When Is Mi Form 5081 Due

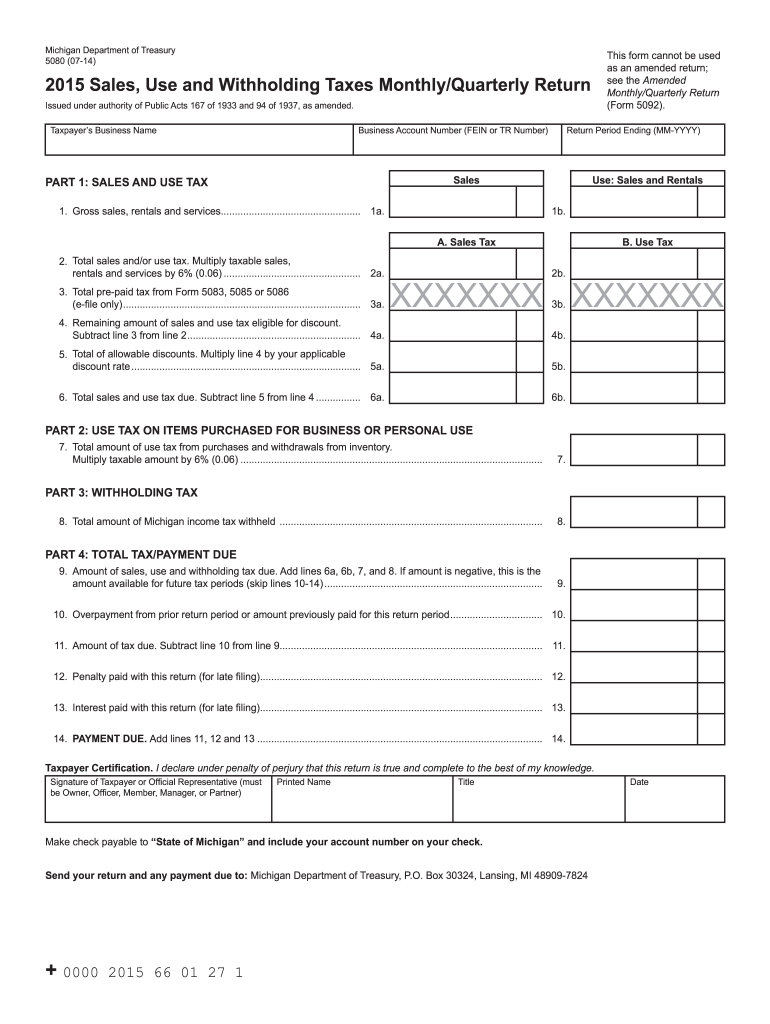

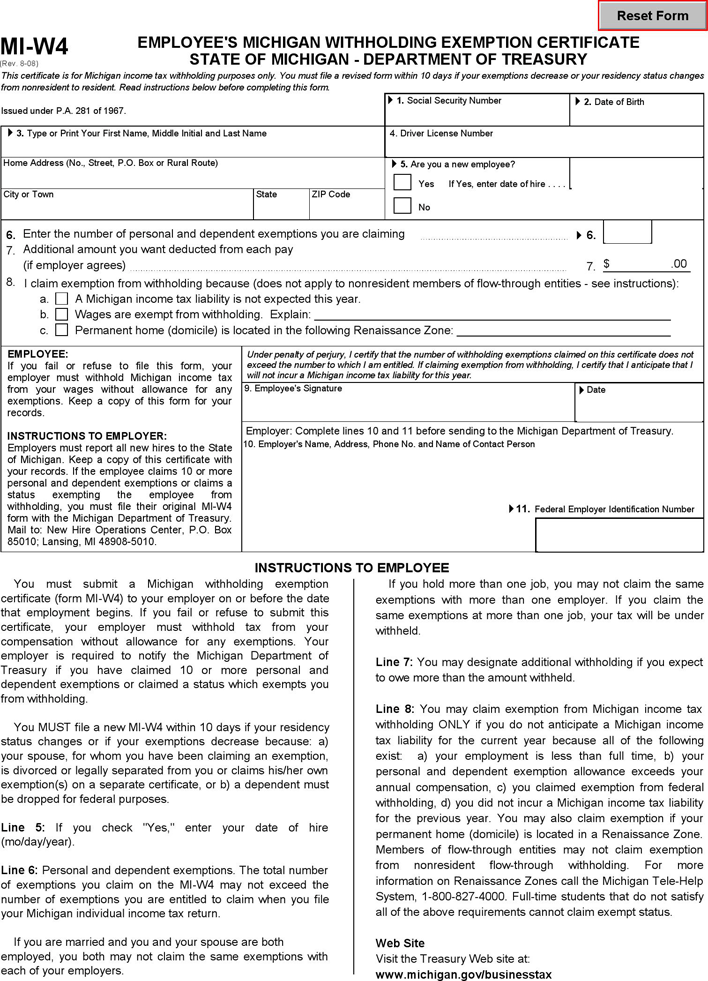

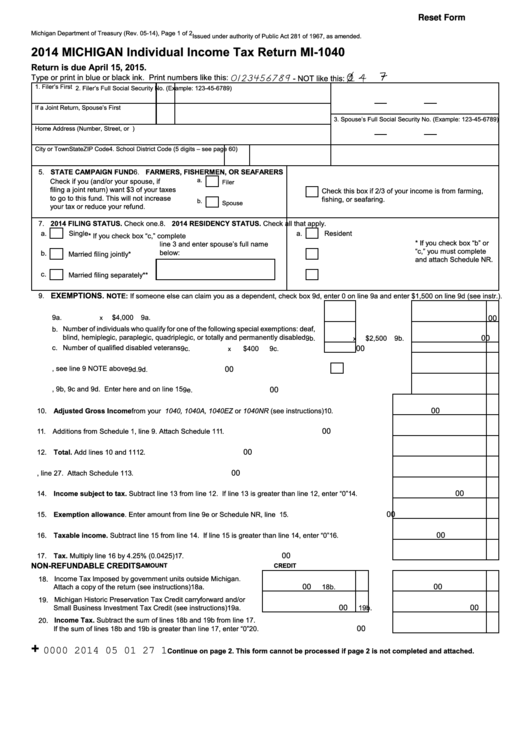

When Is Mi Form 5081 Due - File this return by february 28, 2022. Easily sign the michigan form 5081 with your finger. See the 2022 2022 sales, use and withholding taxes annual. For annual filers, the due date is february 28th, 2022, with a discount given for early remittance. Web if your return is filed after february 28 and no tax is due, compute penalty at $10 per day up to a maximum of $400. Click the link to see the 2022 form instructions. Deadline to file other 1099 forms is march 31, 2023. This form cannot be used as an. The michigan department of treasury (dot) jan. Web form 5081 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using approved tax preparation software. Web form number form name; Web follow the simple instructions below: Web issued under authority of public acts 167 of 1933, 94 of 1937, and 281 of 1967, all as amended. Form 5082, sales, use and withholding taxes amended annual. 2022 sales, use and withholding taxes amended annual return: Web form 5081 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using approved tax preparation software. This form cannot be used as an. Web michigan treasury announces new form 5081 ez, sales, use, withholding tax ez annual return. Form 5082, sales, use and withholding taxes amended annual. Easily sign the michigan form 5081 with. Issued under authority of public acts 167 of 1933, 94 of 1937, and 281 of 1967, all as amended. Web follow the simple instructions below: Form 5082, sales, use and withholding taxes amended annual. Please reference michigan’s sales and. Direct questions should be sent. State 1099 files overview note: Save or instantly send your ready documents. Direct questions should be sent. Please reference michigan’s sales and. Files are created only when the forms include. Web click the link to see the 2023 form instructions. The michigan department of treasury (dot) jan. Please reference michigan’s sales and. Web if your return is filed after february 28 and no tax is due, compute penalty at $10 per day up to a maximum of $400. Form 5082, sales, use and withholding taxes amended annual. Deadline to file other 1099 forms is march 31, 2023. However, even if a company is told by the state to file. File this return by february 28, 2022. Easily sign the michigan form 5081 with your finger. See the 2022 2022 sales, use and withholding taxes annual. Web all nominations are due by friday, october 27, 2023. If your return is filed with additional tax due, include penalty and. The us legal forms browser. Web issued under authority of public acts 167 of 1933, 94 of 1937, and 281 of 1967, all as amended. Michigan publishes fillable tax forms, including form. Click the link to see the 2022 form instructions. Form 5082, sales, use and withholding taxes amended annual. Deadline to file other 1099 forms is march 31, 2023. File this return by february 28, 2022. Save or instantly send your ready documents. File this return by february 28, 2022. State 1099 files overview note: Web click the link to see the 2023 form instructions. Web 2023 sales, use and withholding taxes annual return. Fill out the requested boxes which are. Web michigan treasury announces new form 5081 ez, sales, use, withholding tax ez annual return. This form cannot be used as an. Save or instantly send your ready documents. Please reference michigan’s sales and. Web issued under authority of public acts 167 of 1933, 94 of 1937, and 281 of 1967, all as amended. The michigan department of treasury (dot) jan. The us legal forms browser. 2022 sales, use and withholding taxes amended annual return: Issued under authority of public acts 167 of 1933, 94 of 1937, and 281 of 1967, all as amended. If your return is filed with additional tax due, include penalty and. Web if your return is filed after february 28 and no tax is due, compute penalty at $10 per day up to a maximum of $400. Please reference michigan’s sales and. Web if you are an annual filer, you will need to use form 5081. File this return by february 28, 2022. Web most businesses will file monthly or quarterly using form 5080, while others will file annually with form 5081. Click the link to see the 2022 form instructions. Form 5081 is available for submission electronically using michigan treasury online (mto) at. However, even if a company is told by the state to file. There are also other forms that you can use to file use tax only. Web form 5081 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using approved tax preparation software. For annual filers, the due date is february 28th, 2022, with a discount given for early remittance. Web the tips below can help you complete mi 5081 quickly and easily: Web click the link to see the 2023 form instructions. Web this form cannot be used as an 5081 (rev. Save or instantly send your ready documents.Michigan Sales Use And Withholding Tax Form 5081

Michigan Sales Use And Withholding Tax Form 5081

Printable Form 5081 Michigan Printable Forms Free Online

Fill Michigan

Fill Michigan

Dhs 4574 b fillable 2013 form Fill out & sign online DocHub

Printable Form 5081 Michigan Printable Forms Free Online

Michigan Withholding Form 2023 Printable Forms Free Online

tofleedesign Mto Treasury Michigan Gov

Printable State Of Michigan Tax Forms Printable Forms Free Online

Related Post: