Where To Enter Form 5498 In Drake Software

Where To Enter Form 5498 In Drake Software - Web to enter the form 5498 contributions, do the following: Click file > save return. Web recent developments changes to the form 5498 instructions for participant, box 11, to reflect reduction in excise tax on certain accumulations in qualified retirement plans for. Solved•by intuit•102•updated 1 year ago. Web form 5498 is an informational form. There are a variety of forms 5498 such as:. Web where do i enter data from a form 5498? The irs requires the form be filed by companies that maintain an individual retirement arrangement (ira) during the tax year you need to. Enter the contributions in box 1. Upload, modify or create forms. There is no 5498 screen and ordinarily the 5498 would not be used in data entry for a return. 8889 screen (for health savings accounts hsas) 8853 screen (for archer msas, medicare. Web april 20, 2021 allie freeland contributing to your ira means you’re putting savings toward your retirement. Web form 5498 is an informational form. Try it for free. The irs requires the form be filed by companies that maintain an individual retirement arrangement (ira) during the tax year you need to. There is no 5498 screen and ordinarily the 5498 would not be used in data entry for a return. Web to enter the form 5498 contributions, do the following: This information should be entered on form 8606,. Web what do i do with form 5498? Web 1 best answer. This information should be entered on form 8606, line 6 only if you took distributions from. 8889 screen (for health savings accounts hsas) 8853 screen (for archer msas, medicare. Web where do i enter data from a form 5498? You don't enter this form into turbotax; Enter the contributions in box 1. This information should be entered on form 8606, line 6 only if you took distributions from. Web 1 best answer. Upload, modify or create forms. Web form 5498 is an informational form. There are a variety of forms 5498 such as: The irs requires the form be filed by companies that maintain an individual. There are a variety of forms 5498 such as:. Web entering information from form 5498 in proconnect tax. Web entering information from form 5498 in proconnect tax. This information should be entered on form 8606, line 6 only if you took distributions from. Upload, modify or create forms. The irs requires the form be filed by companies that maintain an individual retirement arrangement (ira) during the tax year you need to. Web to enter the form 5498 contributions,. In the deductions section, choose 10. There are a variety of forms 5498 such as:. Web 2 best answer. There is no 5498 screen and ordinarily the 5498 would not be used in data entry for a return. Form 5498 is an informational form. Upload, modify or create forms. Protecting personally identifiable information (pii. Enter the contributions in box 1. Web 2 min read where does the information on form 5498 go in turbotax? The irs requires the form be filed by companies that maintain an individual. Web 2 best answer. Form 5498 is an informational form. Web 1 best answer. Upload, modify or create forms. In the deductions section, choose 10. There are a variety of forms 5498 such as: Web entering information from form 5498 in proconnect tax. Web 2 best answer. Protecting personally identifiable information (pii. Web 1 best answer. Web where do i enter data from a form 5498? Web 2 best answer. Enter the contributions in box 1. You don't enter this form into turbotax; In the deductions section, choose 10. Web 2 min read where does the information on form 5498 go in turbotax? There are a variety of forms 5498 such as:. Web recent developments changes to the form 5498 instructions for participant, box 11, to reflect reduction in excise tax on certain accumulations in qualified retirement plans for. Web what do i do with form 5498? There is no 5498 screen and ordinarily the 5498 would not be used in data entry for a return. Web april 20, 2021 allie freeland contributing to your ira means you’re putting savings toward your retirement. Web 1 best answer. The irs requires the form be filed by companies that maintain an individual. Try it for free now! Solved•by intuit•102•updated 1 year ago. This information should be entered on form 8606, line 6 only if you took distributions from. There are a variety of forms 5498 such as: Web to enter the form 5498 contributions, do the following: Protecting personally identifiable information (pii. Go to screen 32.2, archer medical.5498 IRA/ESA/SA Contribution Information (1099R)

Tax Software>Drake DFile Dillner's Accounting Tools

Schedule E Screen Design (Drake17 and future) (ScheduleE)

How to File IRS Form 5498 with TaxBandits YouTube

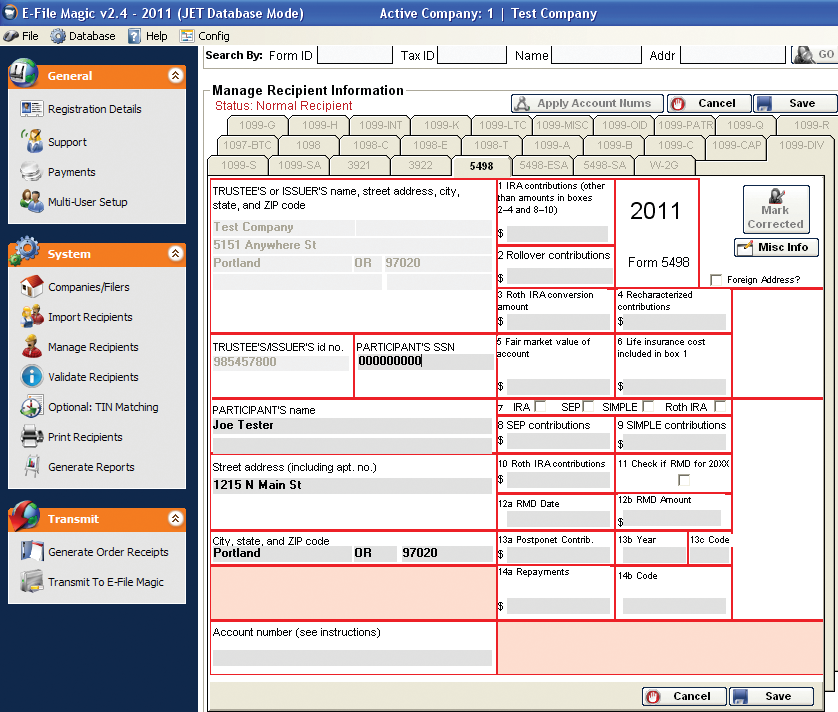

5498 Software to Create, Print & EFile IRS Form 5498

Form 5498 Software IRA Contribution Information

All About IRS Tax Form 5498 for 2020 IRA for individuals

What is Form 5498? TaxBandits YouTube

How to correct Form 5498 Fill online, Printable, Fillable Blank

IRS Form 5498 Software 289 eFile 5498 Outsourcing

Related Post: