State Of Utah Tax Extension Form

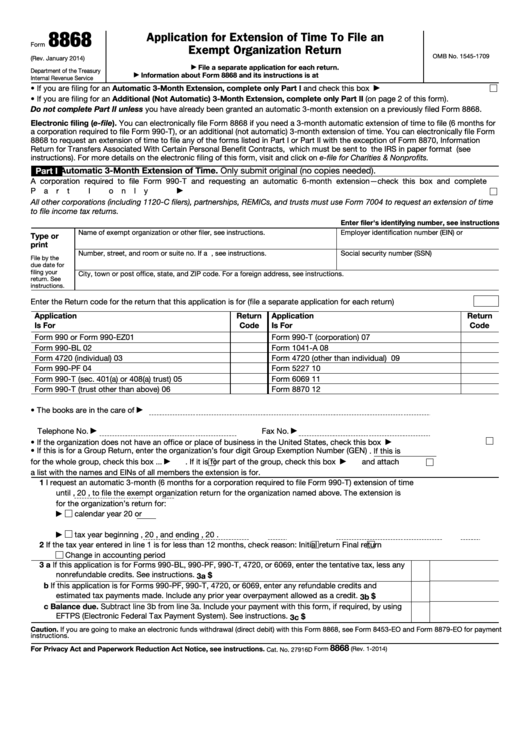

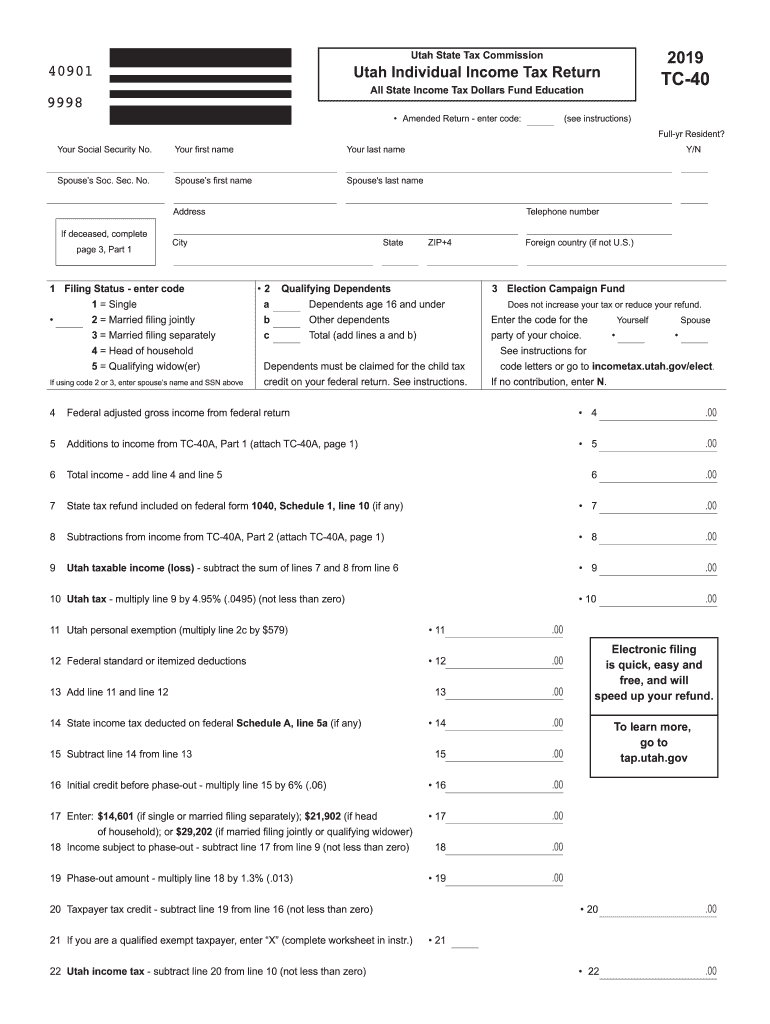

State Of Utah Tax Extension Form - The utah tax extension is automatic. Web if you pay your state income taxes by the april 15 tax deadline or state income tax due date, you do not have to file a state tax extension form. All utah sales and use tax returns and other sales. Ustc original form your social security no. Edit, sign and print tax forms on any device with signnow. Web payments return to tax listing payments are due the same time as the returns except for the following which may require prepayments: Web utsa tax extension form: That means there is does official use or writing request to submit as longish as him owe no state tax. Individual tax return” and submit it before the july 15 th. Your first name your last name spouse’s soc. Web file the 2022 return for calendar year 2022 and fi scal years beginning in 2022 and ending in 2023. That means there is no official application or written request to submit as long as you owe zero state tax. Complete, edit or print tax forms instantly. If the return is for a fi scal year or a short tax. If the return is for a fi scal year or a short tax year (less than 12 months), fi ll. Web you do not need to file a form to request the extension. Web you can pay your utah taxes in person by check, money order, cash or credit card at a utah state tax commission office. That means there. Web the state of utah doesn’t require any extension form as it automatically grants extensions up to 6 months. Complete, edit or print tax forms instantly. Web utah tax extension form: Web 51 rows sales tax filing is changing. See visit us in person for a list of ustc offices. However, penalties will be assessed if you have not met the prepayment requirements by the original due date of. The utah tax extension is automatic. Web if you pay your state income taxes by the april 15 tax deadline or state income tax due date, you do not have to file a state tax extension form. Web if you have. Edit, sign and print tax forms on any device with signnow. Complete, edit or print tax forms instantly. That means there is no official application or written request to submit as long as you owe zero state tax. The utah tax extension is automatic. Web if you do not owe utah income taxes or expect a tax refund by the. Web if you pay your state income taxes by the april 15 tax deadline or state income tax due date, you do not have to file a state tax extension form. Explore more file form 4868 and extend your 1040. Web if you do not owe utah income taxes or expect a tax refund by the tax deadline, your accepted. Edit, sign and print tax forms on any device with signnow. Complete, edit or print tax forms instantly. Web payments return to tax listing payments are due the same time as the returns except for the following which may require prepayments: No extension form is required. Web if you do not owe utah income taxes or expect a tax refund. Edit, sign and print tax forms on any device with signnow. Ustc original form your social security no. Web payments return to tax listing payments are due the same time as the returns except for the following which may require prepayments: Phoenix, az —the due date for the 2022 calendar year returns filed with extensions is almost here. Web 51. Web you can pay your utah taxes in person by check, money order, cash or credit card at a utah state tax commission office. Complete, edit or print tax forms instantly. That means there is no official application or written request to submit as long as you owe zero state tax. Web if you do not owe utah income taxes. That means there is does official use or writing request to submit as longish as him owe no state tax. Web you can pay your utah taxes in person by check, money order, cash or credit card at a utah state tax commission office. See visit us in person for a list of ustc offices. Ustc original form your social. Web file the 2022 return for calendar year 2022 and fi scal years beginning in 2022 and ending in 2023. You must prepay by the original due date: Individual income taxpayers who received a filing. Phoenix, az —the due date for the 2022 calendar year returns filed with extensions is almost here. Admitted insurer tax corporate income. Web the state of utah doesn’t require any extension form as it automatically grants extensions up to 6 months. If the return is for a fi scal year or a short tax year (less than 12 months), fi ll. Web 51 rows sales tax filing is changing. Ustc original form your social security no. Edit, sign and print tax forms on any device with signnow. Web utah tax extension form: Web you do not need to file a form to request the extension. Web if you have been previously licensed for this rn or wpl in the state of utah, please list: Your first name your last name spouse’s soc. However, penalties will be assessed if you have not met the prepayment requirements by the original due date of. That means there is does official use or writing request to submit as longish as him owe no state tax. Complete, edit or print tax forms instantly. Explore more file form 4868 and extend your 1040. No extension form is required. The utah tax extension is automatic.Fillable Form 8868 Utah Application For Extension Of Time To File An

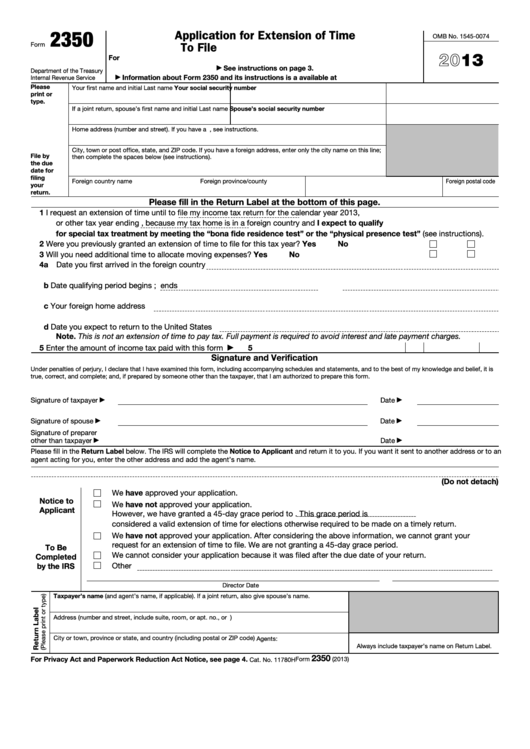

Fillable Form 2350 Application For Extension Of Time To File U.s

Utah Tax Form Fill Out and Sign Printable PDF Template signNow

Printable Form 4868

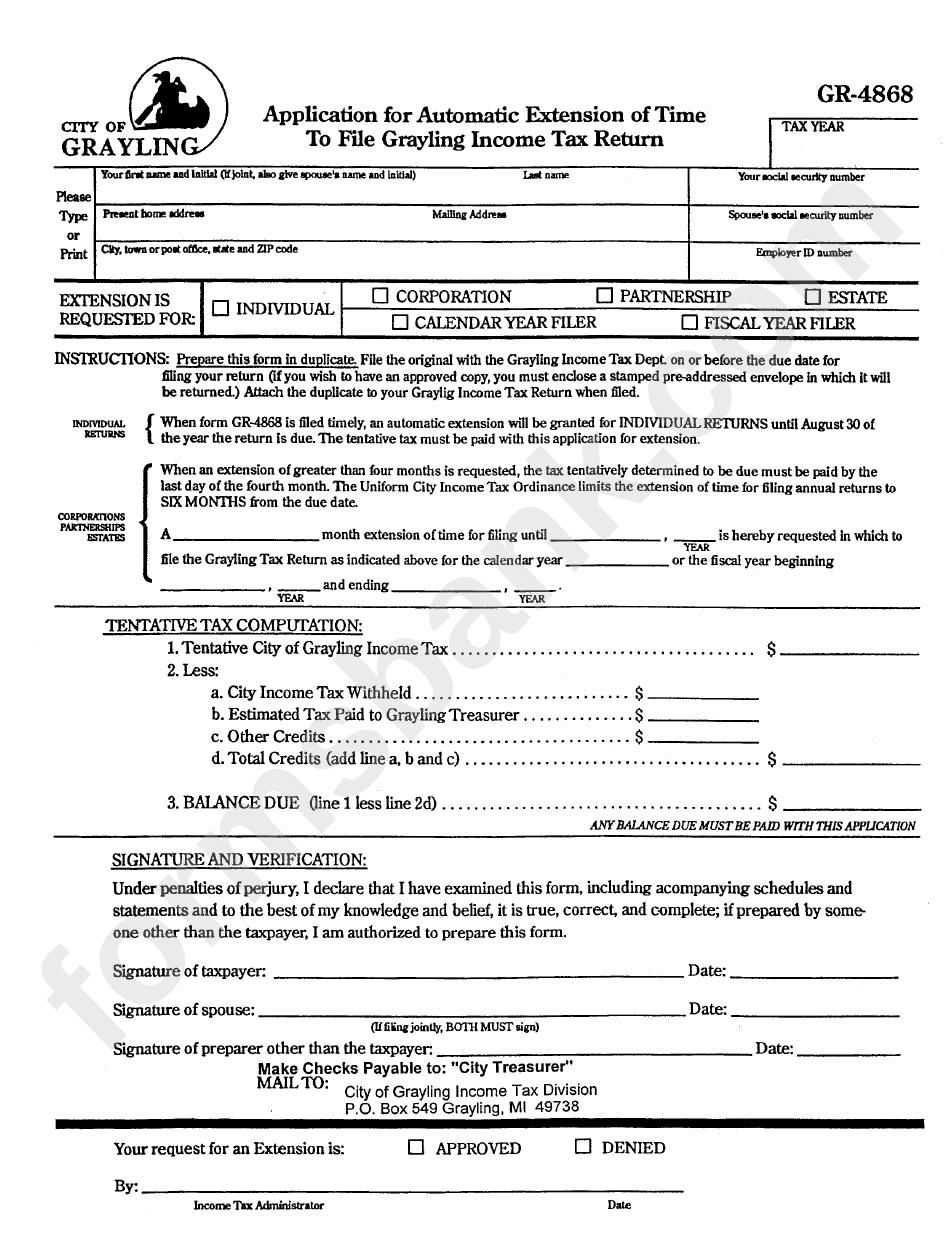

tax extension form 2019 Fill Online, Printable, Fillable Blank irs

IRS Extension 2022 Form 4868 IRS Forms TaxUni

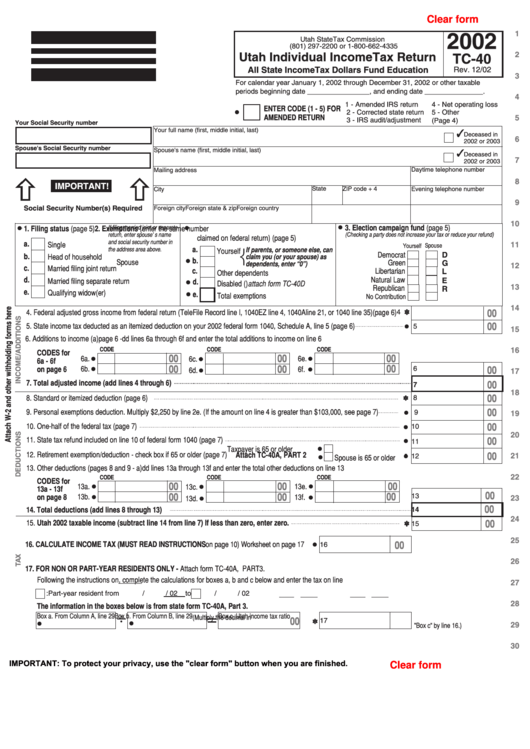

Fillable Form Tc40 Utah Individual Tax Return 2002

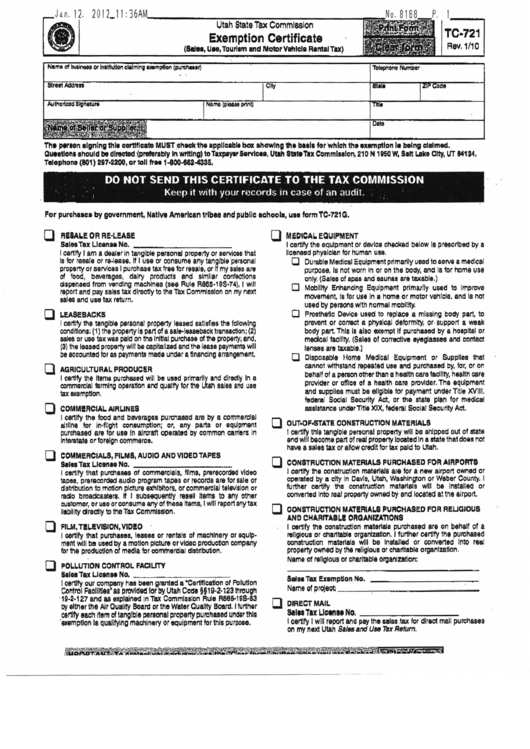

Utah State Sales Tax Exemption Form printable pdf download

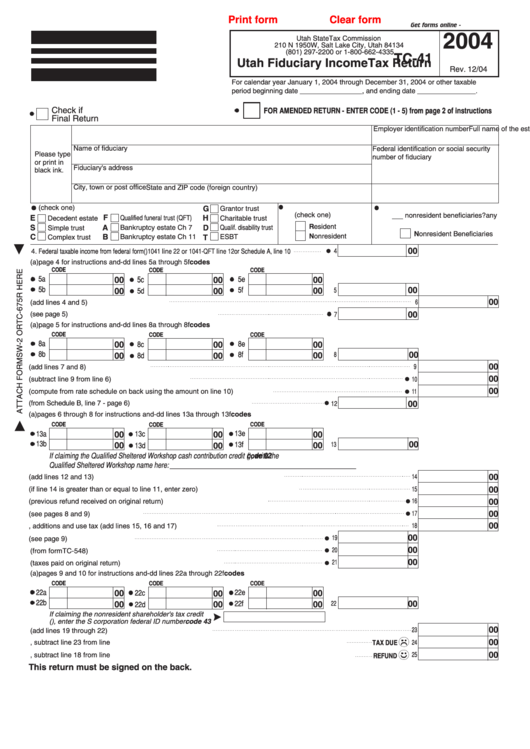

Fillable Form Tc41 Utah Fiduciary Tax Return 2004 printable

Tax extention filr ploratracks

Related Post: