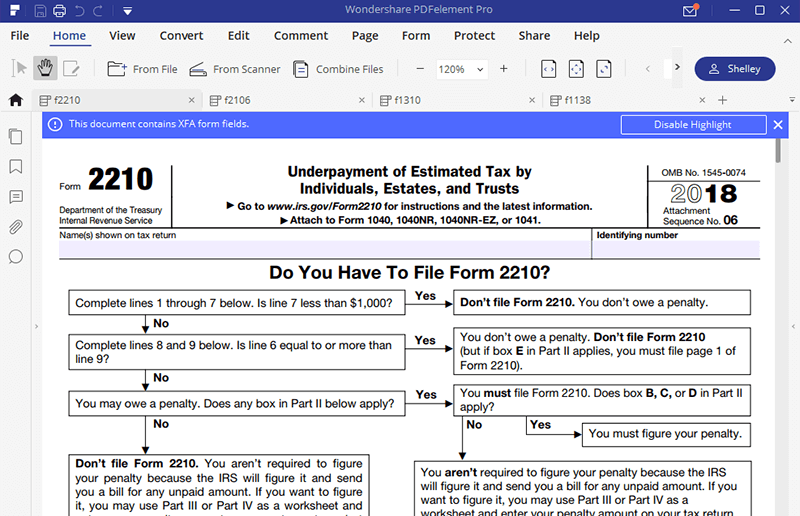

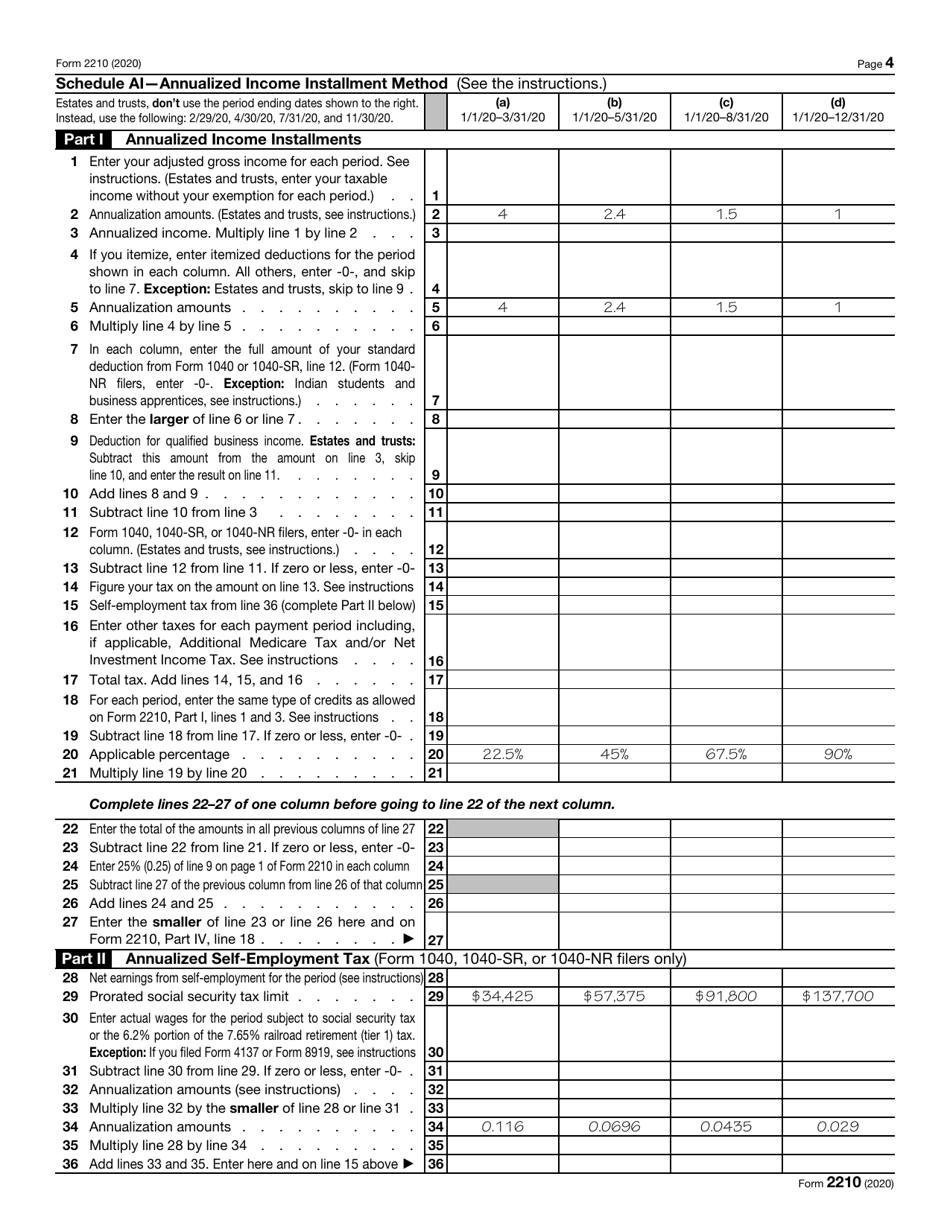

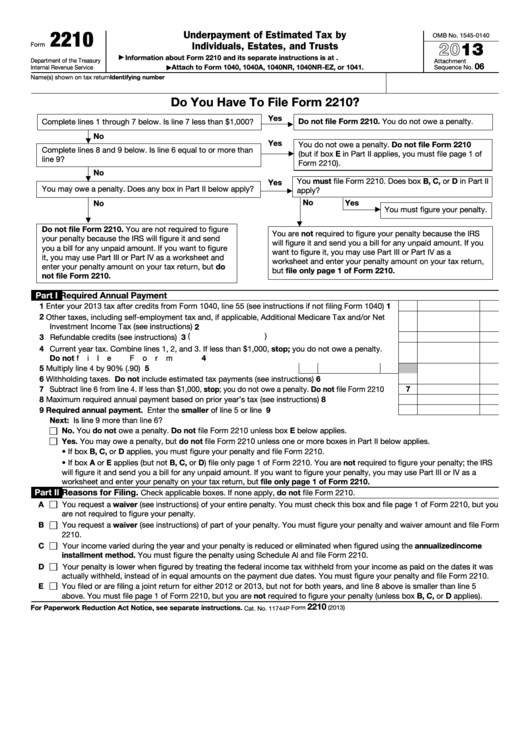

Form 2210 Line 4

Form 2210 Line 4 - Is line 6 equal to or more. You don’t owe a penalty. Web do you have to file form 2210? Is line 7 less than $1,000? In requesting a waiver, the taxpayer will need to calculate the amount of requested relief in order to complete lines 1 through 3 of form 2010 or lines 1. Form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is. You do not owe a penalty. If you want to figure it, you may use. Web (worksheet for form 2210, part iv, section b—figure the penalty), later. Do not file form 2210. Complete lines 1 through 7 below. You do not owe a penalty. Form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is. Complete lines 1 through 7 below. In requesting a waiver, the taxpayer will need to calculate the amount of requested relief in order to complete lines 1 through 3 of. And the schedule a (form 1040/sr) page is at irs.gov/schedulea. If this number is less than. Form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is. You don’t owe a penalty. You don’t owe a penalty. You don’t owe a penalty. Do not file form 2210. Web is line 4 or line 7 less than $1,000? And the schedule a (form 1040/sr) page is at irs.gov/schedulea. Is line 6 equal to or more. You don’t owe a penalty. If more than one payment was required to fully satisfy an underpayment amount, make a separate. Web enter the total penalty from line 14 of the worksheet for form 2210, part iv, section b—figure the penalty. Complete lines 1 through 7 below. Complete lines 8 and 9 below. And the schedule a (form 1040/sr) page is at irs.gov/schedulea. Enter the penalty on form 2210, line 27, and on the “estimated tax penalty” line on your tax return. Web the amount on line 4 of your 2210 form last year would be the same as the amount on line 24 of your 2020 1040 minus the amount on line. Web is line 4 or line 7 less than $1,000? Complete lines 1 through 7 below. Web (worksheet for form 2210, part iv, section b—figure the penalty), later. You don’t owe a penalty. Web after completing lines 1 through 7 on irs form 2210, is line 4 or line 7 less than $1,000? If you want to figure it, you may use. Web do not file form 2210. Complete lines 8 and 9 below. Department of the treasury internal revenue service. Complete lines 1 through 7 below. Web line 4 is for itemized deductions. Web do not file form 2210. You don’t owe a penalty. Web do you have to file form 2210? Complete lines 1 through 7 below. 06 identifying number name(s) shown on tax return do you have to file form 2210?. Web is line 4 or line 7 less than $1,000? Does anyone know how to handle state and local income taxes which are capped at $10,000? Say for example i had $3000 in. Web enter the total penalty from line 14 of the worksheet for. Is line 7 less than $1,000? In requesting a waiver, the taxpayer will need to calculate the amount of requested relief in order to complete lines 1 through 3 of form 2010 or lines 1. Is line 6 equal to or more. Is line 4 or line 7 less than $1,000? Web complete lines 1 through 7 below. Web (worksheet for form 2210, part iv, section b—figure the penalty), later. Is line 4 or line 7 less than $1,000? Web after completing lines 1 through 7 on irs form 2210, is line 4 or line 7 less than $1,000? Web enter the total penalty from line 14 of the worksheet for form 2210, part iv, section b—figure the penalty. You do not owe a penalty. Web do you have to file form 2210? Complete lines 1 through 7 below. 1 if you expect to deduct investment interest expense, don’t include on this line any qualified dividends or net capital gain that you will elect to treat as investment income. Web do not file form 2210. Is line 6 equal to or more than line 9? If yes, the taxpayer is not required to file irs form 2210 because they do not owe a. In requesting a waiver, the taxpayer will need to calculate the amount of requested relief in order to complete lines 1 through 3 of form 2010 or lines 1. Complete lines 8 and 9 below. You do not owe a penalty. Is line 7 less than $1,000? Is line 4 or line 7 less than $1,000? Web do you have to file form 2210? If typing in a link. You don’t owe a penalty. Make the computation requested on line 4 and enter the result.IRS Form 2210Fill it with the Best Form Filler

IRS Form 2210Fill it with the Best Form Filler

Form 2210 Fill out & sign online DocHub

2210 Form 2022 2023

Instructions For Form 2210 Underpayment Of Estimated Tax By

IRS Form 2210 Download Fillable PDF or Fill Online Underpayment of

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Fillable Form 2210 Underpayment Of Estimated Tax By Individuals

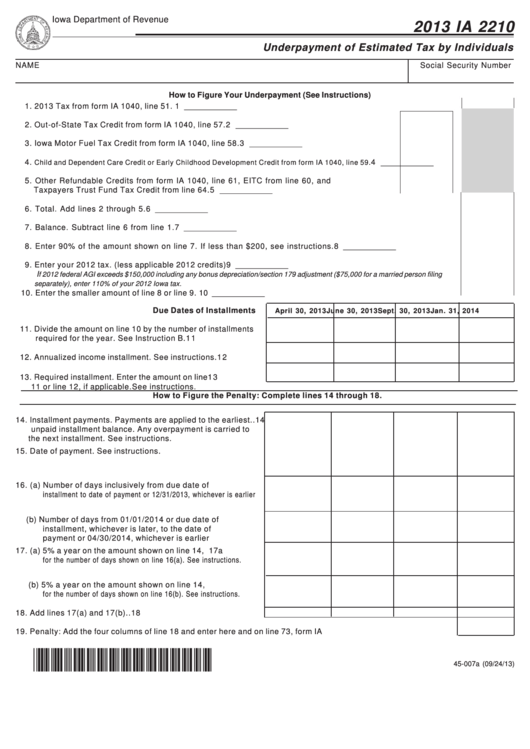

Fillable Form Ia 2210 Underpayment Of Estimated Tax By Individuals

Instructions for Form 2210

Related Post: