1098 T Form Ucr

1098 T Form Ucr - To see if you qualify for a credit, and for help in calculating the amount. Usc will send the form to all qualified: You must file for each student you enroll and for whom a reportable transaction is made. If you or your parents pay for your uc tuition and fees, you may be able to offset the costs of school. Ad amazon.com has been visited by 1m+ users in the past month Files (0) show actions for files. Ad upload, modify or create forms. To see if you qualify for a credit, and for help in calculating the amount. The university of california has contracted with tab service company to electronically. Web the internal revenue service (irs) permitted colleges and universities to choose between two methods for reporting qualified tuition and related expenses. County of san bernardino, workforce development department, 800.451.5627. International students who have filed a taxpayer identification. For employee my taxes my paycheck. To see if you qualify for a credit, and for help in calculating the amount. Files (0) show actions for files. Ad upload, modify or create forms. In addition to these specific instructions, you should also use the 2023 general instructions for certain information returns. Ad free federal tax filing for simple and complex returns. Forms will not be mailed. To see if you qualify for a credit, and for help in calculating the amount. Retain this statement for your records. Retain this statement for your records. Eligibility information for education tax. Get credit for your uc education: Web the internal revenue service (irs) permitted colleges and universities to choose between two methods for reporting qualified tuition and related expenses. For employee my taxes my paycheck. International students who have filed a taxpayer identification. Retain this statement for your records. Ad amazon.com has been visited by 1m+ users in the past month Retain this statement for your records. For security reasons, you will then be prompted to. Ad free federal tax filing for simple and complex returns. Web this statement is required to support any claim for an education credit. Files (0) show actions for files. To see if you qualify for a credit, and for help in calculating the amount. Get credit for your uc education: Web financial and tuition assistance. For security reasons, you will then be prompted to. Web this statement is required to support any claim for an education credit. Your student id is required; Web impact of reporting change: Web visit the registrar’s website for more information: Retain this statement for your records. For employee my taxes my paycheck. To see if you qualify for a credit, and for help in calculating the amount. Ad amazon.com has been visited by 1m+ users in the past month Web impact of reporting change: For employee my taxes my paycheck. The university of california has contracted with tab service company to electronically. For security reasons, you will then be prompted to. Web this statement is required to support any claim for an education credit. International students who have filed a taxpayer identification. Web the internal revenue service (irs) permitted colleges and universities to choose between two methods for reporting qualified tuition and related expenses. In addition to these specific instructions, you should also use the 2023 general instructions for certain information. Ad amazon.com has been visited by 1m+ users in the past month To see if you qualify for a credit, and for help in calculating the amount. Retain this statement for your records. Get credit for your uc education: Upload files or drop files. Files (0) show actions for files. Retain this statement for your records. Ad amazon.com has been visited by 1m+ users in the past month Web visit the registrar’s website for more information: For employee my taxes my paycheck. International students who have filed a taxpayer identification. Ad free federal tax filing for simple and complex returns. Retain this statement for your records. To see if you qualify for a credit, and for help in calculating the amount. County of san bernardino, workforce development department, 800.451.5627. Eligibility information for education tax. Ad upload, modify or create forms. If you or your parents pay for your uc tuition and fees, you may be able to offset the costs of school. Forms will not be mailed. Web the internal revenue service (irs) permitted colleges and universities to choose between two methods for reporting qualified tuition and related expenses. To see if you qualify for a credit, and for help in calculating the amount. Upload files or drop files. Web this statement is required to support any claim for an education credit. Complete, edit or print tax forms instantly. Web this statement is required to support any claim for an education credit.1098T Information Bursar's Office Office of Finance UTHSC

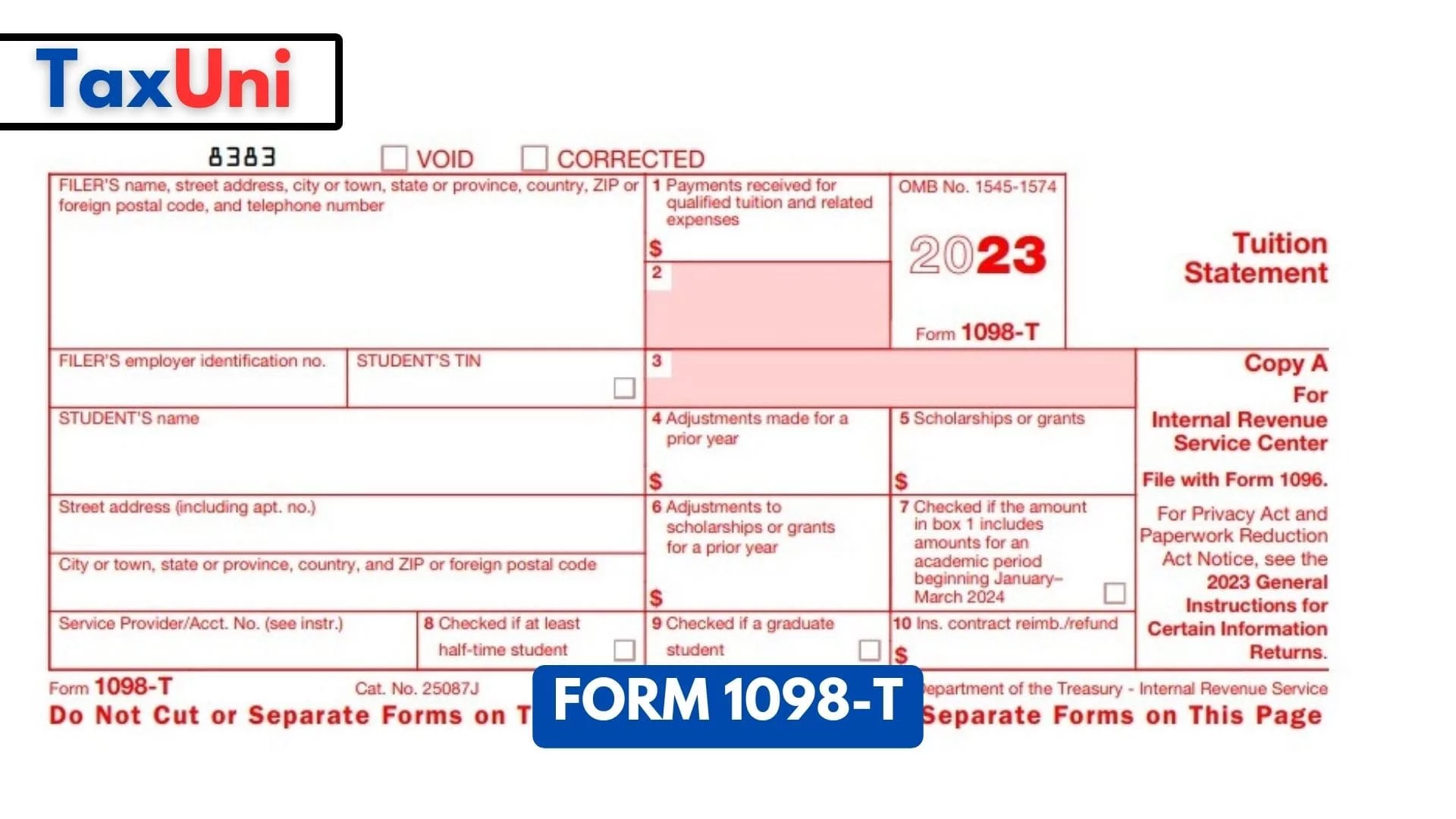

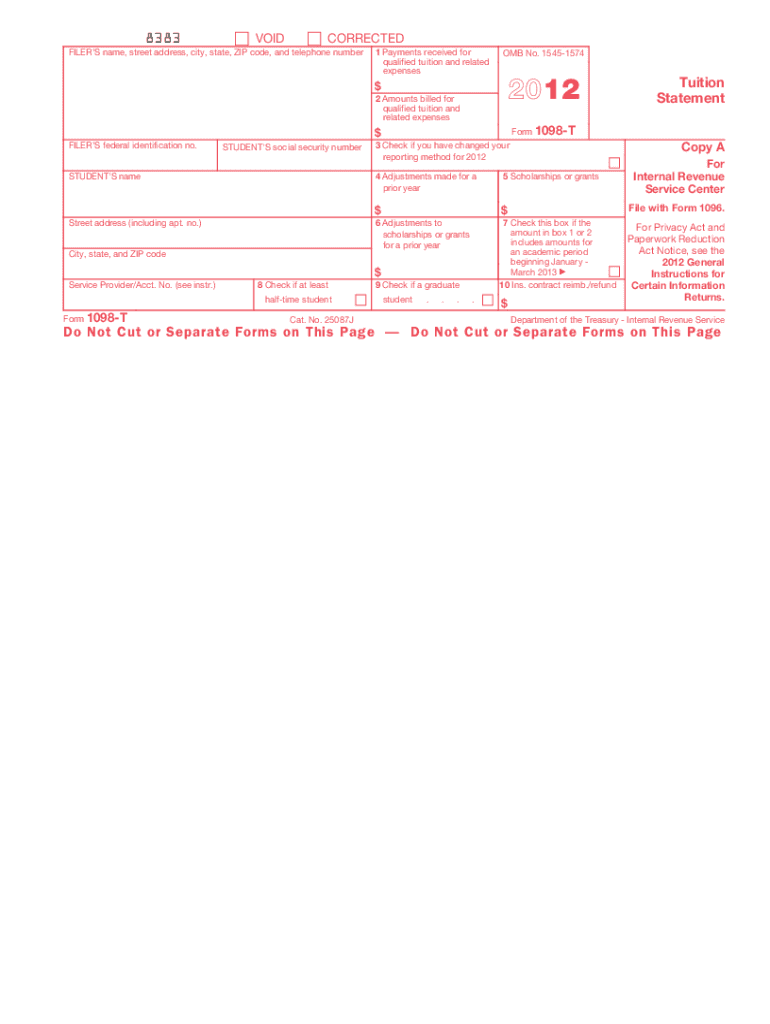

1098T Pressure Seal Form (1098T)

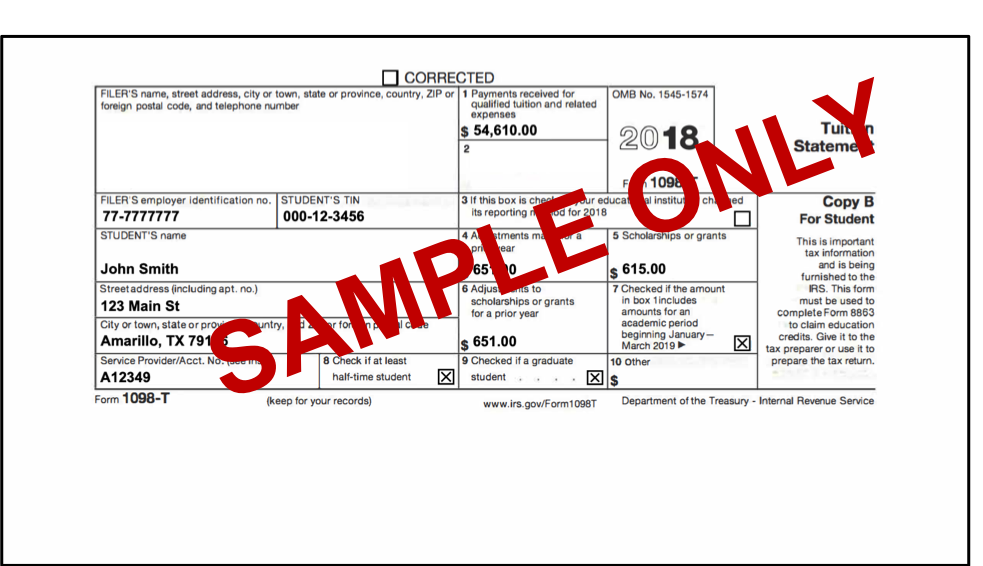

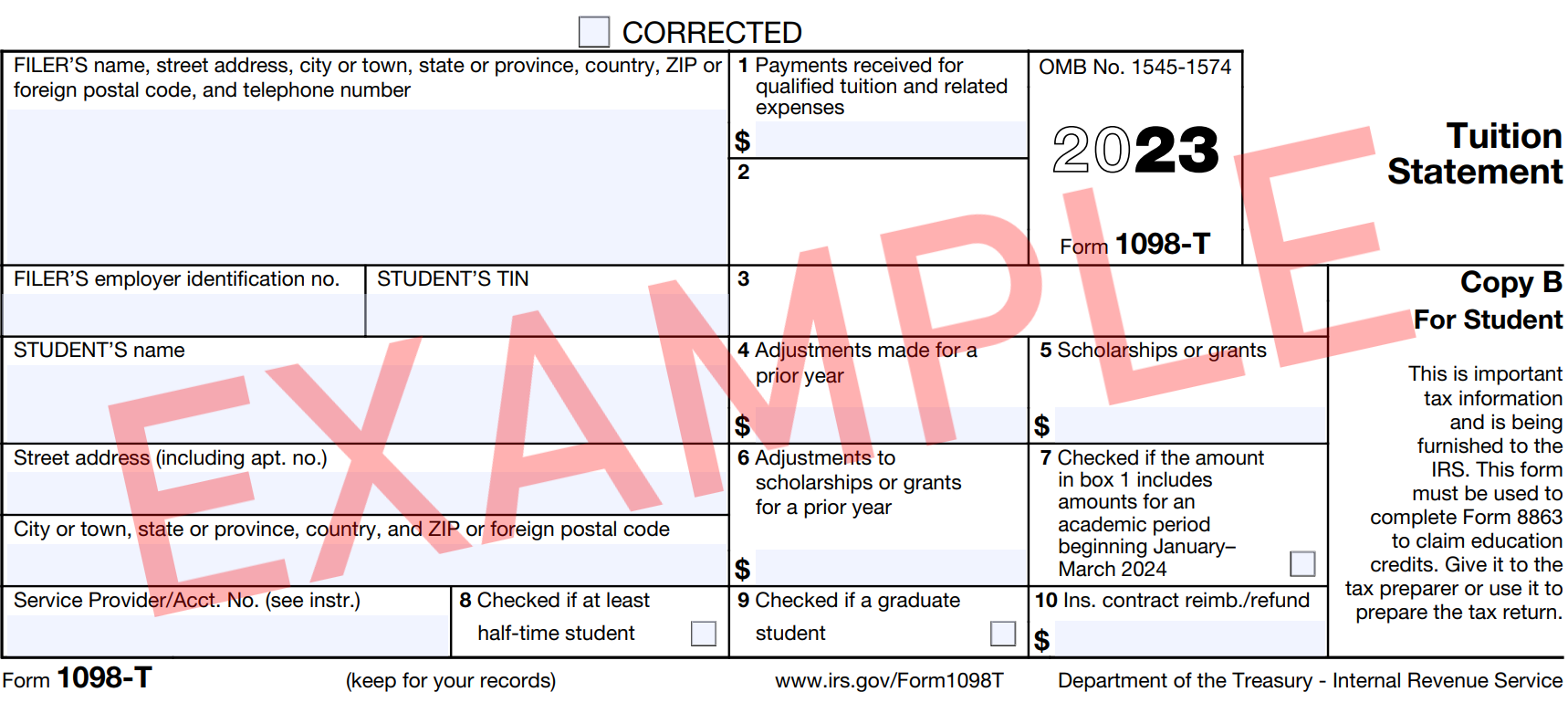

Form 1098T 2022 2023

2020 Form IRS 1098T Fill Online, Printable, Fillable, Blank pdfFiller

Frequently Asked Questions About the 1098T The City University of

1098T IRS Tax Form Instructions 1098T Forms

How To File Your 1098 T Form Universal Network

Picture16 1098T Forms

Form 1098T Information Student Portal

1098 T Form Fill Out and Sign Printable PDF Template signNow

Related Post: