When Will Form 4562 Be Available

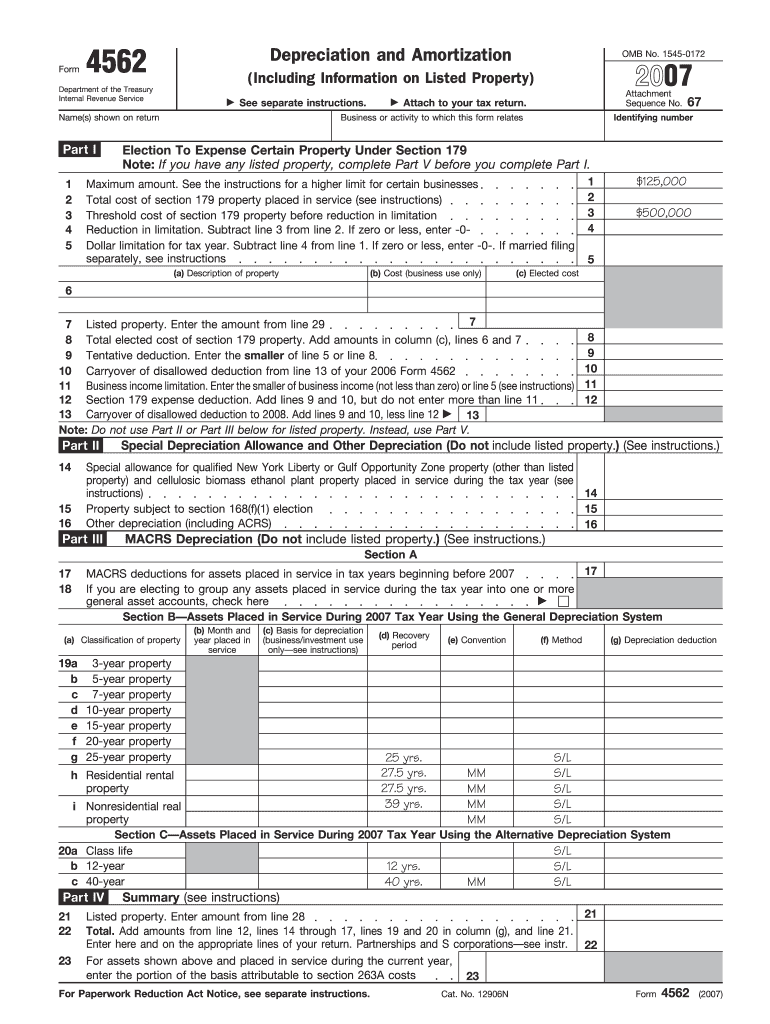

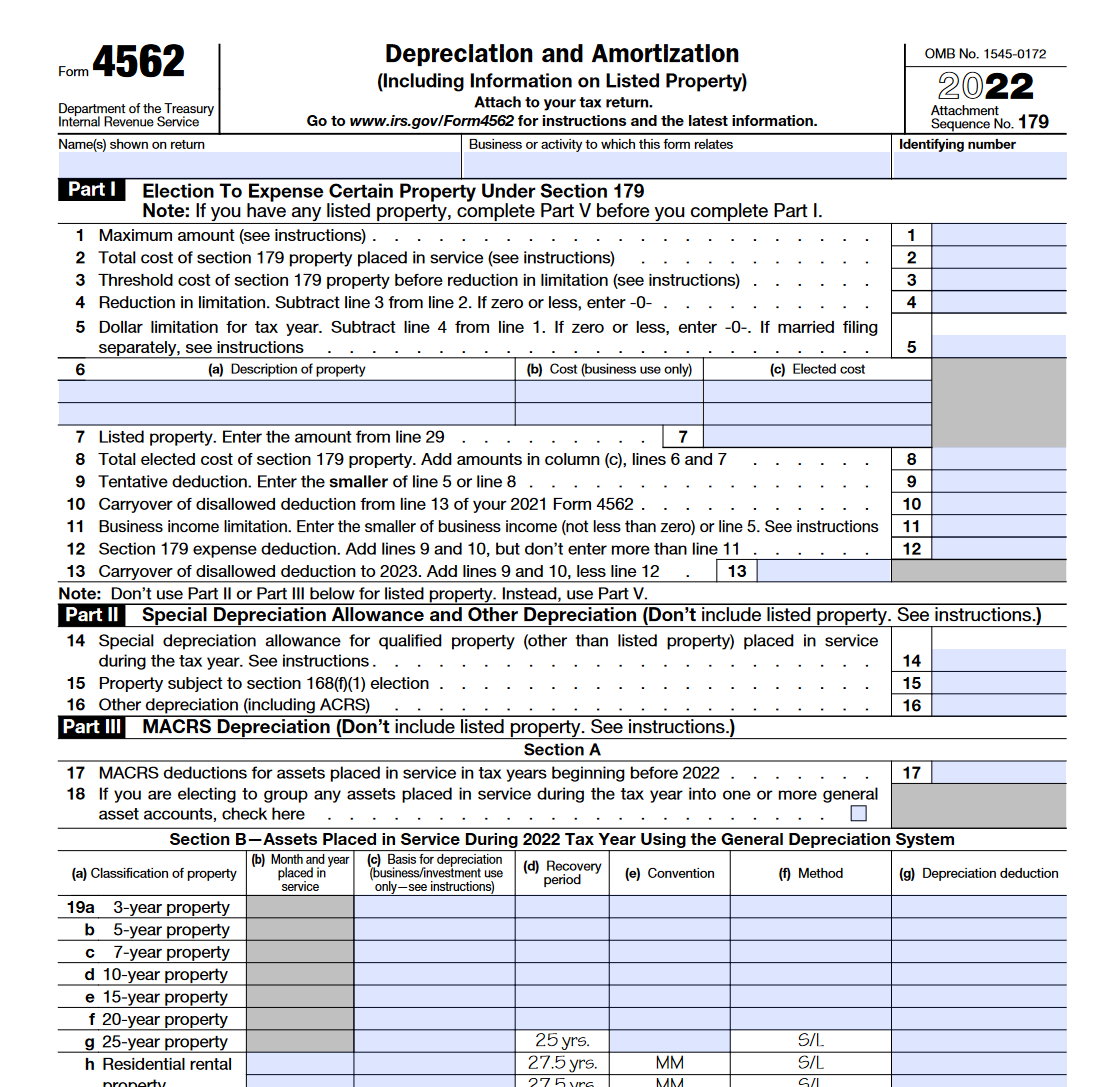

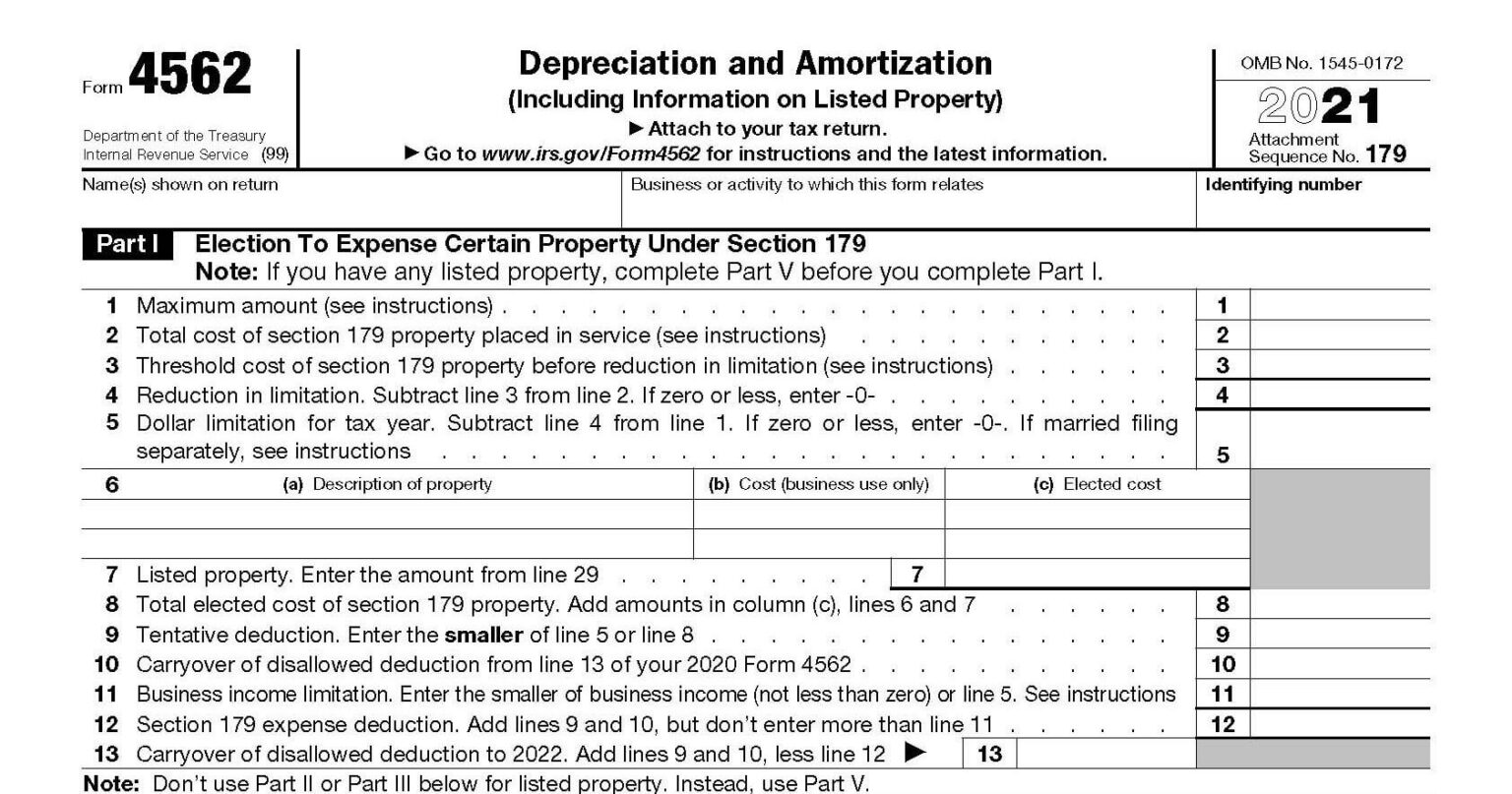

When Will Form 4562 Be Available - Phase down of the special depreciation allowance for certain property. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Web although form 4562 is listed as available, the depreciation section (calculations and reporting) is scheduled to be ready by february 26, 2022. Amortization of research and experimental expenditures. Ad download or email irs 4562 & more fillable forms, try for free now! Learn what assets should be included on form 4562, as. Web updated for tax year 2022 • june 2, 2023 8:54 am. Information about form 4562, depreciation and amortization, including recent updates, related forms, and. Web forms available for filing season 2023 (tax year 2022) forms with known limitations. Estimate how much you could potentially save in just a matter of minutes. Information about form 4562, depreciation and amortization, including recent updates, related forms, and. If you get a message that your software is up to date and you still cannot. Web click on online at the top of the desktop program screen. You must make section 179 election. Section 179 deduction dollar limits. Ad download or email irs 4562 & more fillable forms, try for free now! Learn what assets should be included on form 4562, as. Estimate how much you could potentially save in just a matter of minutes. To complete form 4562, you'll need to know the cost of assets like. You must make section 179 election on irs form. Phase down of the special depreciation allowance for certain property. Amortization of research and experimental expenditures. Click on check for updates. Web click on online at the top of the desktop program screen. For sole proprietors and c corporations, this date usually falls on april 15 if you use a calendar tax year. Phase down of the special depreciation allowance for certain property. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Web updated for tax year 2022 • june 2, 2023 8:54 am.. Was the vehicle available for. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. Web updated for tax year 2022 • june 2, 2023 8:54 am. Web although form 4562 is listed as available, the depreciation section (calculations and reporting) is. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Web although form 4562 is listed as available, the depreciation section (calculations and reporting) is scheduled to be ready by february 26, 2022. View our list. Web updated for tax year 2022 • june 2, 2023 8:54 am. Web click on online at the top of the desktop program screen. Information about form 4562, depreciation and amortization, including recent updates, related forms, and. Web although form 4562 is listed as available, the depreciation section (calculations and reporting) is scheduled to be ready by february 26, 2022.. Section 179 deduction dollar limits. Learn what assets should be included on form 4562, as. To complete form 4562, you'll need to know the cost of assets like. For sole proprietors and c corporations, this date usually falls on april 15 if you use a calendar tax year. Web form 4562 department of the treasury internal revenue service (99) depreciation. Phase down of the special depreciation allowance for certain property. The program only supports filing for the. Checkmarks indicate forms that have been finalized in the. View our list of the latest forms available for windows and mac users. Web page last reviewed or updated: Web updated for tax year 2022 • june 2, 2023 8:54 am. You must make section 179 election on irs form. Web page last reviewed or updated: Learn what assets should be included on form 4562, as. Click on check for updates. For sole proprietors and c corporations, this date usually falls on april 15 if you use a calendar tax year. Web forms available for filing season 2023 (tax year 2022) forms with known limitations. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Click on check for updates. Ad download or email irs 4562 & more fillable forms, try for free now! If you get a message that your software is up to date and you still cannot. Amortization of research and experimental expenditures. View our list of the latest forms available for windows and mac users. The program only supports filing for the. Section 179 deduction dollar limits. Checkmarks indicate forms that have been finalized in the. Was the vehicle available for. Web the internal revenue service usually releases income tax forms for the current tax year between october and january, although changes to some forms can come even later. Web updated for tax year 2022 • june 2, 2023 8:54 am. Web form 4562 is required for the first year that a depreciable asset is placed into service. Web page last reviewed or updated: Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Web form 4562 department of the treasury internal revenue service (99) depreciation and amortization (including information on listed property). Learn what assets should be included on form 4562, as. If no new assets have been placed into service in subsequent years, form 4562.Form 4562, Depreciation and Amortization IRS.gov Fill out & sign

IRS Form 4562 Explained A StepbyStep Guide

Form 4562 A Simple Guide to the IRS Depreciation Form Bench

4562 Form 2022 2023

IRS Form 4562. Depreciation and Amortization Forms Docs 2023

Form 4562 A Simple Guide to the IRS Depreciation Form Bench Accounting

IRS Form 4562 Explained A StepbyStep Guide

How to Complete IRS Form 4562

Partnership’s Minnesota Form 4562 — Example 2

2020 Form IRS 4562 Instructions Fill Online, Printable, Fillable, Blank

Related Post: