Where To Get Form 8962

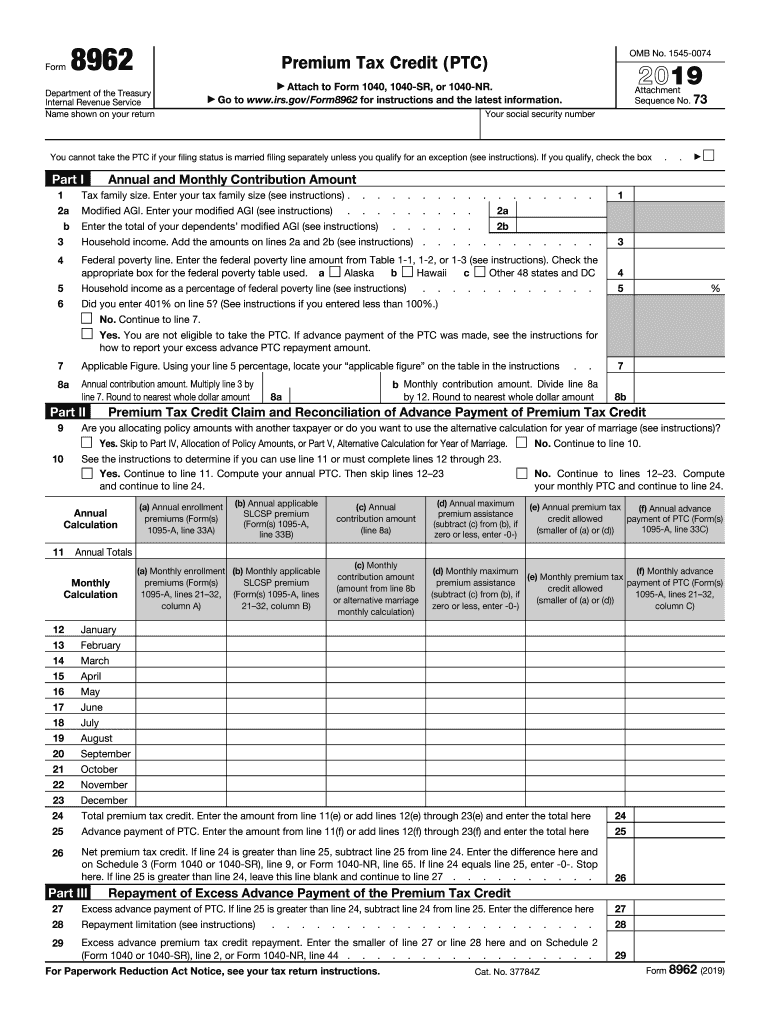

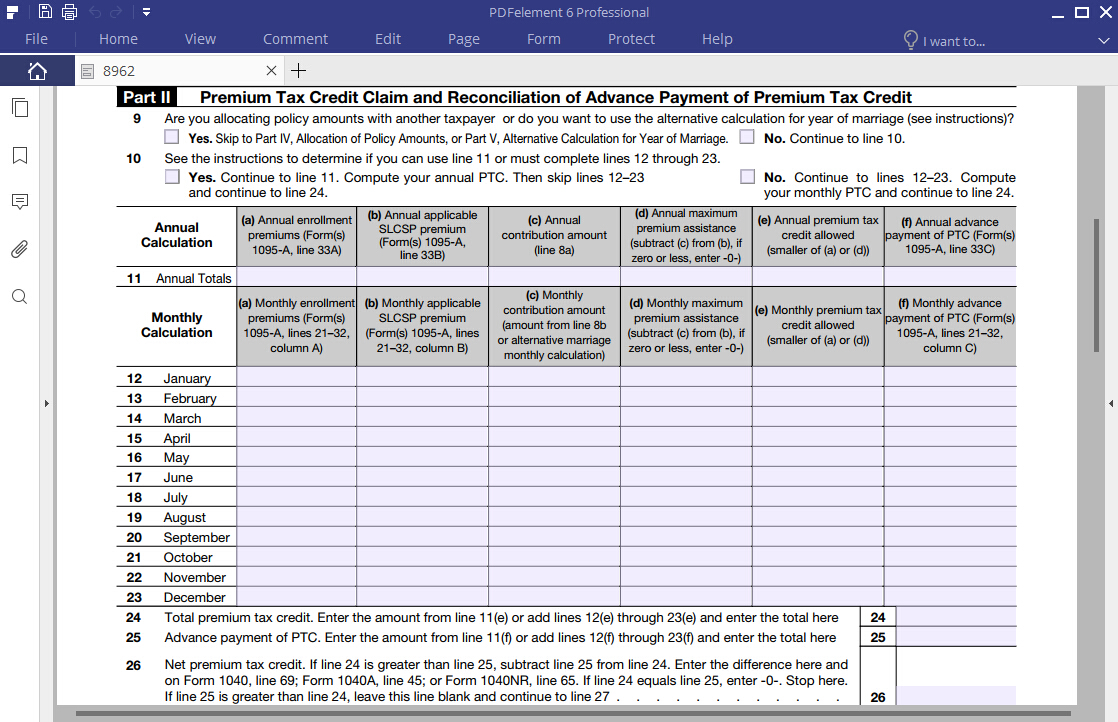

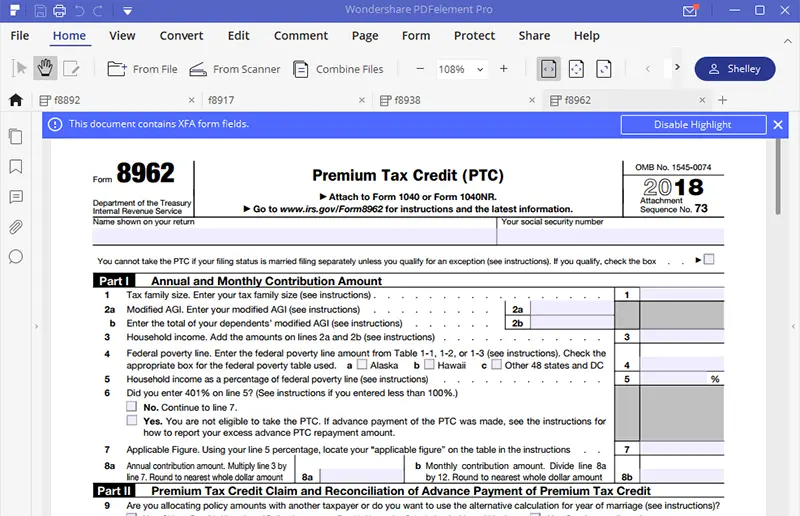

Where To Get Form 8962 - You’ll need it to complete form 8962, premium tax credit. Web your federal tax form 8962 for 2022 will assist the internal revenue service (irs) in calculating your ptc amount. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or (2) to claim. Try it for free now! Web starting with tax year 2021, electronically filed tax returns will be rejected if the taxpayer is required to reconcile advance payments of the premium tax credit (aptc). Web this form includes details about the marketplace insurance you and household members had in 2022. Convenient toolkit for editing pdfs. Web 3 baths, 2344 sq. For tax year 2020 only, you are not required. Ad download or email form 8962 & more fillable forms, register and subscribe now! View owner's full name, address, public records, and background check for +16022768962 with whitepages reverse phone lookup. Ad download or email form 8962 & more fillable forms, register and subscribe now! Web your federal tax form 8962 for 2022 will assist the internal revenue service (irs) in calculating your ptc amount. Web either way, you will complete form 8962, premium. Web starting with tax year 2021, electronically filed tax returns will be rejected if the taxpayer is required to reconcile advance payments of the premium tax credit (aptc). This form is only used by taxpayers who. What is tax form 8962? View owner's full name, address, public records, and background check for +16022768962 with whitepages reverse phone lookup. Web form. Realtime information for (480) 376 8971. House located at 8962 s forest ave, tempe, az 85284. Upload, modify or create forms. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Web 3 baths, 2344 sq. View sales history, tax history, home value estimates, and overhead views. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. Web starting with tax year 2021, electronically filed tax returns will be rejected if the taxpayer is. Who needs to file form 8962? Web either way, you will complete form 8962, premium tax credit (ptc) and attach it to your tax return for the year. Realtime information for (480) 376 8971. This form is only used by taxpayers who. Market leader with over 700k customers. Try it for free now! Web your federal tax form 8962 for 2022 will assist the internal revenue service (irs) in calculating your ptc amount. Web either way, you will complete form 8962, premium tax credit (ptc) and attach it to your tax return for the year. Who needs to file form 8962? You’ll need it to complete form 8962,. View sales history, tax history, home value estimates, and overhead views. Web this form includes details about the marketplace insurance you and household members had in 2022. What is tax form 8962? House located at 8962 s forest ave, tempe, az 85284. Who needs to file form 8962? You’ll need it to complete form 8962, premium tax credit. Department of the treasury internal revenue service. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Upload, modify or create forms. Below is the full information about 4803768962 built on community contributions. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or (2) to claim. House located at 8962 s forest ave, tempe, az 85284. You’ll need it to complete form 8962, premium tax credit. View sales history, tax history, home value estimates, and overhead views. Web this form. Web either way, you will complete form 8962, premium tax credit (ptc) and attach it to your tax return for the year. Web the form may be obtained by one of three ways: What is tax form 8962? View sales history, tax history, home value estimates, and overhead views. Web your federal tax form 8962 for 2022 will assist the. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium, or (2) to claim. Realtime information for (480) 376 8971. Who needs to file form 8962? Why is form 8962 important? Department of the treasury internal revenue service. What is tax form 8962? Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Market leader with over 700k customers. Below is the full information about 4803768962 built on community contributions. The completed form must then be mailed to dps with the. View sales history, tax history, home value estimates, and overhead views. You’ll need it to complete form 8962, premium tax credit. Web either way, you will complete form 8962, premium tax credit (ptc) and attach it to your tax return for the year. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Convenient toolkit for editing pdfs. Our website, form8962.net, can significantly help when. Web 3 baths, 2344 sq. Upload, modify or create forms. Web the form may be obtained by one of three ways: Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year.How To Fill Out Form 8962 laurasyearinhongkong

How to Get IRS Form 8962 Two Quick Ways

What Is Form 8962 Used For Maybe you would like to learn more about

3 Easy Ways to Fill Out Form 8962 wikiHow

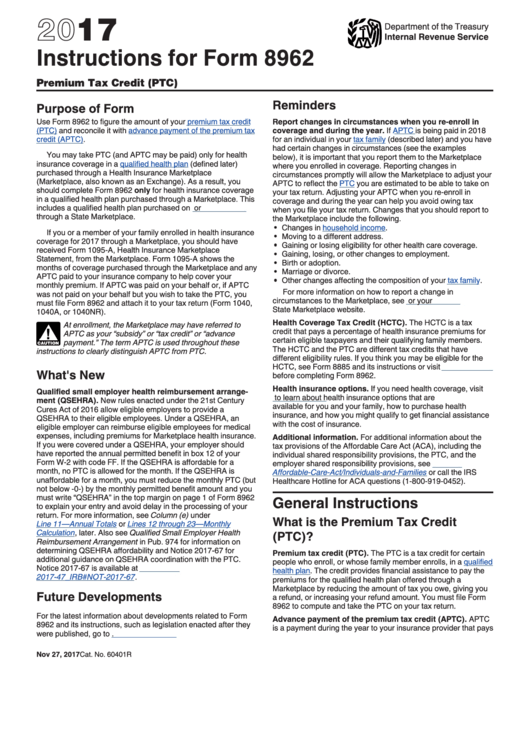

2014 federal form 8962 instructions

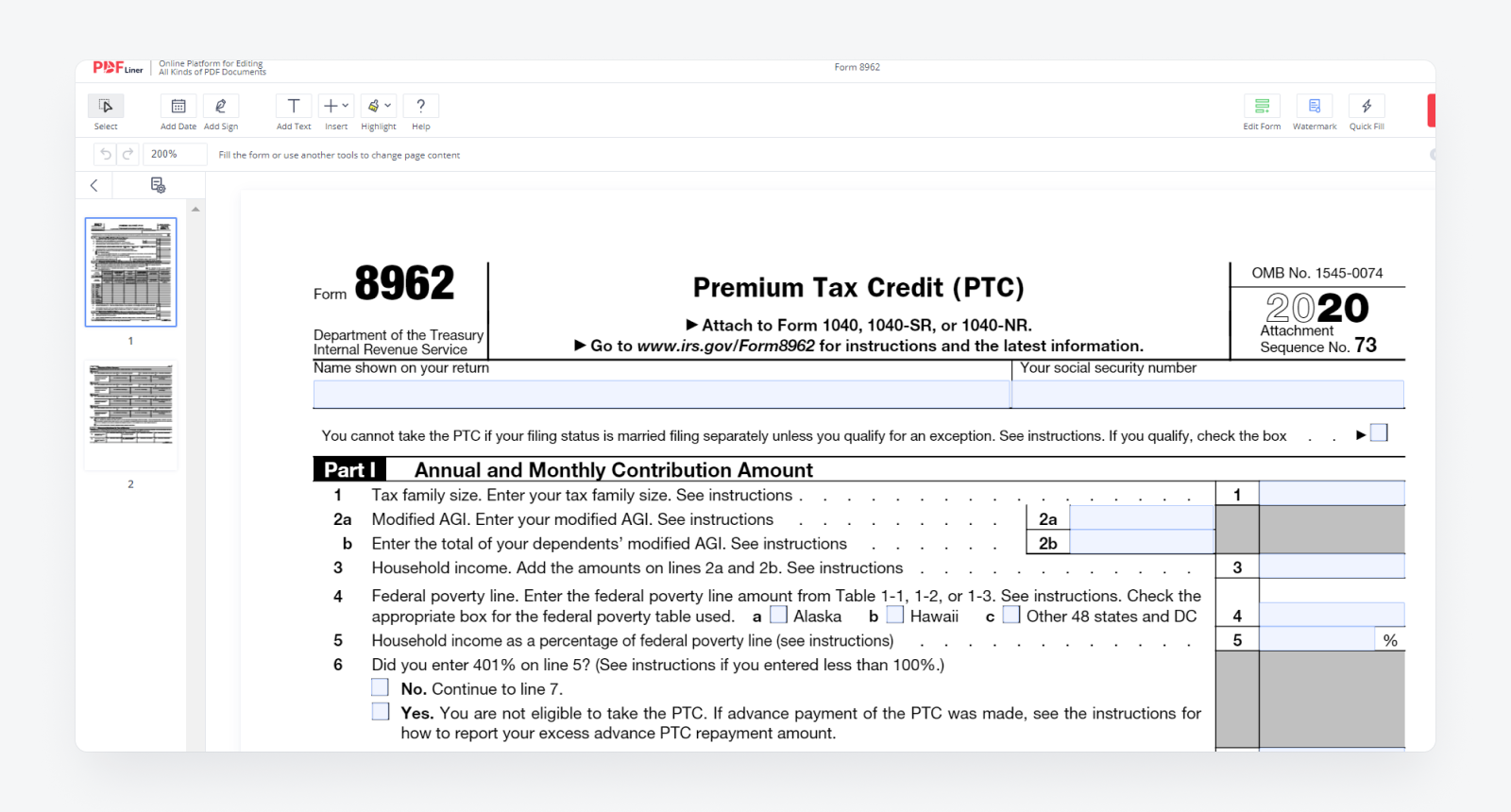

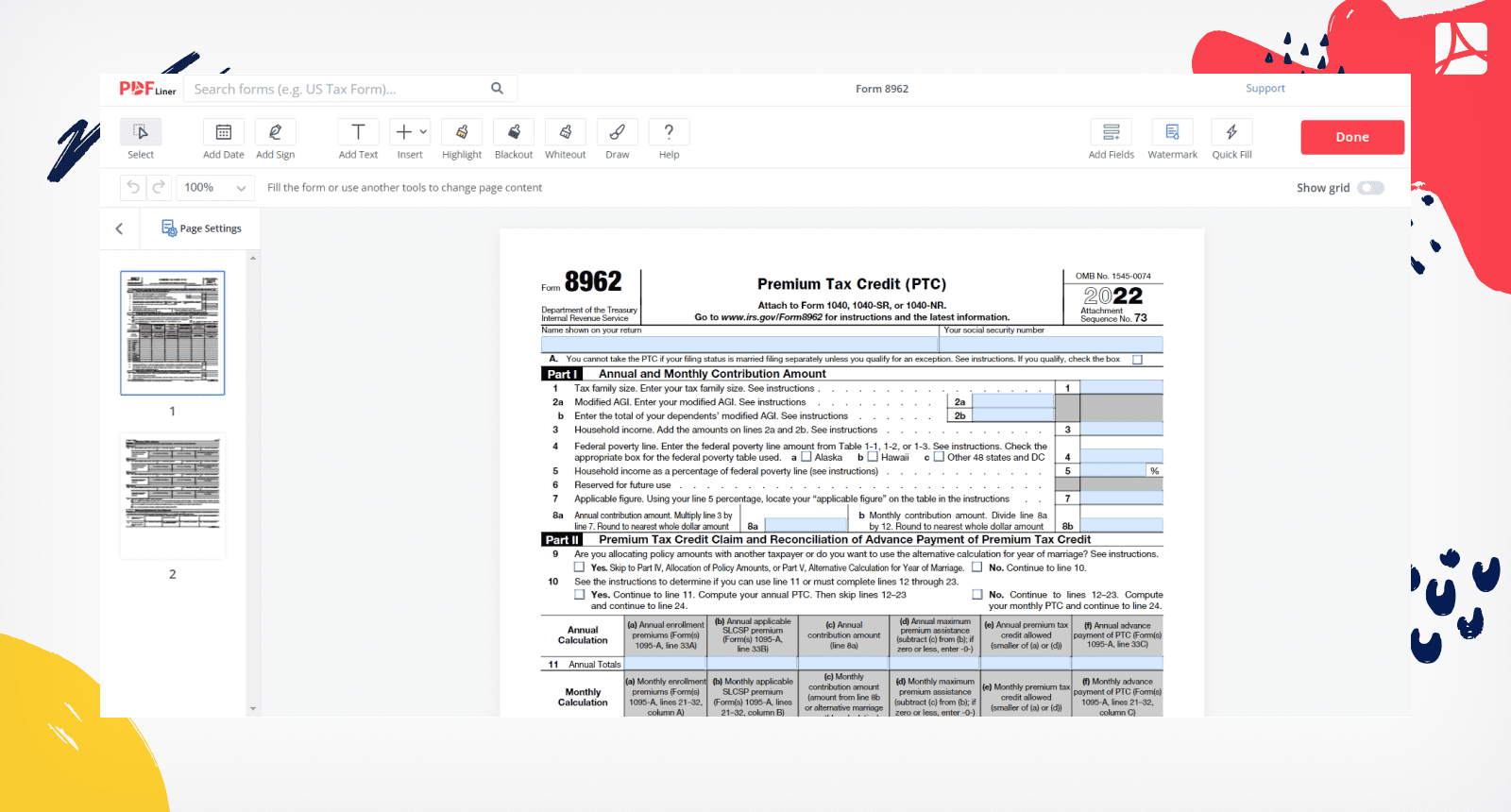

Form 8962 (2022) Fillable, Printable 8962 form PDFliner

8962 Form Fill Out and Sign Printable PDF Template signNow

IRS Form 8962 Instruction for How to Fill it Right

How To Fill Out Tax Form 8962

Tax Form 8962 Printable

Related Post:

:max_bytes(150000):strip_icc()/irs-form-8962.resized-4c525af04e6347f296d912d00785f2f2.png)