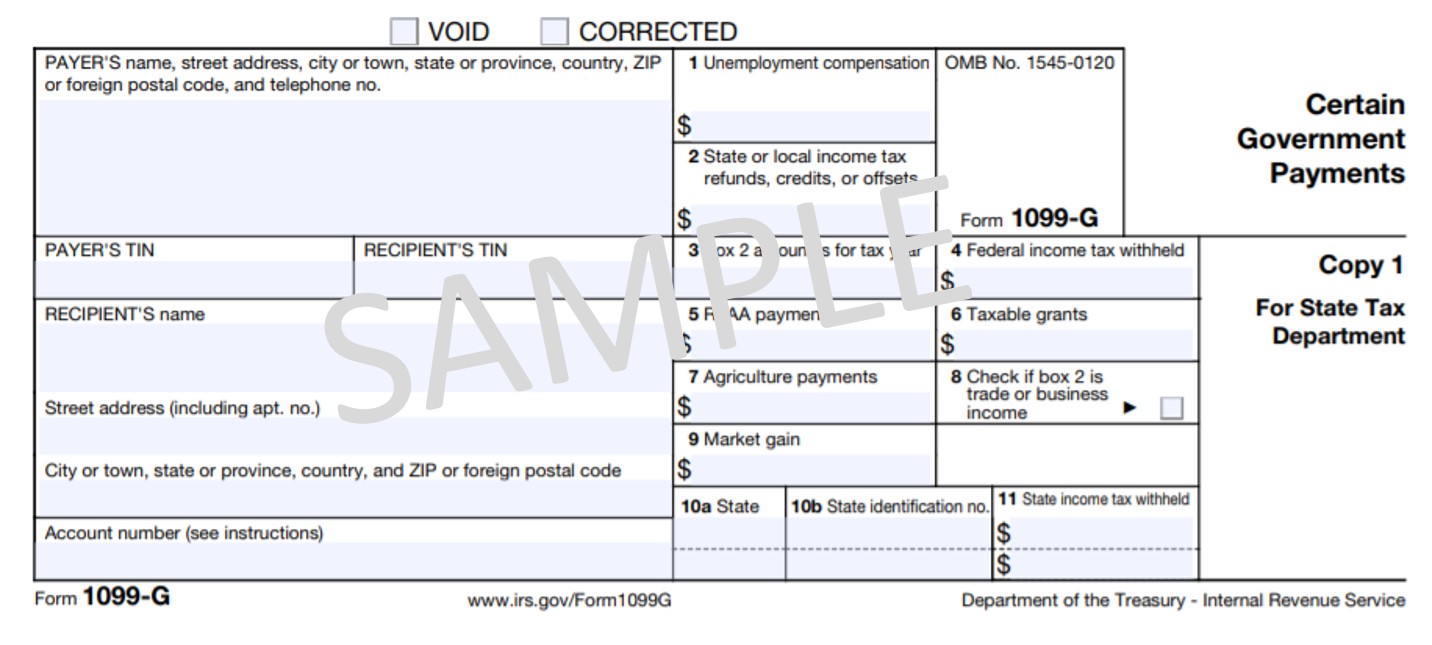

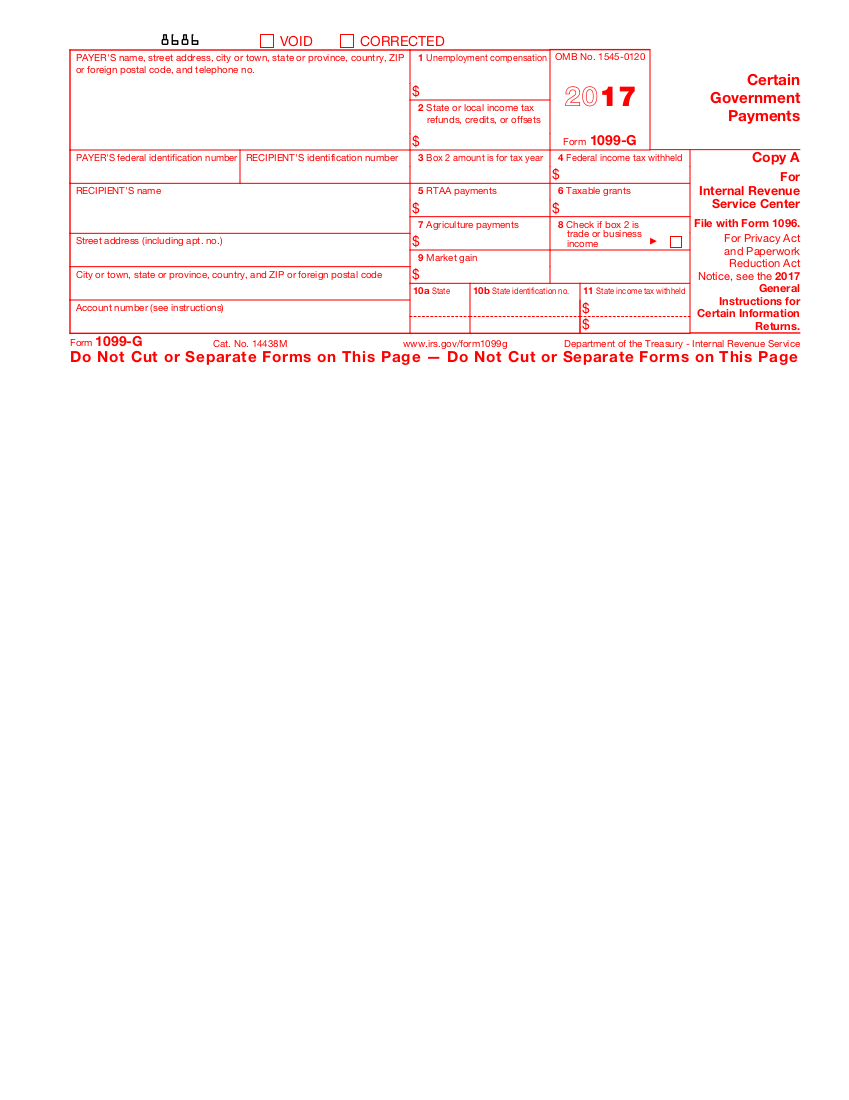

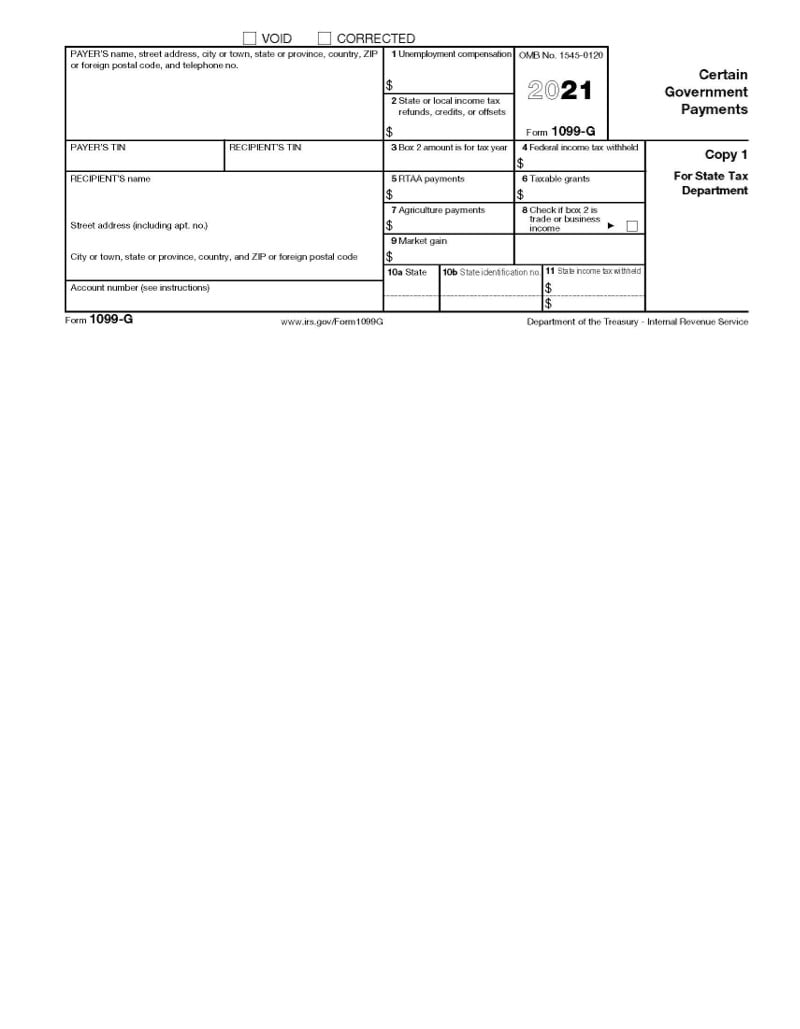

Wi Form 1099 G

Wi Form 1099 G - The form will not be mailed. You may access it from the dwd website: Web this form provides information about your state tax refund, which you must include as income on your federal tax return if you itemize deductions. Web this is important tax information and is being furnished to the irs. Web wisconsin dor my tax account allows taxpayers to register tax accounts, file taxes, make payments, check refund statuses, search for unclaimed property, and manage audits. State or local income tax refunds, credits, or offsets; Sign up now to go paperless. Ad make office life easier with efficient recordkeeping supported by appropriate forms. Web individuals, fiduciaries, partnerships, limited liability companies, and corporations doing business in wisconsin and making payments to individuals of rents, royalties, or certain nonwage compensation must file form 1099, as provided below. Your my tax account session has expired due to inactivity. Claimants' statements are available online for the past six years, which is helpful if claimants have to file amended tax returns. To report unemployment compensation on your 2021 tax return: Web wisconsin dor my tax account allows taxpayers to register tax accounts, file taxes, make payments, check refund statuses, search for unclaimed property, and manage audits. If you are required. View or print a copy of your current or previous. Web individuals, fiduciaries, partnerships, limited liability companies, and corporations doing business in wisconsin and making payments to individuals of rents, royalties, or certain nonwage compensation must file form 1099, as provided below. Web wisconsin dor my tax account allows taxpayers to register tax accounts, file taxes, make payments, check refund. To report unemployment compensation on your 2021 tax return: View or print a copy of your current or previous. Web this form provides information about your state tax refund, which you must include as income on your federal tax return if you itemize deductions. You may access it from the dwd website: Ad make office life easier with efficient recordkeeping. State or local income tax refunds, credits, or offsets; Web this is important tax information and is being furnished to the irs. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Web individuals, fiduciaries, partnerships,. Grab great deals and offers on forms & recordkeeping items at amazon. Ad make office life easier with efficient recordkeeping supported by appropriate forms. State or local income tax refunds, credits, or offsets; Claimants' statements are available online for the past six years, which is helpful if claimants have to file amended tax returns. View or print a copy of. Claimants' statements are available online for the past six years, which is helpful if claimants have to file amended tax returns. Your my tax account session has expired due to inactivity. View or print a copy of your current or previous. Ad make office life easier with efficient recordkeeping supported by appropriate forms. Web wisconsin dor my tax account allows. Ad make office life easier with efficient recordkeeping supported by appropriate forms. Web on your 2009 wisconsin individual income tax return, you chose to receive email notification from the wisconsin department of revenue when your tax information is available online. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if. Your my tax account session has expired due to inactivity. You may access it from the dwd website: Web wisconsin dor my tax account allows taxpayers to register tax accounts, file taxes, make payments, check refund statuses, search for unclaimed property, and manage audits. Web on your 2009 wisconsin individual income tax return, you chose to receive email notification from. The form will show the amount of unemployment compensation they received during 2020 in box. Web on your 2009 wisconsin individual income tax return, you chose to receive email notification from the wisconsin department of revenue when your tax information is available online. Grab great deals and offers on forms & recordkeeping items at amazon. Sign up now to go. Web this is important tax information and is being furnished to the irs. Your my tax account session has expired due to inactivity. Grab great deals and offers on forms & recordkeeping items at amazon. Web on your 2009 wisconsin individual income tax return, you chose to receive email notification from the wisconsin department of revenue when your tax information. Your my tax account session has expired due to inactivity. Claimants' statements are available online for the past six years, which is helpful if claimants have to file amended tax returns. The form will not be mailed. State or local income tax refunds, credits, or offsets; Web this is important tax information and is being furnished to the irs. Ad make office life easier with efficient recordkeeping supported by appropriate forms. Web wisconsin dor my tax account allows taxpayers to register tax accounts, file taxes, make payments, check refund statuses, search for unclaimed property, and manage audits. Claimants' statements are available online for the past six years, which is helpful if claimants need to file amended tax returns. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Web individuals, fiduciaries, partnerships, limited liability companies, and corporations doing business in wisconsin and making payments to individuals of rents, royalties, or certain nonwage compensation must file form 1099, as provided below. View or print a copy of your current or previous. To report unemployment compensation on your 2021 tax return: Web this form provides information about your state tax refund, which you must include as income on your federal tax return if you itemize deductions. Web on your 2009 wisconsin individual income tax return, you chose to receive email notification from the wisconsin department of revenue when your tax information is available online. The form will show the amount of unemployment compensation they received during 2020 in box. Sign up now to go paperless. Grab great deals and offers on forms & recordkeeping items at amazon. You may access it from the dwd website: State or local income tax refunds, credits, or offsets;1099G Form 2021

Form 1099G Definition

1099 IRS Tax Form

1099 G Government Payments MJC

1099G (2017) Edit Forms Online PDFFormPro

Understanding Form 1099G

Irs.gov Form 1099 G Universal Network

Object moved

Jan 31, 2014. Information on how to access your 1099G tax statements

How To Find 1099 G Form Online Paul Johnson's Templates

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.20.15AM-ed3d6962a8d74a509a58ce0cab7069bf.png)