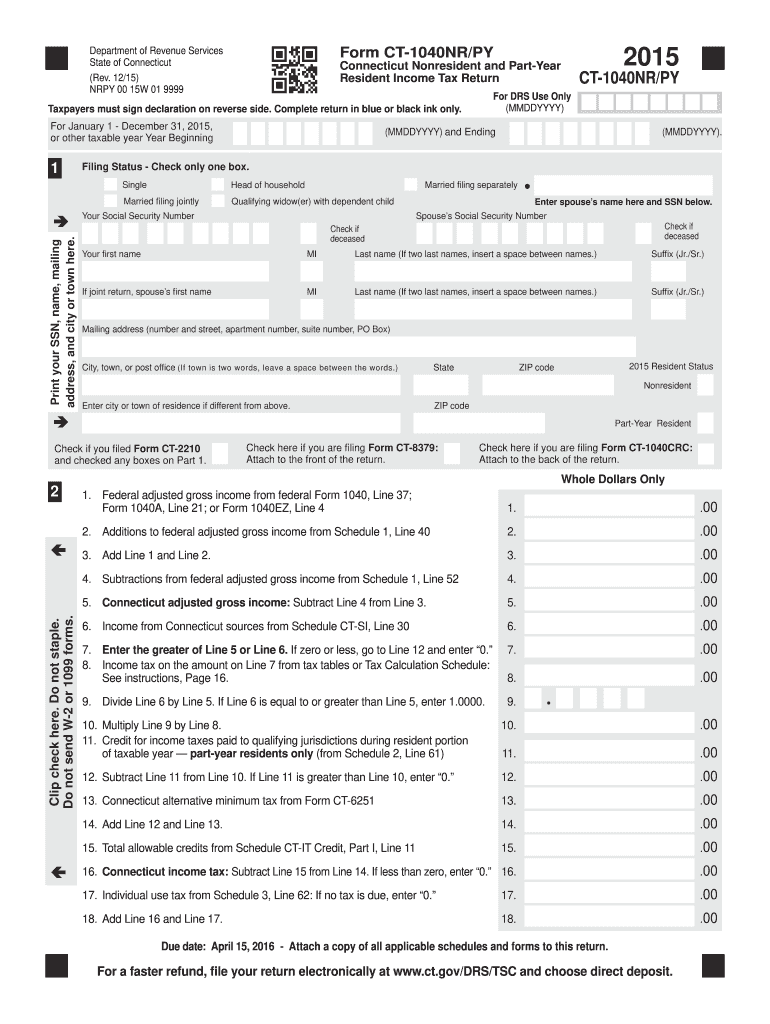

Who Must File Form Ct-1040Nr/Py

Who Must File Form Ct-1040Nr/Py - Ad signnow.com has been visited by 100k+ users in the past month Web for a faster refund, file your return electronically at portal.ct.gov/tsc and choose direct deposit. For january 1 ‐ december 31, 2021, or. 12/17) nrpy 1217w 02 9999 your social security number 20f. Web who must file form ct 1040nr py? 6 claiming a refund for. Web if you are a nonresident and you meet the requirements for who must file form ct‑1040nr/py for the 2022 taxable year, you must file form ct‑1040nr/py. This form is for income earned in tax year. You must file a connecticut (ct) state income tax return if any of the following is true for the 2022 tax year: Web to prevent any delay in processing your return, the correct year’s form must be submitted to the department of revenue services (drs). Web who must file form ct 1040nr py? 12/17) nrpy 1217w 02 9999 your social security number 20f. 4 the gross income test. Open form follow the instructions. For january 1 ‐ december 31, 2021, or. This form is most often used by individuals who have lived and/or worked in multiple. 5 relief from joint liability. Enter your status, income, deductions and credits and estimate your total taxes. Web to prevent any delay in processing your return, the correct year’s form must be submitted to the department of revenue services (drs). Taxpayers must sign declaration on. You must file a connecticut (ct) state income tax return if any of the following is true for the 2022 tax year: Web if you are a nonresident and you meet the requirements for who must file form ct‑1040nr/py for the 2022 taxable year, you must file form ct‑1040nr/py. 12/17) nrpy 1217w 02 9999 your social security number 20f. Taxpayers. Open form follow the instructions. Ad discover helpful information and resources on taxes from aarp. 5 how do i file a. This form is for income earned in tax year. Web if you are a nonresident and you meet the requirements for who must file form ct‑1040nr/py for the 2022 taxable year, you must file form ct‑1040nr/py. This form is most often used by individuals who have lived and/or worked in multiple. Web for a faster refund, file your return electronically at portal.ct.gov/tsc and choose direct deposit. 4 the gross income test. Web to prevent any delay in processing your return, the correct year’s form must be submitted to the department of revenue services (drs). You must. You must file a connecticut (ct) state income tax return if any of the following is true for the 2022 tax year: 5 relief from joint liability. This form is for income earned in tax year. Taxpayers must sign declaration on reverse side. 5 the gross income test. Web resident and nonresident defined: Web for a faster refund, file your return electronically at portal.ct.gov/tsc and choose direct deposit. Ad discover helpful information and resources on taxes from aarp. Taxpayers must sign declaration on reverse side. This form is for income earned in tax year. For january 1 ‐ december 31, 2021, or. 4 the gross income test. 5 what is connecticut adjusted gross income? Taxpayers must sign declaration on reverse side. Web if you are a nonresident and you meet the requirements for who must file form ct‑1040nr/py for the 2022 taxable year, you must file form ct‑1040nr/py. Enter your status, income, deductions and credits and estimate your total taxes. You must file a connecticut (ct) state income tax return if any of the following is true for the 2022 tax year: Web to prevent any delay in processing your return, the correct year’s form must be submitted to the department of revenue services (drs). Web if you. 12/17) nrpy 1217w 02 9999 your social security number 20f. Web department of revenue services state of connecticut (rev. Web for a faster refund, file your return electronically at portal.ct.gov/tsc and choose direct deposit. 5 the gross income test. 5 how do i file a. We last updated the nonresident/part. Web if you are a nonresident and you meet the requirements for who must file form ct‑1040nr/py for the 2022 taxable year, you must file form ct‑1040nr/py. Easily sign the form with your finger. 5 what is connecticut adjusted gross income? 5 how do i file a. Web to prevent any delay in processing your return, the correct year’s form must be submitted to the department of revenue services (drs). Ad signnow.com has been visited by 100k+ users in the past month Web if you are a nonresident and you meet the requirements for who must file form ct‑1040nr/py for the 2022 taxable year, you must file form ct‑1040nr/py. This form is for income earned in tax year. 5 the gross income test. Taxpayers must sign declaration on reverse side. Web for a faster refund, file your return electronically at portal.ct.gov/tsc and choose direct deposit. Web who must file form ct 1040nr py? 4 the gross income test. Enter your status, income, deductions and credits and estimate your total taxes. 12/17) nrpy 1217w 02 9999 your social security number 20f. Ad discover helpful information and resources on taxes from aarp. Open form follow the instructions. For january 1 ‐ december 31, 2021, or. You must file a connecticut (ct) state income tax return if any of the following is true for the 2022 tax year:2015 Form MA DoR 1NR/PY Fill Online, Printable, Fillable, Blank

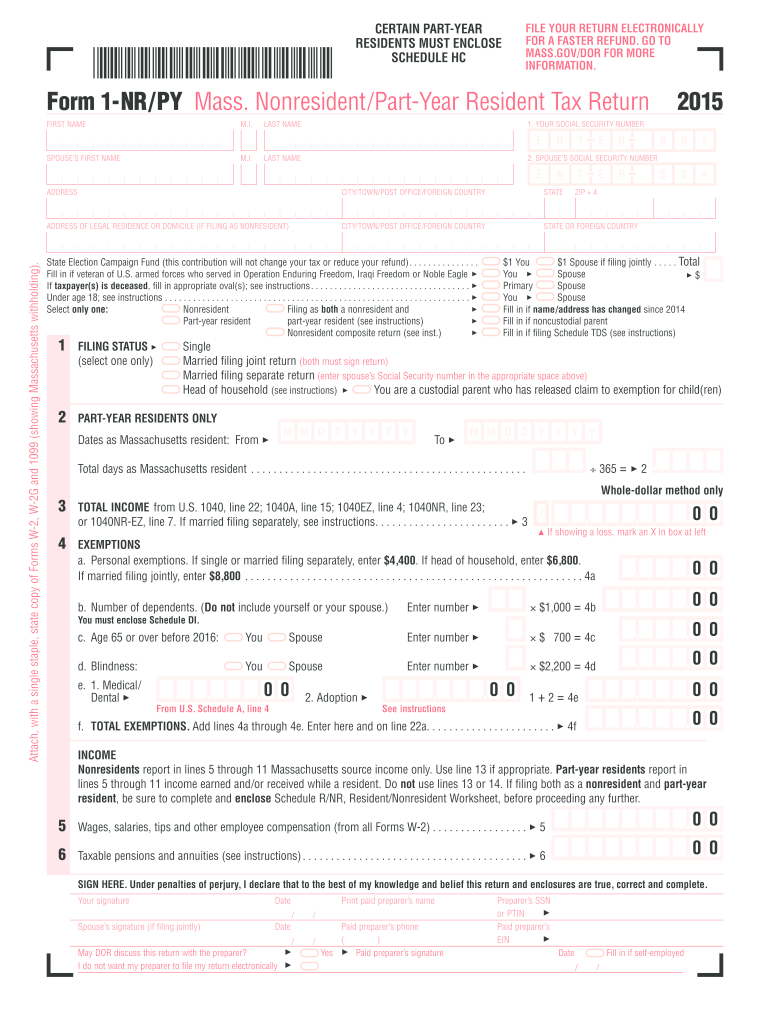

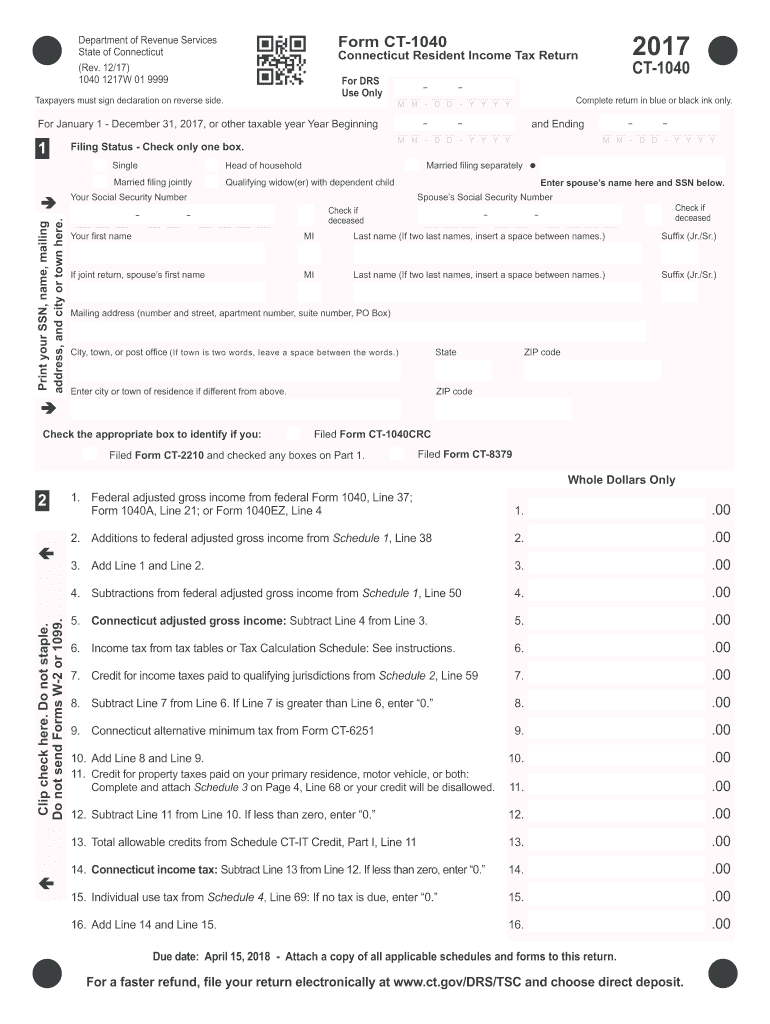

Form Ct1040nr/py Connecticut Nonresident Or PartYear Resident

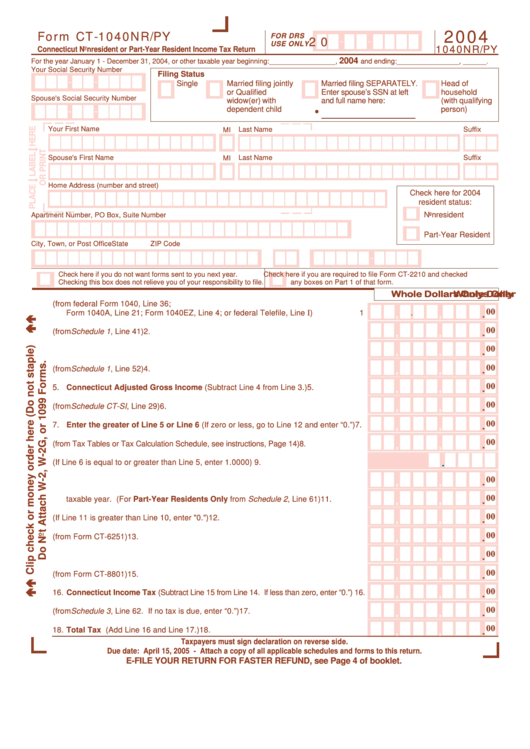

Form CT 1040NR PY Connecticut Nonresident and Part Year Resident

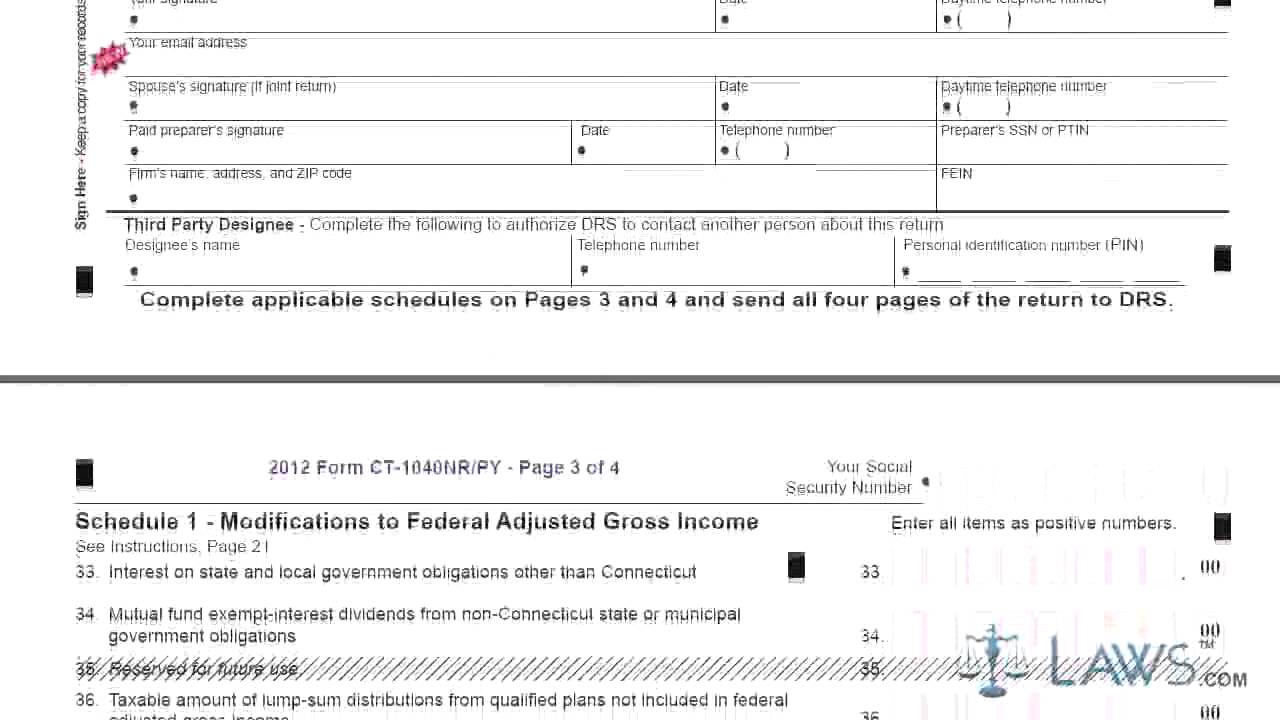

Form Ct1040nr/py Nonresident And PartYear Resident Tax

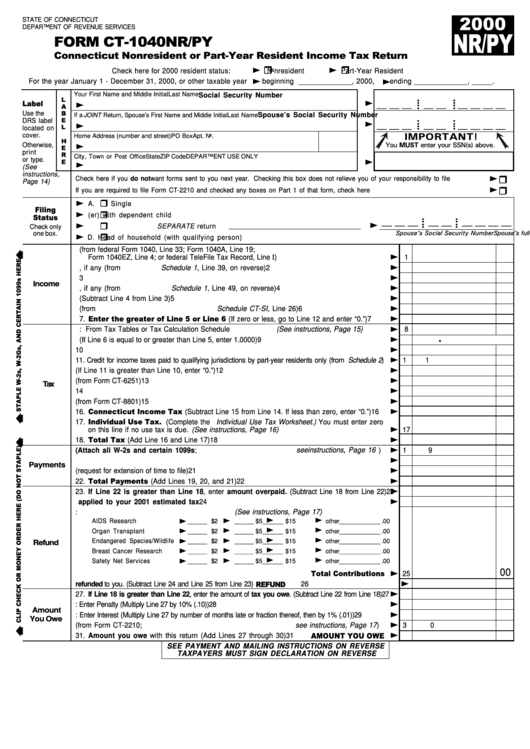

Ct 1040 Fill Out and Sign Printable PDF Template signNow

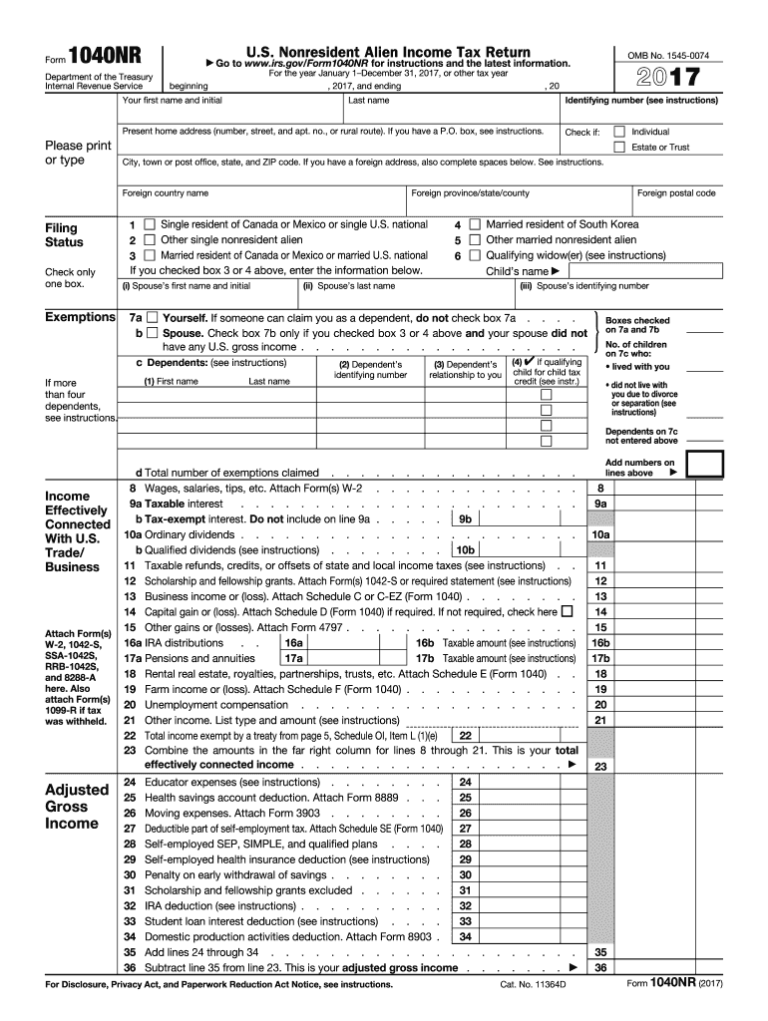

2021 Form IRS 1040NR Schedule A Fill Online, Printable, Fillable

1040nr Fill Out And Sign Printable PDF Template SignNow 2021 Tax

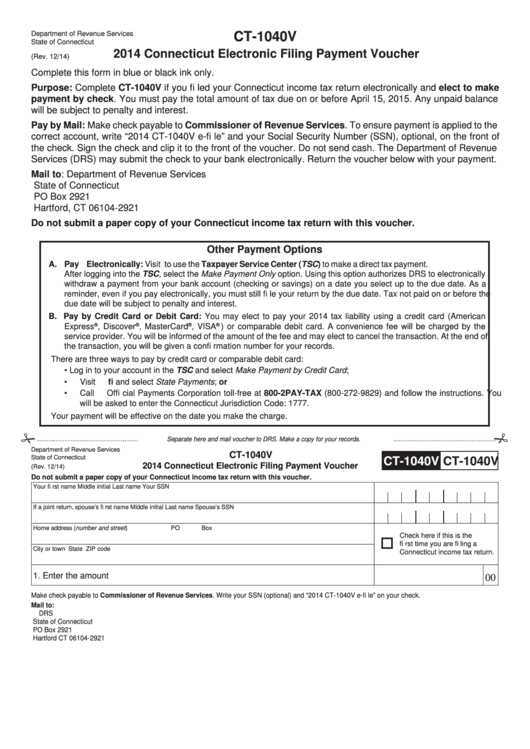

Form Ct1040v Connecticut Electronic Filing Payment Voucher 2014

(PDF) 2020 Nonresident and FORM PartYear Resident CT1040 · Check

Ct 1040nr py 2015 form Fill out & sign online DocHub

Related Post: