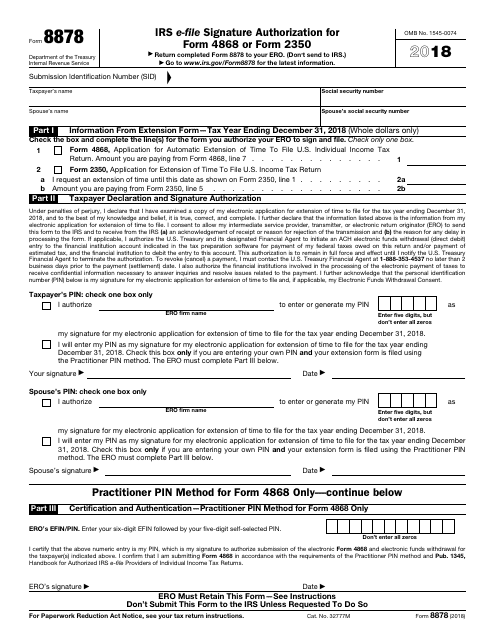

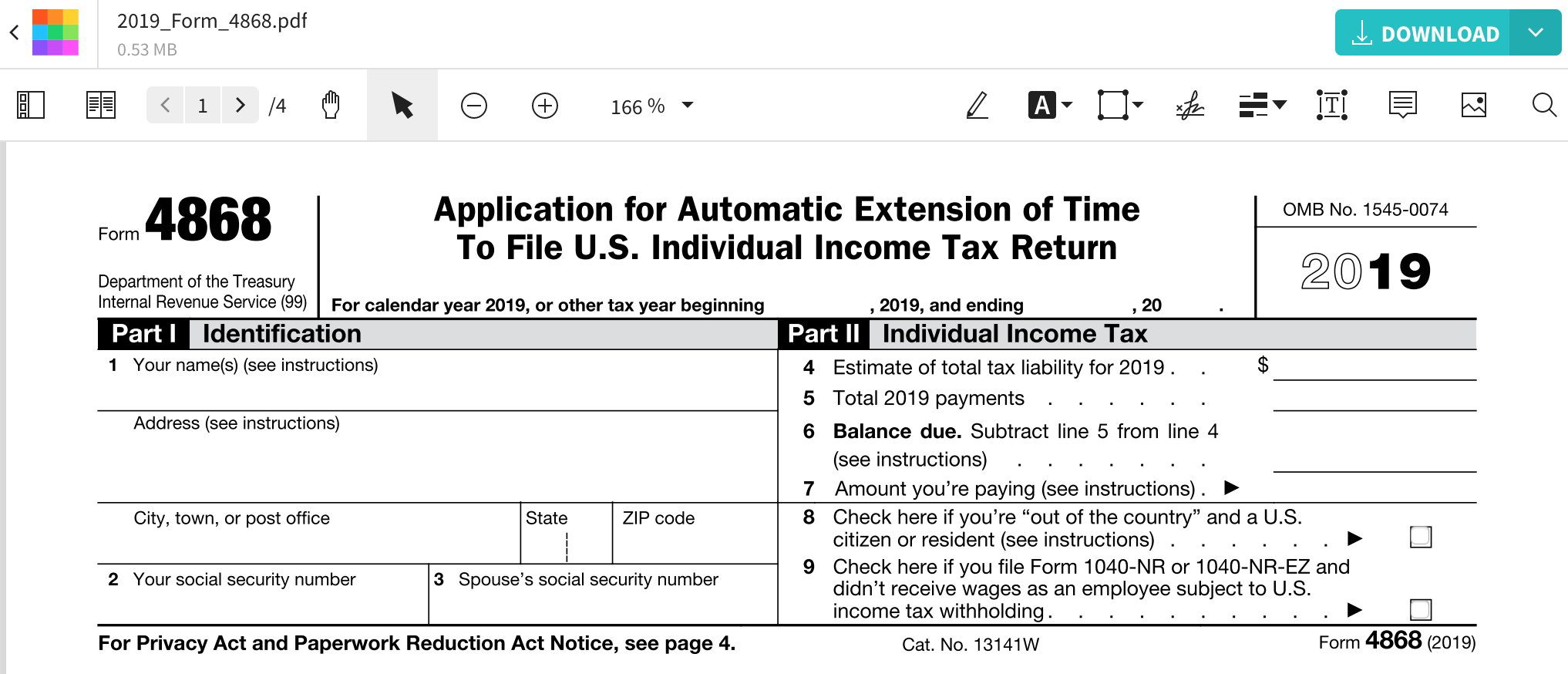

Irs Form 8878

Irs Form 8878 - Web complete form 8878 (a) when form 4868 is filed using the practitioner pin method, or (b) when the taxpayer authorizes the electronic return originator (ero) to enter or generate. Taxpayers, who currently use forms 8878 or 8879 to sign electronic forms 1040 federal. Internal revenue service go to www.irs.gov/form8878 for the latest information. Do not send this form. These forms are similar to form 8879 and are. Web department of the treasury ero must obtain and retain completed form 8878. Easy, fast, secure & free to try! Web the irs accepts electronic signatures on forms 8878 and 8879. Retain the completed form 8878 for 3 years from the return due date or the date the irs received the return,. A person authorized to sign. Retain the completed form 8878 for 3 years from the return due date or the date the irs received the return,. Taxpayers, who currently use forms 8878 or 8879 to sign electronic forms 1040 federal. Web submission identification number (sid) check the box and complete the line(s) for the form you authorize your ero to sign and file. These forms. These forms are similar to form 8879 and are. Taxpayers, who currently use forms 8878 or 8879 to sign electronic forms 1040 federal. Web department of the treasury ero must obtain and retain completed form 8878. What is the form used for? Do not send this form. Internal revenue service go to www.irs.gov/form8878 for the latest information. Web the irs accepts electronic signatures on forms 8878 and 8879. Web submission identification number (sid) check the box and complete the line(s) for the form you authorize your ero to sign and file. Do not send this form. Web you must sign and date irs form 8878 or irs. Do your 2021, 2020, 2019, 2018 all the way back to 2000 These forms are similar to form 8879 and are. Web complete form 8878 (a) when form 4868 is filed using the practitioner pin method, or (b) when the taxpayer authorizes the electronic return originator (ero) to enter or generate. Do not send this form. Web you must sign. Retain the completed form 8878 for 3 years from the return due date or the date the irs received the return,. A person authorized to sign. Web department of the treasury ero must obtain and retain completed form 8878. Ad do your 2021, 2020, 2019, 2018 all the way back to 2000 easy, fast, secure & free to try! Do. Web you must sign and date irs form 8878 or irs form 8879 after reviewing the return and ensuring that the tax return information matches the information on the return. Internal revenue service go to www.irs.gov/form8878 for the latest information. Esignatures can be used for a wide range of online documents apart from irs forms such as engagement letters,. Do. Do not send this form. Easy, fast, secure & free to try! Web the irs accepts electronic signatures on forms 8878 and 8879. Web you must sign and date irs form 8878 or irs form 8879 after reviewing the return and ensuring that the tax return information matches the information on the return. A person authorized to sign. Web department of the treasury ero must obtain and retain completed form 8878. Web submission identification number (sid) check the box and complete the line(s) for the form you authorize your ero to sign and file. Web • do not send form 8878 to the irs unless requested to do so. Do your 2021, 2020, 2019, 2018 all the way. Ad do your 2021, 2020, 2019, 2018 all the way back to 2000 easy, fast, secure & free to try! A person authorized to sign. Web submission identification number (sid) check the box and complete the line(s) for the form you authorize your ero to sign and file. Retain the completed form 8878 for 3 years from the return due. What is the form used for? Esignatures can be used for a wide range of online documents apart from irs forms such as engagement letters,. Ad do your 2021, 2020, 2019, 2018 all the way back to 2000 easy, fast, secure & free to try! Web you must sign and date irs form 8878 or irs form 8879 after reviewing. A person authorized to sign. Web you must sign and date irs form 8878 or irs form 8879 after reviewing the return and ensuring that the tax return information matches the information on the return. Do not send this form. Web form 8878 allows the taxpayer to authorizes the electronic return originator (ero) to enter or generate their personal identification number (pin) on form 4868 or form 2350. Internal revenue service go to www.irs.gov/form8878 for the latest information. Do your 2021, 2020, 2019, 2018 all the way back to 2000 Web complete form 8878 (a) when form 4868 is filed using the practitioner pin method, or (b) when the taxpayer authorizes the electronic return originator (ero) to enter or generate. Web the irs accepts electronic signatures on forms 8878 and 8879. Web • do not send form 8878 to the irs unless requested to do so. Taxpayers, who currently use forms 8878 or 8879 to sign electronic forms 1040 federal. Web department of the treasury ero must obtain and retain completed form 8878. What is the form used for? Easy, fast, secure & free to try! Esignatures can be used for a wide range of online documents apart from irs forms such as engagement letters,. Retain the completed form 8878 for 3 years from the return due date or the date the irs received the return,. Ad do your 2021, 2020, 2019, 2018 all the way back to 2000 easy, fast, secure & free to try! Web submission identification number (sid) check the box and complete the line(s) for the form you authorize your ero to sign and file. These forms are similar to form 8879 and are.IRS Form 8878 Download Fillable PDF or Fill Online IRS EFile Signature

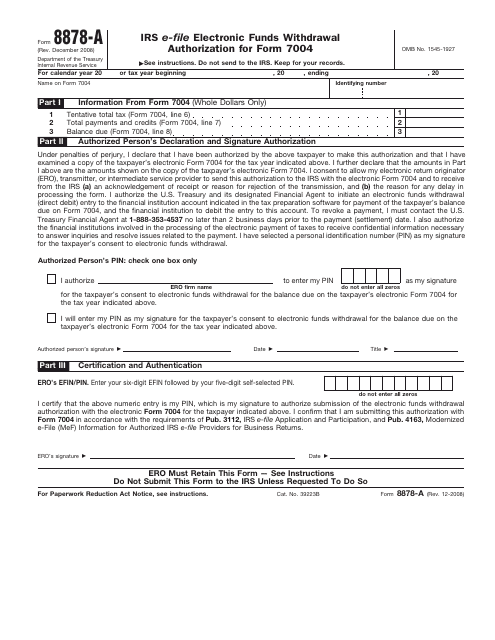

Form 8878A IRS EFile Electronic Funds Withdrawal Authorization for

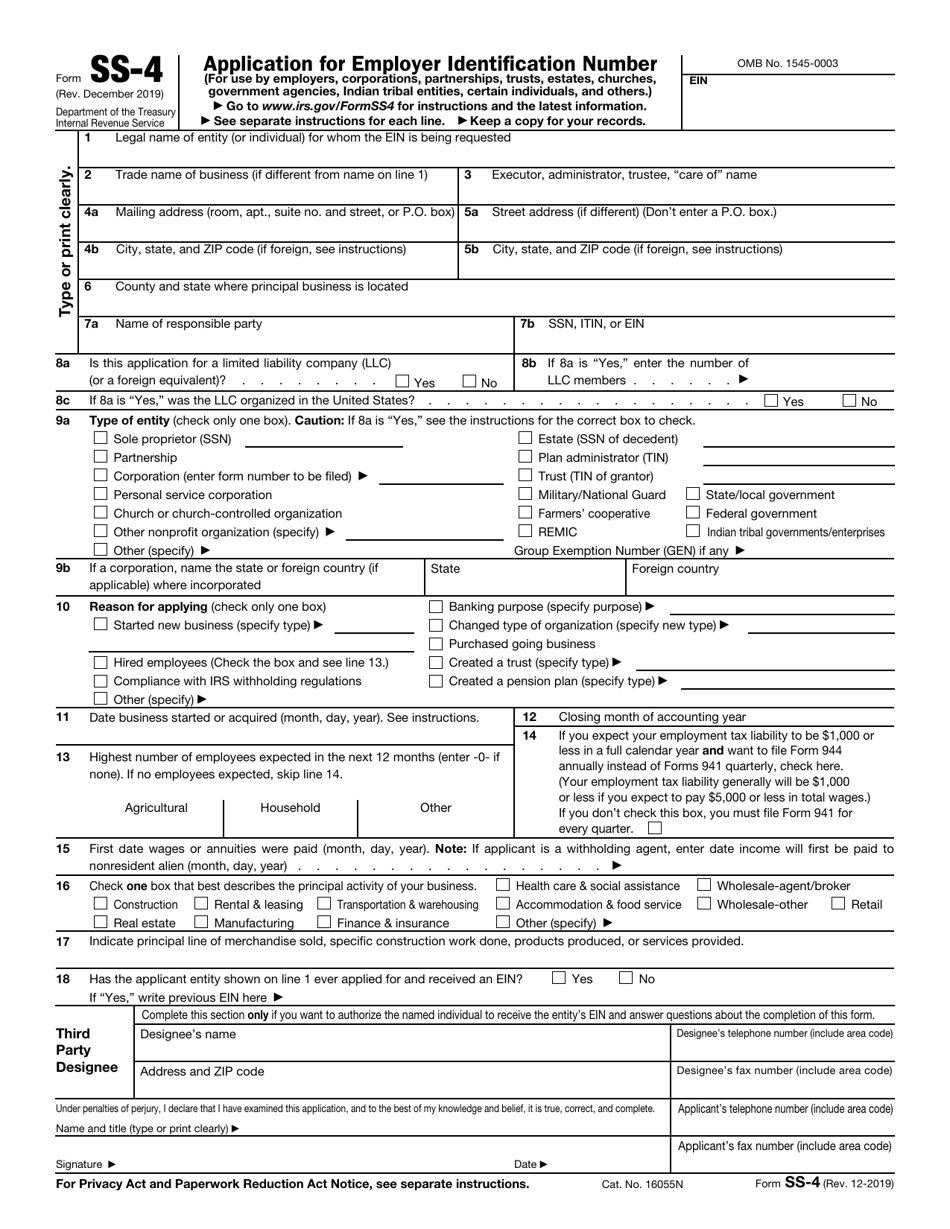

IRS Form SS4 Download Fillable PDF or Fill Online Application for

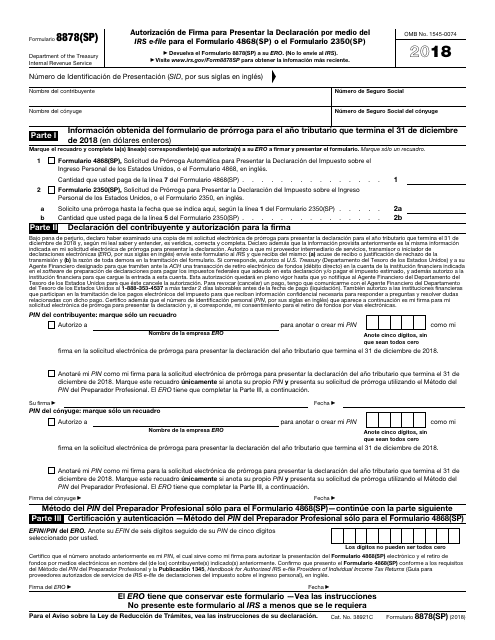

IRS Formulario 8878(SP) Download Fillable PDF or Fill Online

Form 8878 IRS efile Signature Authorization for Form 4868 or Form

Financial Concept Meaning Form 8878a IRS Efile Electronic Funds

Print Irs Extension Form 4868 2021 Calendar Printables Free Blank

IRS Form 8868 Fill Out, Sign Online and Download Fillable PDF

IRS Form 8878A Download Fillable PDF or Fill Online IRS EFile

Fill Free fillable Form 8878 2019 Signature Authorization PDF form

Related Post: