La Care Tax Form

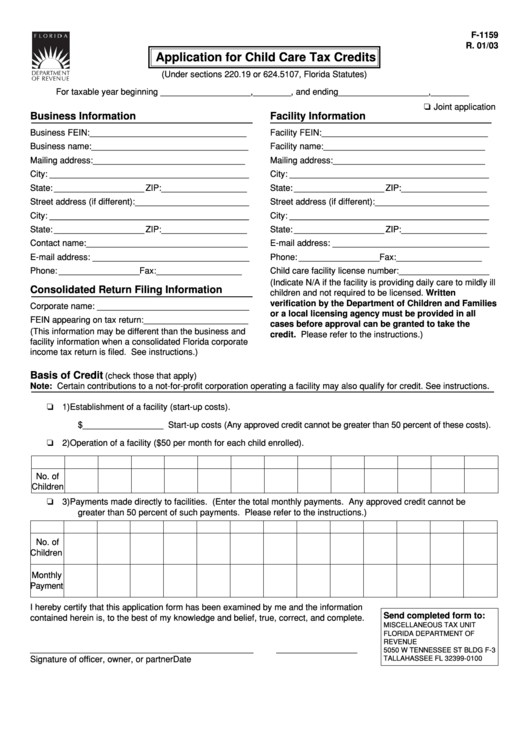

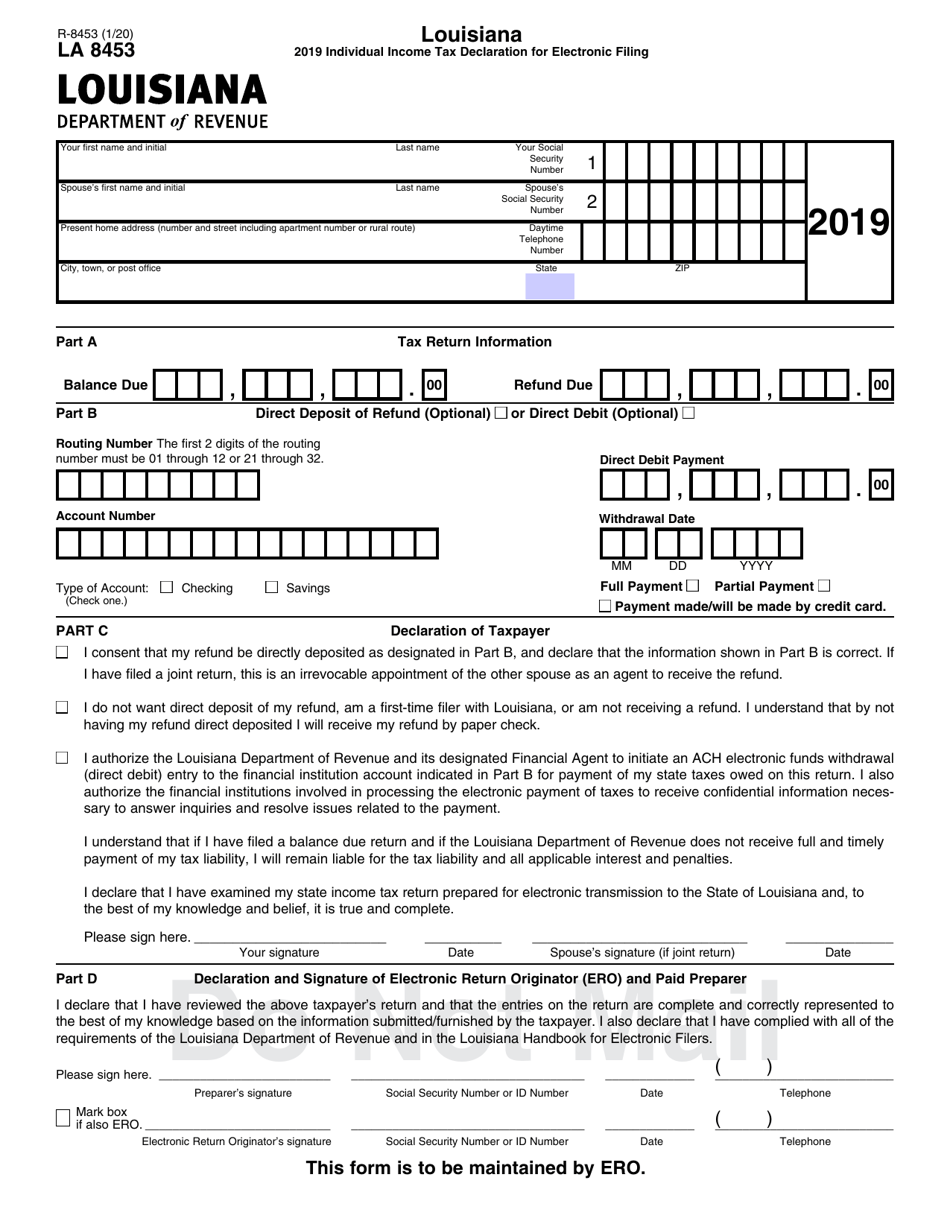

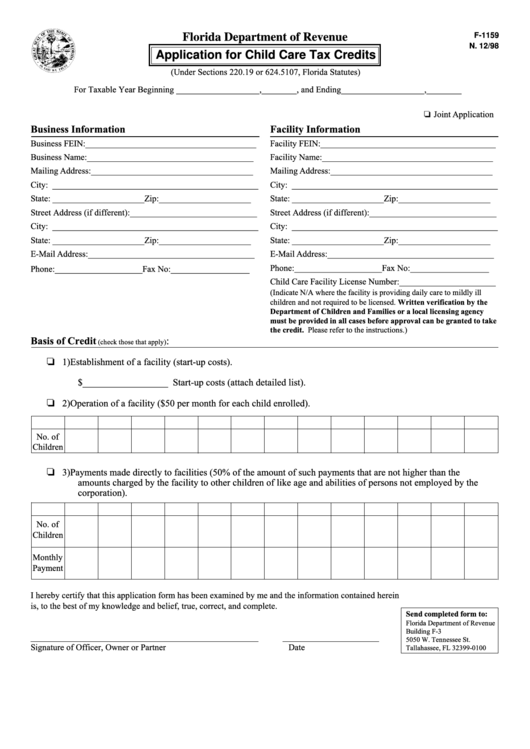

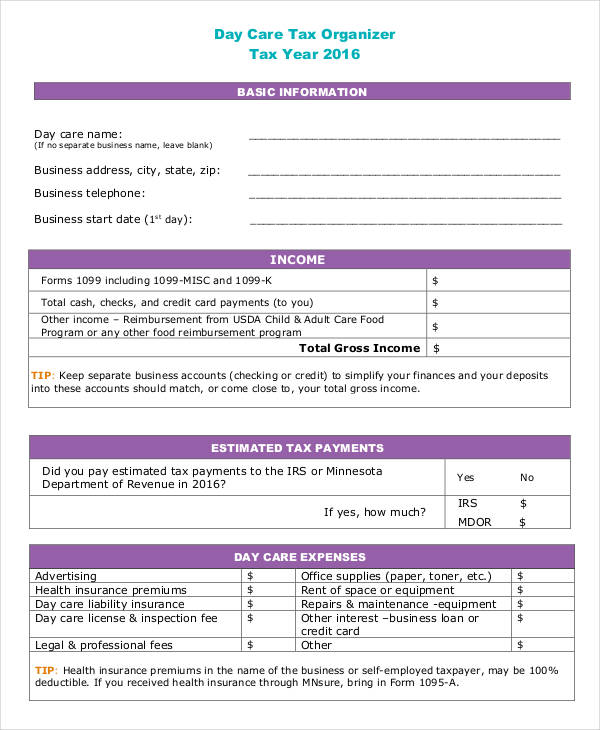

La Care Tax Form - Web file your taxes online. Join the growing majority of participants who submit their claim online for faster service. 2021 louisiana refundable child care credit your federal adjusted. Web you’ll need to complete the software form and file your completed tax documents electronically or by mail. Check the status of your authorization using the online iexchange portal. Web care tax credit for taxpayers whose federal adjusted gross income exceeds $25,000 may not be refunded, and any unused credit amounts can be used over the next five years. Web clients can fill out their specifics in the spreadsheet; Web this form contains proof you had qualifying health insurance and important tax information you'll need to complete your household's federal income tax filing. Care health plan has enabled two factor authentication (2fa) for all members who wish to create an account or who simply want to login to the member portal. Web your louisiana tax table income subtract lines 8c and 9 from line 7. Web care tax credit for taxpayers whose federal adjusted gross income exceeds $25,000 may not be refunded, and any unused credit amounts can be used over the next five years. Web your louisiana tax table income subtract lines 8c and 9 from line 7. Care covered™ summary are you and/or einen individual your claim as a tax dependent was subscribed. Care direct network prior authorization fax request form, effective 11/1/22. By checking this box, you consent to our data privacy policy. 2021 louisiana refundable child care credit your federal adjusted. Web clients can fill out their specifics in the spreadsheet; Web your louisiana tax table income subtract lines 8c and 9 from line 7. The tool will then calculate their exemptions related to income. Ensure we have your latest address on file. This form is printable for the client or client's tax preparer. Web due to numbering limitations, some credits have been assigned new codes on schedule j. Web clients can fill out their specifics in the spreadsheet; Web you’ll need to complete the software form and file your completed tax documents electronically or by mail. The affordable care act contains comprehensive health insurance reforms and includes tax provisions that affect individuals, families,. Web care tax credit for taxpayers whose federal adjusted gross income exceeds $25,000 may not be refunded, and any unused credit amounts can be used. Web this publication is called a subscriber agreement & combined evidence of coverage and disclosure form (also called the subscriber agreement & member handbook). Care direct network prior authorization fax request form, effective 11/1/22. By checking this box, you consent to our data privacy policy. 2022 income & franchise tax changes. Check the status of your authorization using the online. Web these are examples of qualifying incomes. Web your louisiana tax table income subtract lines 8c and 9 from line 7. See how to complete 2022 tax return. Log in to your healthequity account at. Ensure we have your latest address on file. 2022 income & franchise tax changes. You can download the form and instructions at www.irs.gov to. Join the growing majority of participants who submit their claim online for faster service. Check the status of your authorization using the online iexchange portal. Web care tax credit for taxpayers whose federal adjusted gross income exceeds $25,000 may not be refunded, and any. Web due to numbering limitations, some credits have been assigned new codes on schedule j. Web clients can fill out their specifics in the spreadsheet; Web your louisiana tax table income subtract lines 8c and 9 from line 7. Web care tax credit for taxpayers whose federal adjusted gross income exceeds $25,000 may not be refunded, and any unused credit. Join the growing majority of participants who submit their claim online for faster service. Log in to your healthequity account at. Care health plan has enabled two factor authentication (2fa) for all members who wish to create an account or who simply want to login to the member portal. Web you’ll need to complete the software form and file your. 2021 louisiana refundable child care credit your federal adjusted. This form is printable for the client or client's tax preparer. By checking this box, you consent to our data privacy policy. Check the status of your authorization using the online iexchange portal. Ensure we have your latest address on file. Web care tax credit for taxpayers whose federal adjusted gross income exceeds $25,000 may not be refunded, and any unused credit amounts can be used over the next five years. By checking this box, you consent to our data privacy policy. See how to complete 2022 tax return. Care direct network prior authorization fax request form, effective 11/1/22. Web you’ll need to complete the software form and file your completed tax documents electronically or by mail. 2021 louisiana refundable child care credit your federal adjusted. Web these are examples of qualifying incomes. Join the growing majority of participants who submit their claim online for faster service. Care covered™ summary are you and/or einen individual your claim as a tax dependent was subscribed in minimum essential product (mec), you will obtain a tax. Log in to your healthequity account at. Web this publication is called a subscriber agreement & combined evidence of coverage and disclosure form (also called the subscriber agreement & member handbook). You can download the form and instructions at www.irs.gov to. Web your louisiana tax table income subtract lines 8c and 9 from line 7. The affordable care act contains comprehensive health insurance reforms and includes tax provisions that affect individuals, families,. Web file your taxes online. 2022 income & franchise tax changes. The tool will then calculate their exemptions related to income. Web due to numbering limitations, some credits have been assigned new codes on schedule j. Check the status of your authorization using the online iexchange portal. Web your covered california insureds can now access their health care tax forms by visiting the documents and correspondence section of their online covered california web.Form F1159 Application For Child Care Tax Credits 2003 printable

Do You Have to Show Proof of Health Insurance When Filing Taxes

Form R8453 Download Fillable PDF or Fill Online Louisiana Individual

Fillable Form F1159 Application For Child Care Tax Credits printable

2014 Form VA VA8453 Fill Online, Printable, Fillable, Blank pdfFiller

Child Care Invoice Sample Master of Template Document

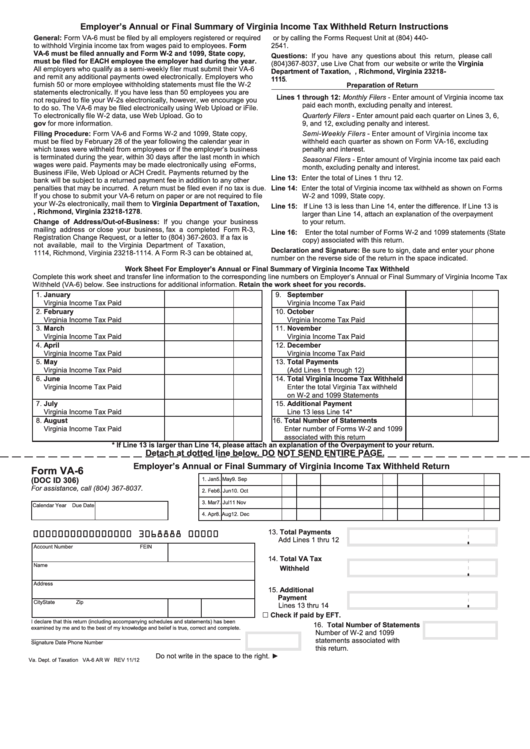

Fillable Form Va6 Employer'S Annual Or Final Summary Of Virginia

Formulário 1095 A relação do “ObamaCare” com o Imposto de Renda

Helping Your Clients With Their Health Care Tax Forms L.A. Care

In home child care provider taxes Fill online, Printable, Fillable Blank

Related Post: