Credit Limit Worksheet For Form 2441

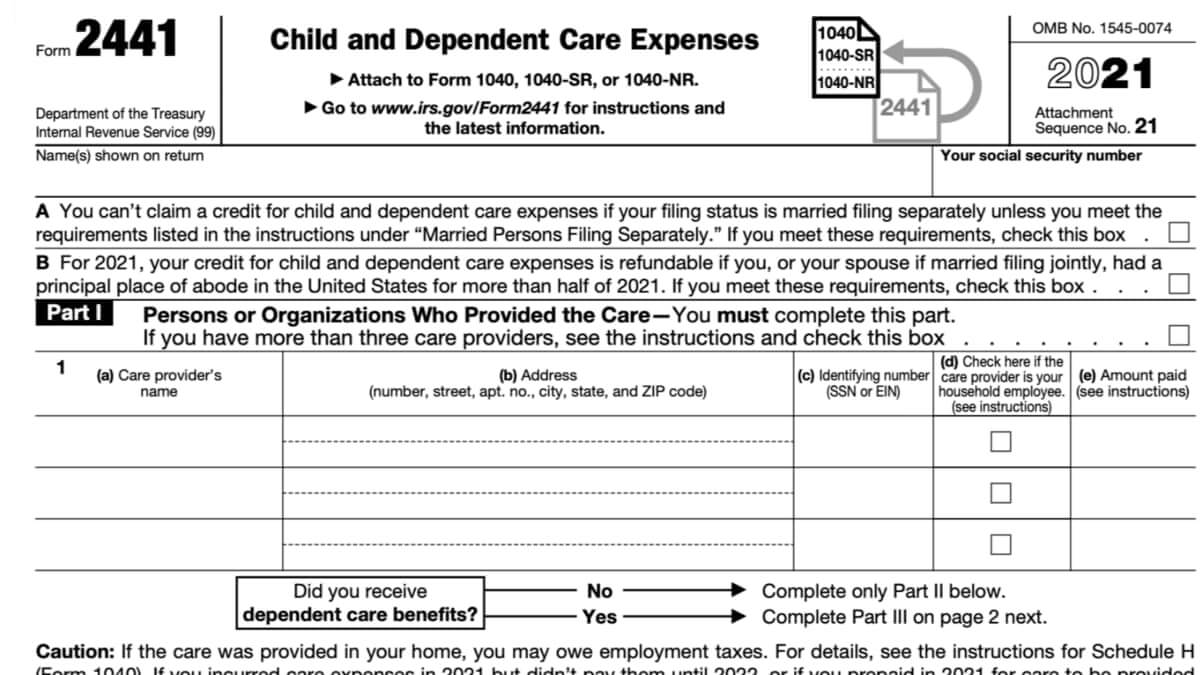

Credit Limit Worksheet For Form 2441 - Don’t confuse this credit with the child tax credit! Do not enter more than the allowable child and dependent care expense credit, which is: But if you’re filing form 2555 or 4563, or you’re excluding income from puerto rico, see pub. Web if you pay for child care (for children under age 13), so that you and your spouse could work or look for work, you may be able to file this credit. The allowable credit will decrease if. Complete all necessary information in the required fillable. In figuring the child and dependent care credit, take into account qualifying expenses up to a limit of $3,000 for one dependent, or $6,000 for two. We last updated the child and. Web credit limit worksheet a. Web instructions for form 2441 child and dependent care expenses department of the treasury internal revenue service reminder married persons filing separately. Web calculate the credit using form 2441, child and dependent care expenses. The maximum credit percentage has been increased to 50%. Web the maximum allowable credit is $1,050 for one dependent or $2,100 for two or more dependents (35% of $3,000/$6,000 in expenses). The allowable credit will decrease if. Web follow our simple steps to get your credit limit worksheet. Do not enter more than the allowable child and dependent care expense credit, which is: See form 2441, line 8, for the 2022. Web if you pay for child care (for children under age 13), so that you and your spouse could work or look for work, you may be able to file this credit. Ad get access to the. Web use form 2441 to figure the amount, if any, of the benefits you can exclude from your income. Real estate, family law, estate planning, business forms and power of attorney forms. Web credit limit worksheet a. Your expenses are subject to both the earned. For tax year 2021 only: Web 2441 you can’t claim a credit for child and dependent care expenses if your filing status is married filing separately unless you meet the requirements listed in the instructions. Web 2441 (if you have more than two care providers, see the instructions.) (a) care provider’s draft (b) address (c) identifying number (d) amount paid name (number, street, apt. Your. Your expenses are subject to both the earned. Web if you pay for child care (for children under age 13), so that you and your spouse could work or look for work, you may be able to file this credit. Complete all necessary information in the required fillable. Pick the web sample from the library. The expense limit has been. Web 2441 you can’t claim a credit for child and dependent care expenses if your filing status is married filing separately unless you meet the requirements listed in the instructions. Web the maximum allowable credit is $1,050 for one dependent or $2,100 for two or more dependents (35% of $3,000/$6,000 in expenses). Web 2441 (if you have more than two. Ad edit, fill, sign 2018 2441 get & more fillable forms. Web add the total amount in column (d) from line 2, above. Web the maximum allowable credit is $1,050 for one dependent or $2,100 for two or more dependents (35% of $3,000/$6,000 in expenses). Web calculate the credit using form 2441, child and dependent care expenses. Complete all necessary. We last updated the child and. Don’t confuse this credit with the child tax credit! Real estate, family law, estate planning, business forms and power of attorney forms. But if you’re filing form 2555 or 4563, or you’re excluding income from puerto rico, see pub. Web instructions for form 2441 child and dependent care expenses department of the treasury internal. Web 2441 (if you have more than two care providers, see the instructions.) (a) care provider’s draft (b) address (c) identifying number (d) amount paid name (number, street, apt. Web use form 2441 to figure the amount, if any, of the benefits you can exclude from your income. The maximum credit percentage has been increased to 50%. The expense limit. Do not enter more than the allowable child and dependent care expense credit, which is: Web credit limit worksheet a. Web instructions for form 2441 child and dependent care expenses department of the treasury internal revenue service reminder married persons filing separately. For tax year 2021 only: Ad edit, fill, sign 2018 2441 get & more fillable forms. The expense limit has been raised to $8,000 for one individual, and to. You must complete part iii of form 2441 before you can figure the credit, if. Web credit limit worksheet a. Pick the web sample from the library. Web the expense limit has been raised to $8,000 for one individual, and to $16,000 for more than one. Don’t confuse this credit with the child tax credit! Web the maximum allowable credit is $1,050 for one dependent or $2,100 for two or more dependents (35% of $3,000/$6,000 in expenses). In figuring the child and dependent care credit, take into account qualifying expenses up to a limit of $3,000 for one dependent, or $6,000 for two. Real estate, family law, estate planning, business forms and power of attorney forms. The allowable credit will decrease if. Complete all necessary information in the required fillable. But if you’re filing form 2555 or 4563, or you’re excluding income from puerto rico, see pub. The maximum credit percentage has been increased to 50%. Web use form 2441 to figure the amount, if any, of the benefits you can exclude from your income. Do not enter more than the allowable child and dependent care expense credit, which is: We last updated the child and. Ad edit, fill, sign 2018 2441 get & more fillable forms. Ad get access to the largest online library of legal forms for any state. Web if you pay for child care (for children under age 13), so that you and your spouse could work or look for work, you may be able to file this credit. Web 2441 (if you have more than two care providers, see the instructions.) (a) care provider’s draft (b) address (c) identifying number (d) amount paid name (number, street, apt.2018 Form 2441 Credit Limit Worksheet.

Credit Limit Worksheets A Form

Irs Form 2441 Printable Printable Forms Free Online

2441 Form 2022 2023

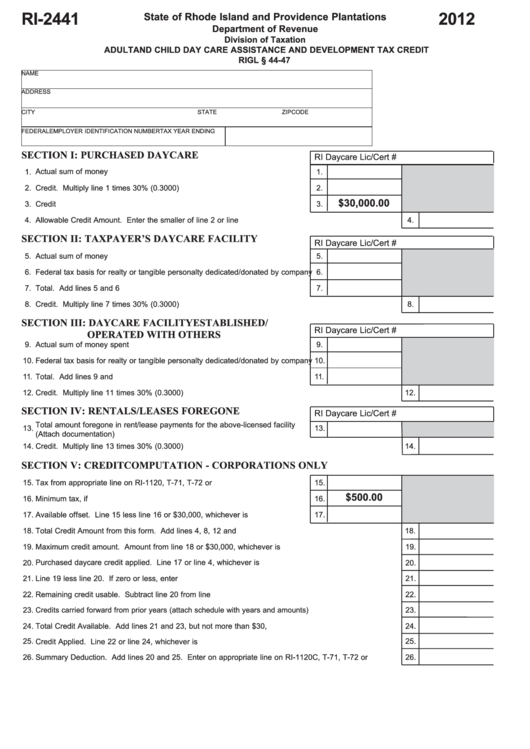

Fillable Form Ri2441 Adult And Child Day Care Assistance And

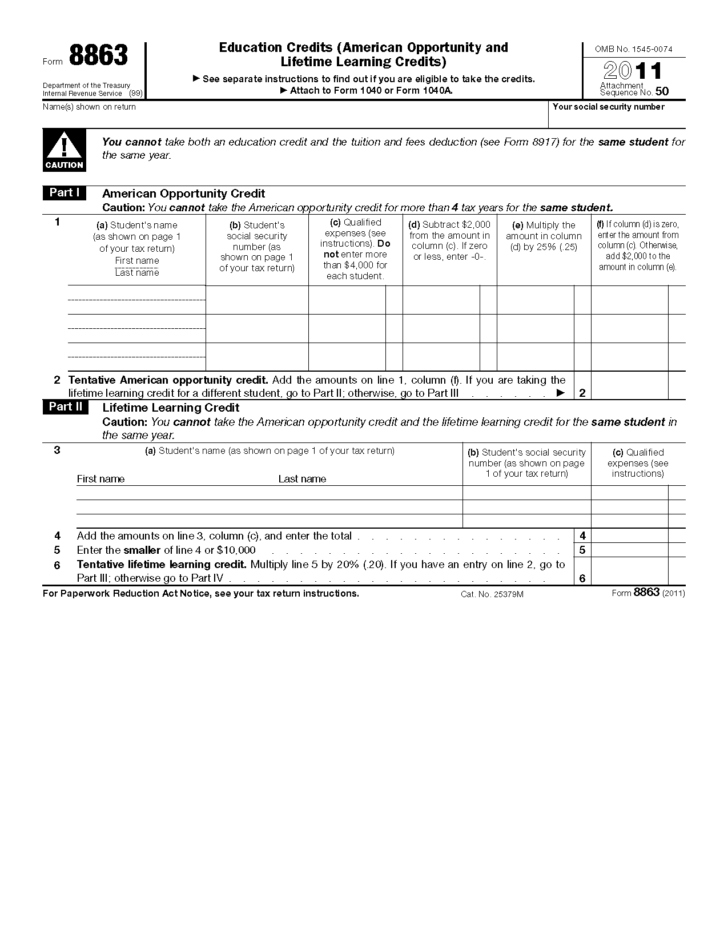

8812 Credit Limit Worksheet A

Credit Limit Worksheet 2016 —

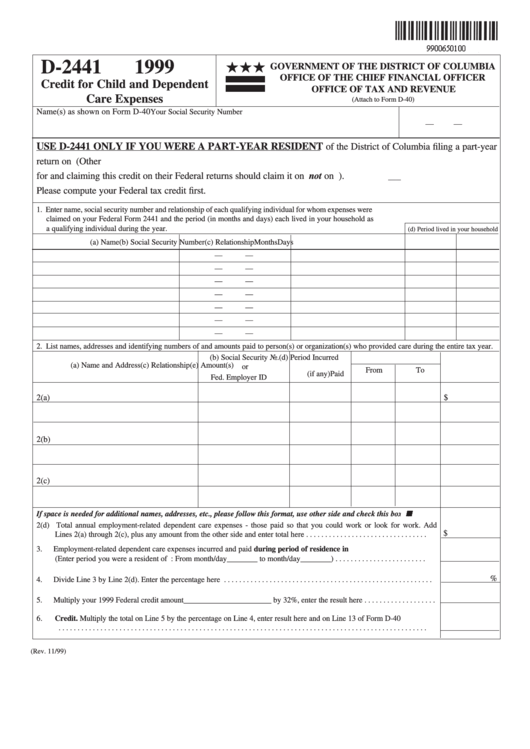

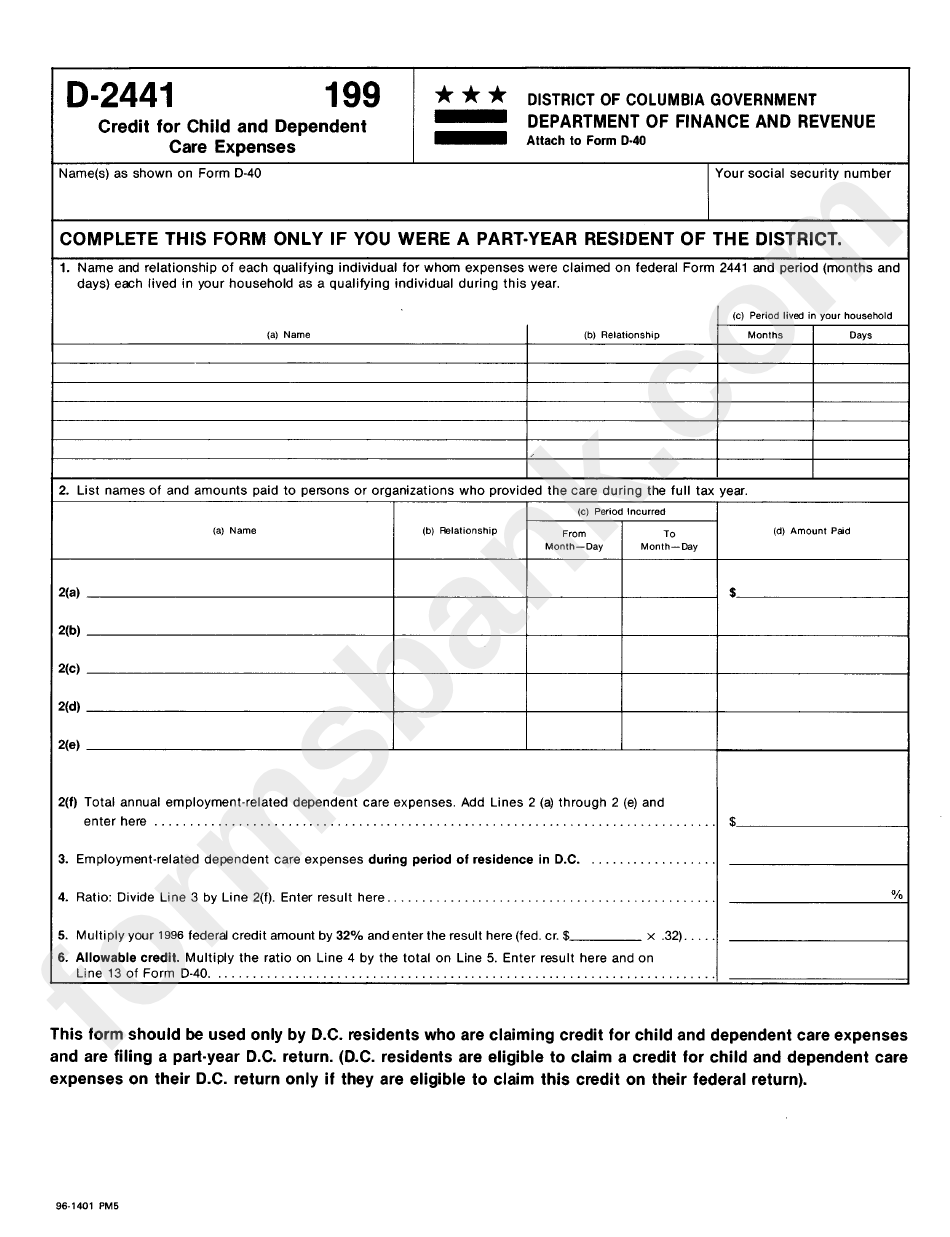

Fillable Form D2441 Credit For Child And Dependent Care Expenses

IRS Form 2441 What It Is, Who Can File, and How To Fill it Out

credit limit worksheet Fill Online, Printable, Fillable Blank form

Related Post:

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)