Wi Form 1-Es

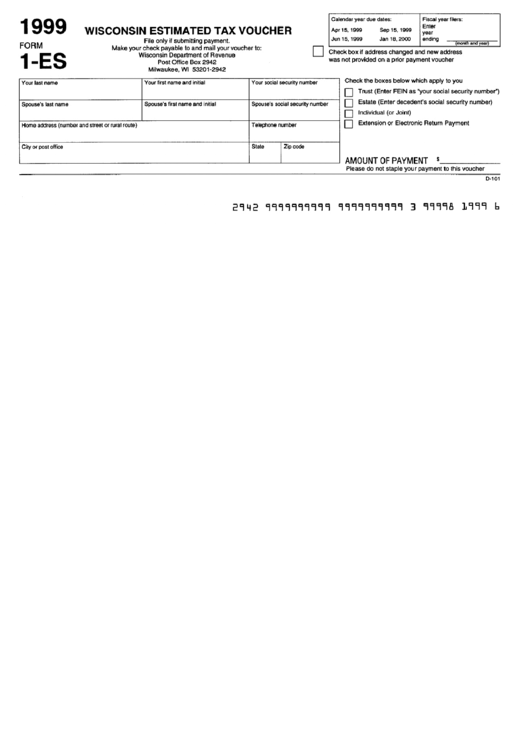

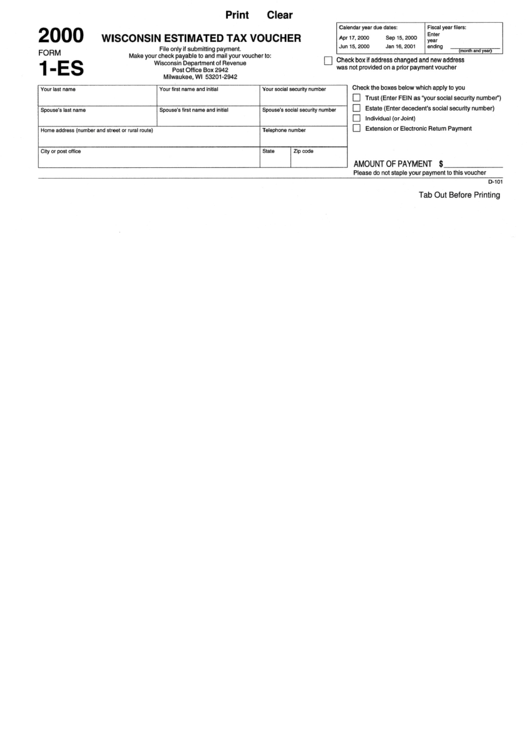

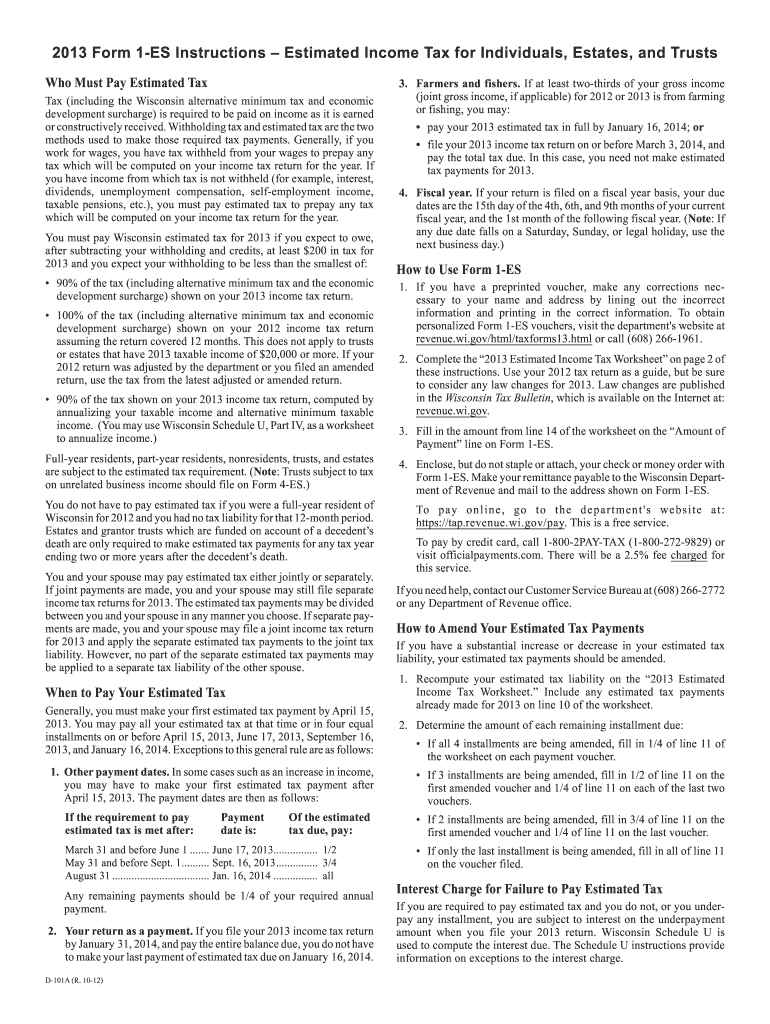

Wi Form 1-Es - Who must pay estimated tax. It appears you don't have a pdf plugin for this browser. Web wisconsin department of revenue: Web 1/20/2023 2:00 pm: Save or instantly send your ready documents. Printable wisconsin income tax form. Wisconsin supplement to the federal historic rehabilitation. This form is for income earned in tax year 2022, with tax returns due in april. Web wisconsin has a state income tax that ranges between 4% and 7.65%, which is administered by the wisconsin department of revenue. Tax is required to be paid on income as it is earned or. Schedule jt, wisconsin jobs tax credit. This form is for income earned in tax year 2022, with tax returns due in april. Who must pay estimated tax. Web wisconsin department of revenue: Web wisconsin dor my tax account allows taxpayers to register tax accounts, file taxes, make payments, check refund statuses, search for unclaimed property, and manage audits. Web 1/20/2023 2:00 pm: Download blank or fill out online in pdf format. Wisconsin department of revenue if tax due. Schedule jt, wisconsin jobs tax credit. Complete, sign, print and send your tax documents easily with us legal forms. Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. Who must pay estimated tax. Tax is required to be paid on income as it is earned or. This form is for income earned in tax year 2022, with tax returns due in april. It appears you don't have a pdf plugin for this browser. Estimated income tax voucher instructions: Save or instantly send your ready documents. Tax is required to be paid on income as it is earned or. Wisconsin supplement to the federal historic rehabilitation. Printable wisconsin income tax form. Wisconsin — estimated income tax instructions. Complete, sign, print and send your tax documents easily with us legal forms. Tax is required to be paid on income as it is earned or. (go to www.revenue.wi.gov/pay for electronic payment options) Use a wi estimated tax 2020 template to make your. Schedule jt, wisconsin jobs tax credit. Wisconsin department of revenue if tax due. Your response to my question was february. Printable wisconsin income tax form. Web wisconsin has a state income tax that ranges between 4% and 7.65%, which is administered by the wisconsin department of revenue. Wisconsin — estimated income tax instructions. Tax is required to be paid on income as it is earned or. Who must pay estimated tax. You can download or print. Save or instantly send your ready documents. Tax is required to be paid on income as it is earned or. Rent certificate (ef only) available. Complete, sign, print and send your tax documents easily with us legal forms. Web 1/20/2023 2:00 pm: Who must pay estimated tax. Wisconsin supplement to the federal historic rehabilitation. Tax is required to be paid on income as it is earned or. Who must pay estimated tax. Tax is required to be paid on income as it is earned or. Who must pay estimated tax. Web wisconsin has a state income tax that ranges between 4% and 7.65%, which is administered by the wisconsin department of revenue. Wisconsin supplement to the federal historic rehabilitation. Web wisconsin form 1 es, also known as the employer's quarterly report of withholding and unemployment insurance taxes, is a form used by employers in wisconsin to report. Forms for all. Easily fill out pdf blank, edit, and sign them. Web wisconsin dor my tax account allows taxpayers to register tax accounts, file taxes, make payments, check refund statuses, search for unclaimed property, and manage audits. (go to www.revenue.wi.gov/pay for electronic payment options) Web wisconsin department of revenue: Use a wi estimated tax 2020 template to make your. Your response to my question was february. Tax is required to be paid on income as it is earned or. Tax is required to be paid on income as it is earned or. Wisconsin department of revenue if tax due. This form is for income earned in tax year 2022, with tax returns due in april. Web 1/20/2023 2:00 pm: Estimated income tax voucher instructions: Save or instantly send your ready documents. Rent certificate (ef only) available. Printable wisconsin income tax form. Who must pay estimated tax. Web wisconsin has a state income tax that ranges between 4% and 7.65%, which is administered by the wisconsin department of revenue. Schedule jt, wisconsin jobs tax credit. Wisconsin supplement to the federal historic rehabilitation. Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,.Fillable Form 1Es1999 Wisconsin Estimated Tax Voucher printable pdf

Fillable Form 1Es Wisconsin Estimated Tax Voucher printable pdf download

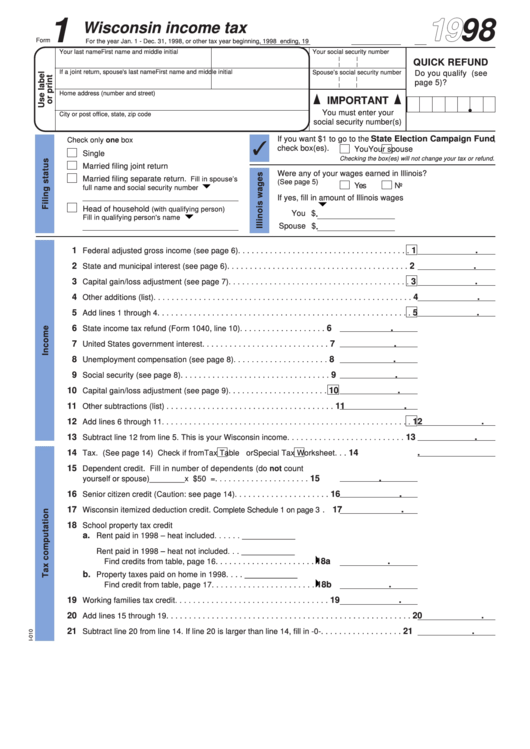

Fillable Wisconsin Form 1 Printable Forms Free Online

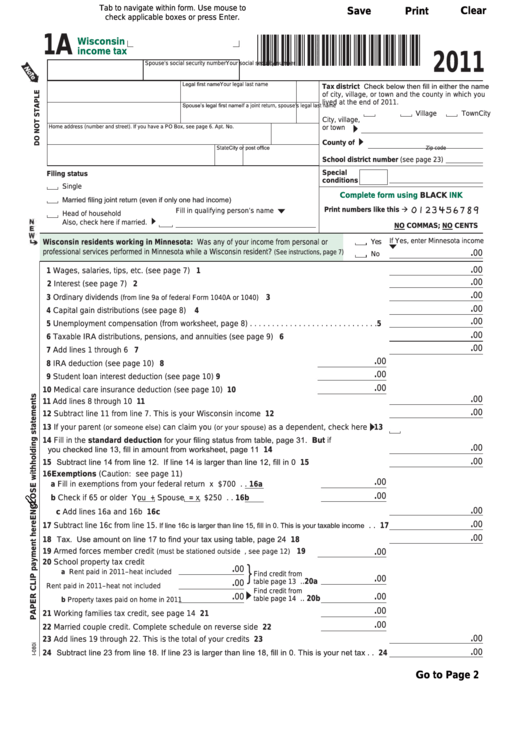

Fillable Form 1a Wisconsin Tax 2011 printable pdf download

Wisconsin Form 1 Es Fill Out and Sign Printable PDF Template signNow

Printable Wisconsin Tax Forms Printable Forms Free Online

2012 Form WI DoR 1ES (D101) Fill Online, Printable, Fillable, Blank

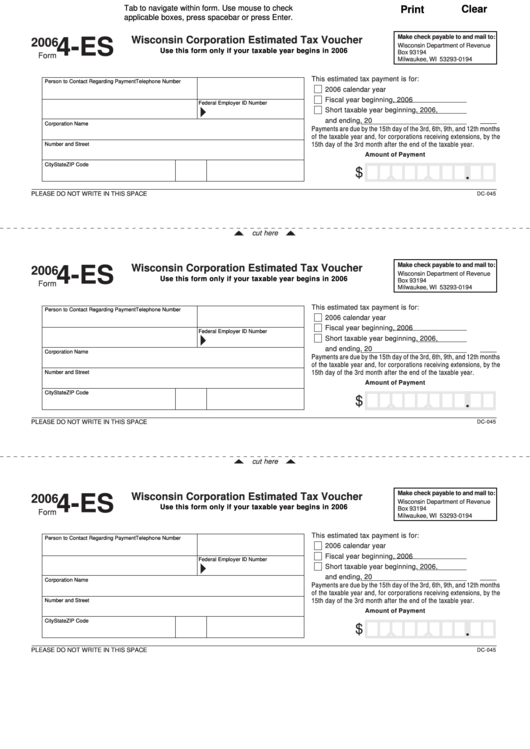

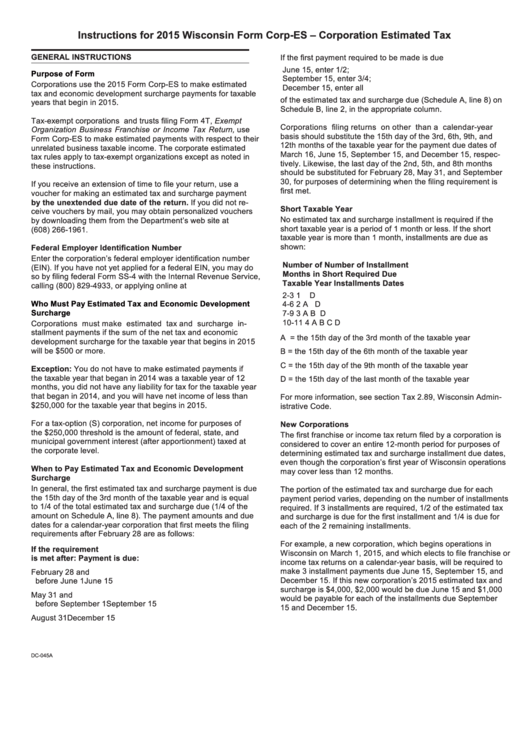

Instructions For 2015 Wisconsin Form CorpEs printable pdf download

Wisconsin Form 1 Es 2023 Printable Forms Free Online

Material requirement form Wisconsin form 1es 2020

Related Post: