Where To Mail Form 843 And 8316

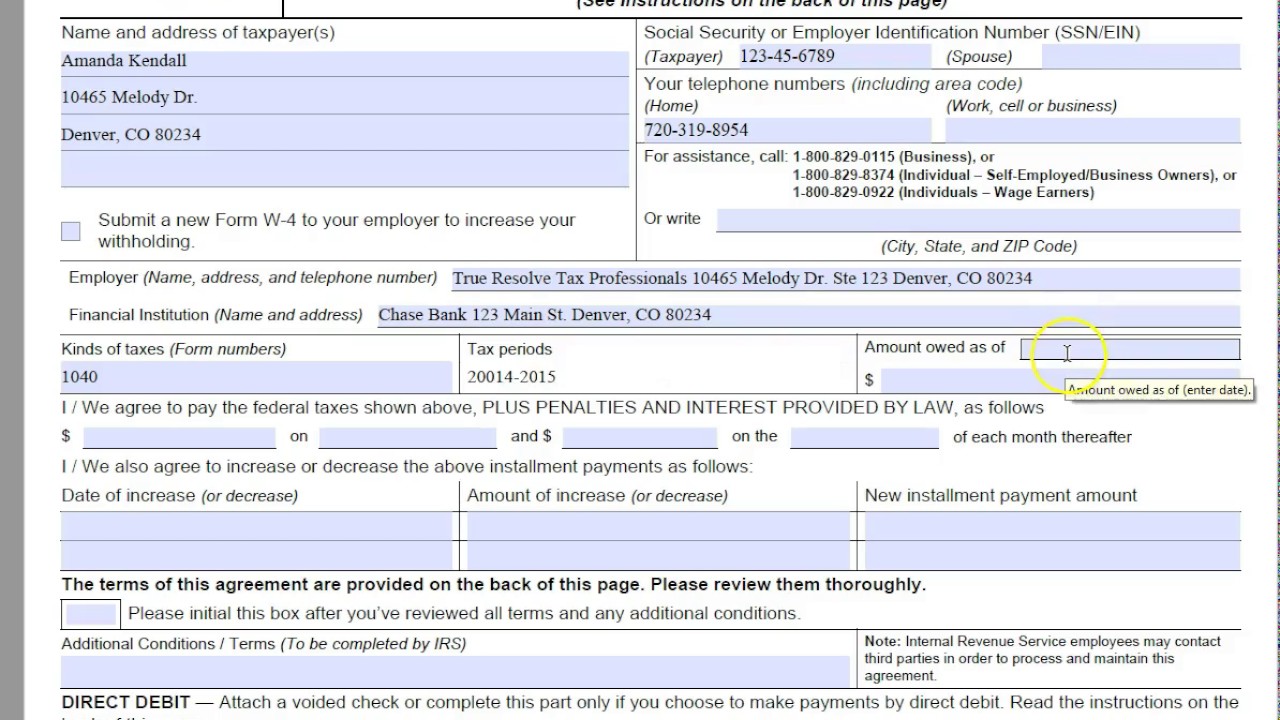

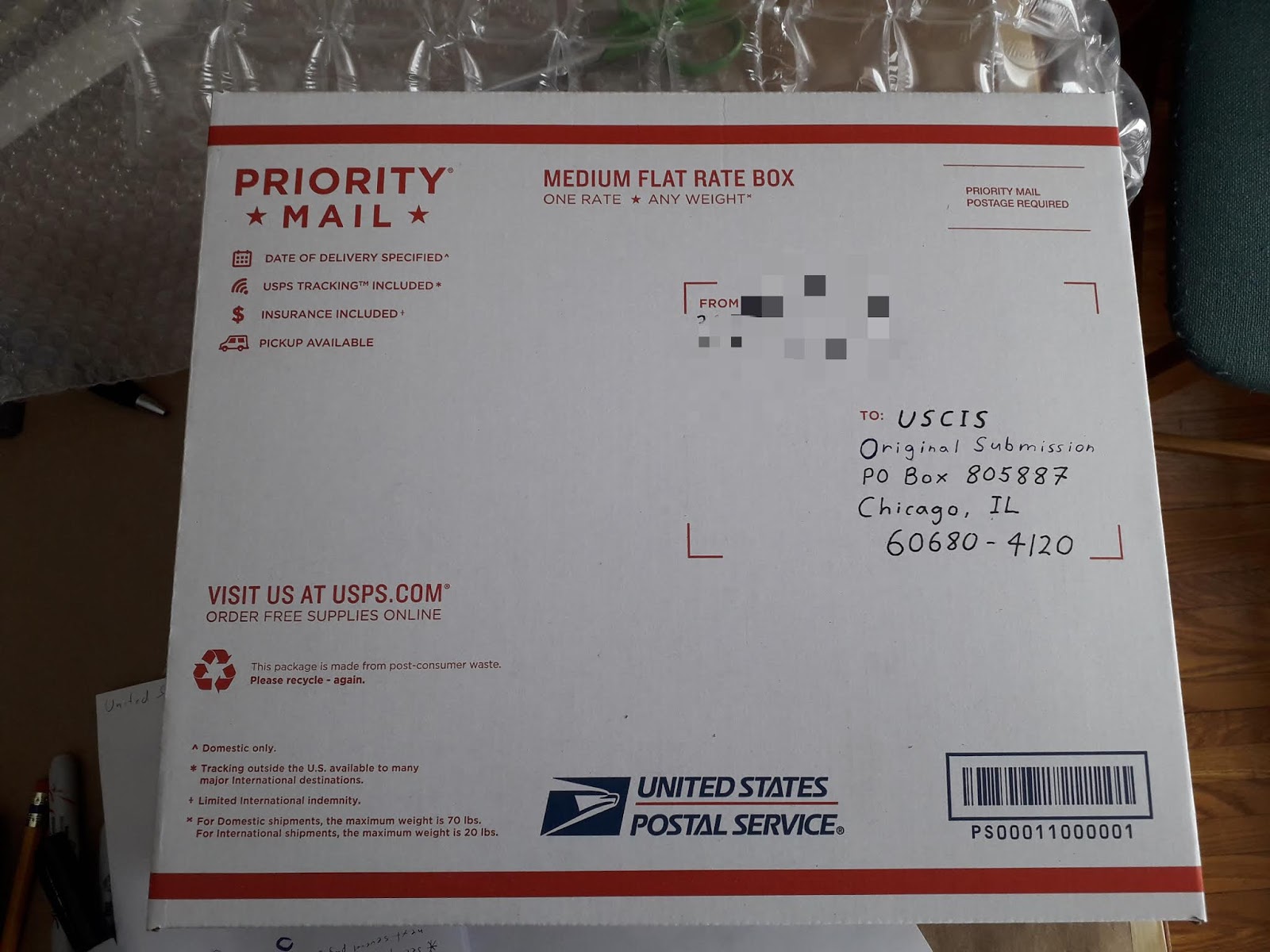

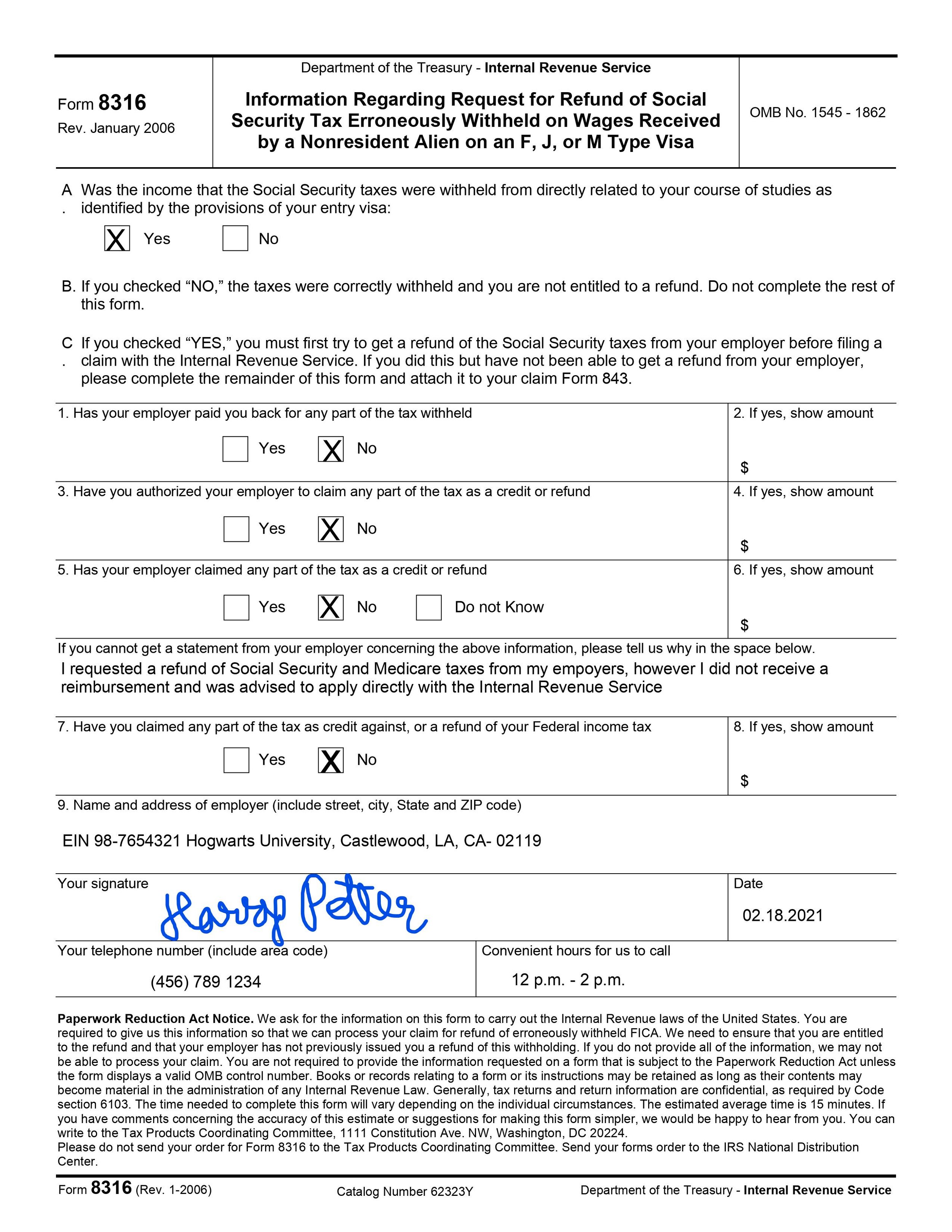

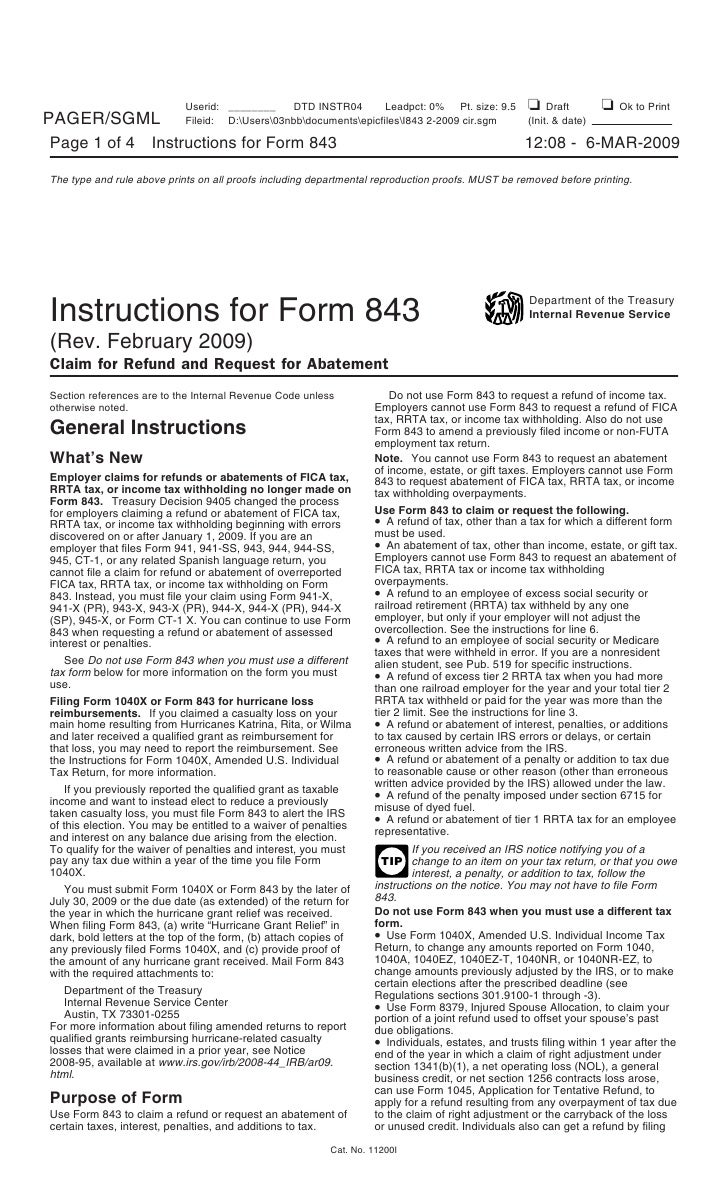

Where To Mail Form 843 And 8316 - Web mailing addresses for form 843. Department of the treasury, internal revenue service center, ogden, ut. The service center where you would be required to file a current year tax. In response to an irs notice regarding a tax or fee related to certain taxes such as income, employment, gift,. Web purpose of form use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax. Income, estate, gift, employment and excise. Web in order to request a refund of these taxes that were withheld incorrectly, you will want to complete form 843 along with form 8316 and mail both completed forms together to:. Web form 843, claim for refund and request for abatement can be completed by making entries on the 843 screen. Web please do not send your order for form 8316 to the tax products coordinating committee. Make sure to include the following:. Income, estate, gift, employment and excise. In response to an irs notice regarding a tax or fee related to certain taxes such as income, employment, gift,. The service center where you would be required to file a current year tax. Web if you are filing form 843. Ad iluvenglish.com has been visited by 10k+ users in the past month This is not a fast process. Be sure to sign and date the forms and keep copies for your records. Web if you are unable to receive a refund of these taxes from your employer, you may then file form 843 and 8316 to request a refund from the irs. If you are filing form 843 to claim a. Web. Web in this article, we will discuss the mailing addresses for form 843 and form 8316, as well as answer some common questions related to these forms. Web form 843, claim for refund and request for abatement can be completed by making entries on the 843 screen. Web the instructions for form 843 state that for penalties, the form should. Department of the treasury, internal revenue service center, ogden, ut. Should i send all 3 different set (form 843 and form 8316) in one file to irs or send 3 different. Form 843 is available in the 1040, 1120, 1120s, 990, 706 and. Then mail the form to…. Wait at least 60 days before contacting the irs by phone to. Web please do not send your order for form 8316 to the tax products coordinating committee. Web information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to file. Mail the completed packet to: Form 843 is available in the 1040, 1120, 1120s, 990, 706 and. In section 5 of. Attach these documents to form 843: Exception for exempt organizations, federal,. Web please do not send your order for form 8316 to the tax products coordinating committee. Web mailing addresses for form 843. It asks the internal revenue service (irs) for administrative relief from certain tax penalties under. Web purpose of form use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax. Web form 843 is the “claim for refund and request for abatement.”. Make sure to include the following:. Ad practicetestgeeks.com has been visited by 100k+ users in the past month Web if you are unable. Web form 843, claim for refund and request for abatement can be completed by making entries on the 843 screen. Web please complete the remainder of this form and attach it to your claim form 843. Web mailing addresses for form 843. Make sure to include the following:. The service center where you would be required to file a current. Web form 843, claim for refund and request for abatement can be completed by making entries on the 843 screen. Should i send all 3 different set (form 843 and form 8316) in one file to irs or send 3 different. Be sure to sign and date the forms and keep copies for your records. A copy of the original.. Ad iluvenglish.com has been visited by 10k+ users in the past month Income, estate, gift, employment and excise. Then mail the form to. The service center where you would be required to file a current year tax. In section 5 of form 843, the irs asks you to choose one of the following reasons for your request: Should i send all 3 different set (form 843 and form 8316) in one file to irs or send 3 different. A copy of the original. Web form 843, claim for refund and request for abatement can be completed by making entries on the 843 screen. Be sure to sign and date the forms and keep copies for your records. Web purpose of form use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax. Make sure to include the following:. Web if you are filing form 843. Web information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to file. The address shown in the notice. This is not a fast process. Web if you are unable to receive a refund of these taxes from your employer, you may then file form 843 and 8316 to request a refund from the irs. Then mail the form to. Exception for exempt organizations, federal,. Ad practicetestgeeks.com has been visited by 100k+ users in the past month Form 843 is available in the 1040, 1120, 1120s, 990, 706 and. Then mail the form to…. Has your employer paid you back for any part of the tax withheld. Web this form can be used to request abatement for penalties associated with the following types of taxes: Web a completed form 8316 mail form 843 with attachments (in a separate envelope than your tax return) to: Web this number will be written on line 4 of your irs form 843.Where To File Form 433f Charles Leal's Template

Where To Mail Form 843 To The IRS?

I 130 I 485 Concurrent Filing Cover Letter Cover Letter (подкаст

Form 843 example Fill out & sign online DocHub

Form 843 Penalty Abatement Request & Reasonable Cause

Get Refund for incorrect FICA taxes — USA Tax Gurus

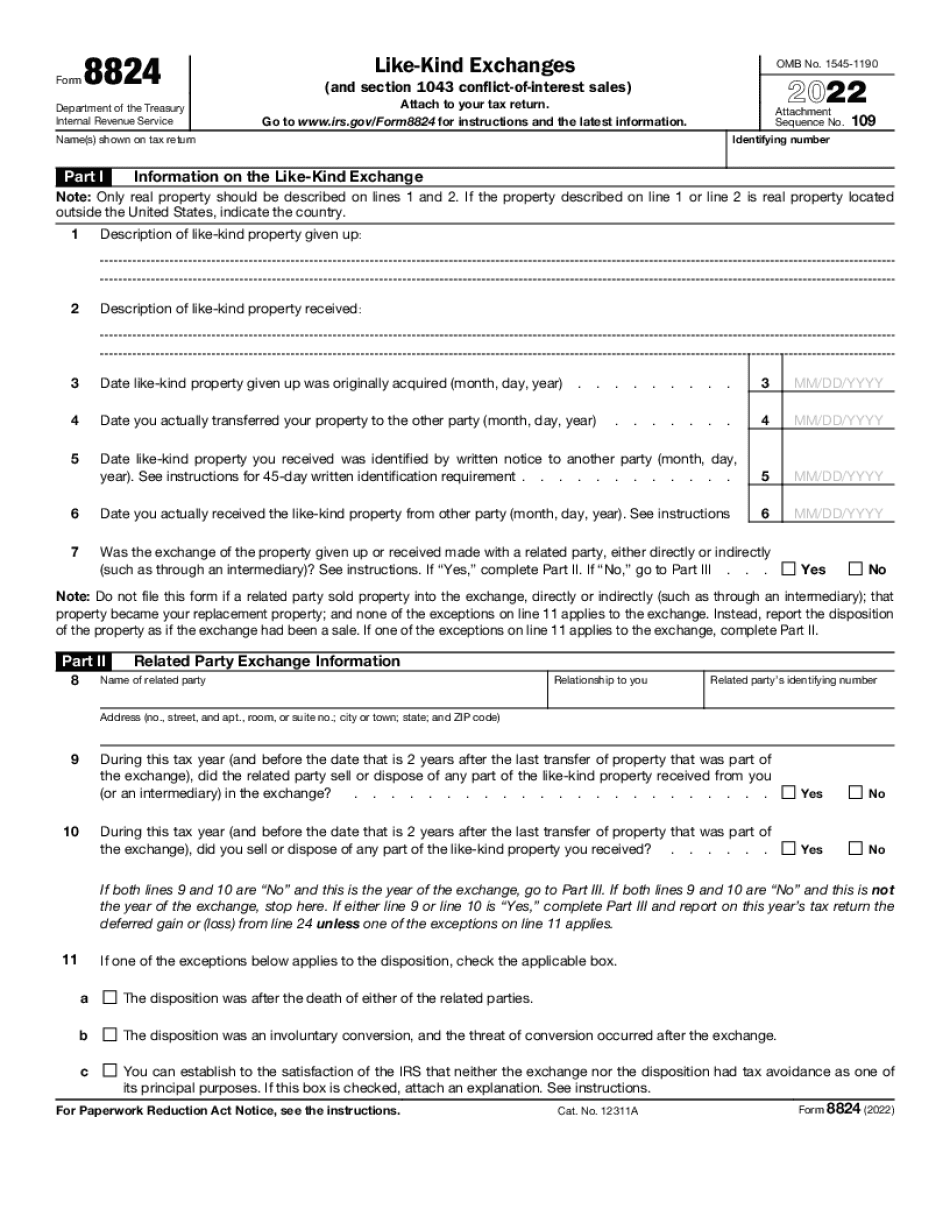

Form 843, Claim for Refund and Request for Abatement IRS Fill

Instructions for Form 843, Claim for Refund and Request for Abatement

irs mail address finder

IRS Form 843. Claim for Refund and Request for Abatement Forms Docs

Related Post: