3804 Cr Form

3804 Cr Form - I am working on an s corp return for. If you are using the purchased product, you can. Prepare and populate california form 3804 and / or form 3893 in an s corporation return using worksheet. Attach to your california tax return. Web go to income deductions > partnership passthrough worksheet. Web check the form 3804 box for each shareholder or partner who elects to be included in the pte filing. The pte elective tax credit will. Review the partner or shareholder information that's been. Web the california franchise tax board (ftb) aug. Enter the 13d amount in credit from passthrough elective entity tax (pte) {ca}. Web refer to the following for form numbers and dates available: It depends on whether you are using turbo tax online, or the purchased product. If you are using the purchased product, you can. Prepare and populate california form 3804 and / or form 3893 in an s corporation return using worksheet. Web alloy structural steel is provided with higher. Web alloy structural steel is provided with higher yield strength, tensile strength, endurance strength, yield ratio (about 0.85 generally ) enough plasticity and toughness. Web check the form 3804 box for each shareholder or partner who elects to be included in the pte filing. Prepare and populate california form 3804 and / or form 3893 in an s corporation return. If you are using the purchased product, you can. It depends on whether you are using turbo tax online, or the purchased product. Prepare and populate california form 3804 and / or form 3893 in an s corporation return using worksheet. Web alloy structural steel is provided with higher yield strength, tensile strength, endurance strength, yield ratio (about 0.85 generally. When will the elective tax expire? Web the california franchise tax board (ftb) aug. I elective tax credit amount. The pte elective tax credit will. Web go to income deductions > partnership passthrough worksheet. It depends on whether you are using turbo tax online, or the purchased product. Web refer to the following for form numbers and dates available: I elective tax credit amount. Name(s) as shown on your california tax return (smllcs see. Web go to income deductions > partnership passthrough worksheet. Web the california franchise tax board (ftb) aug. In general, for taxable years beginning on or after january 1, 2015, california law conforms. When will the elective tax expire? Enter the 13d amount in credit from passthrough elective entity tax (pte) {ca}. Attach to your california tax return. Attach to your california tax return. Name(s) as shown on your california tax return (smllcs see. Web refer to the following for form numbers and dates available: Attach to your california tax return. Web alloy structural steel is provided with higher yield strength, tensile strength, endurance strength, yield ratio (about 0.85 generally ) enough plasticity and toughness. I elective tax credit amount. Web check the form 3804 box for each shareholder or partner who elects to be included in the pte filing. Prepare and populate california form 3804 and / or form 3893 in an s corporation return using worksheet. Attach to your california tax return. The pte elective tax credit will. I elective tax credit amount. Web go to income deductions > partnership passthrough worksheet. Enter the 13d amount in credit from passthrough elective entity tax (pte) {ca}. In general, for taxable years beginning on or after january 1, 2015, california law conforms. Attach to your california tax return. Web check the form 3804 box for each shareholder or partner who elects to be included in the pte filing. When will the elective tax expire? Review the partner or shareholder information that's been. In general, for taxable years beginning on or after january 1, 2015, california law conforms. Web go to income deductions > partnership passthrough worksheet. It depends on whether you are using turbo tax online, or the purchased product. Enter the 13d amount in credit from passthrough elective entity tax (pte) {ca}. Web check the form 3804 box for each shareholder or partner who elects to be included in the pte filing. Attach to your california tax return. Review the partner or shareholder information that's been. Web alloy structural steel is provided with higher yield strength, tensile strength, endurance strength, yield ratio (about 0.85 generally ) enough plasticity and toughness. If you are using the purchased product, you can. Prepare and populate california form 3804 and / or form 3893 in an s corporation return using worksheet. I am working on an s corp return for. I elective tax credit amount. The pte elective tax credit will. When will the elective tax expire? Web the california franchise tax board (ftb) aug. Name(s) as shown on your california tax return (smllcs see. In general, for taxable years beginning on or after january 1, 2015, california law conforms. Web go to income deductions > partnership passthrough worksheet. Web refer to the following for form numbers and dates available: Attach to your california tax return.Cr Dvhe70 Fill Online, Printable, Fillable, Blank pdfFiller

California FTB Releases 2022 Instructions for Form FTB 3804CR, Pass

CA Form FTB 3801CR 20202022 Fill and Sign Printable Template Online

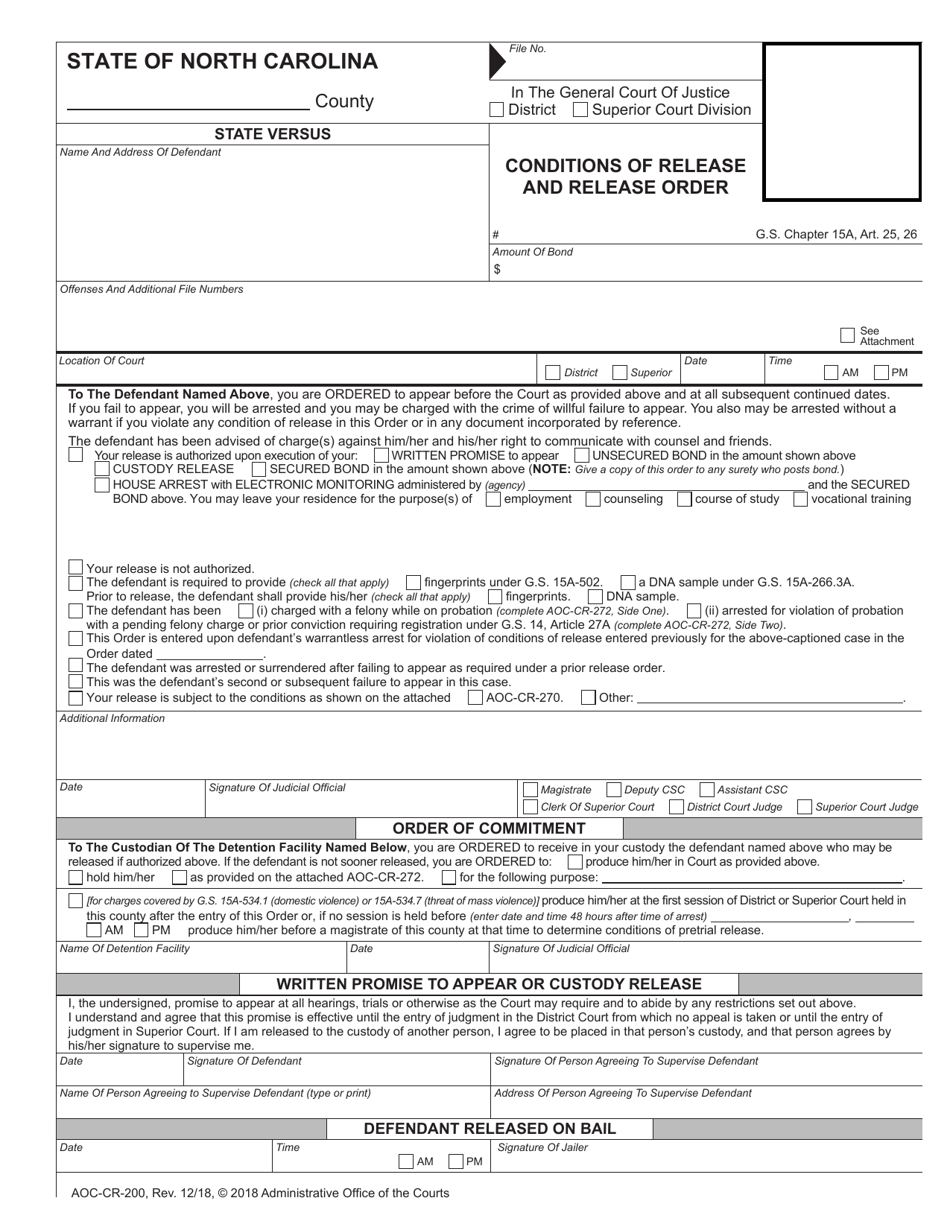

Form AOCCR200 Download Fillable PDF or Fill Online Conditions of

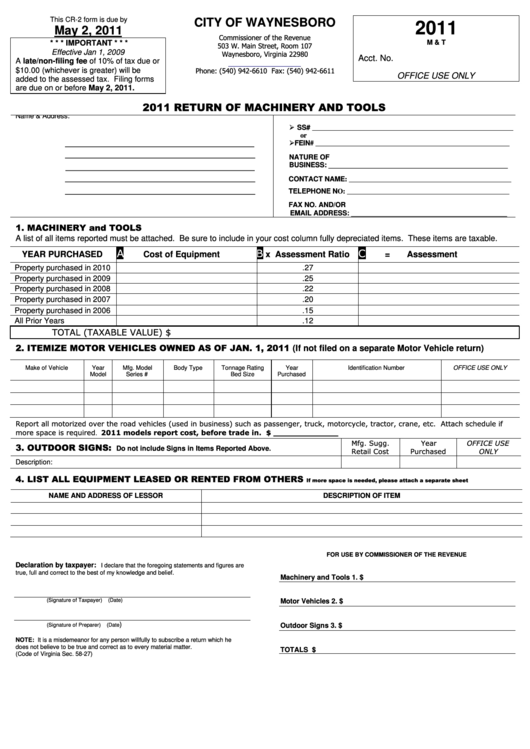

Form Cr2 Return Of Machinery And Tools 2011 printable pdf download

cr 3 police report texas form Fill out & sign online DocHub

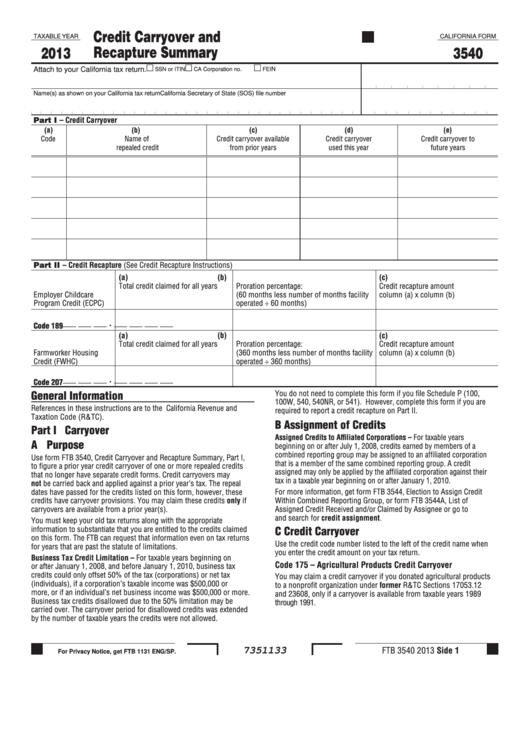

Fillable California Form 3540 Credit Carryover And Recapture Summary

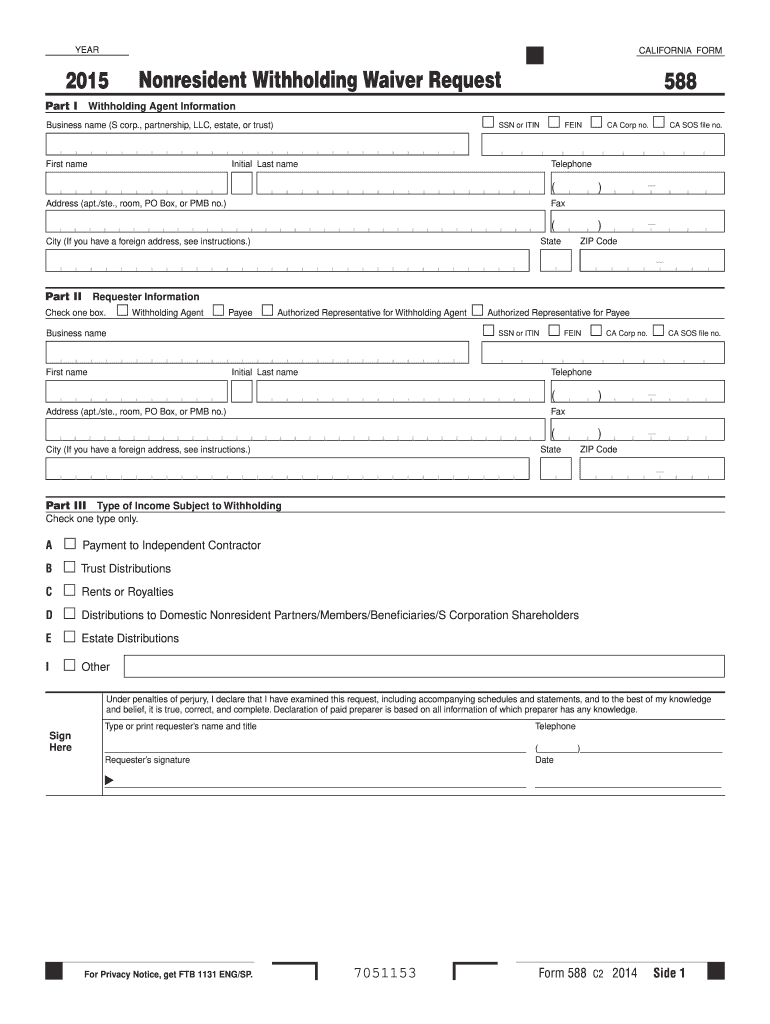

Form 588 California Franchise Tax Board Fill out & sign online DocHub

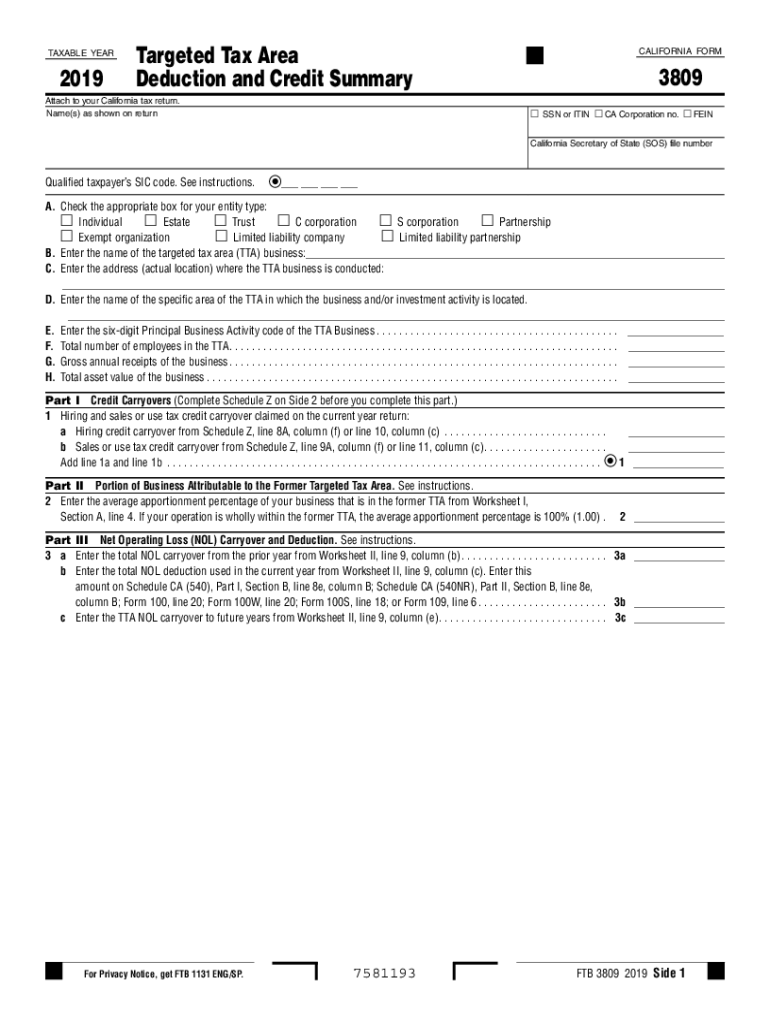

Fillable form 3809 Fill out & sign online DocHub

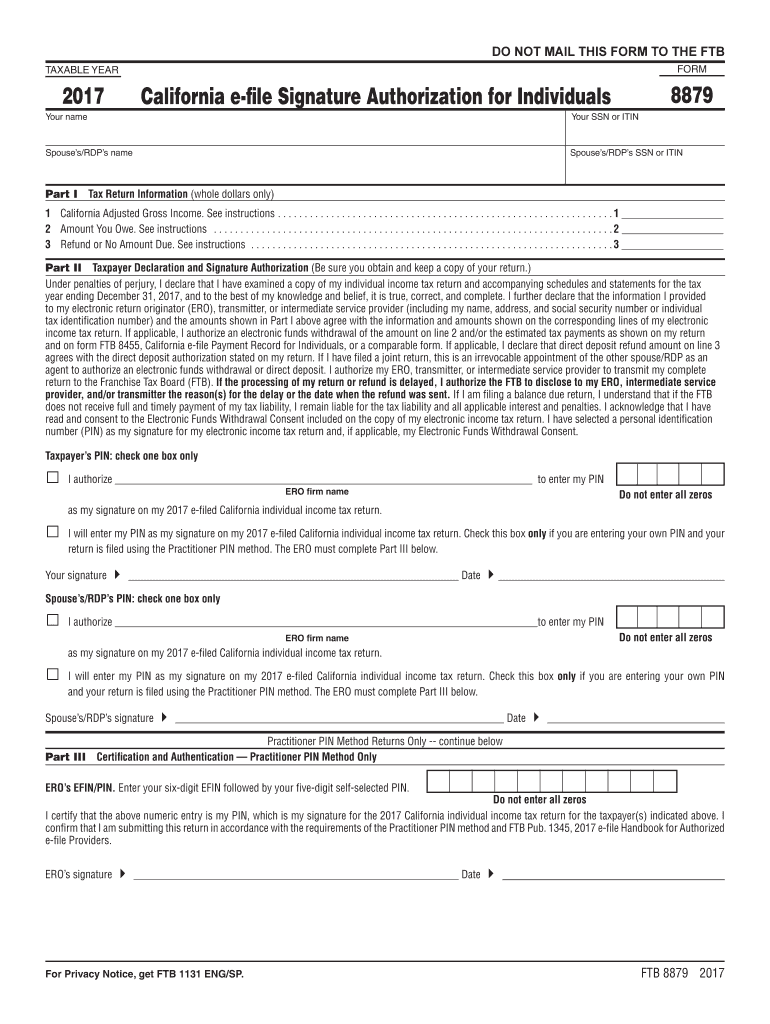

California Tax Form 8879 Fill Out and Sign Printable PDF Template

Related Post: