Where To Mail W4V Form

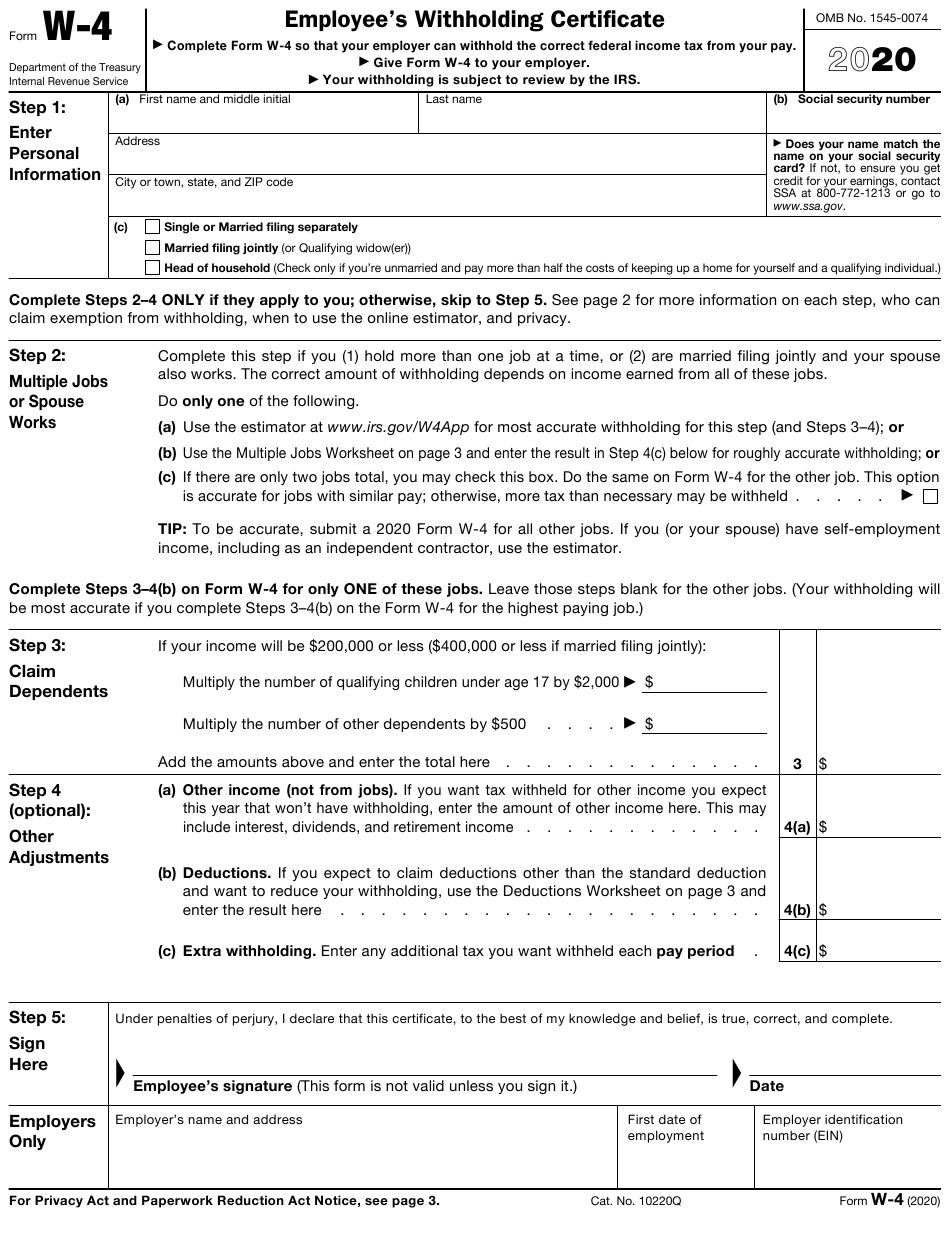

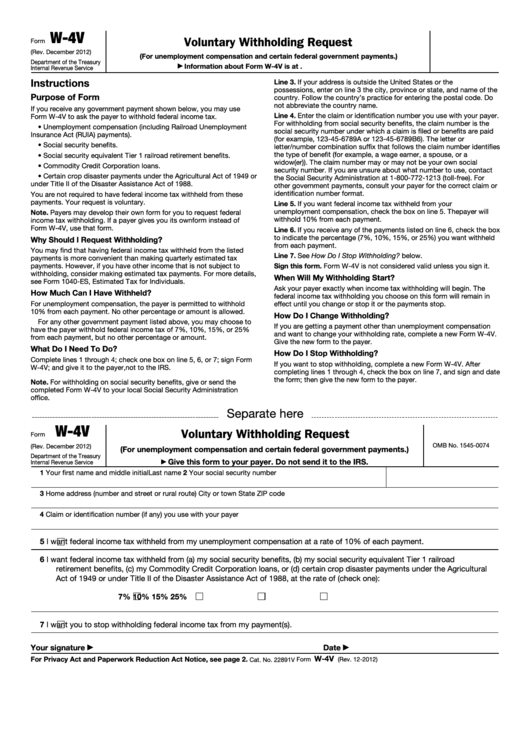

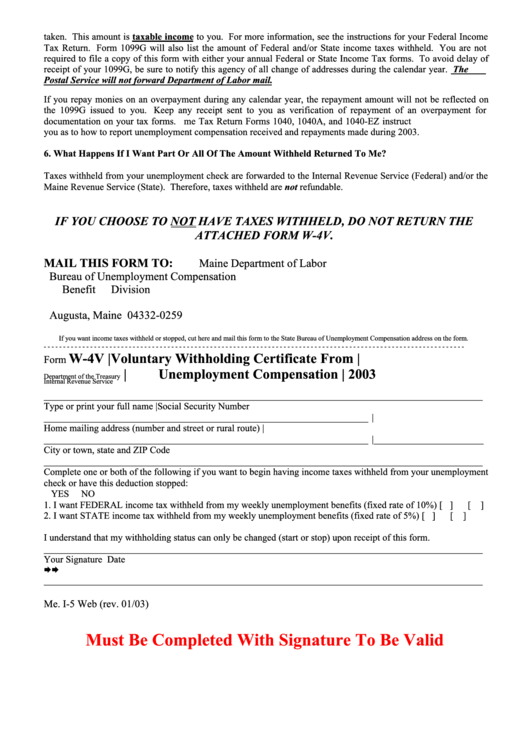

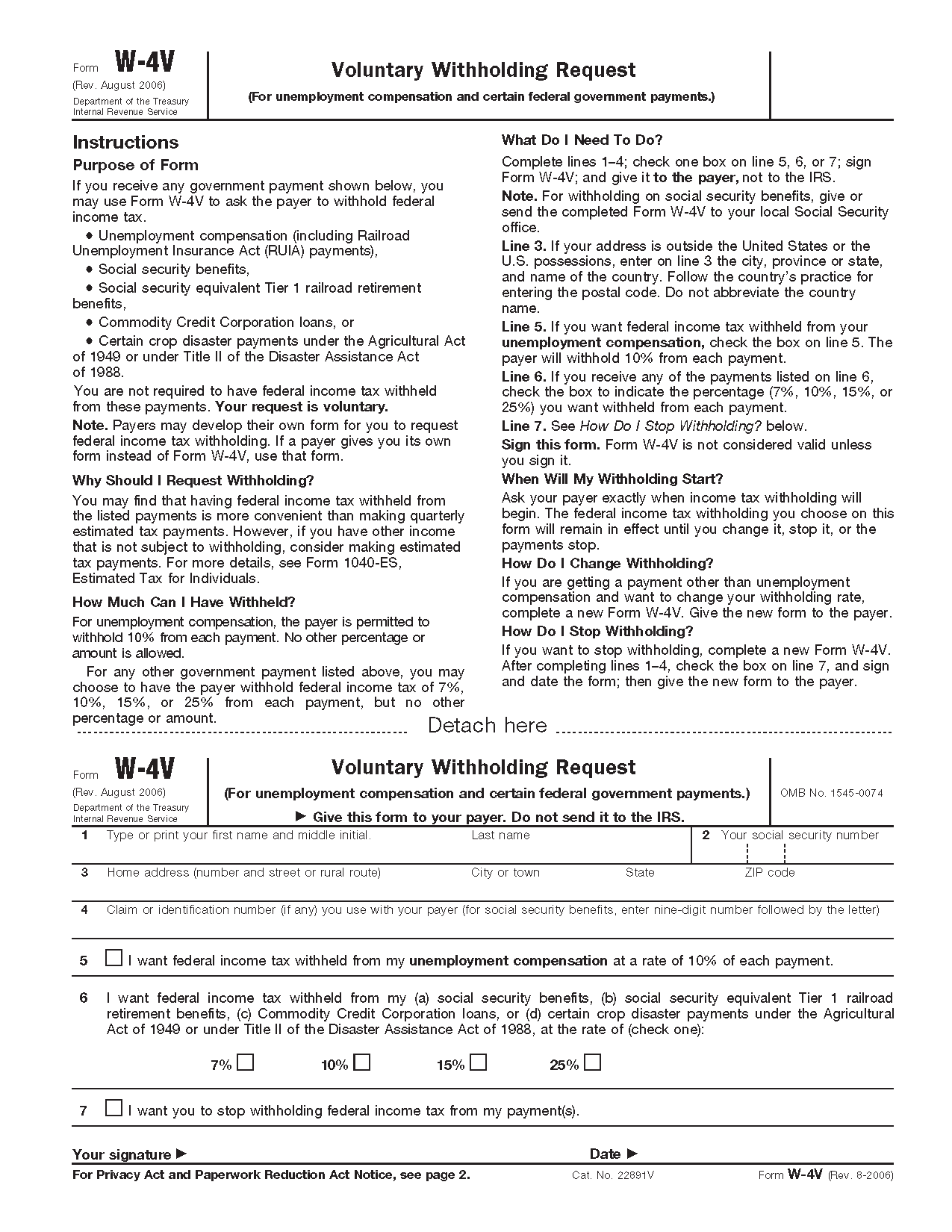

Where To Mail W4V Form - Please let me know your city and state, and i will give you the mailing address. Web if you want to have taxes withheld from unemployment compensation, you would send the form directly to the state paying the unemployment compensation. Web this form is provided and used for the request of voluntary withholdings regarding income taxes, and should be submitted to your payer, not to the irs. This is due to changes. Give the new form to the payer. If a customer service representatives (csr) representative (tsr) or spike mails out the form to a. Whether you are subject to tax on. Social security and railroad retirement payments may be includible in income. Web if you plan to file for unemployment, the unemployment compensation paid during the year is included in your gross income. Web see answers (3) best answer. Web page last reviewed or updated: Web sign the form and return it to your local social security office by mail or in person. Some addresses may not match a particular instruction booklet or publication. (for unemployment compensation and certain federal. Web see answers (3) best answer. Search by state and form number the mailing address to file paper individual tax returns and payments. Some addresses may not match a particular instruction booklet or publication. If you need more information if you have questions about your tax liability or want to request a. Web if you want to have taxes withheld from unemployment compensation, you would send. Please let me know your city and state, and i will give you the mailing address. If a customer service representatives (csr) representative (tsr) or spike mails out the form to a. Voluntary withholding request from the irs' website. Social security and railroad retirement payments may be includible in income. This is due to changes. Some addresses may not match a particular instruction booklet or publication. Web withholding on form w‐4 or form w‐4p. (for unemployment compensation and certain federal. Please let me know your city and state, and i will give you the mailing address. Web if you want to have taxes withheld from unemployment compensation, you would send the form directly to the. Web page last reviewed or updated: Social security and railroad retirement payments may be includible in income. Give the new form to the payer. If you need more information if you have questions about your tax liability or want to request a. Some addresses may not match a particular instruction booklet or publication. Search by state and form number the mailing address to file paper individual tax returns and payments. February 2018) department of the treasury internal revenue service. Web mail or fax us a request to withhold taxes. Social security and railroad retirement payments may be includible in income. You must submit this form. Web withholding on form w‐4 or form w‐4p. This is due to changes. (for unemployment compensation and certain federal. Web if you want to have taxes withheld from unemployment compensation, you would send the form directly to the state paying the unemployment compensation. See form w‐4v, voluntary withholding request,. Web this form is provided and used for the request of voluntary withholdings regarding income taxes, and should be submitted to your payer, not to the irs. Whether you are subject to tax on. Web page last reviewed or updated: Please let me know your city and state, and i will give you the mailing address. If a customer service. If a customer service representatives (csr) representative (tsr) or spike mails out the form to a. February 2018) (for unemployment compensation and certain federal government and other payments.) department of the treasury. You must submit this form. Web page last reviewed or updated: See form w‐4v, voluntary withholding request,. Please let me know your city and state, and i will give you the mailing address. Give the new form to the payer. Social security and railroad retirement payments may be includible in income. If a customer service representatives (csr) representative (tsr) or spike mails out the form to a. Web this form is provided and used for the request. You can download or print. Then, find the social security office closest to your home and mail or fax us the completed form. (for unemployment compensation and certain federal. This is due to changes. If a customer service representatives (csr) representative (tsr) or spike mails out the form to a. Web page last reviewed or updated: See form w‐4v, voluntary withholding request,. Social security and railroad retirement payments may be includible in income. Voluntary withholding request from the irs' website. You can find the office using the social security web. Please let me know your city and state, and i will give you the mailing address. Web see answers (3) best answer. Give the new form to the payer. Web if you plan to file for unemployment, the unemployment compensation paid during the year is included in your gross income. You must submit this form. If you need more information if you have questions about your tax liability or want to request a. Give the new form to the payer. Some addresses may not match a particular instruction booklet or publication. Web if you want to have taxes withheld from unemployment compensation, you would send the form directly to the state paying the unemployment compensation. Web page last reviewed or updated:Federal Withholding Tax Form W4v

Fillable Form W4v Voluntary Withholding Request printable pdf download

W4v Fill out & sign online DocHub

How to Fill Out Form W4V for Unemployment Withholding Taxes YouTube

Form W 4V Printable

Irs Form W4V Printable Request for taxpayer identification number

Fillable Form W 4v Printable Forms Free Online

Irs Form W4V Printable IRS 656B 2020 Fill and Sign Printable

W 4V Form SSA Printable 2022 W4 Form

Irs Form W 4V Printable

Related Post: