The Partnership Form Of Business Organization Quizlet

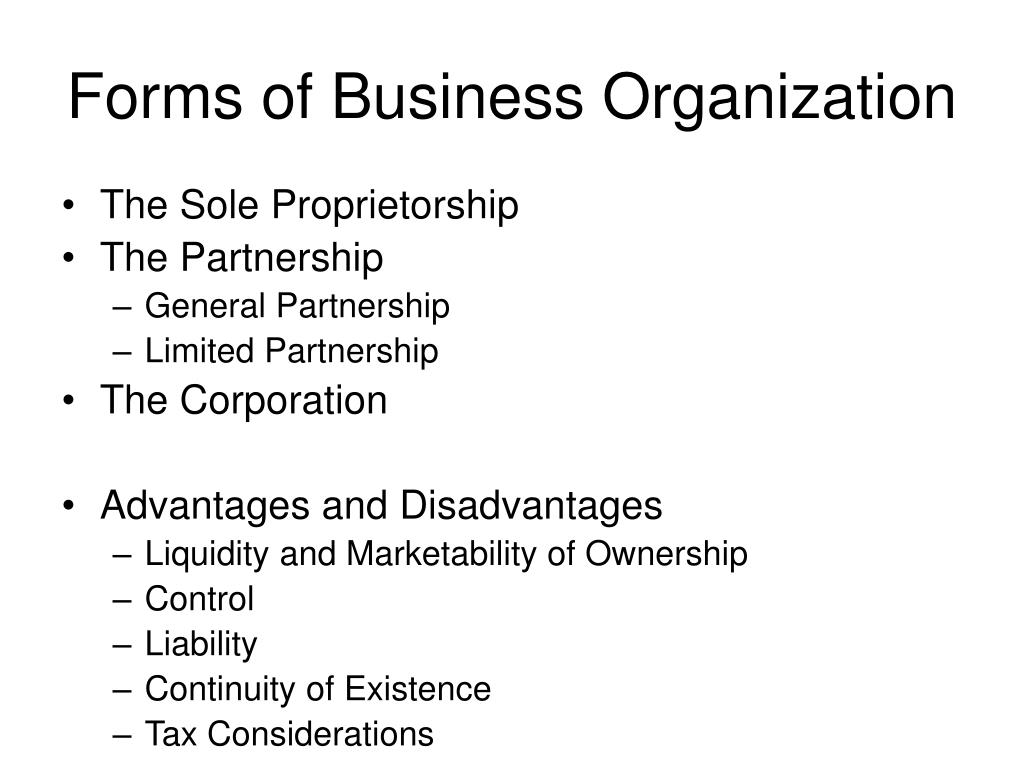

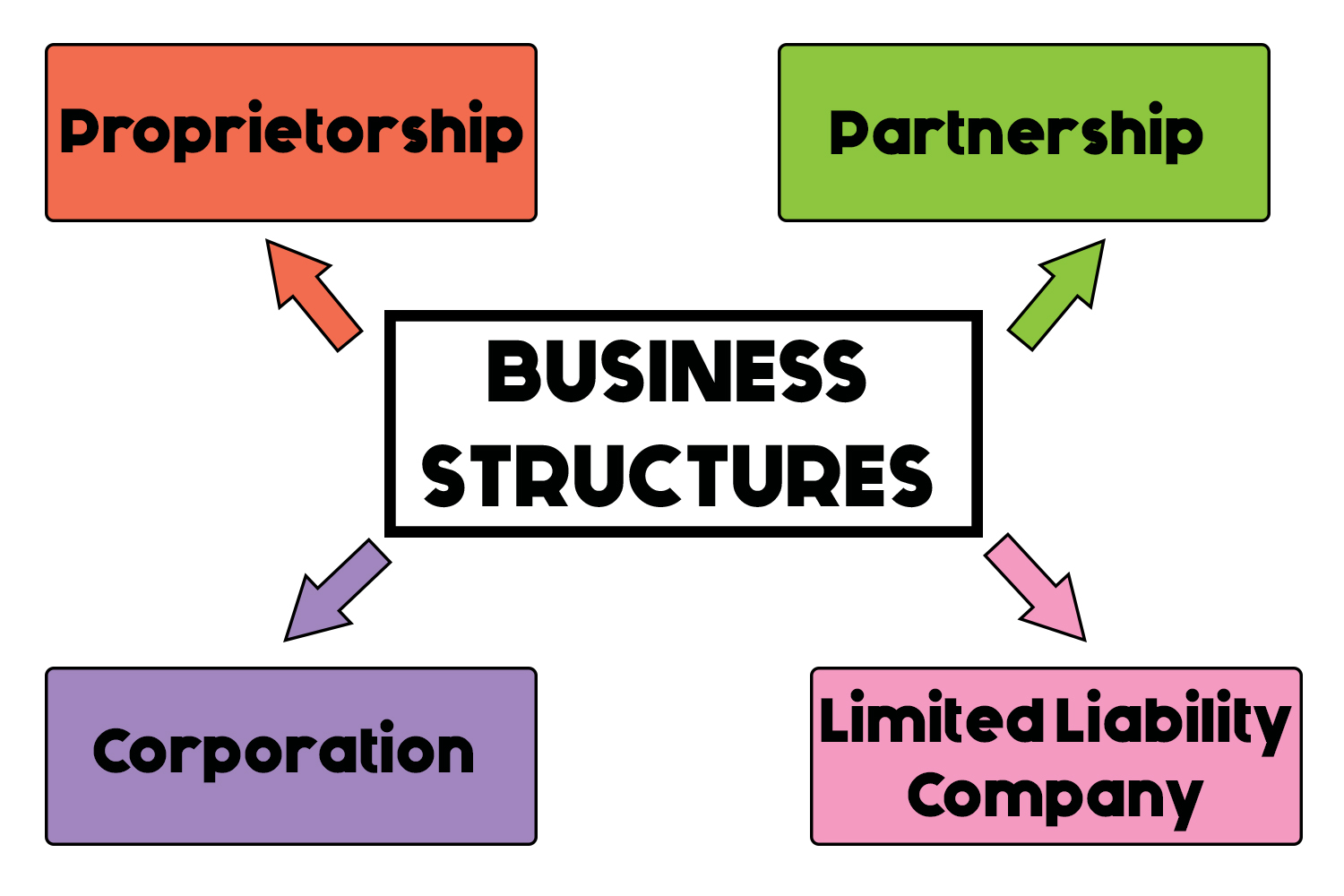

The Partnership Form Of Business Organization Quizlet - Web terms in this set (15) coporation. These parties, called partners, may be individuals, corporations ,. Web 5 main types/forms of business organization 1. Must have at least two owners in most states. Ad real estate, family law, estate planning, business forms and power of attorney forms. Web business organization with limited liability of a corporation, yet taxed like partnership, formed under state law, owners of llc (members) pay personal income taxes on. Both the partnership and the partners. Profit/loss flows through entity 3. A form of business that is owned and operated by one person. Generally receives favorable tax treatment relative to a. Both the partnership and the partners. The business is owned by one person c. Sole proprietorships account for the great majority of small enterprises. Web the most common forms of business are the sole proprietorship, partnership, corporation, and s corporation. Get access to the largest online library of legal forms for any state. Web terms in this set (15) coporation. Web study with quizlet and memorize flashcards containing terms like in a partnership form of organization, income tax liability, if any, is incurred by: Sole proprietorships account for the great majority of small enterprises. The best definition of a sole trader form of business organization is: Two or more people enter into an. Partnerships must have at least two persons that agree to form a joint venture, which share profits and. Web terms in this set (30) sole proprietorship. Both the partnership and the partners. Web an unincorporated business structure that two or more parties form and own together is called a partnership. Web terms in this set (15) coporation. Ad real estate, family law, estate planning, business forms and power of attorney forms. Profit/loss flows through entity 3. Generally receives favorable tax treatment relative to a. This is the most common way to do business, and is the easiest type of. Partners have unlimited liability 3. Two or more people enter into an agreement to operate an enterprise in the pursuit of profit 2. Web 5 main types/forms of business organization 1. Web business organization with limited liability of a corporation, yet taxed like partnership, formed under state law, owners of llc (members) pay personal income taxes on. The proprietorship form of business organization a. Both. The best definition of a sole trader form of business organization is: Both the partnership and the partners. The business is owned by one person c. Generally receives favorable tax treatment relative to a. Partnership corporation sole proprietorship cooperative limited liability company partnership you. Web what forms of business organization restrict the number and type of shareholder? Web terms in this set (15) coporation. Get access to the largest online library of legal forms for any state. The owners of a partnership. Web a partnership is an arrangement between two or more people to oversee business operations and share its profits and liabilities. Partnership corporation sole proprietorship cooperative limited liability company partnership you. The owners of a partnership. Web the five forms of business organizations include the following: Profit/loss flows through entity 3. Two or more people enter into an agreement to operate an enterprise in the pursuit of profit 2. Unlimited liability for the partners. These parties, called partners, may be individuals, corporations ,. Must have at least two owners in most states. Web study with quizlet and memorize flashcards containing terms like in a partnership form of organization, income tax liability, if any, is incurred by: Web terms in this set (15) coporation. Web how many people can be in a partnership? Web what forms of business organization restrict the number and type of shareholder? Web the most common forms of business are the sole proprietorship, partnership, corporation, and s corporation. Partnerships must have at least two persons that agree to form a joint venture, which share profits and. Web study with quizlet. Business owned by a group of people and authorized by the state in which it is located to act as though it were a single person, separate from its. Web terms in this set (30) sole proprietorship. The distinguishing features of the partnership are the personal and unrestricted liability of each partner for the. This is the most common way to do business, and is the easiest type of. Both the partnership and the partners. Partnerships must have at least two persons that agree to form a joint venture, which share profits and. Web how many people can be in a partnership? These parties, called partners, may be individuals, corporations ,. Ad real estate, family law, estate planning, business forms and power of attorney forms. Get access to the largest online library of legal forms for any state. Two or more people enter into an agreement to operate an enterprise in the pursuit of profit 2. Must have at least two owners in most states. A form of business that is owned and operated by one person. Web june 21, 2023 a partnership is a form of business organization in which owners have unlimited personal liability for the actions of the business. A limited liability company (llc) is a. Web business organization with limited liability of a corporation, yet taxed like partnership, formed under state law, owners of llc (members) pay personal income taxes on. Web an unincorporated business structure that two or more parties form and own together is called a partnership. Sole proprietorships account for the great majority of small enterprises. Partners have unlimited liability 3. Profit/loss flows through entity 3.Identify The Characteristics Of The Partnership Form Of Business

Partnership Definition, Features, Advantages, Limitations

PPT Accounting for Partnerships PowerPoint Presentation, free

PPT CHAPTER 12 PowerPoint Presentation, free download ID4355890

9. forms of business organization

Different Forms Of Business Organizations And Their Advantages And

Partnership Chart by Inc Legal Services

Business Organization Forms of Business Ownership online presentation

Structure examples Advantages of partnership firm

Business Organizations

Related Post: