Why Is Turbotax Asking For Form 8615

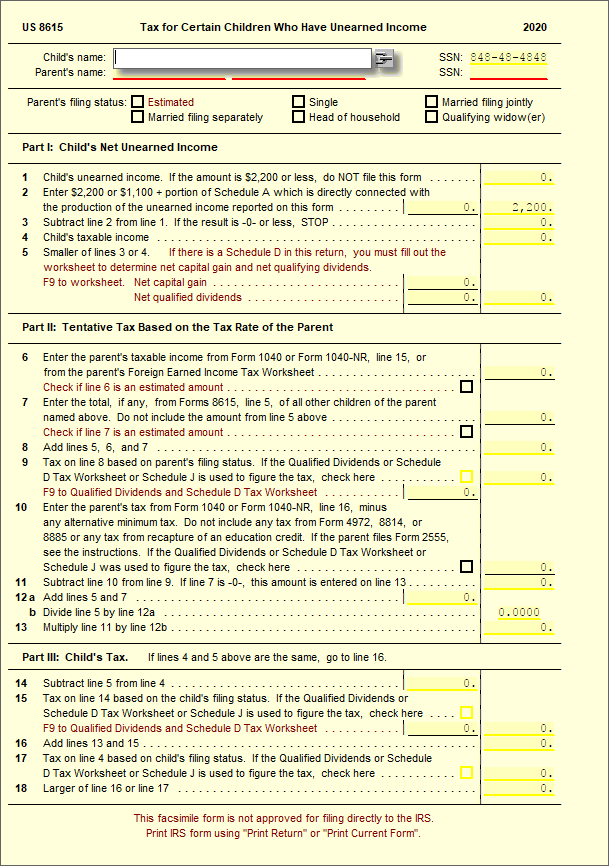

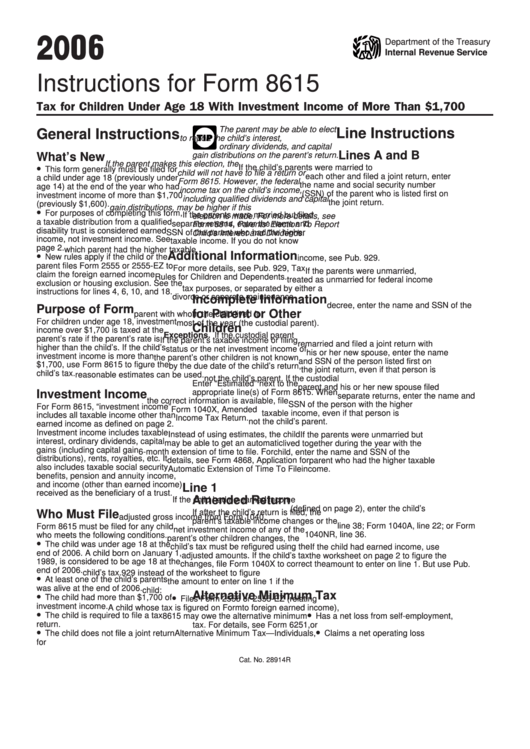

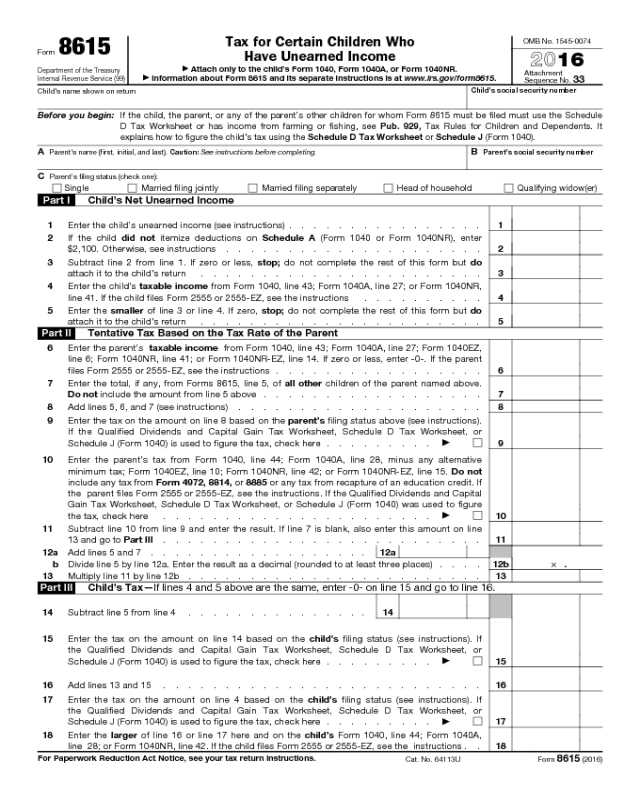

Why Is Turbotax Asking For Form 8615 - For details, see form 6251, alternative minimum tax—individuals, and its instructions. The child is required to file a tax return. Web a child whose tax is figured on form 8615 may owe the alternative minimum tax. Web form 8615 is used when parents are reporting a child's income on their tax return. Web form 8615 must be filed with the child’s tax return if all of the following apply: Web the election allows taxpayers to recalculate the tax on dependent children with unearned income for these years to be based on the parent’s individual tax rate. That is why i was asking. Web in the upper right corner, click my account > tools. The child has more than $2,500 in unearned. Tax for certain children who have unearned income in turbotax online because it is not needed, follow the steps below: I believe its using my scholarship awards as the unearned income, but that's a guess. Web form 8615 must be filed for any child who meets all of the following conditions. Web this turbotax help explains who must file irs form 8615: Web if the child, the parent, or any of the parent’s other children for whom form 8615 must. For 2020, a child must file form 8615 if all of. Web form 8615 is used to figure your child's tax on unearned income. Web common questions about form 8615 and unearned income below, you'll find answers to frequently asked questions about tax for certain children who have unearned. Quickly prepare and file your 2022 tax return. Web form 8615. Web form 8615 must be filed for any child who meets all of the following conditions. The child had more than $2,300 of unearned income. The child is required to file a tax return. Type child’s income in search in the upper right; The form is only required to be included on your return if all of the conditions below. Tax for certain children who have unearned income. The child is required to file a tax return. Click delete next to the form or schedule and follow the. Web form 8615 must be filed for any child who meets all of the following conditions. Web to fill out form 8615 in turbotax: Web the child did not meet any of the requirements you listed, and i could not rid myself of the form 8615 error. That is why i was asking. Tax for certain children who have unearned income in turbotax online because it is not needed, follow the steps below: Web in the upper right corner, click my account > tools.. Web if the child, the parent, or any of the parent’s other children for whom form 8615 must be filed must use the schedule d tax worksheet or has income from farming or fishing, see. For children under age 18 and certain older children described below in who must file, unearned income over $2,000 is taxed at the parent's rate. For 2023, form 8615 needs to be filed if all of the following conditions apply: Click delete next to the form or schedule and follow the. I used turbotax but i keep getting this page with 8615 form on my turbotax. The child are required to file a tax return. It's likely you have accessed or entered something on this. Ad from simple to advanced income taxes. Web if turbotax is adding form 8615 to your son's return, then he is being subject to kiddie tax.this would mean that he would have had to have more than $2,200. Web unfortunately you do still need to fill out the form 8615 so while the advice of the turbotax person would allow. Web in the upper right corner, click my account > tools. Web who's required to file form 8615? Tax for certain children who have unearned income. The child are required to file a tax return. The child is required to file a tax return. Click jump to child’s income; The child had more than $2,300 of unearned income. Web form 8615 must be filed with the child’s tax return if all of the following apply: Web turbotax is forcing me to fill out form 8615 for myself, as the child in question? The child had more than $2,300 of unearned income. For 2023, form 8615 needs to be filed if all of the following conditions apply: Web a child whose tax is figured on form 8615 may owe the alternative minimum tax. Web form 8615 must be filed with the child’s tax return if all of the following apply: For 2020, a child must file form 8615 if all of the. The child had more than $2,300 of unearned income. Web common questions about form 8615 and unearned income below, you'll find answers to frequently asked questions about tax for certain children who have unearned. Max refund and 100% accuracy are guaranteed. Click jump to child’s income; The child had more than $2,300 of unearned income. I used turbotax but i keep getting this page with 8615 form on my turbotax. The child had more than $2,300 of unearned income. Web refunds children who have unearned income that’s subject to the kiddie tax must file a form 8615 with their 1040 tax return. Web to delete form 8615: That is why i was asking. You can go to the left side of the turbotax screen in the dark margin under tax tools, and select. Ad from simple to advanced income taxes. It's likely you have accessed or entered something on this form in error. Ad do your 2021, 2020, 2019, 2018 all the way back to 2000 easy, fast, secure & free to try! Log on to your turbo. Web who's required to file form 8615?8615 Tax for Certain Children Who Have Unearned UltimateTax

Form 8615 Tax for Certain Children Who Have Unearned (2015

IRS Form 8615 Instructions

Form 8615 Tax Pro Community

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

Publication 929 Tax Rules for Children and Dependents; Tax Rules for

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

Instructions For Form 8615 Tax For Children Under Age 18 With

Form 8615 Edit, Fill, Sign Online Handypdf

Related Post: