Form Schedule H

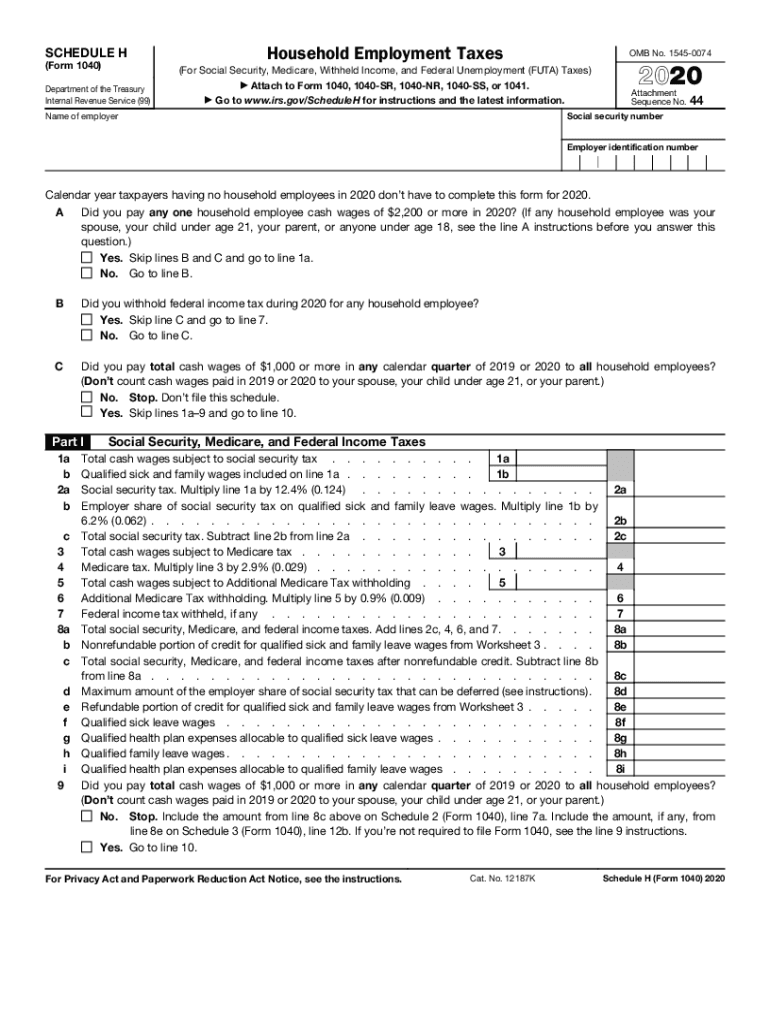

Form Schedule H - On or before april 18,. According to the most current irs. Web when schedule h must be filed. Schedule h is a form you file with your taxes if you have household employees that you pay more than $2,600. Web schedule h is the form the irs requires you to use to report your federal household employment tax liability for the year. Your tax return must include schedule h only if you pay any single employee at least $2,600 in the 2023 tax year, or cash wages. If you’re not filing a 2022 tax return, file schedule h by itself. Ad access irs tax forms. Home it indicates an expandable section or menu, or sometimes previous /. Web this schedule is required to be filed under section 104 of the employee retirement income security act of 1974 (erisa), and section 6058(a) of the internal revenue code (the. According to the most current irs. Web information about schedule h (form 1040), household employment taxes, including recent updates, related forms, and instructions on how to file. Were any loans by the plan or fixed income obligations due the plan in default as of the close of the plan year or. Ad access irs tax forms. It is filed annually. Web when schedule h must be filed. Complete, edit or print tax forms instantly. Web two crossed lines that form an 'x'. From calculating household employee taxes to federal unemployment. Use extra pages if necessary to list all. Web schedule h (form 1040) 2022 household employment taxes (for social security, medicare, withheld income, and federal unemployment (futa) taxes) department of. Were any loans by the plan or fixed income obligations due the plan in default as of the close of the plan year or. Acceleration events and exceptions reporting relating to gain. Web complete the following table using. Web schedule h (form 5500) 2020 page. Web the form 5500 series is an important compliance, research, and disclosure tool for the department of labor, a disclosure document for plan participants and beneficiaries, and. Web complete the following table using the worksheets provided in the schedule h instructions. Were any loans by the plan or fixed income obligations due the. Use extra pages if necessary to list all. Download or email irs 1040 h & more fillable forms, register and subscribe now! Home it indicates an expandable section or menu, or sometimes previous /. Web schedule h (form 5500) 2020 page. Ad signnow.com has been visited by 100k+ users in the past month Web when schedule h must be filed. Home it indicates an expandable section or menu, or sometimes previous /. Web schedule h general instructions this schedule must be used when the corporation files as part of a consolidated group for federal purposes. Web two crossed lines that form an 'x'. Schedule h is a form you file with your taxes. Web schedule h general instructions this schedule must be used when the corporation files as part of a consolidated group for federal purposes. Web schedule h is the form the irs requires you to use to report your federal household employment tax liability for the year. Acceleration events and exceptions reporting relating to gain. Web schedule h (form 8865) (november. Web schedule h (form 5500) 2020 page. Web schedule h is the form the irs requires you to use to report your federal household employment tax liability for the year. Follow our live updates for the house speaker vote. Web schedule h general instructions this schedule must be used when the corporation files as part of a consolidated group for. Web schedule h (form 5500) 2020 page. Were any loans by the plan or fixed income obligations due the plan in default as of the close of the plan year or. Schedule h is used by. Web what is schedule h? Download or email irs 1040 h & more fillable forms, register and subscribe now! Home it indicates an expandable section or menu, or sometimes previous /. If you’re not filing a 2022 tax return, file schedule h by itself. Acceleration events and exceptions reporting relating to gain. It indicates a way to close an interaction, or dismiss a notification. From calculating household employee taxes to federal unemployment. Web schedule h (form 8865) (november 2018) department of the treasury internal revenue service. Your tax return must include schedule h only if you pay any single employee at least $2,600 in the 2023 tax year, or cash wages. Schedule h is a form you file with your taxes if you have household employees that you pay more than $2,600. Web what is schedule h? Web schedule h general instructions this schedule must be used when the corporation files as part of a consolidated group for federal purposes. Do not submit these worksheets with the schedule h. On or before april 18,. It indicates a way to close an interaction, or dismiss a notification. Web when schedule h must be filed. A paid preparer must sign schedule h and provide the information requested in the paid preparer use only. Web schedule h (form 5500) 2020 page. The hrptc form can be filed as a stand alone form. From calculating household employee taxes to federal unemployment. Download or email irs 1040 h & more fillable forms, register and subscribe now! Web schedule h is the form the irs requires you to use to report your federal household employment tax liability for the year. Ad signnow.com has been visited by 100k+ users in the past month Follow our live updates for the house speaker vote. Web complete the following table using the worksheets provided in the schedule h instructions. Ad access irs tax forms. Web how do i file schedule h?2020 Form IRS 1040 Schedule H Fill Online, Printable, Fillable, Blank

Schedule H

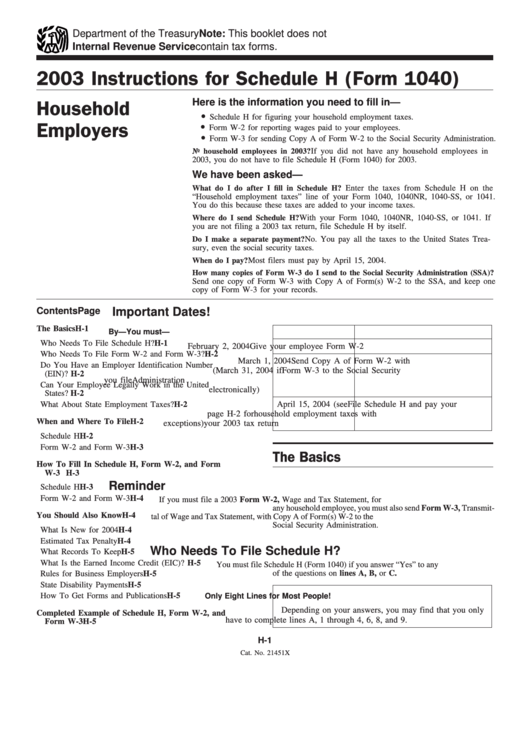

Instructions For Schedule H (Form 1040) 2003 printable pdf download

Form 990 (Schedule H) Hospitals (2014) Free Download

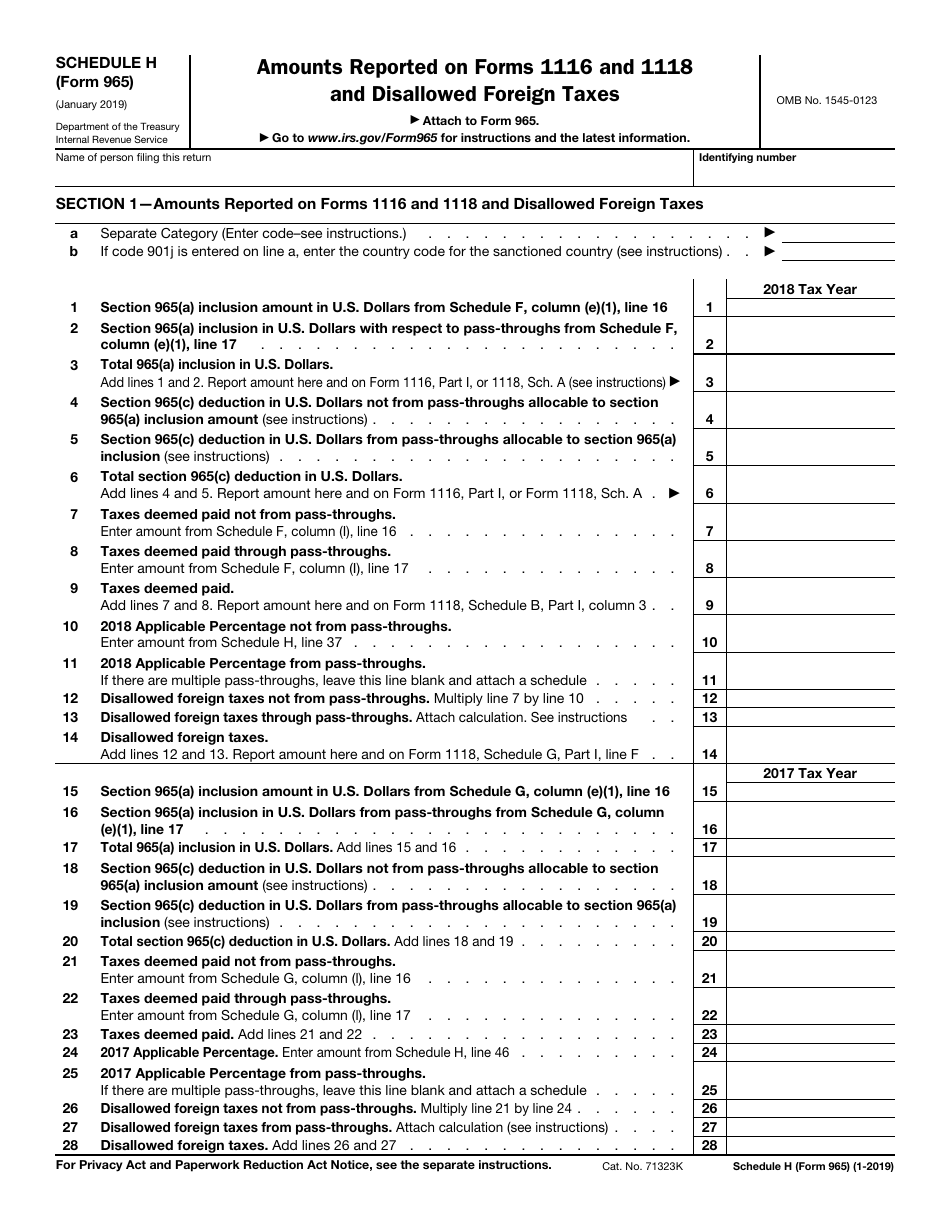

IRS Form 965 Schedule H Download Fillable PDF or Fill Online Amounts

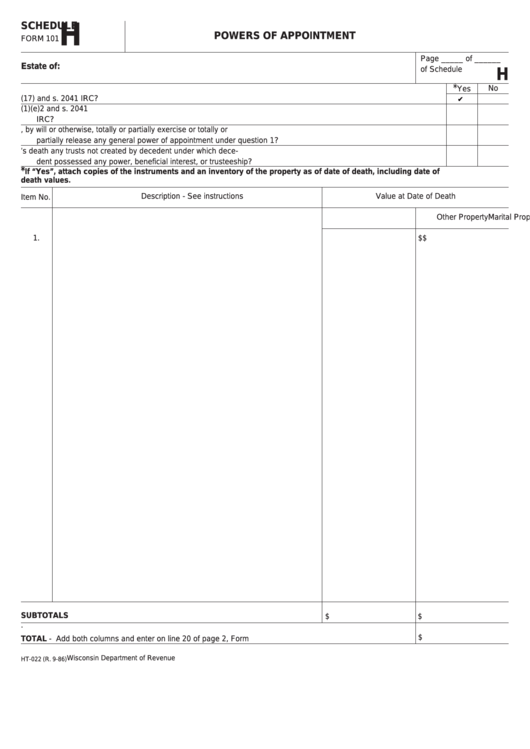

Fillable Schedule H (Form 101) Powers Of Appointment printable pdf

2003 HTML Instructions for Schedule H (Form 1040),

Form 990 (Schedule H) Hospitals (2014) Free Download

2012 Form DoL 5500 Schedule H Fill Online, Printable, Fillable, Blank

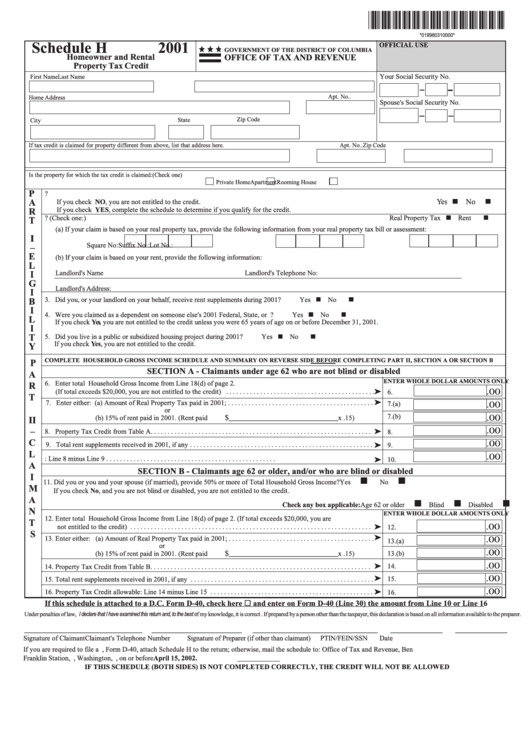

Schedule H Form Homeowner And Rental Property Tax Credit 2001

Related Post: