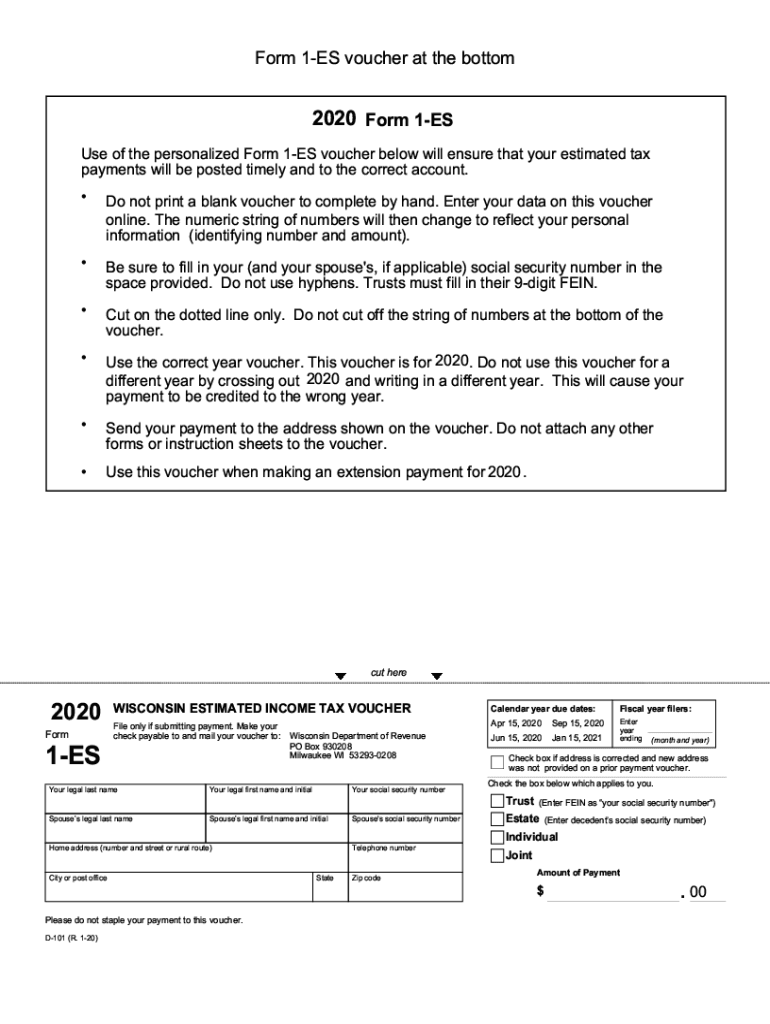

Wisconsin Estimated Tax Form

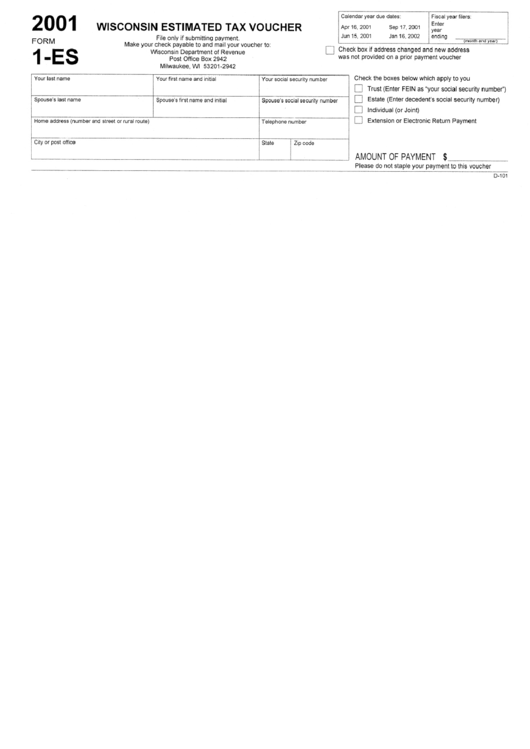

Wisconsin Estimated Tax Form - The $500 minimum is less than. Generally, you must make your first estimated tax payment by april 18, 2023. Estimate your taxes and refunds easily with this free tax calculator from aarp. Tax is required to be paid on income as it is earned or. Schedule jt, wisconsin jobs tax credit. Web when should i pay? Web other states' tax forms; You must pay estimated income tax if you are self. On the next page, you will be able to add more details like. Open form follow the instructions. Web wisconsin dor my tax account allows taxpayers to register tax accounts, file taxes, make payments, check refund statuses, search for unclaimed property, and manage audits. Generally, you must make your first estimated tax payment by april 18, 2023. Tax is required to be paid on income as it is earned or. Web you’ll usually need to pay wisconsin estimated. Easily sign the form with your finger. Web credit against their state income tax liability or a refund check. Web wisconsin department of revenue: The $500 minimum is less than. Web when should i pay? You must pay estimated income tax if you are self. Wisconsin prior years' tax forms. Ad discover helpful information and resources on taxes from aarp. Web wisconsin dor my tax account allows taxpayers to register tax accounts, file taxes, make payments, check refund statuses, search for unclaimed property, and manage audits. Open form follow the instructions. Web you’ll usually need to pay wisconsin estimated taxes if you’ll owe $500 or more when you file your wisconsin income tax return. Web you can use our free wisconsin income tax calculator to get a good estimate of what your tax liability will be come april. Rent certificate (ef only) available. Web you must pay wisconsin estimated tax for. (go to www.revenue.wi.gov/pay for electronic payment options) * indicates a required field. Tax is required to be paid on income as it is earned or. Estimate your taxes and refunds easily with this free tax calculator from aarp. Generally, you must make your first estimated tax payment by april 18, 2023. Ad discover helpful information and resources on taxes from. Easily sign the form with your finger. Estimate your taxes and refunds easily with this free tax calculator from aarp. Send filled & signed form or save. Web the assessment ratio to be used in calculating the estimated fair market value on tax bills for this tax district is.977985781. Web you must pay wisconsin estimated tax for 2023 if you. (go to www.revenue.wi.gov/pay for electronic payment options) * indicates a required field. Tax is required to be paid on income as it is earned or. You must pay estimated income tax if you are self. Generally, you must make your first estimated tax payment by april 18, 2023. Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing,. For additional inquiries please see question 4 of the individual income tax estimated tax. Open form follow the instructions. Web other states' tax forms; Web wisconsin department of revenue: Web the amount of wisconsin income from last year's tax return; Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. Who must pay estimated tax. Web you must pay wisconsin estimated tax for 2022 if you expect to owe, after subtracting your withholding and credits, at least $500 in tax for 2022 and. Easily sign the form with your finger. Generally, you must make your. Generally, you must make your first estimated tax payment by april 18, 2023. Wisconsin prior years' tax forms. Web wisconsin department of revenue: Web you can use our free wisconsin income tax calculator to get a good estimate of what your tax liability will be come april. Ad discover helpful information and resources on taxes from aarp. Web when should i pay? Web the amount of wisconsin income from last year's tax return; Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. Tax is required to be paid on income as it is earned or. Web you must pay wisconsin estimated tax for 2023 if you expect to owe, after subtracting your withholding and credits, at least $500 in tax for 2023 and you expect your. On the next page, you will be able to add more details like. Check your irs tax refund status. For additional inquiries please see question 4 of the individual income tax estimated tax. Web you must pay wisconsin estimated tax for 2022 if you expect to owe, after subtracting your withholding and credits, at least $500 in tax for 2022 and. Sign into your efile.com account and check acceptance by the irs. Web wisconsin dor my tax account allows taxpayers to register tax accounts, file taxes, make payments, check refund statuses, search for unclaimed property, and manage audits. Easily sign the form with your finger. Web credit against their state income tax liability or a refund check. (go to www.revenue.wi.gov/pay for electronic payment options) * indicates a required field. Who must pay estimated tax. Web the assessment ratio to be used in calculating the estimated fair market value on tax bills for this tax district is.977985781. Open form follow the instructions. Rent certificate (ef only) available. Generally, you must make your first estimated tax payment by april 18, 2023. You may pay all your estimated tax at that time or in four equal installments on or.Form 1Es Wisconsin Estimated Tax Voucher 2001 printable pdf download

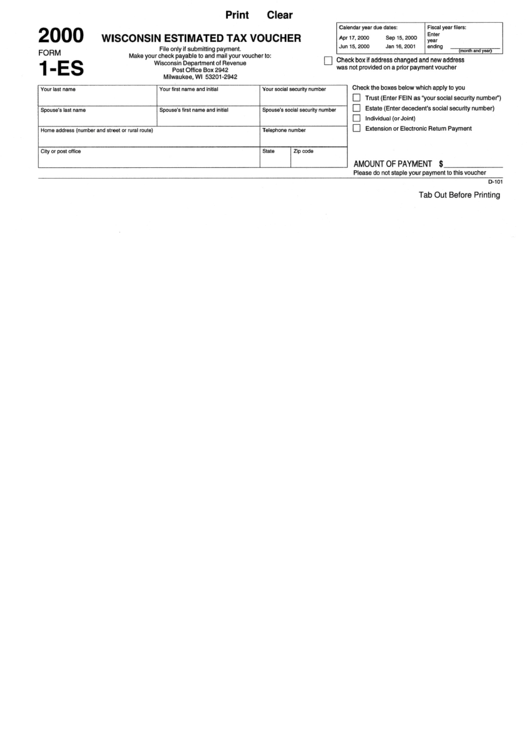

Fillable Form 1Es Wisconsin Estimated Tax Voucher printable pdf download

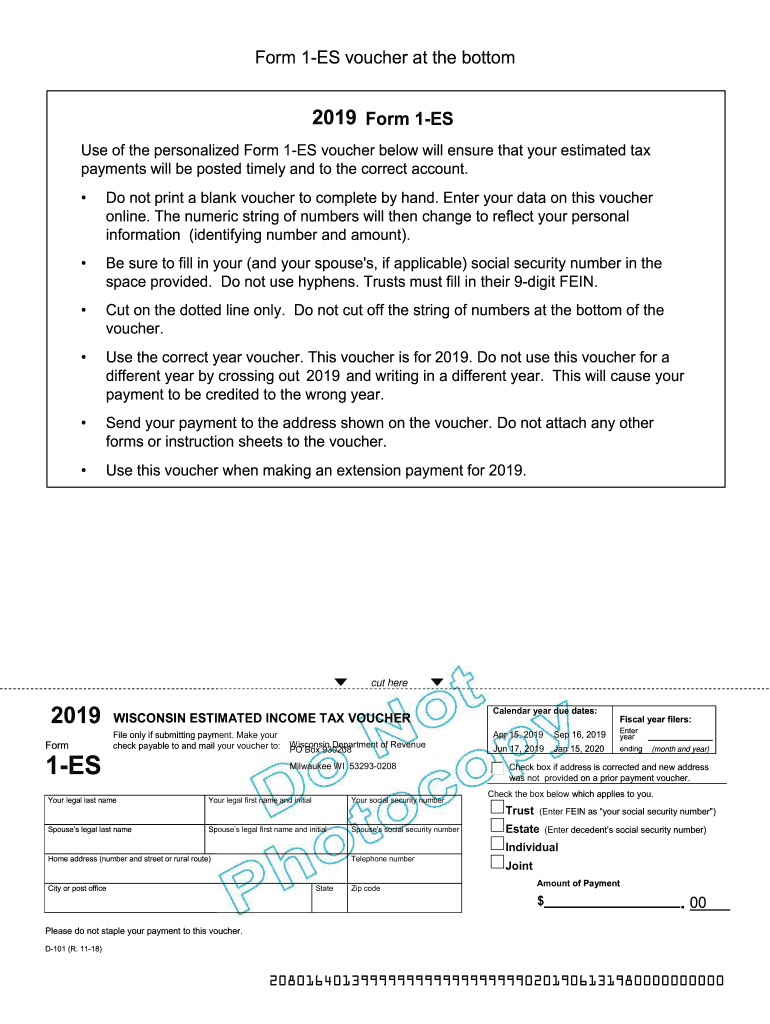

2019 Form WI DoR 1ES (D101) Fill Online, Printable, Fillable, Blank

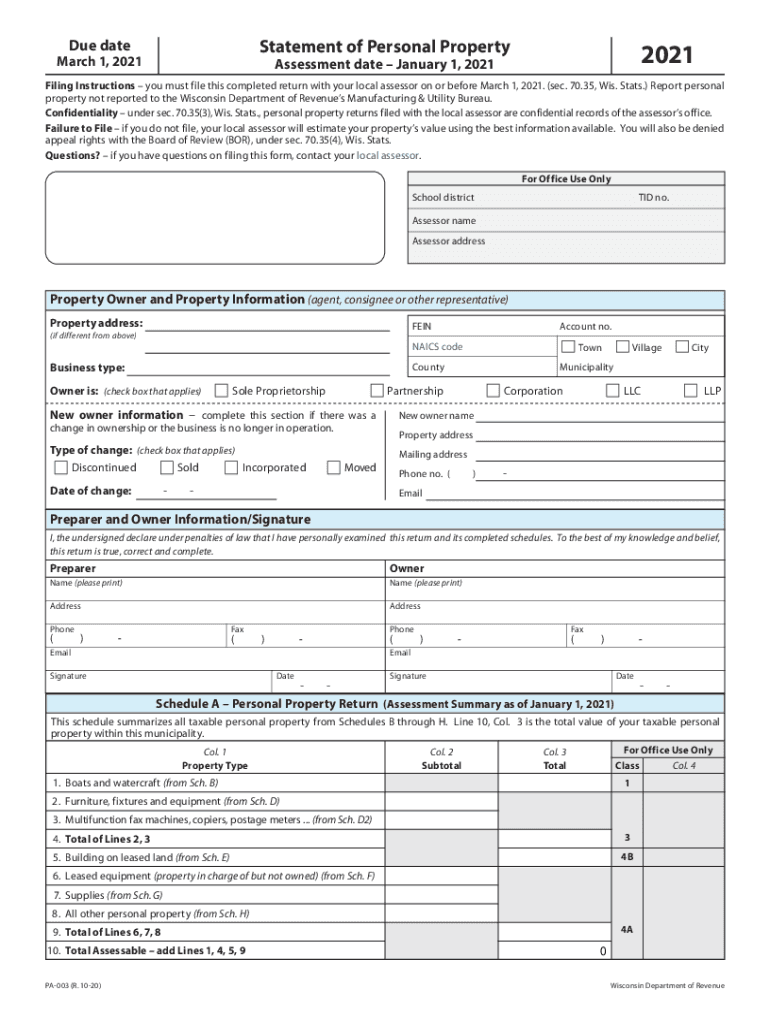

Wisconsin Tax Forms 2021 2022 W4 Form

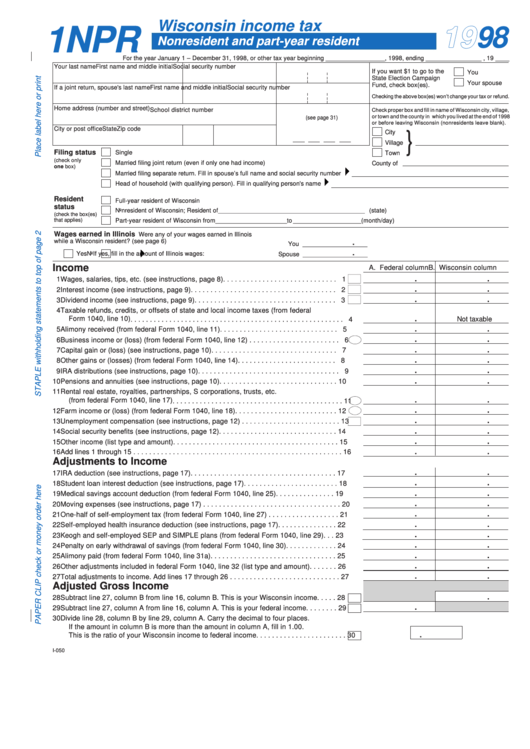

Fillable Wisconsin Tax Form Nonresident And PartYear Resident

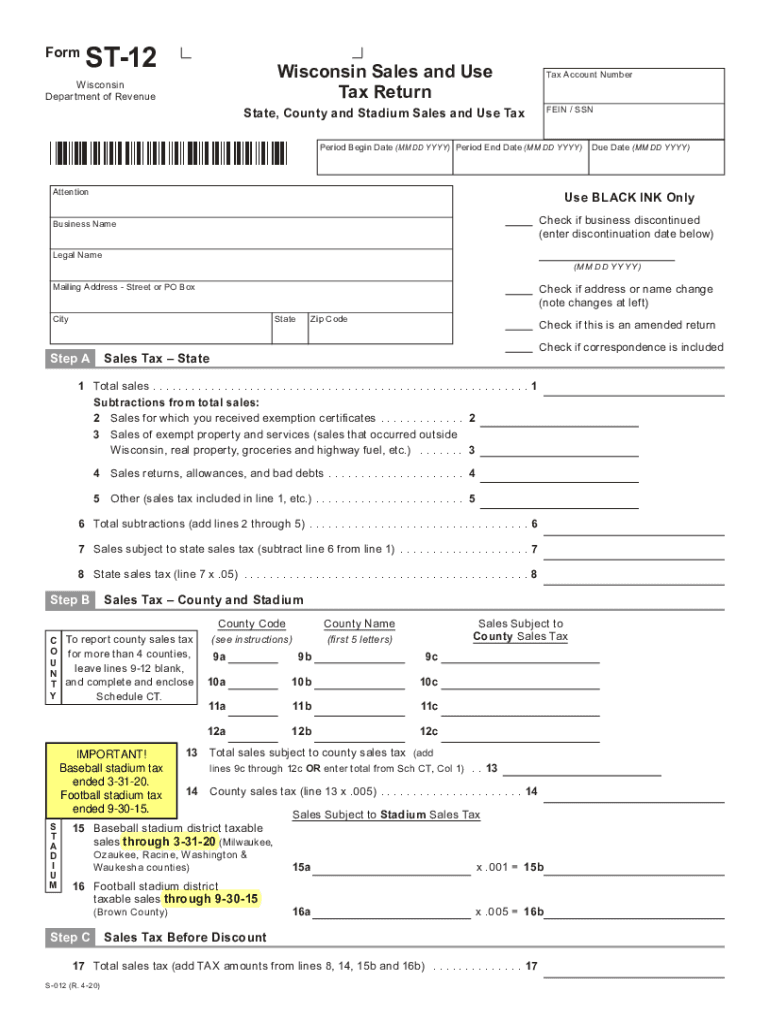

WI DoR ST12 2020 Fill out Tax Template Online US Legal Forms

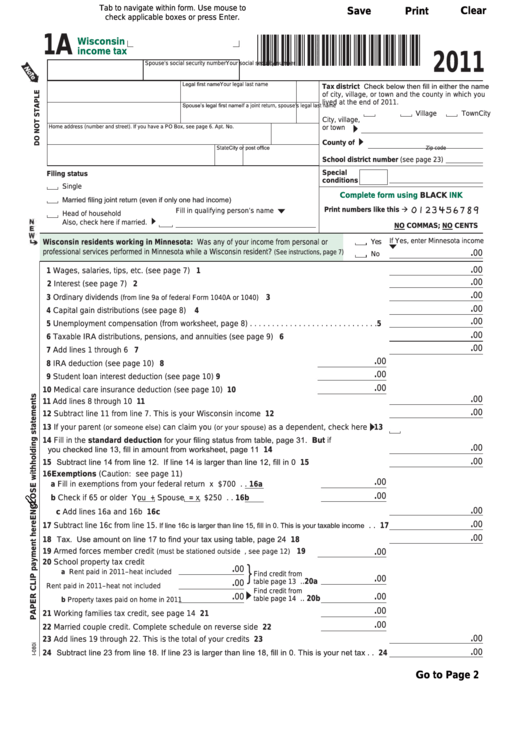

Fillable Form 1a Wisconsin Tax 2011 printable pdf download

Form 1 Download Fillable PDF or Fill Online Wisconsin Tax 2020

Form 1 ES, Wisconsin Estimated Tax Voucher Form 1 ES, Wisconsin

Wisconsin estimated tax payment fillable 2012 form Fill out & sign

Related Post: