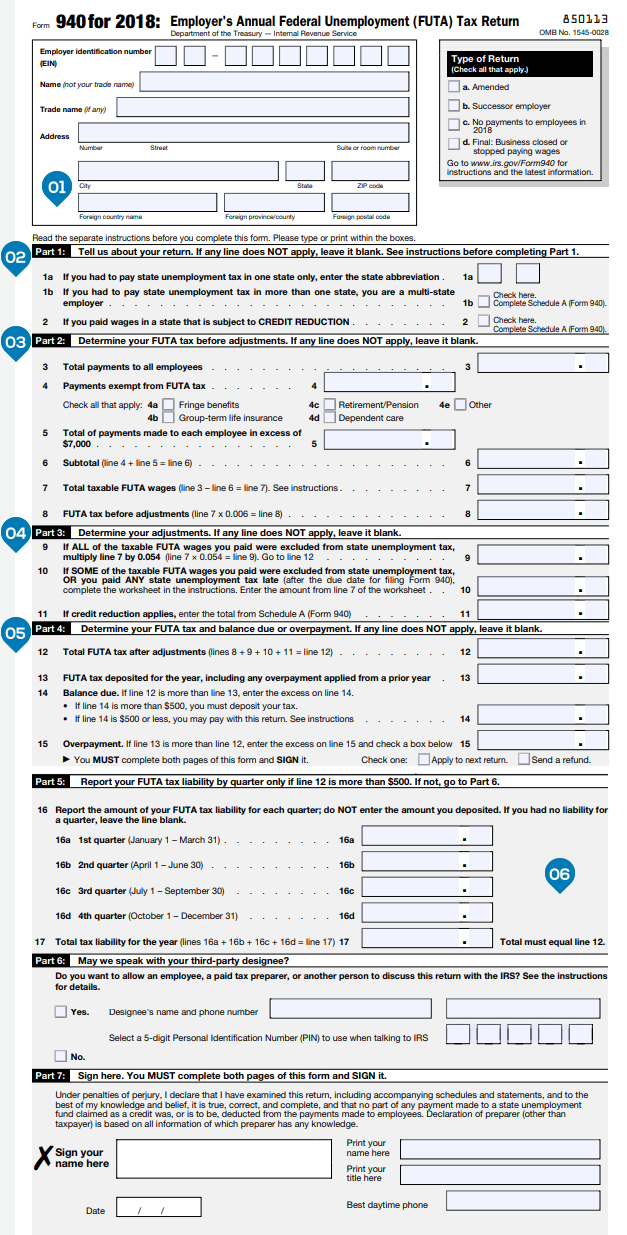

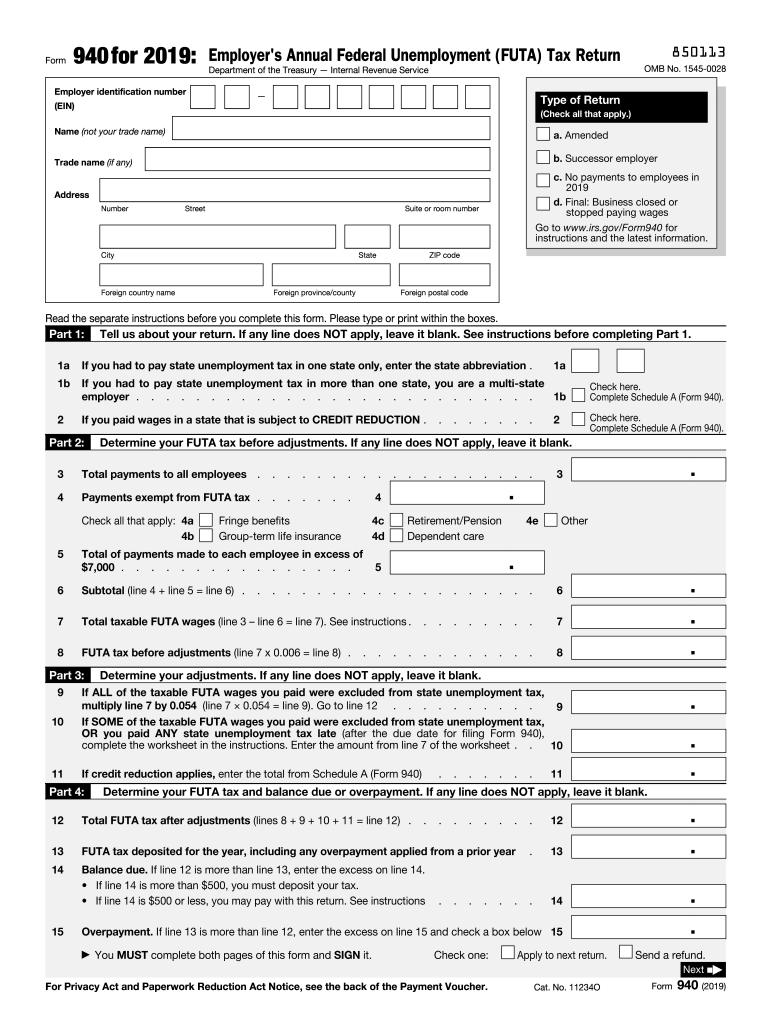

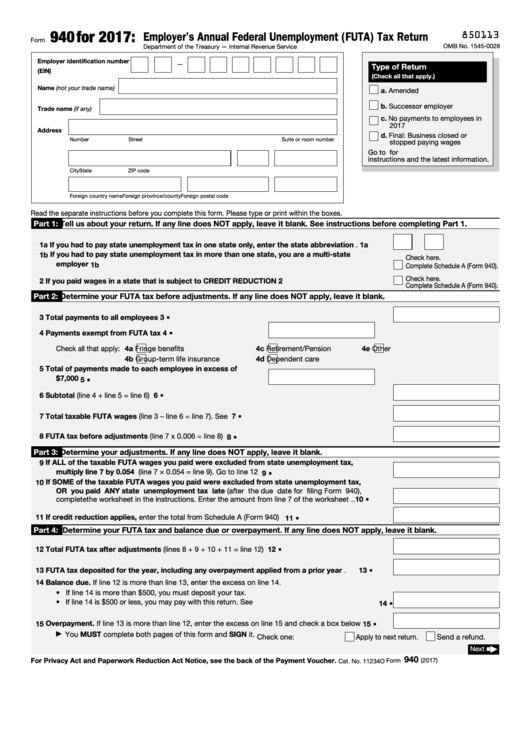

940 Form 2019

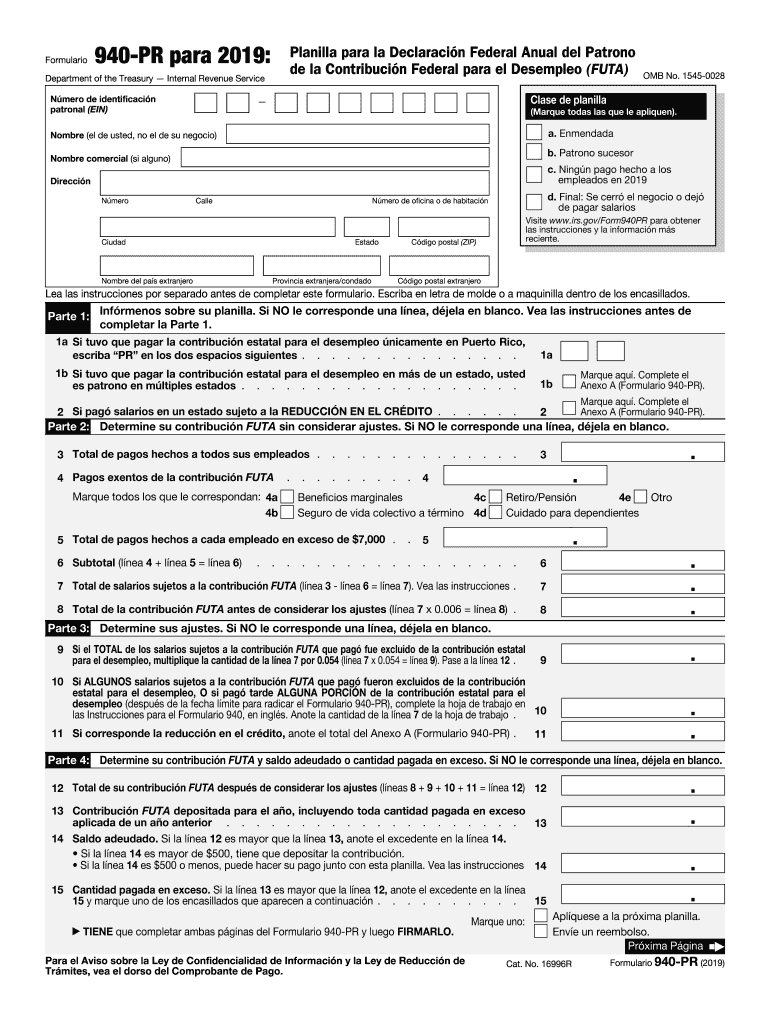

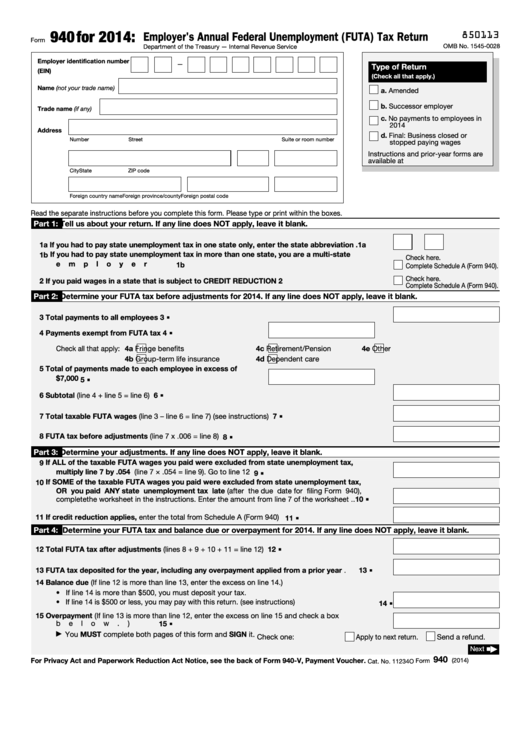

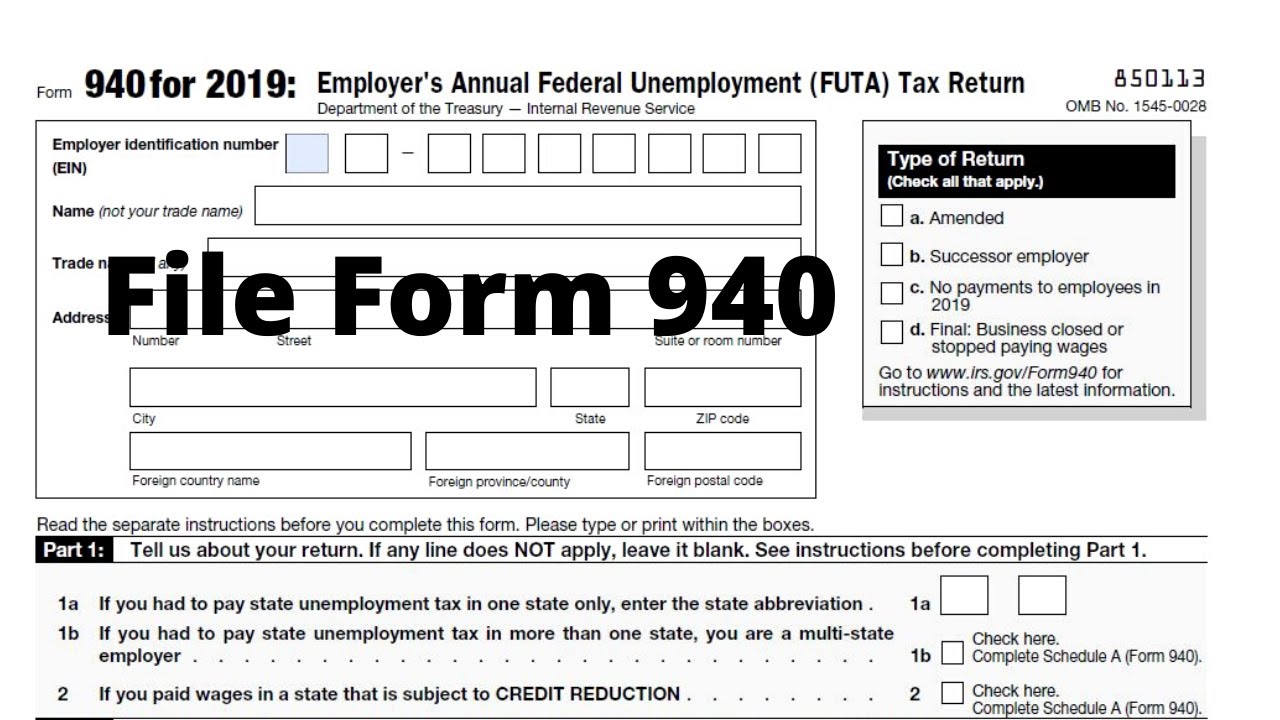

940 Form 2019 - This form is used to report and pay unemployment taxes to the. Choose the payroll tax tab. Get deals and low prices on 2019 tax forms at amazon Information about form 940, employer's annual federal unemployment (futa) tax return, including recent updates,. Ad download or email irs 940 & more fillable forms, register and subscribe now! Web the f940 accessible 2019 form 940 form is 3 pages long and contains: Add together the amounts from. Easily sign the form with your finger. Employer's annual federal unemployment (futa) tax return department of the treasury — internal revenue service 850113 omb no. Web schedule a (form 940) for 2019: Web schedule a (form 940) for 2019: Web list on line 5 the total amount over the wage base you paid to each employee after subtracting the exempt wages. Web form 940 (2020) employer's annual federal unemployment (futa) tax return. Web page last reviewed or updated: Web form 940 is a tax form that allows employers to report their annual. This form is used to report and pay unemployment taxes to the. Most employers that have employees are. Web form 940 is a tax form that allows employers to report their annual futa (federal unemployment tax act) payroll tax. Get deals and low prices on 2019 tax forms at amazon Web schedule a (form 940) for 2019: Most employers that have employees are. Employer's annual federal unemployment (futa) tax return department of the treasury — internal revenue service 850113 omb no. Open form follow the instructions. Web form 940 is a tax form that allows employers to report their annual futa (federal unemployment tax act) payroll tax. Place an “x” in the box. Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts. For more information about a cpeo’s. Web file form 940, employer’s annual federal unemployment (futa) tax return, with the irs to report taxable futa wages paid in the previous. Read the separate instructions before you complete form 941. Add together the amounts from. Web we ask for the information on form 940 to carry out the internal revenue laws of the united states. Easily sign the form with your finger. If you deposited all the futa. This form is used to report and pay unemployment taxes to the. Web form 940 (2020) employer's annual federal unemployment (futa) tax return. Open form follow the instructions. Once done, here are the steps in running the report: Web by doing this, you will be able to create or file the 940 form. This form is used to report and pay unemployment taxes to the. If you deposited all the futa. Web form 940 instructions. Web list on line 5 the total amount over the wage base you paid to each employee after subtracting the exempt wages. Add together the amounts from. Web get a 940 (2019) here. Web learn how to complete the irs form 940 to report federal unemployment tax payments and taxes owed, as well as information about state unemployment taxes. Frequently asked questions (faqs) if you’re an employer who’s required to pay federal unemployment tax, you’ll need to complete and. Web list on line 5 the total amount. Web file form 940, employer’s annual federal unemployment (futa) tax return, with the irs to report taxable futa wages paid in the previous year. Information about form 940, employer's annual federal unemployment (futa) tax return, including recent updates,. Web form 940 is a tax form that allows employers to report their annual futa (federal unemployment tax act) payroll tax. Once. Web get a 940 (2019) here. Web form 940 instructions. Web page last reviewed or updated: Web form 940 is a tax form that allows employers to report their annual futa (federal unemployment tax act) payroll tax. Web schedule a (form 940) for 2019: This form is used to report and pay unemployment taxes to the. Most employers that have employees are. If you deposited all the futa. Web list on line 5 the total amount over the wage base you paid to each employee after subtracting the exempt wages. Easily sign the form with your finger. Read the separate instructions before you complete form 941. Web 2019 instructions for form 940 employer's annual federal unemployment (futa) tax return department of the treasury internal revenue service section references are to. Choose the payroll tax tab. Answer these questions for this quarter. Web get a 940 (2019) here. Web form 940 is a tax form that allows employers to report their annual futa (federal unemployment tax act) payroll tax. See the instructions on page 2. Web cpeos must generally file form 940 and schedule r (form 940), allocation schedule for aggregate form 940 filers, electronically. Web form 940, line 9 or line 10 (f) credit reduction amount allocated to the listed client ein from form 940, line 11 (g) total futa tax after adjustments allocated to the listed client ein. For more information about a cpeo’s. Web file form 940, employer’s annual federal unemployment (futa) tax return, with the irs to report taxable futa wages paid in the previous year. Web schedule a (form 940) for 2019: Employer's annual federal unemployment (futa) tax return department of the treasury — internal revenue service 850113 omb no. Web page last reviewed or updated: Web the f940 accessible 2019 form 940 form is 3 pages long and contains:IRS 940PR 2019 Fill and Sign Printable Template Online US Legal Forms

How to Fill Out Form 940 Instructions, Example, & More

Form 940 Instructions How to Fill It Out and Who Needs to File It

How to File 940 Form with ezPaycheck Payroll Software

Fillable 940 Forms Printable Forms Free Online

How to File Form 940 FUTA Employer’s Annual federal Unemployment Tax

Payroll Forms Employers Need

Changes to IRS Form 940 You Need To Know Blog TaxBandits

IRS 940 2019 Fill and Sign Printable Template Online US Legal Forms

Fillable Form 940 Employer'S Annual Federal Unemployment (Futa) Tax

Related Post: