1040 Nj Form

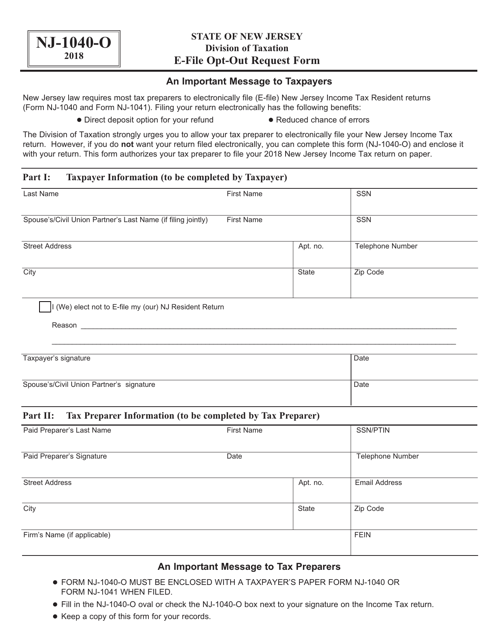

1040 Nj Form - If new jersey was your domicile for only part of the year and you received income from new jersey sources while you were a nonresident,. Web more about the new jersey individual tax instructions. Individual income tax return 2022 department of the treasury—internal revenue service. Web it’s simple and easy to follow the instructions, complete your nj tax return, and file it online. This service only provides for filing new jersey resident income tax returns. Web through q2 2023, the state, territorial, and tribal recipients of haf have expended over $5.5 billion to assist homeowners, a 32% increase from q1 2023. Enter spouse/cu partner last name. Web new jersey tax rate schedules 2021 filing status: Pay the lowest amount of taxes possible with strategic planning and preparation Web if this is your first time filing a tax return with new jersey, you cannot use this portal to make a payment. Single table a married/cu partner, filing separate return step 1 step 2 step 3 enter multiply. This form is for income earned in tax year 2022, with tax returns due in april. State of new jersey division of taxation. Ad discover helpful information and resources on taxes from aarp. Web through q2 2023, the state, territorial, and tribal recipients of. Web the standard deduction is adjusted for inflation every year, and for single taxpayers (and married individuals filing separately), the standard deduction increased. Open the form in the online editor. Visit our gross income tax returns page for a list of printable income tax forms and schedules, as well as other filing. If you need to file any. Web page. This form is for income earned in tax year 2022, with tax returns due in april. Web landfill closure and contingency tax. State of new jersey division of taxation. This service only provides for filing new jersey resident income tax returns. Irs use only—do not write or staple in this. Web landfill closure and contingency tax. Web new jersey tax rate schedules 2021 filing status: Single table a married/cu partner, filing separate return step 1 step 2 step 3 enter multiply. Irs use only—do not write or staple in this. Free, fast, full version (2023) available! Visit our gross income tax returns page for a list of printable income tax forms and schedules, as well as other filing. Free, fast, full version (2023) available! State of new jersey division of taxation. You can download or print. Open the form in the online editor. Web through q2 2023, the state, territorial, and tribal recipients of haf have expended over $5.5 billion to assist homeowners, a 32% increase from q1 2023. Free, fast, full version (2023) available! Ad discover helpful information and resources on taxes from aarp. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in new jersey during calendar year. Last name, first name, and initial (joint filers enter first name and initial of each. Web new jersey tax rate schedules 2021 filing status: You can download or print. Web page last reviewed. Web if this is your first time filing a tax return with new jersey, you cannot use this portal to make a payment. Enter your status, income, deductions and credits and estimate your total taxes. You can download or print. If new jersey was your domicile for only part of the year and you received income from new jersey sources. This form is for income earned in tax year 2022, with tax returns due in april. Individual income tax return 2022 department of the treasury—internal revenue service. Irs use only—do not write or staple in this. Web new jersey tax rate schedules 2021 filing status: State of new jersey division of taxation. State of new jersey division of taxation. Ad save time and money with professional tax planning & preparation services. Web through q2 2023, the state, territorial, and tribal recipients of haf have expended over $5.5 billion to assist homeowners, a 32% increase from q1 2023. Find the document you want in the collection of templates. You can download or print. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in new jersey during calendar year. Enter spouse/cu partner last name. You can download or print. Pay the lowest amount of taxes possible with strategic planning and preparation If you need to file any. Web the standard deduction is adjusted for inflation every year, and for single taxpayers (and married individuals filing separately), the standard deduction increased. Visit our gross income tax returns page for a list of printable income tax forms and schedules, as well as other filing. Irs use only—do not write or staple in this. Find the document you want in the collection of templates. Application for extension of time to file. Open the form in the online editor. Web if this is your first time filing a tax return with new jersey, you cannot use this portal to make a payment. If new jersey was your domicile for only part of the year and you received income from new jersey sources while you were a nonresident,. Web landfill closure and contingency tax. Ad discover helpful information and resources on taxes from aarp. Irs issues guidance on state tax payments to help taxpayers. Last name, first name, and initial (joint filers enter first name and initial of each. Use the labels provided with the envelope and mail to: This form is for income earned in tax year 2022, with tax returns due in april. This service only provides for filing new jersey resident income tax returns.Form NJ1040O Download Fillable PDF or Fill Online EFile OptOut

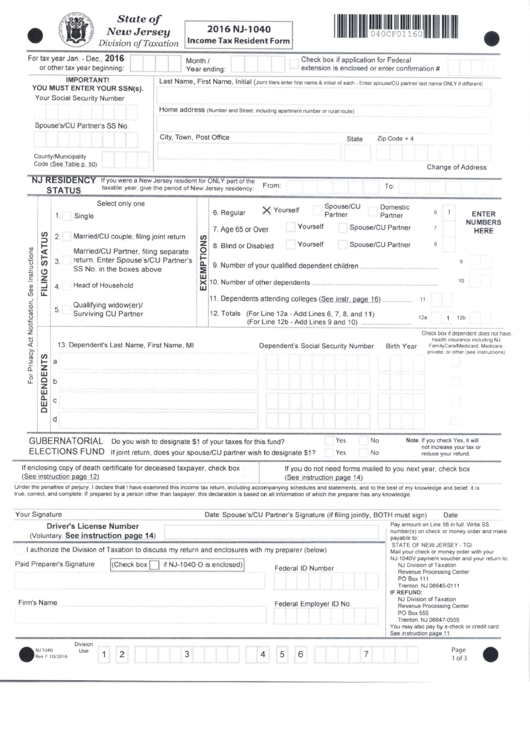

Form Nj1040 Tax Resident Form 2016 printable pdf download

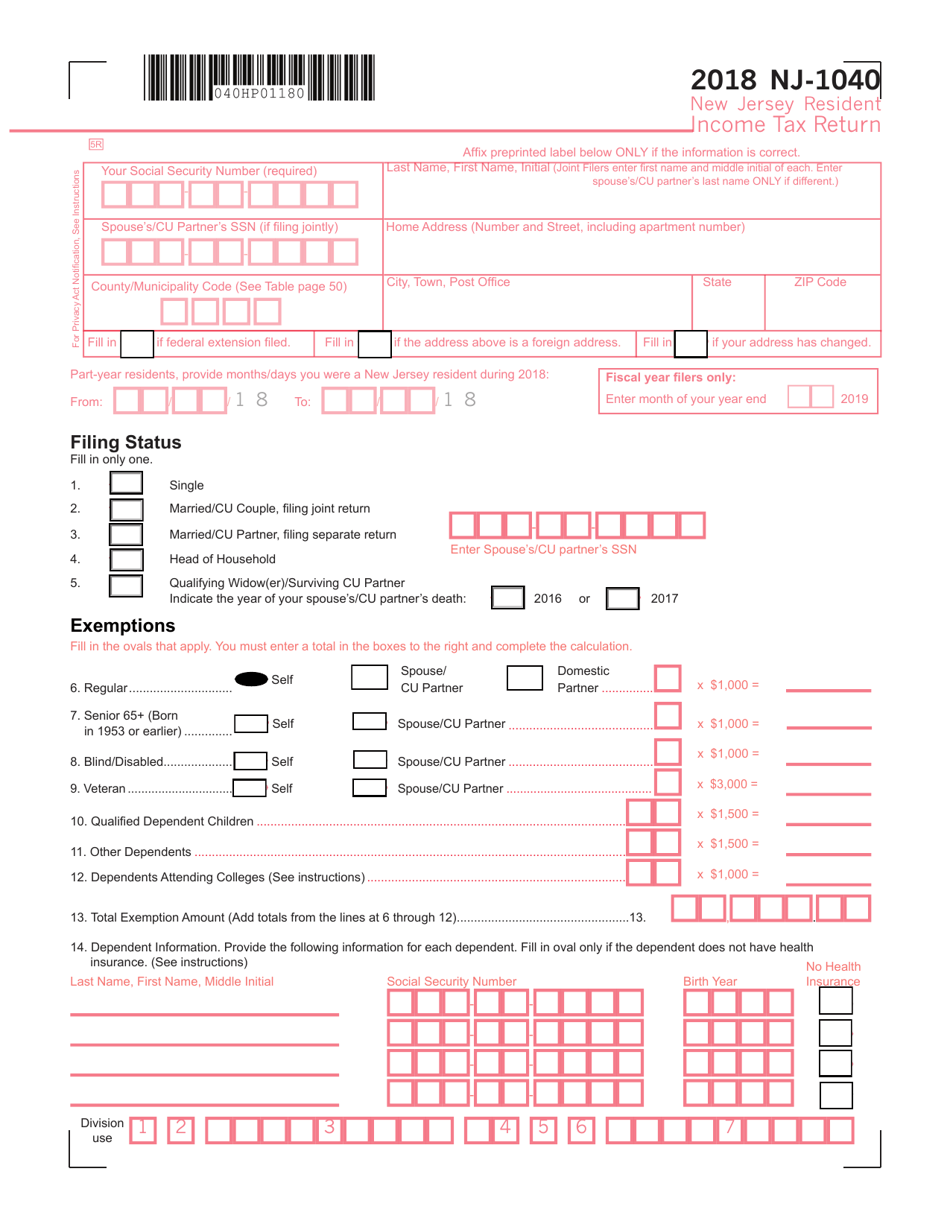

Form NJ1040 2018 Fill Out, Sign Online and Download Fillable PDF

Nj 1040 Fill out & sign online DocHub

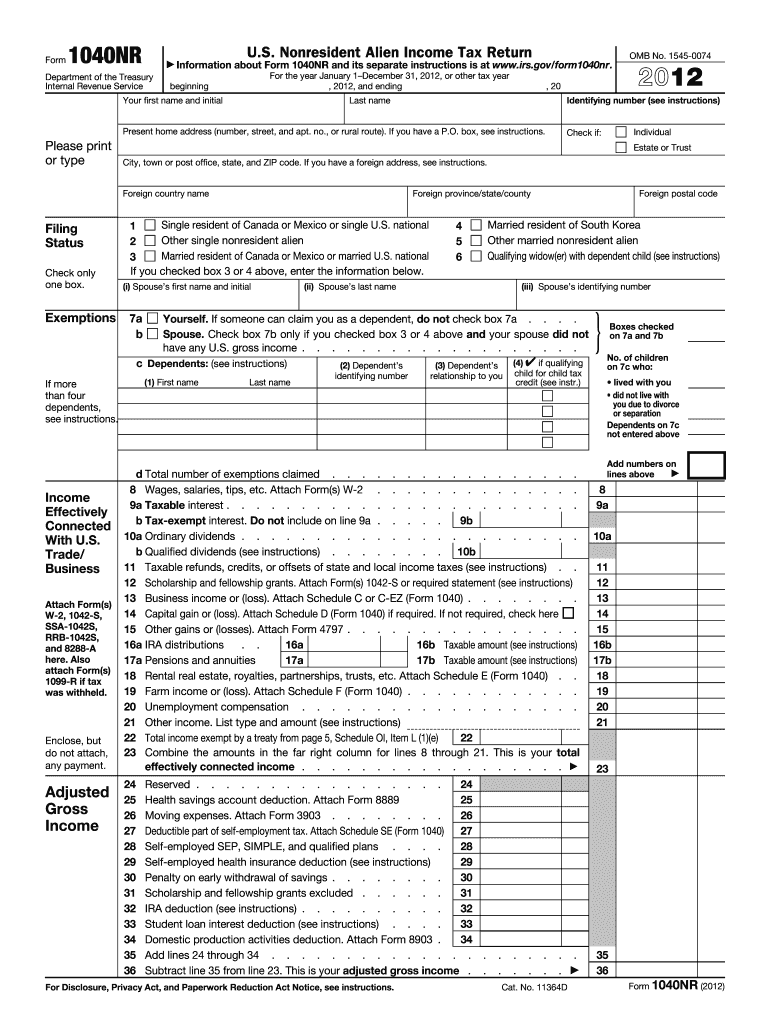

Form nj 1040nr Fill out & sign online DocHub

Nj 1040 form 2016 pdf Fill out & sign online DocHub

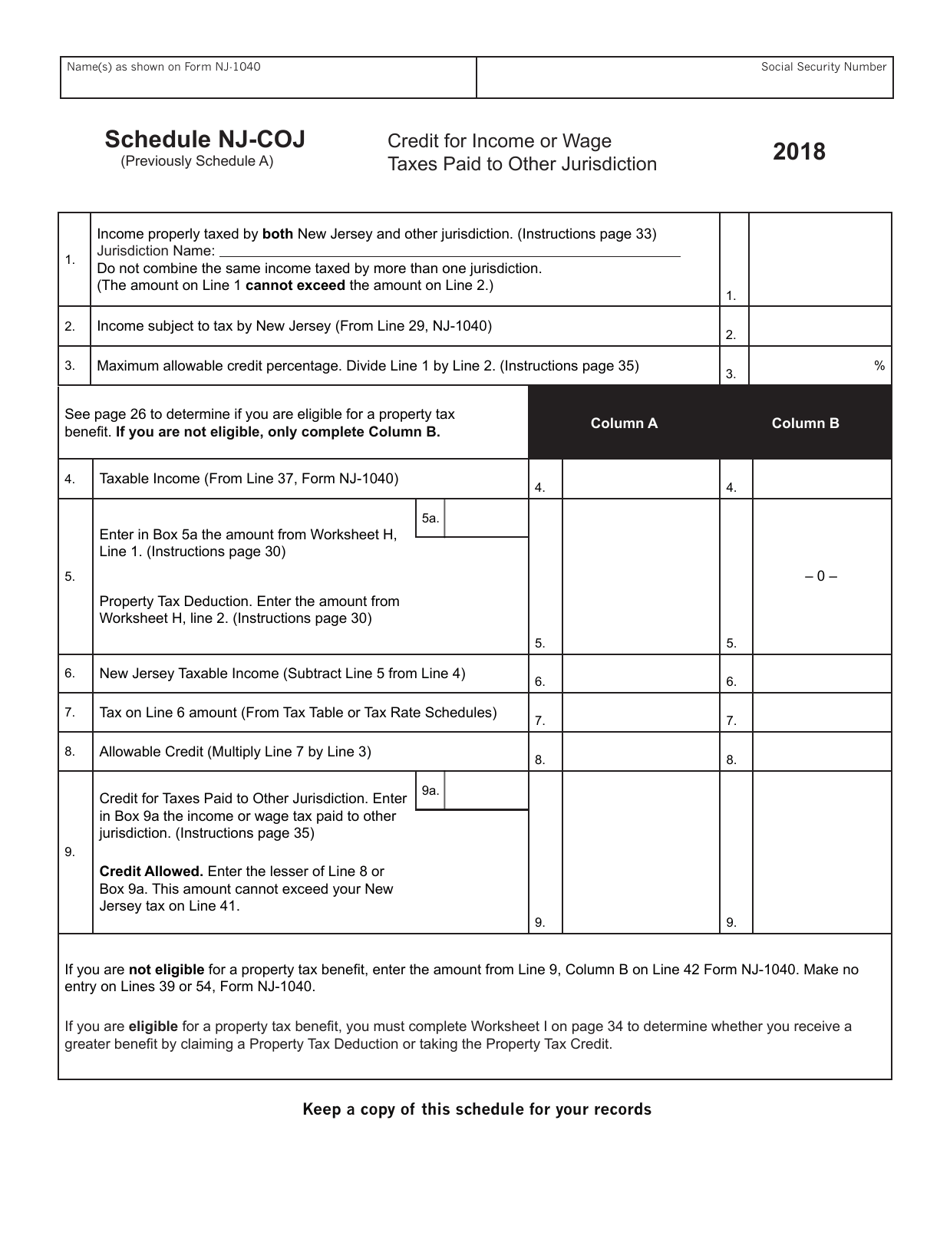

Form NJ1040 Schedule NJCOJ 2018 Fill Out, Sign Online and

Nj 1040 Fillable Form Fill Online, Printable, Fillable, Blank pdfFiller

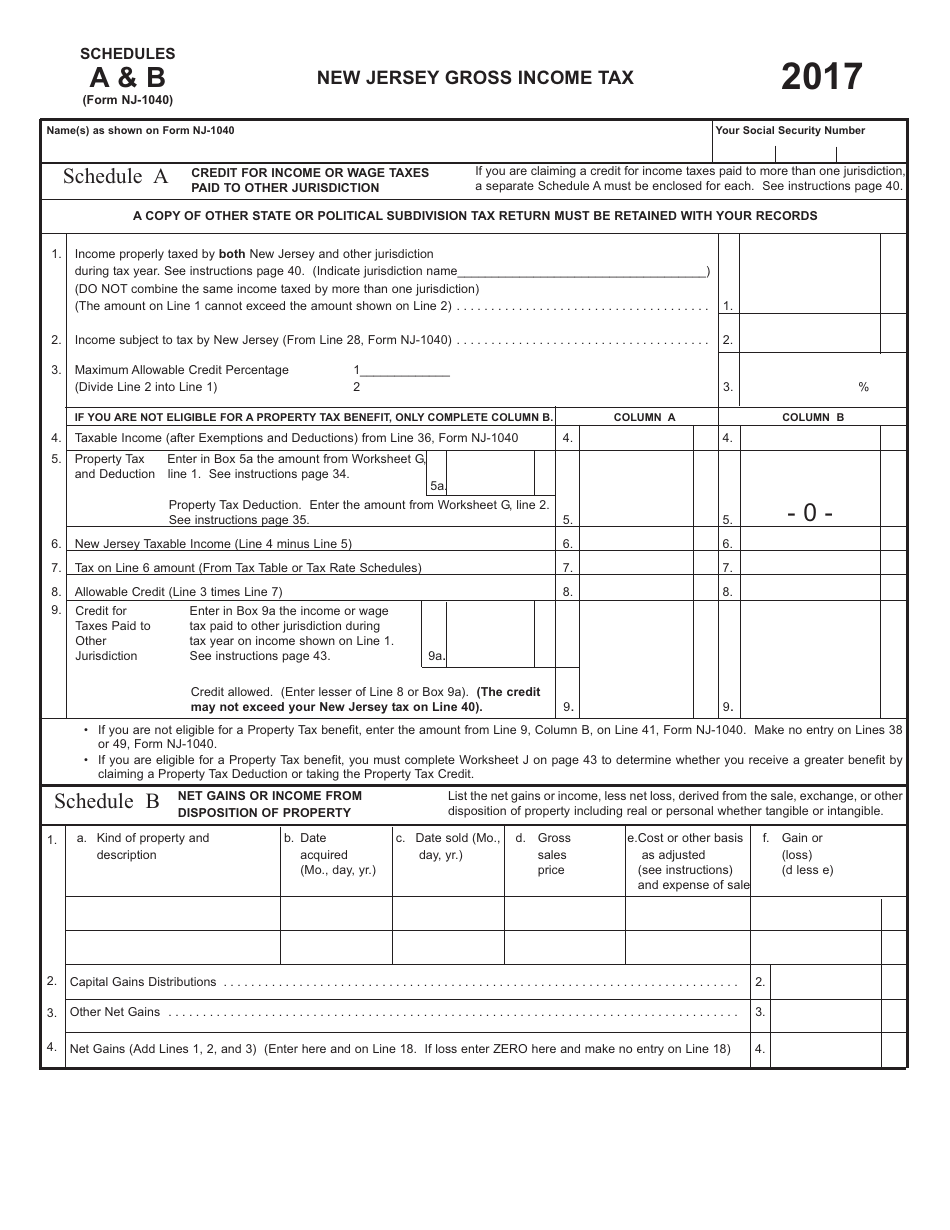

Form NJ1040 Schedule A, B 2017 Fill Out, Sign Online and Download

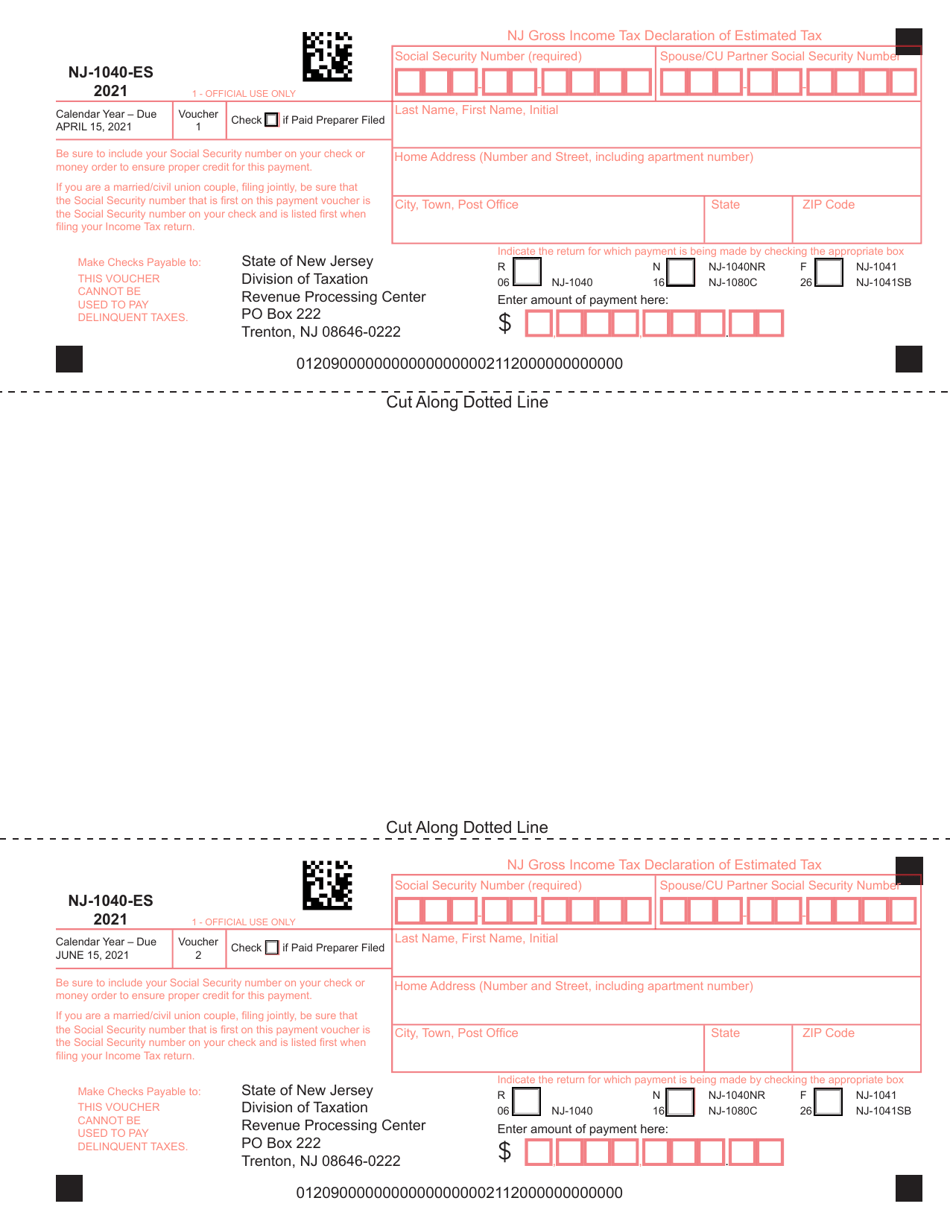

Form NJ1040ES Download Fillable PDF or Fill Online Estimated Tax

Related Post: