Arizona Form 140Py Instructions

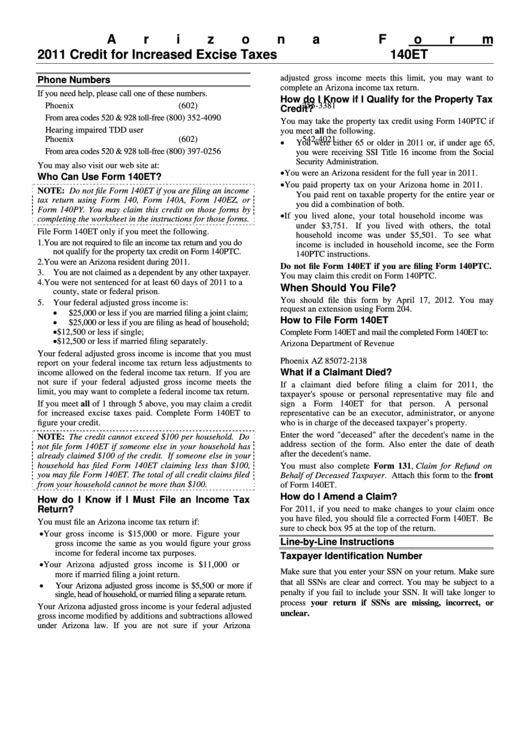

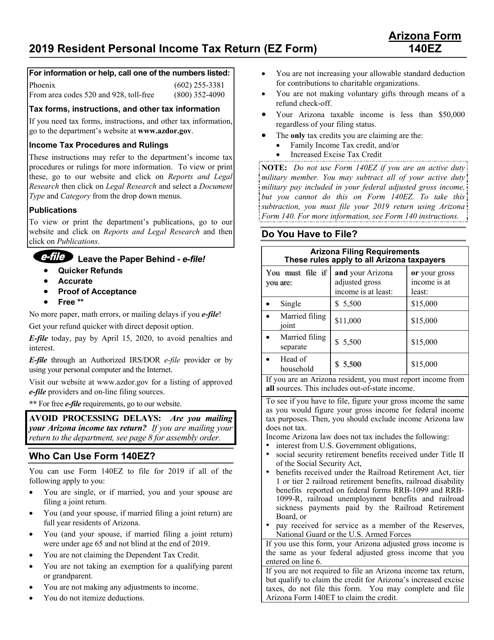

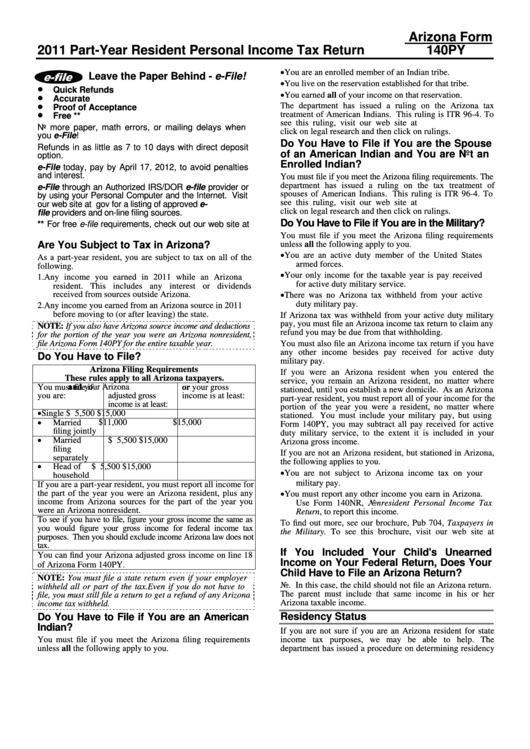

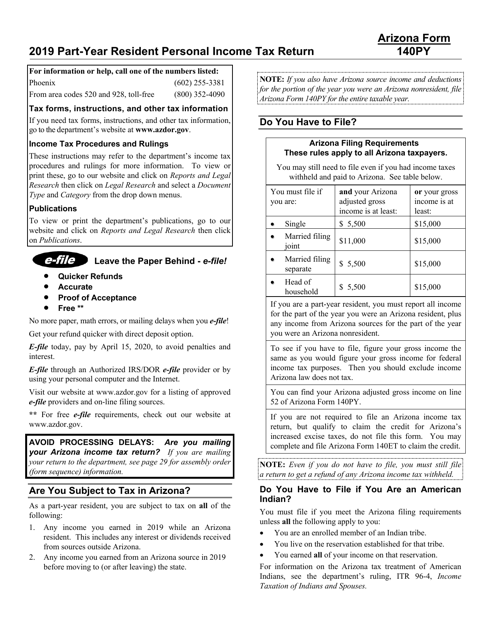

Arizona Form 140Py Instructions - For information or help, call one of the numbers listed: Use the same names(s) and social security number(s). Note #3 on forms 140nr, 140py and 140x). Web 2021 form 140py schedule a(pyn) itemized deductions. Ad uslegalforms.com has been visited by 100k+ users in the past month Web 14 rows update to the 2020 increase standard deduction worksheet for. We last updated the income tax instruction packet in february 2023, so this is the latest version. Try it for free now! File a form 140py if you were an arizona resident for less than 12 months during 2021. Complete, edit or print tax forms instantly. Upload, modify or create forms. Web a taxpayer who elects to file an sbi tax return is required to make an adjustment reducing their federal adjusted gross income reported on the individual income. For information or help, call one of the numbers listed: Web 14 rows update to the 2020 increase standard deduction worksheet for. Download the form 140py, a. Download the form 140py, a booklet that includes the instructions, the form, and the. Try it for free now! Web packet of instructions and forms for filling out your arizona form 140 tax return. For information or help, call one of the numbers listed: Use the same names(s) and social security number(s). Web who must use form 140? Web free printable 2022 arizona form 140 and 2022 arizona form 140 instructions booklet in pdf format to print, fill in, and mail your state income tax return. Web file a form 140py if you were an arizona resident for less than 12 months during 2019. Complete, edit or print tax forms instantly. Web. For information or help, call one of the numbers listed: Try it for free now! Web we last updated arizona form 140py in february 2023 from the arizona department of revenue. Complete, edit or print tax forms instantly. You (and your spouse, if married filing a joint return) may file form 140 only if you are full year residents of. Note #3 on forms 140nr, 140py and 140x). Web packet of instructions and forms for filling out your arizona form 140 tax return. Web a taxpayer who elects to file an sbi tax return is required to make an adjustment reducing their federal adjusted gross income reported on the individual income. Web 14 rows update to the 2020 increase standard. Arizona form 2022 nonresident personal income tax return 140nr. Web packet of instructions and forms for filling out your arizona form 140 tax return. Download the form 140py, a booklet that includes the instructions, the form, and the. Web follow the simple instructions below: Web a taxpayer who elects to file an sbi tax return is required to make an. Use the same names(s) and social security number(s). Upload, modify or create forms. Arizona form 2022 nonresident personal income tax return 140nr. For information or help, call one of the numbers listed: We last updated the income tax instruction packet in february 2023, so this is the latest version. Upload, modify or create forms. File a form 140py if you were an arizona resident for less than 12 months during 2021. Web packet of instructions and forms for filling out your arizona form 140 tax return. For information or help, call one of the numbers listed: Web file a form 140py if you were an arizona resident for less. Tax forms, instructions, and other tax information. Arizona form 2022 nonresident personal income tax return 140nr. Web 14 rows update to the 2020 increase standard deduction worksheet for. Web follow the simple instructions below: Web file a form 140py if you were an arizona resident for less than 12 months during 2019. Upload, modify or create forms. Arizona form 2022 nonresident personal income tax return 140nr. Web 2021 form 140py schedule a(pyn) itemized deductions. This form is for income earned in tax year 2022, with tax returns due in april. Tax forms, instructions, and other tax information. You (and your spouse, if married filing a joint return) may file form 140 only if you are full year residents of arizona. Use the same names(s) and social security number(s). Web who must use form 140? Web follow the simple instructions below: Web please disregard the information provided in the worksheet's note section (note #2 on form 140; The correct amount to enter on. This form is for income earned in tax year 2022, with tax returns due in april. File a form 140py if you were an arizona resident for less than 12 months during 2021. For information or help, call one of the numbers listed: Arizona form 2022 nonresident personal income tax return 140nr. We last updated the income tax instruction packet in february 2023, so this is the latest version. Note #3 on forms 140nr, 140py and 140x). Complete, edit or print tax forms instantly. Web a taxpayer who elects to file an sbi tax return is required to make an adjustment reducing their federal adjusted gross income reported on the individual income. For information or help, call one of the numbers listed: Web free printable 2022 arizona form 140 and 2022 arizona form 140 instructions booklet in pdf format to print, fill in, and mail your state income tax return. Web file a form 140py if you were an arizona resident for less than 12 months during 2019. Web we last updated arizona form 140py in february 2023 from the arizona department of revenue. Ad uslegalforms.com has been visited by 100k+ users in the past month Web packet of instructions and forms for filling out your arizona form 140 tax return.Instructions For Arizona Form 140et Credit For Increased Excise Taxes

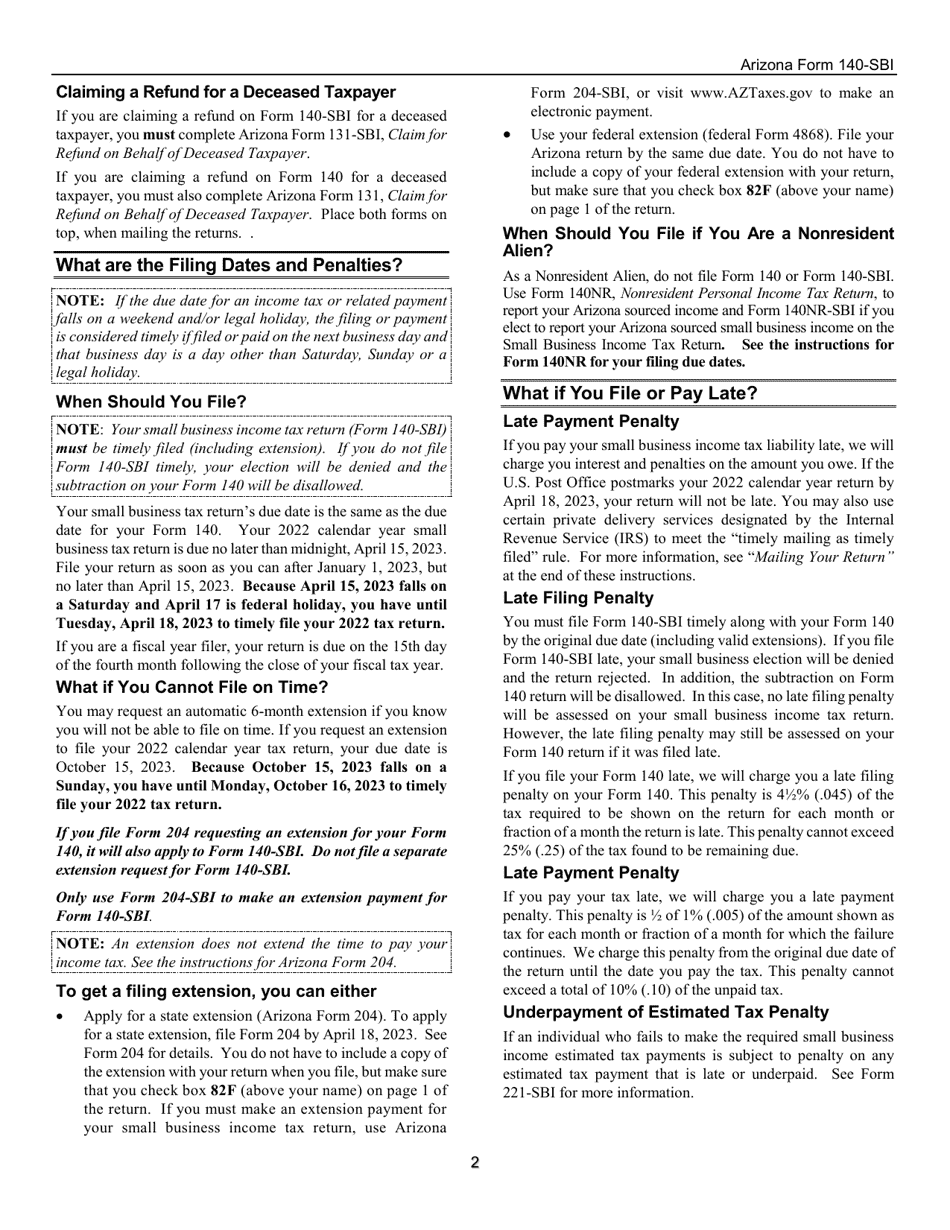

Download Instructions for Arizona Form 140SBI, ADOR11400 Small

Download Instructions for Arizona Form 140SBI, ADOR11400 Small

Printable Arizona Form 140 Fill Out and Sign Printable PDF Template

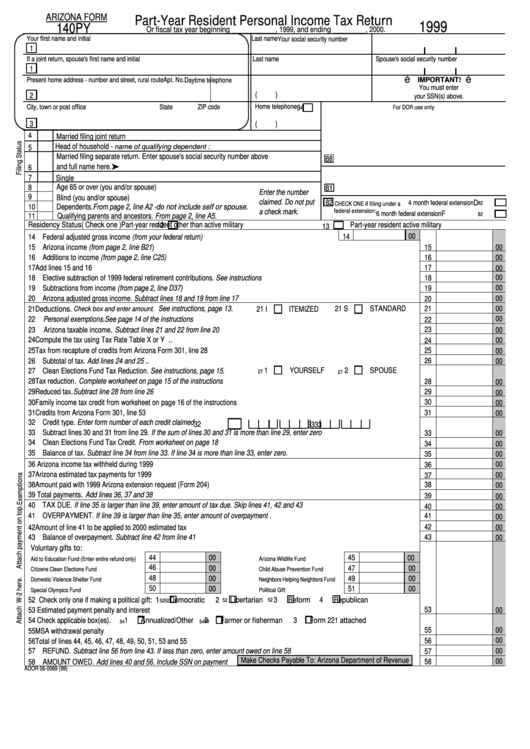

140py Fillable Form Printable Forms Free Online

AZ DoR 140 Instructions 20202021 Fill out Tax Template Online US

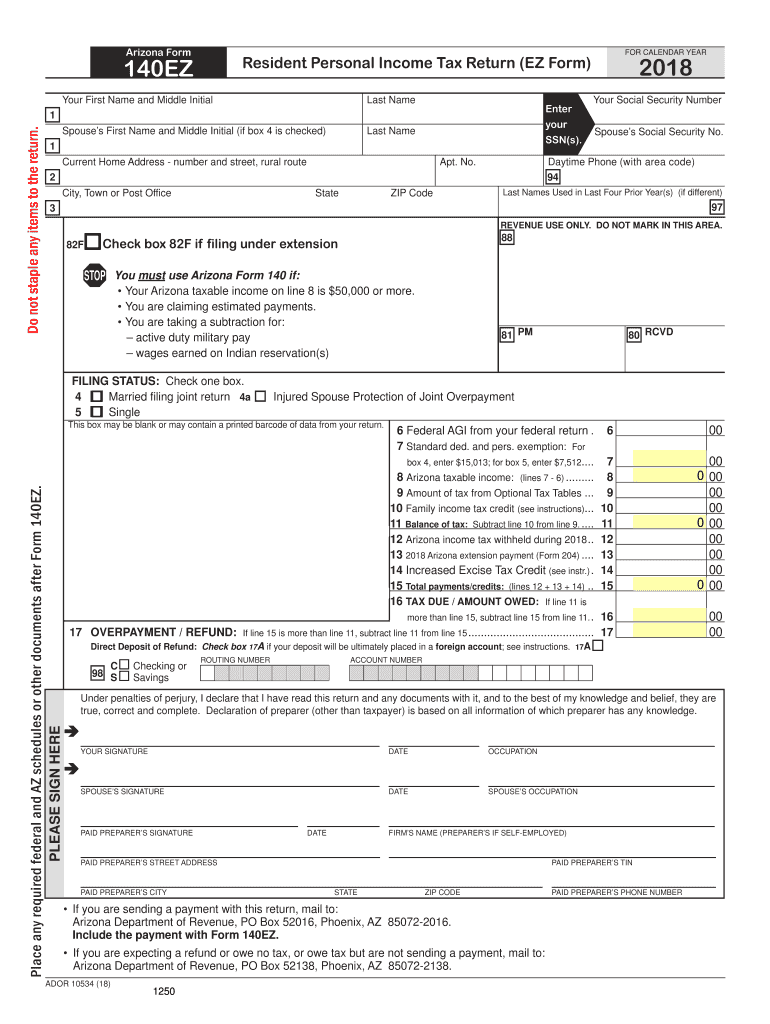

Download Instructions for Arizona Form 140EZ, ADOR10534 Resident

2020 AZ Form 140Fill Online, Printable, Fillable, Blank pdfFiller

Instructions For Arizona Form 140py PartYear Resident Personal

Download Instructions for Arizona Form 140PY, ADOR10149 PartYear

Related Post: