Irs Form 8703

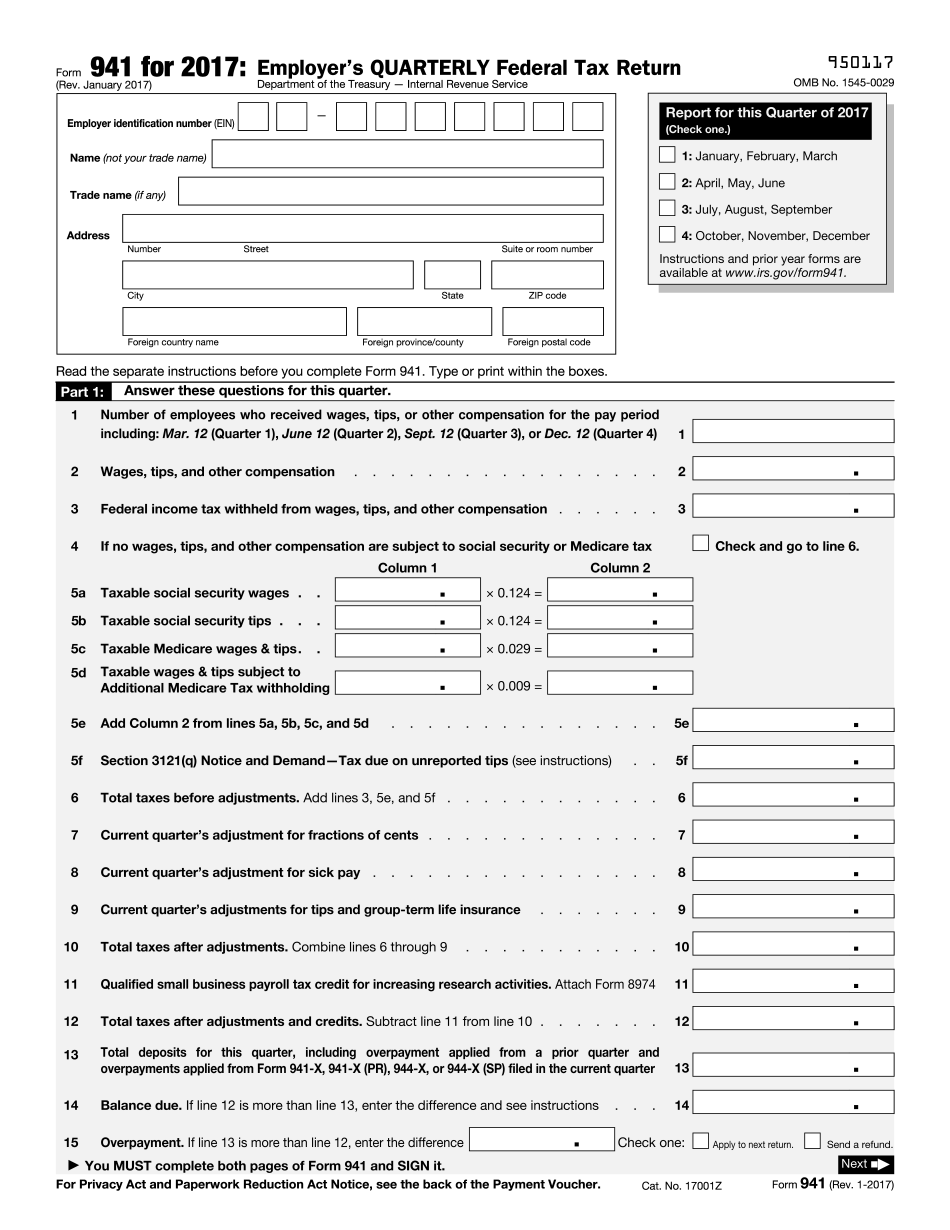

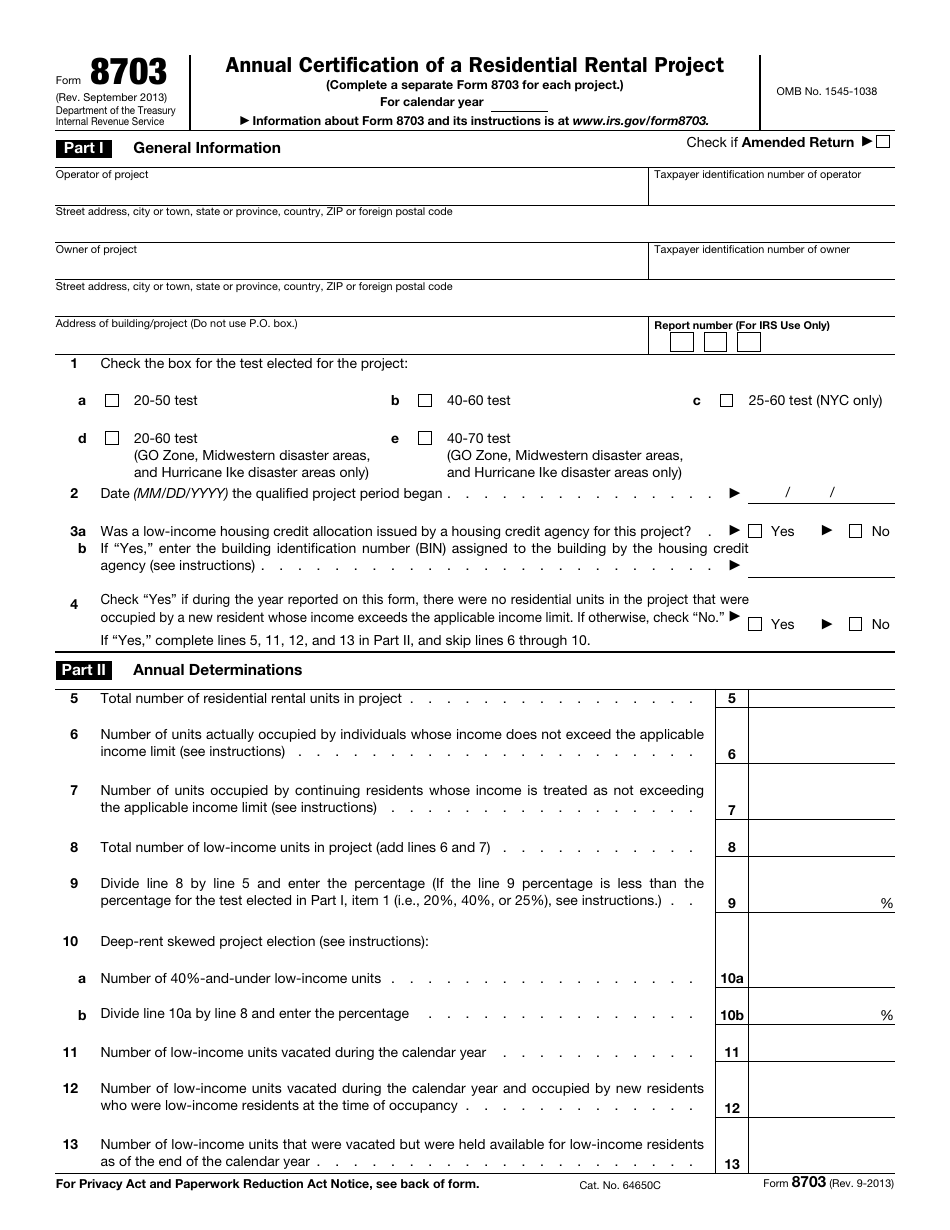

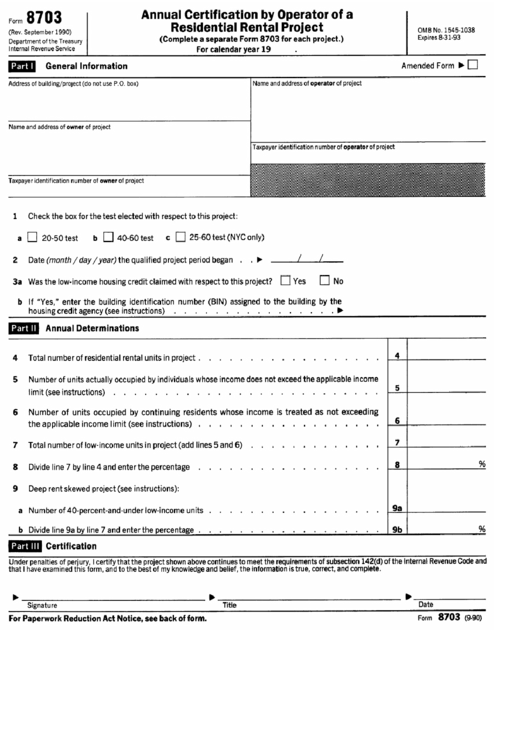

Irs Form 8703 - Web of the internal revenue code must file form 8703 annually during the qualified project period. A separate form 8703 must be filed for each. Web irs form 8703 must be filed with the irs by march 31st after the close of the calendar year for which the certification is being made. Internal revenue service service center ogden, ut 84201 penalty. Web an irs form 8703 annual certification of a residential rental project must be completed when a bond property falls under section 142 of the internal revenue code of 1986. December 2021) department of the treasury internal revenue service. Form 8703 is used by an operator of a residential rental project to provide annual information the irs will use to determine. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web employer's quarterly federal tax return. If you would like to join our asset management mailing list you can fill out the form. Section 6652(j) provides for a penalty of $100 for each failure to comply. Annual certification of a residential rental project (complete a separate form 8703 for. Web employer's quarterly federal tax return. Form 8703 september 2013 annual certification of a residential rental project. The form is due to the irs by march 31 after the. Web an irs form 8703 annual certification of a residential rental project must be completed when a bond property falls under section 142 of the internal revenue code of 1986. Web the operator of a residential rental project for which an election was made under section 142(d) must file form 8703 annually. Web tax exempt bond properties funded by the. Internal revenue service service center ogden, ut 84201 penalty. The form is due to the irs by march 31 after the. Hdc works closely with our development and property management partners to ensure the physical quality and financial integrity of a portfolio. Form 8703 september 2013 annual certification of a residential rental project. A separate form 8703 must be filed. Internal revenue service service center ogden, ut 84201 penalty. Irs form 8703 must be filed annually during. December 2021) department of the treasury internal revenue service. The form is due to the irs by march 31 after the. File form 8703 with the: Web we last updated the annual certification of a residential rental project in february 2023, so this is the latest version of form 8703, fully updated for tax year 2022. A separate form 8703 must be filed for each. December 2021) department of the treasury internal revenue service. Web the operator of a residential rental project for which an election. A separate form 8703 must be filed for each. Web the operator of a residential rental project for which an election was made under section 142(d) must file form 8703 annually. Annual certification of a residential rental project (complete a separate form 8703 for. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who. The operator of a residential rental project for which an election was made under section. The form is due to the irs by march 31 after the. December 2021) department of the treasury internal revenue service. This form must be filed by march 31 after the close of the calendar year for which. Web we last updated the annual certification. The form is due to the irs by march 31 after the. Web employer's quarterly federal tax return. Form 8703 is used by the operator of a residential rental project to provide annual information that the irs will use to determine. Web in this blog post, we will explore the significance of form 8703 and its implications on affordable housing. Web exemption from tax on corporations, certain trusts, etc. December 2021) department of the treasury internal revenue service. The operator of a residential rental project for which an election was made under section. Web an irs form 8703 annual certification of a residential rental project must be completed when a bond property falls under section 142 of the internal revenue. Irs form 8703 must be filed annually during. Internal revenue service service center ogden, ut 84201 penalty. This form must be filed by march 31 after the close of the calendar year for which. If you would like to join our asset management mailing list you can fill out the form. Form 8703 is used by an operator of a. Web we last updated the annual certification of a residential rental project in february 2023, so this is the latest version of form 8703, fully updated for tax year 2022. Impact of rising utility costs on residents of multifamily housing programs ii. Web exemption from tax on corporations, certain trusts, etc. December 2021) department of the treasury internal revenue service. Form 8703 is used for the purpose. The operator of a residential rental project for which an election was made under section. Web tax exempt bond properties funded by the department must file form 8703 each calendar year of the qualified project period. Irs form 8703 must be filed annually during. If you would like to join our asset management mailing list you can fill out the form. Web the operator of a residential rental project for which an election was made under section 142(d) must file form 8703 annually. Section 6652(j) provides for a penalty of $100 for each failure to comply. Annual certification of a residential rental project (complete a separate form 8703 for. Web of the internal revenue code must file form 8703 annually during the qualified project period. Form 8703 september 2013 annual certification of a residential rental project. Web irs form 8703 must be filed with the irs by march 31st after the close of the calendar year for which the certification is being made. Web in this blog post, we will explore the significance of form 8703 and its implications on affordable housing initiatives. Web an irs form 8703 annual certification of a residential rental project must be completed when a bond property falls under section 142 of the internal revenue code of 1986. Web irs form 8703 must be filed annually during the qualified project period (which is defined in the instructions on the form). Web employer's quarterly federal tax return. This form must be filed by march 31 after the close of the calendar year for which.2023 941 Form Try Blank Template in Word and PDF

IRS Form 1040 Download Fillable PDF or Fill Online U.S. Individual

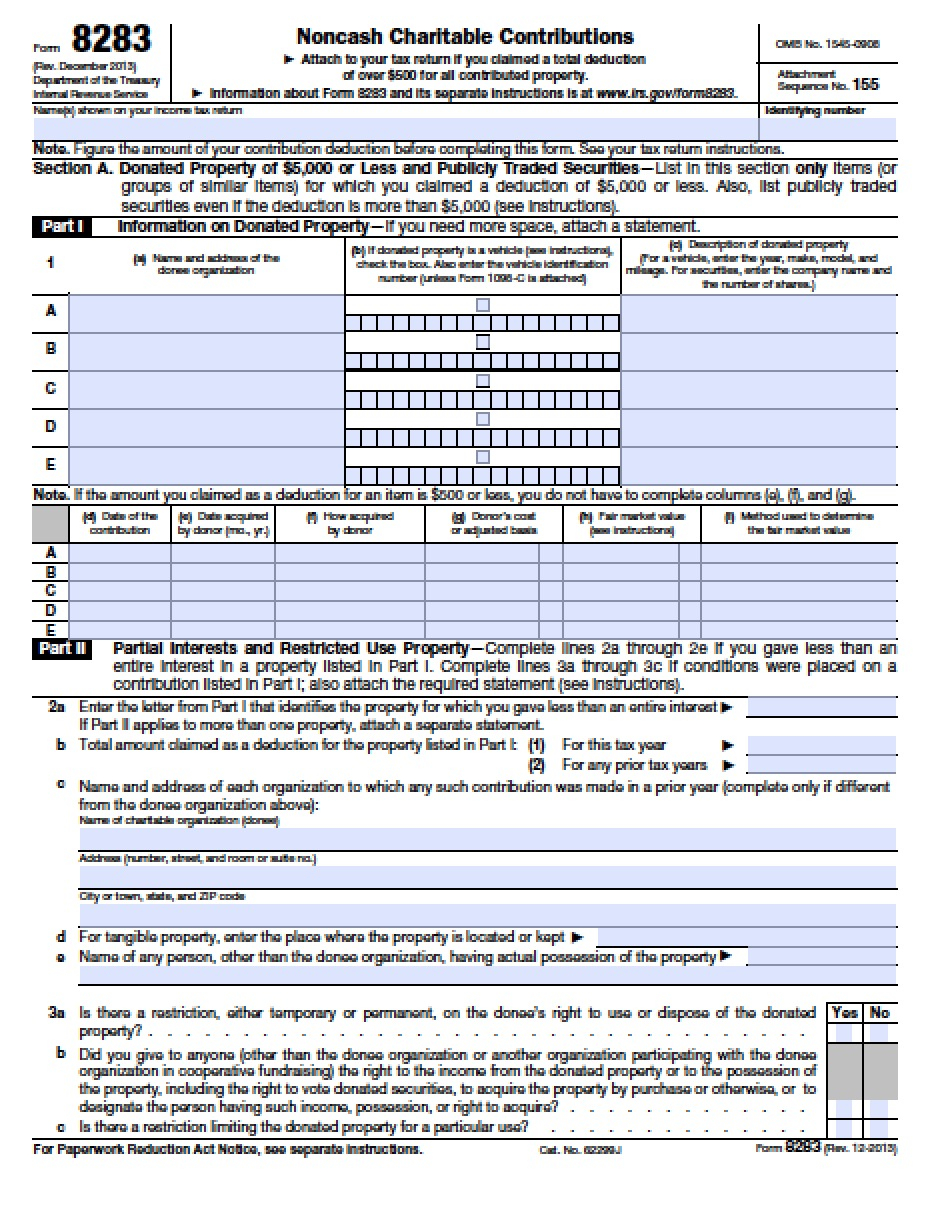

Irs Form 8283 Printable Printable Form 2022

IRS Form 8703 Download Fillable PDF or Fill Online Annual Certification

Form 8703 Annual Certification By Operator Of A Residential Rental

Form 8703 Annual Certification of a Residential Rental Project (2013

Form 8703 Annual Certification of a Residential Rental Project (2013

Download IRS Form 8283 for Free FormTemplate

IRS Form 8868 Fill Out, Sign Online and Download Fillable PDF

Irs W 4 Form Printable Printable Form 2021

Related Post: