Where Does Form 2439 Go On Tax Return

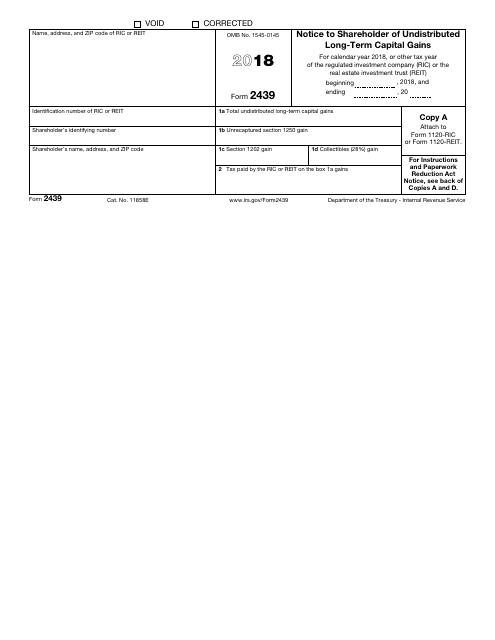

Where Does Form 2439 Go On Tax Return - Corporations (other than s corporations) use this form to apply for a quick refund of taxes from: Web this form is issued, you must do the following. Complete copies a, b, c, and d of form 2439 for each owner. Form 2439 undistributed lt capital gains. Web this form is issued, you must do the following. To report a gain or loss from form 4684, 6781, or 8824; Web this form is issued, you must do the following. The mutual fund company reports these gains on. Complete copies a, b, c, and d of form 2439 for each owner. Web how to enter form 2439 capital gains using worksheet view in an individual return? To report a gain or loss from form 4684, 6781, or 8824; Web cpas should read the detailed instructions in this announcement for changes in the following forms: Complete copies a, b, c, and d of form 2439 for each owner. Web this form is issued, you must do the following. Web this form is issued, you must do the. Web to report a gain from form 2439 or 6252 or part i of form 4797; Web about form 1139, corporation application for tentative refund. Complete copies a, b, c, and d of form 2439 for each owner. The irs form 2439 is issued to a shareholder by either a reit or ric when the corporation has. Form 2439 undistributed. The mutual fund company reports these gains on. To report a gain or loss from form 4684, 6781, or 8824; Notice to shareholder of undistributed. Web go to the input return; Complete copies a, b, c, and d of form 2439 for each owner. A mutual fund usually distributes all its capital gains to its shareholders. Web from within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your screen, then click federal ). The mutual fund company reports these gains on. The information on form 2439 is reported on schedule d. To report. Web to enter form 2439 capital gains, complete the following: Web to report a gain from form 2439 or 6252 or part i of form 4797; The mutual fund company reports these gains on. Web tax year 2023 940 mef ats scenario 3 crocus company. By admin | published july 25, 2021. The irs form 2439 is issued to a shareholder by either a reit or ric when the corporation has. Notice to shareholder of undistributed. Form 2439 undistributed lt capital gains. Complete copies a, b, c, and d of form 2439 for each owner. Corporations (other than s corporations) use this form to apply for a quick refund of taxes from: Complete copies a, b, c, and d of form 2439 for each owner. Web to report a gain from form 2439 or 6252 or part i of form 4797; Complete copies a, b, c, and d of form 2439 for each owner. The mutual fund company reports these gains on. To report a gain or loss from a partnership, s. Web cpas should read the detailed instructions in this announcement for changes in the following forms: From the income section, select dispositions (sch d, etc.) then form 2439. Web from within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your screen, then click federal ). Corporations (other than s. Web if you received a form 2439 with an amount in box 2 tax paid by the ric or reit on box 1a gains, you would report the amount on schedule 3 (form 1040) additional credits. The irs form 2439 is issued to a shareholder by either a reit or ric when the corporation has. Web tax year 2023 940. To report a gain or loss from form 4684, 6781, or 8824; 1.1k views 1 year ago irs forms & schedules. Notice to shareholder of undistributed. Web tax year 2023 940 mef ats scenario 3 crocus company. Web about form 1139, corporation application for tentative refund. It will flow to your schedule d when it is entered into turbotax. Complete copies a, b, c, and d of form 2439 for each owner. Web go to the input return; A mutual fund usually distributes all its capital gains to its shareholders. Form 2439 undistributed lt capital gains. Web this form is issued, you must do the following. To report a gain or loss from a partnership, s. The irs form 2439 is issued to a shareholder by either a reit or ric when the corporation has. Enter “from form 2439” in column (a), enter. Web if you received a form 2439 with an amount in box 2 tax paid by the ric or reit on box 1a gains, you would report the amount on schedule 3 (form 1040) additional credits. Web to report a gain from form 2439 or 6252 or part i of form 4797; To enter form 2439 go to investment income and select undistributed capital gains or you can search for. Web cpas should read the detailed instructions in this announcement for changes in the following forms: Web this form is issued, you must do the following. From the income section, select dispositions (sch d, etc.) then form 2439. To report a gain or loss from form 4684, 6781, or 8824; Web tax year 2023 940 mef ats scenario 3 crocus company. By admin | published july 25, 2021. Where in lacerte do you enter. Web this form is issued, you must do the following.Albamv Tax Form 2439

IRS Releases Form 1040 For 2020 Tax Year Taxgirl

What to do if you have to take an early withdrawal from your Solo 401k

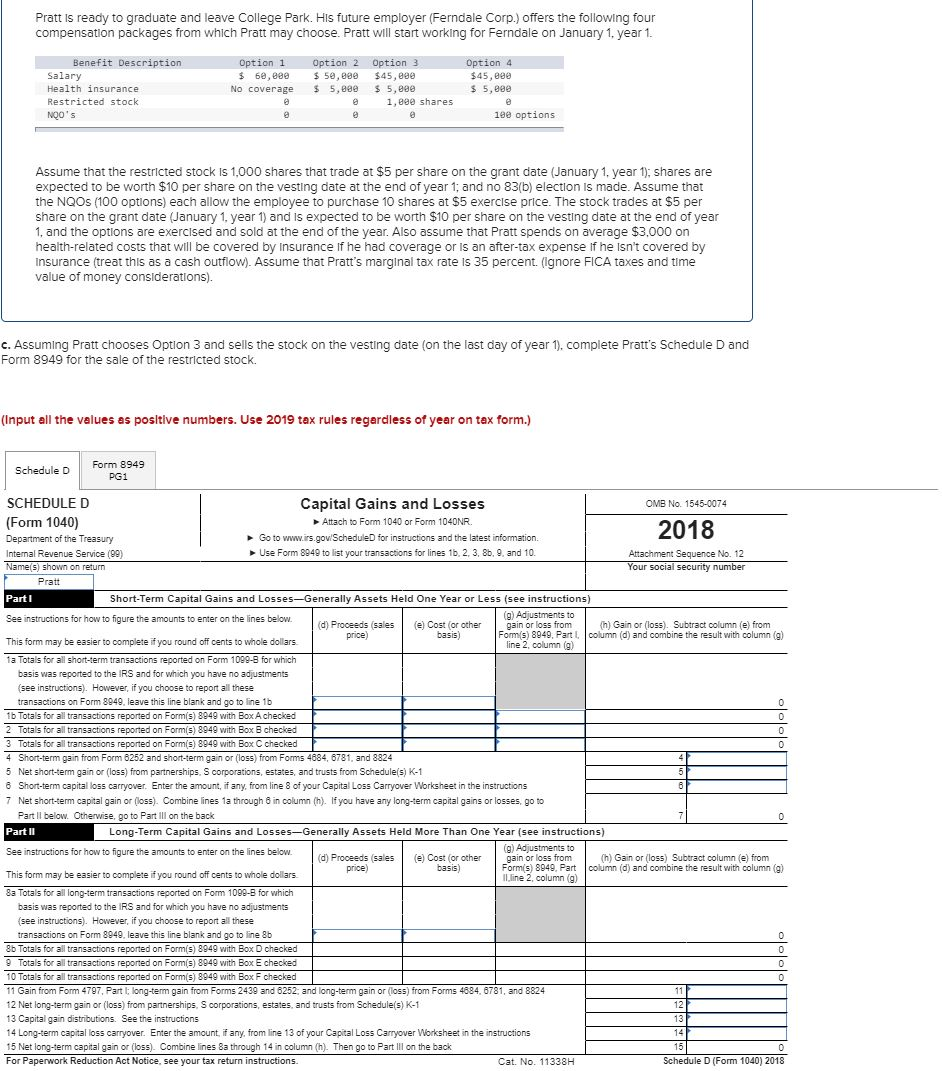

IRS Form 2439 2018 Fill Out, Sign Online and Download Fillable PDF

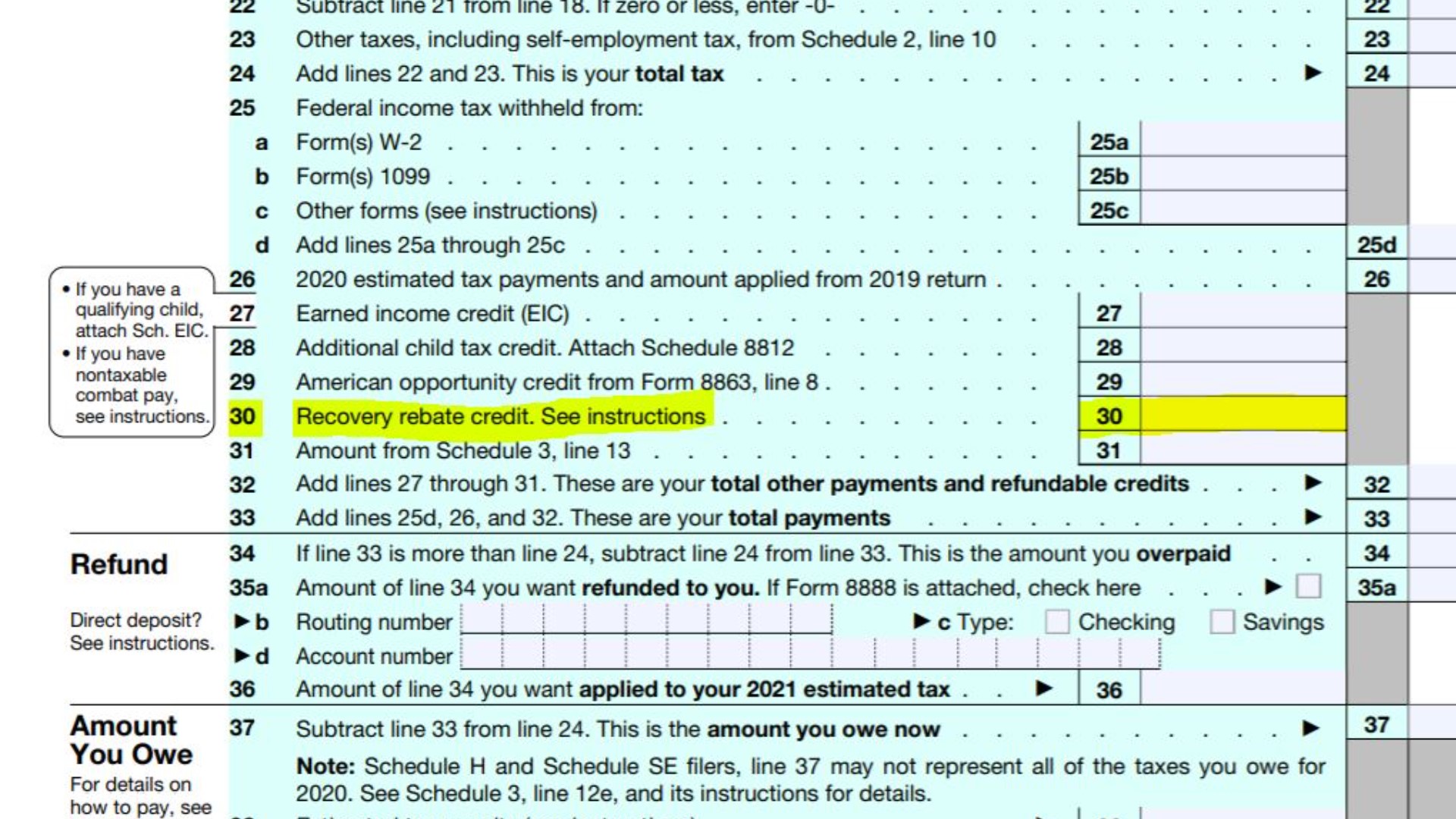

IRS Releases Form 1040 For 2020 Tax Year Taxgirl

1040 Schedule 3 (Drake18 and Drake19) (Schedule3)

Didn't get your stimulus check? Claim it as an tax credit

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

IRS urges electronic filing as tax season begins Friday, amid mail

How to file an amended tax return WTOP News

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)