Where To Mail Form 941 X Without Payment

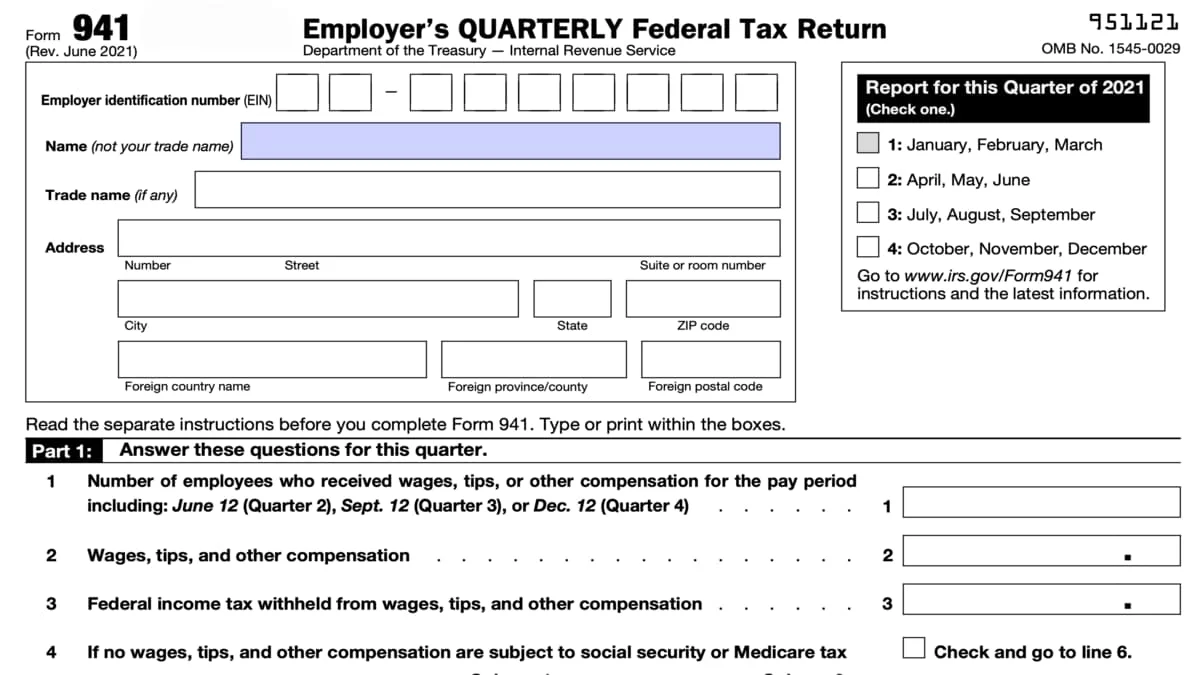

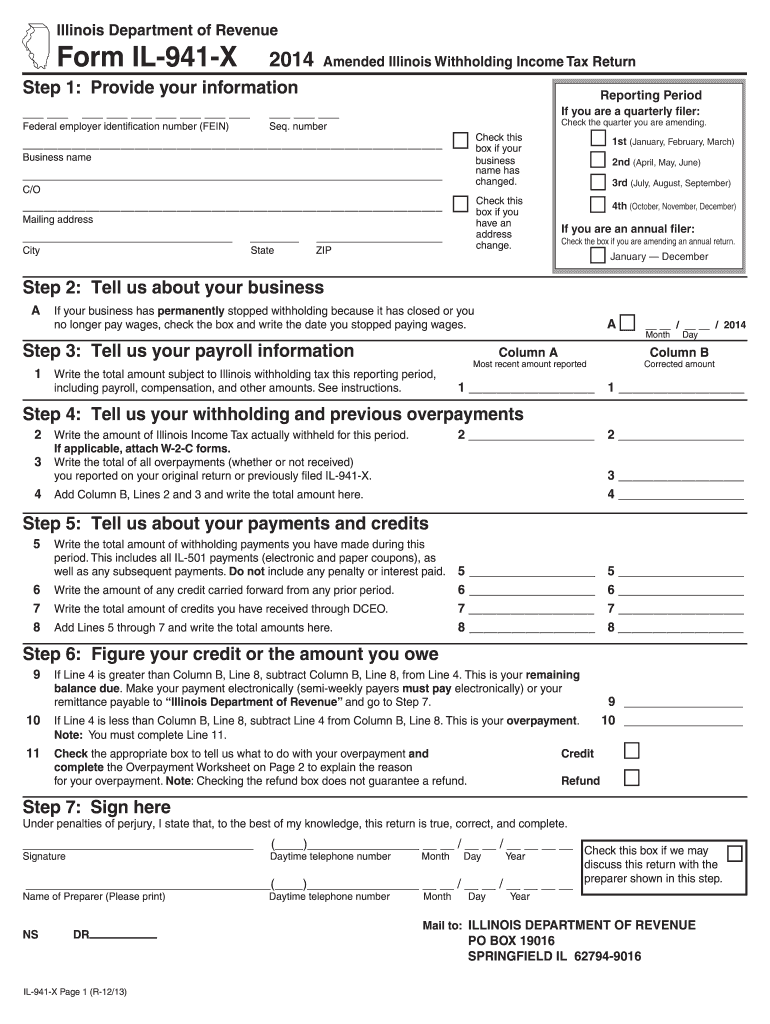

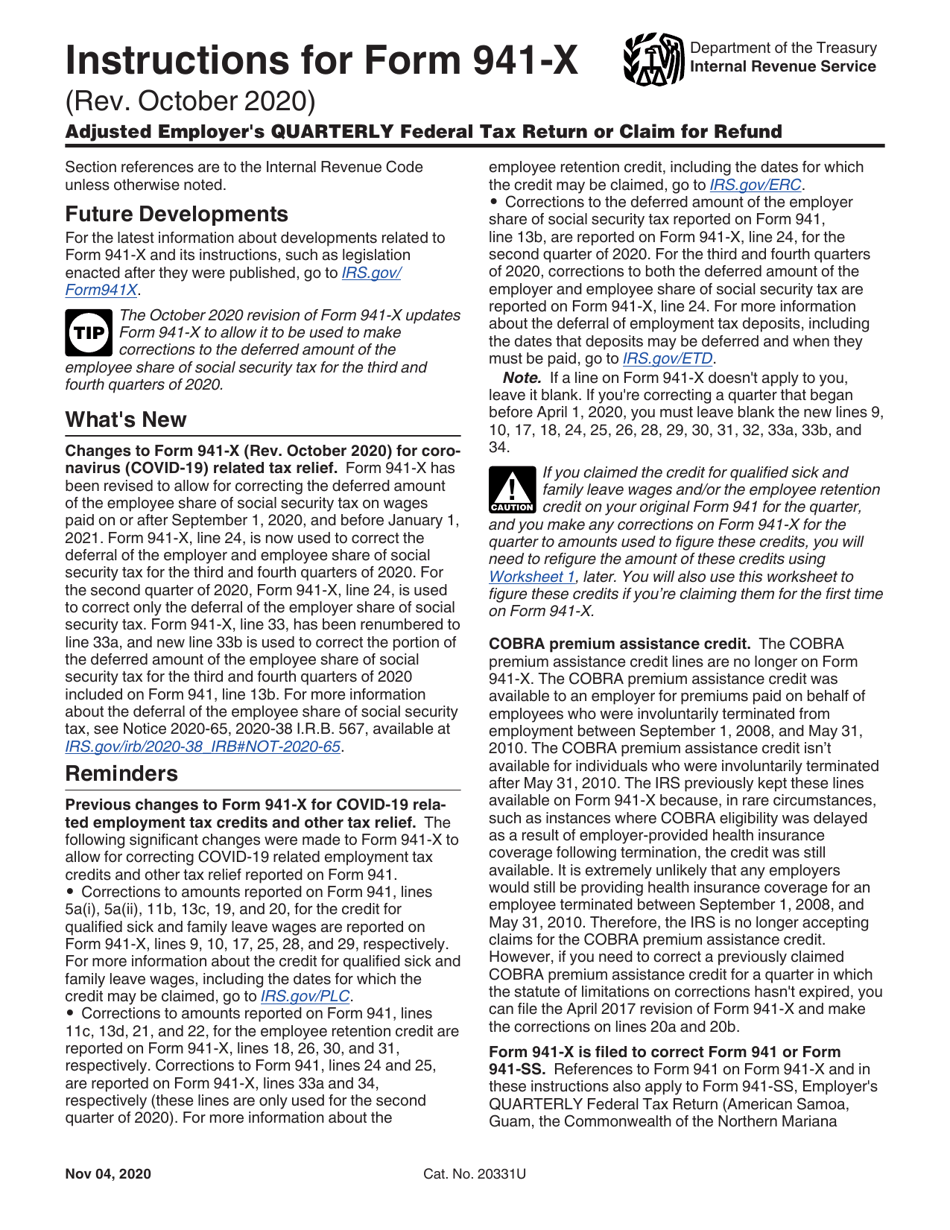

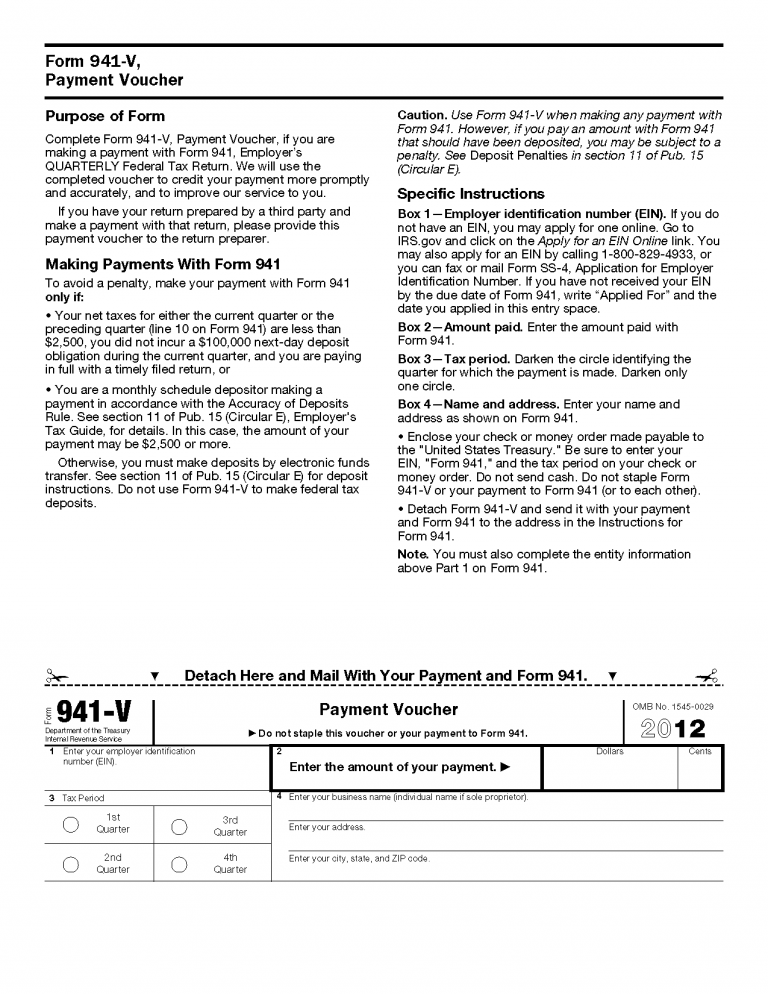

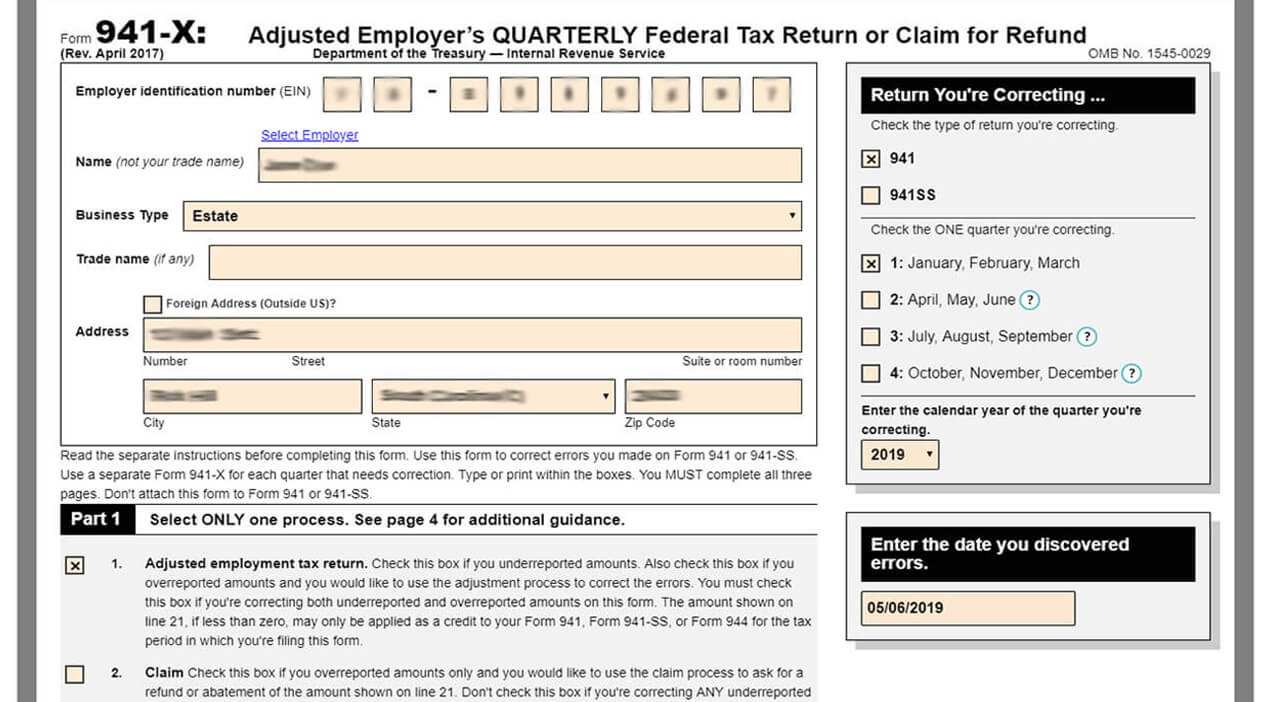

Where To Mail Form 941 X Without Payment - Also check this box if you overreported tax amounts and you would like to use the adjustment. Web if you would mail your return filed without a payment to ogden, as shown under where should you file, later, send your request to the ogden address shown. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from. Territories will file form 941, or, if you prefer your form and instructions in spanish, you can file new form 941 (sp), declaración del impuesto. Web mailing addresses for forms 941. Where to mail form 941 with payment? Web there are two options for electronically filing payroll tax returns: Web you’re only allowed to send payment with form 941 if your total tax due is less than $2,500 for the current quarter and was also less than $2,500 for the previous. An employer is required to file an irs 941x in the event of an error on a. Web if you would mail your return filed without a payment to ogden, as shown under where should you file, later, send your request to the ogden address shown. An employer is required to file an irs 941x in the event of an error on a. Web irs form 941, also known as the employer’s quarterly federal tax return, is. Web you’re only allowed to send payment with form 941 if your total tax due is less than $2,500 for the current quarter and was also less than $2,500 for the previous. Also check this box if you overreported tax amounts and you would like to use the adjustment. Employee wages, income tax withheld from wages, taxable social security wages,. Web if you would mail your return filed without a payment to ogden, as shown under where should you file, later, send your request to the ogden address shown. A list of providers offers options based. Web mailing addresses for forms 941. Where to mail form 941 with payment? Web there are two options for electronically filing payroll tax returns: Web the completed form 941 without payment must be forwarded to the internal revenue service. Web you’re only allowed to send payment with form 941 if your total tax due is less than $2,500 for the current quarter and was also less than $2,500 for the previous. Territories will file form 941, or, if you prefer your form and instructions. Territories will file form 941, or, if you prefer your form and instructions in spanish, you can file new form 941 (sp), declaración del impuesto. Web you’re only allowed to send payment with form 941 if your total tax due is less than $2,500 for the current quarter and was also less than $2,500 for the previous. Which mailing address. Territories will file form 941, or, if you prefer your form and instructions in spanish, you can file new form 941 (sp), declaración del impuesto. Which mailing address you’re going to use whether it is with. An employer is required to file an irs 941x in the event of an error on a. Web you’re only allowed to send payment. Web instead, employers in the u.s. Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from. Also check this box if you overreported tax amounts and you would like to use the adjustment. Web there are two options for electronically filing payroll tax. Web you’re only allowed to send payment with form 941 if your total tax due is less than $2,500 for the current quarter and was also less than $2,500 for the previous. Web the completed form 941 without payment must be forwarded to the internal revenue service. A list of providers offers options based. Web your form 941 mailing address. Web you’re only allowed to send payment with form 941 if your total tax due is less than $2,500 for the current quarter and was also less than $2,500 for the previous. Web instead, employers in the u.s. Web there are two options for electronically filing payroll tax returns: Web if you would mail your return filed without a payment. Web you’re only allowed to send payment with form 941 if your total tax due is less than $2,500 for the current quarter and was also less than $2,500 for the previous. Web instead, employers in the u.s. Web adjusted employment tax return. Also check this box if you overreported tax amounts and you would like to use the adjustment.. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Web you’re only allowed to send payment with form 941 if your total tax due is less than $2,500 for the current quarter and was also less than $2,500 for the previous. Web the completed form 941 without payment must be forwarded to the internal revenue service. Web your form 941 mailing address depends on the state in which your business operates and whether you include payment with tax form 941 or not. Which mailing address you’re going to use whether it is with. Territories will file form 941, or, if you prefer your form and instructions in spanish, you can file new form 941 (sp), declaración del impuesto. Connecticut, delaware, district of columbia, florida, georgia,. Check this box if you underreported tax amounts. Where to mail form 941 with payment? Also check this box if you overreported tax amounts and you would like to use the adjustment. Web the completed form 941 without payment must be forwarded to the internal revenue service. A list of providers offers options based. Web adjusted employment tax return. Web mailing addresses for forms 941. Web there are two options for electronically filing payroll tax returns: Expressefile offers the lowest price of $3.99 for filing form 941. Web instead, employers in the u.s. Web if you would mail your return filed without a payment to ogden, as shown under where should you file, later, send your request to the ogden address shown. Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from. An employer is required to file an irs 941x in the event of an error on a.Form 941 X 2023 Fill online, Printable, Fillable Blank

Form 941 Instructions & Info on Tax Form 941 (including Mailing Info)

941 Form 2021 941 Forms TaxUni

941 Form 2022 Printable PDF Template

IL 941 X Form Fill Out and Sign Printable PDF Template signNow

941 Form Mailing Address 2023 941 Forms Zrivo

Download Instructions for IRS Form 941X Adjusted Employer's Quarterly

IRS Form 941X Complete & Print 941X for 2022

Where to mail 941 with payment Payment

How to Complete & Download Form 941X (Amended Form 941)?

Related Post: