 140a, 140ez, 140py or 140nr. Web popular forms & instructions; Web arizona income tax forms arizona printable income tax forms 96 pdfs arizona has a state income tax that ranges between 2.55% and 3.34% , which is administered by the. Web all arizona taxpayers must file a form 140 with the arizona department of revenue. Federal tax return was itemized. Web the hamas terrorists who murdered babies in their cribs last week weren’t stamped with pathological hatred at birth. We last updated the income tax instruction packet in february 2023, so this is the latest version. Web income tax filing requirements for tax years ending on or before december 31, 2019, individuals with an adjusted gross income of at least $5,500 must file taxes, and an. Code for america, a civic tech nonprofit that works with community leaders and. Identify the return you wish to check the refund status for. It was an acquired habit, the result of a. Starting in 2024, arizona, california, massachusetts and new.Arizona Form 140py PartYear Resident Personal Tax Return

1040ez Arizona State Tax Form Universal Network

Printable Arizona Tax Form 140 Printable Forms Free Online

Arizona Fillable Tax Forms Printable Forms Free Online

Arizona State Tax New Hire Forms 2022

Arizona State Printable Tax Forms Printable Forms Free Online

Fillable Arizona Form A1Qrt Arizona Quarterly Withholding Tax Return

Arizona Tax Forms Fillable Printable Forms Free Online

Fillable Arizona Form Az140v Arizona Individual Tax Payment

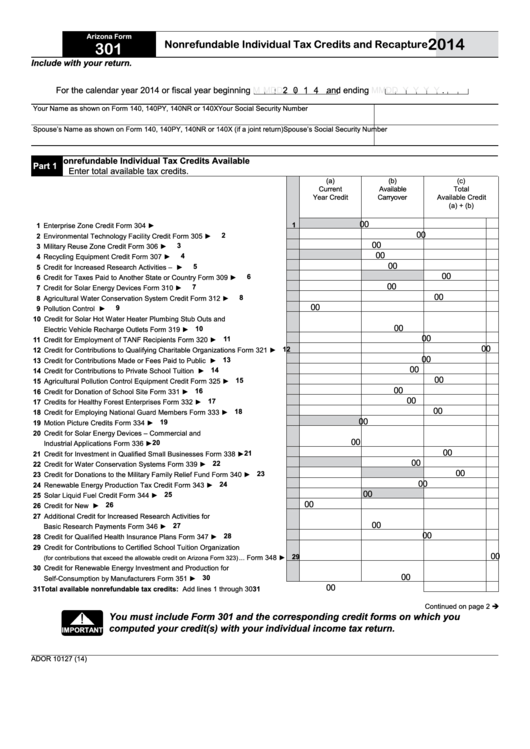

Fillable Arizona Form 301 Nonrefundable Individual Tax Credits And

Related Post: