Form 2210 Line D Withholding

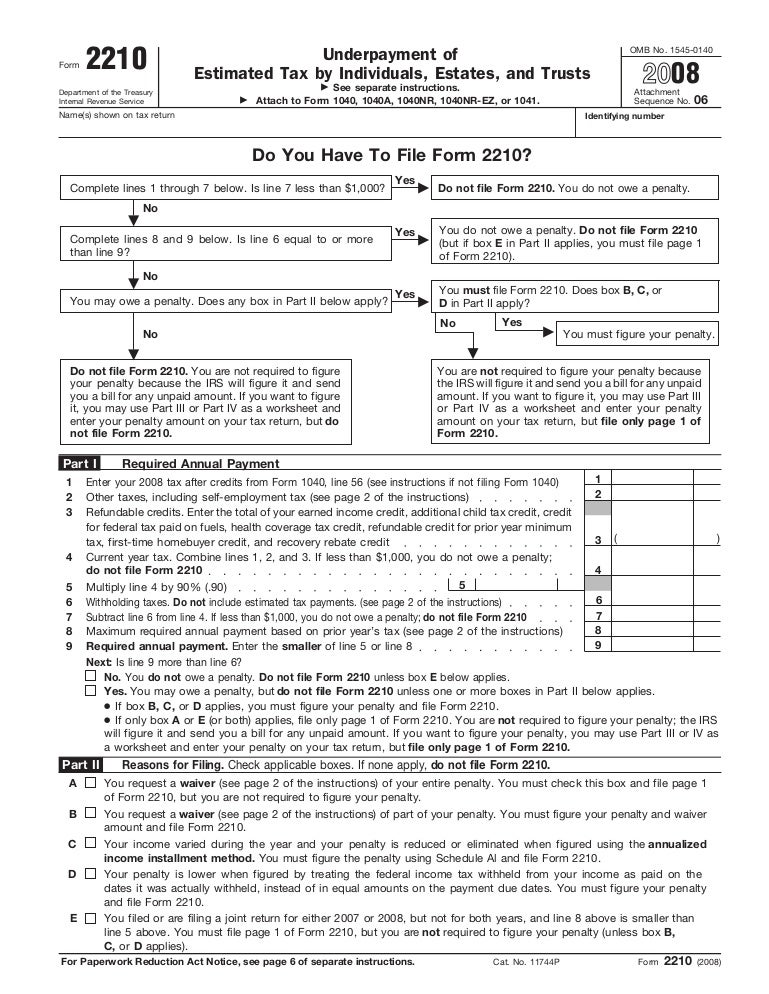

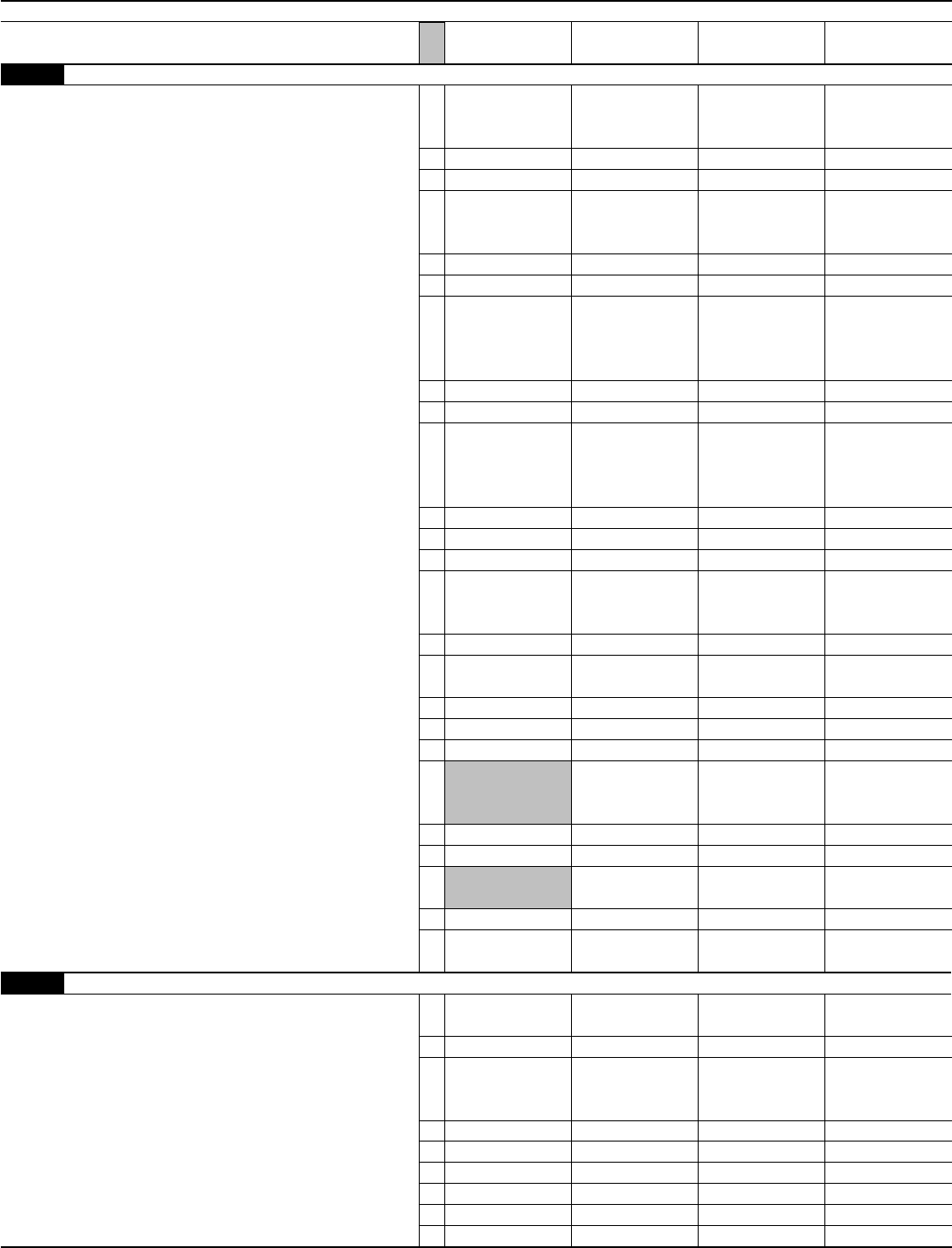

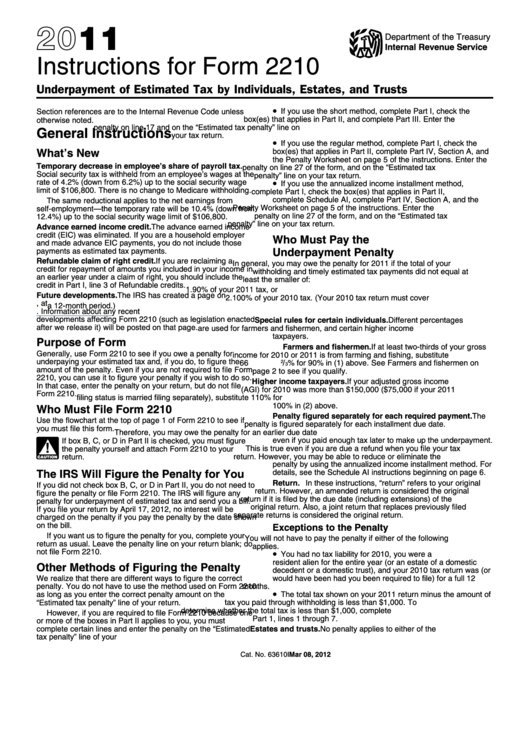

Form 2210 Line D Withholding - Applies, you must figure your penalty and file form 2210. Web up to $9 cash back i went all the way thru the turbotax process, ready to file federal and state returns, but then turbotax says there's a problem with my federal return,. Web for form 2210, turbotax asks me to enter line d withholding. If you want to start over, you might do this: Ad signnow.com has been visited by 100k+ users in the past month Tt should display four boxes with dates for withholding in each of four. You may owe a penalty, but. Not sure what this means/ what to. This form is for income earned in tax year 2022,. Go to view (at the top), choose forms, and select the desired form. The sum of the four columns is not equal to your total withholding of $xxxx for the year. 4 multiply line 3 amount by 110%. The irs will generally figure your penalty for you and you should not file. Web for form 2210, turbotax asks me to enter line d withholding. As you can see, line d is in part. The sum of the four columns is not equal to your total withholding of. To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app. If you want to start over, you might do this: As you can see, line d is in part ii and. Applies, you must figure your penalty and file form 2210. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Underpayment of estimated tax by individuals, estates, and trusts. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Web can't make sense of your post. Ad signnow.com has been visited by 100k+. Purpose of form use form 2210 to see if. If you want to start over, you might do this: 5 minimum withholding and estimated tax. As you can see, line d is in part ii and. Not sure what this means/ what to. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Tt should display four boxes with dates for withholding in each of four. Web department of the treasury internal revenue service. Ad signnow.com has been visited by 100k+ users in the past month 4 multiply line 3 amount by 110%. Web to complete form 2210, you must enter your prior year tax which is found on line 24 of your prior year 1040 and check any corresponding boxes if they relate to your situation. You may owe a penalty, but. Purpose of form use form 2210 to see if. The irs will generally figure your penalty for you and you. Go to view (at the top), choose forms, and select the desired form. Web so line d is asking for the actual amounts withheld in those quarters, not your total withholding divided by 4. If you want to start over, you might do this: Web for form 2210, turbotax asks me to enter line d withholding. As you can see,. 5 minimum withholding and estimated tax. Underpayment of estimated tax by individuals, estates, and trusts. Check this entry form 2210: File form 2210 unless one or more boxes in part ii below applies. Go to view (at the top), choose forms, and select the desired form. As you can see, line d is in part ii and. Web file form 2210 unless box. 5 minimum withholding and estimated tax. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Check this entry form 2210: How do i fix this? Check this entry form 2210: Web file form 2210 unless one or more boxes in part ii below applies. Go to view (at the top), choose forms, and select the desired form. Applies, you must figure your penalty and file form 2210. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Web •you may also complete this form if you believe the underpayment interest assessed by otr for an underpayment of estimated income tax is incorrect. File form 2210 unless one or more boxes in part ii below applies. 5 minimum withholding and estimated tax. As you can see, line d is in part ii and. This form is for income earned in tax year 2022,. 4 multiply line 3 amount by 110%. The sum of the four columns is not equal to your total withholding of $xxxx for the year. The irs will generally figure your penalty for you and you should not file. Go to view (at the top), choose forms, and select the desired form. Check this entry form 2210: How do i fix this? Web i have no idea how to deal with this: Applies, you must figure your penalty and file form 2210. To determine adjustments to your withholdings, go to the tax withholding estimator at irs.gov/w4app. Tt should display four boxes with dates for withholding in each of four. Underpayment of estimated tax by individuals, estates, and trusts. You may owe a penalty, but. Required to figure your penalty because the irs will figure it and. Web file form 2210 unless box.Form 2210Underpayment of Estimated Tax

Form 2210 Edit, Fill, Sign Online Handypdf

Form 2210 Edit, Fill, Sign Online Handypdf

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

IRS Form 2210Fill it with the Best Form Filler

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Form 2210 Fill Online, Printable, Fillable, Blank pdfFiller

Instructions for Federal Tax Form 2210 Sapling

Instructions For Form 2210 Underpayment Of Estimated Tax By

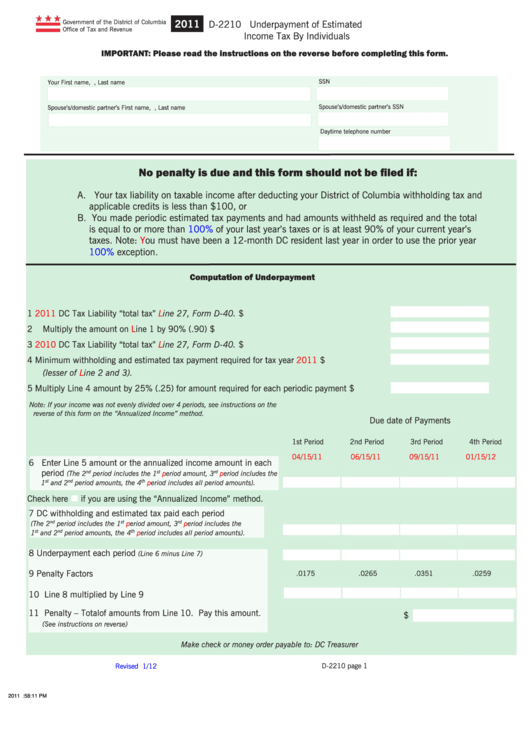

Form D2210 Underpayment Of Estimated Tax By Individuals

Related Post: