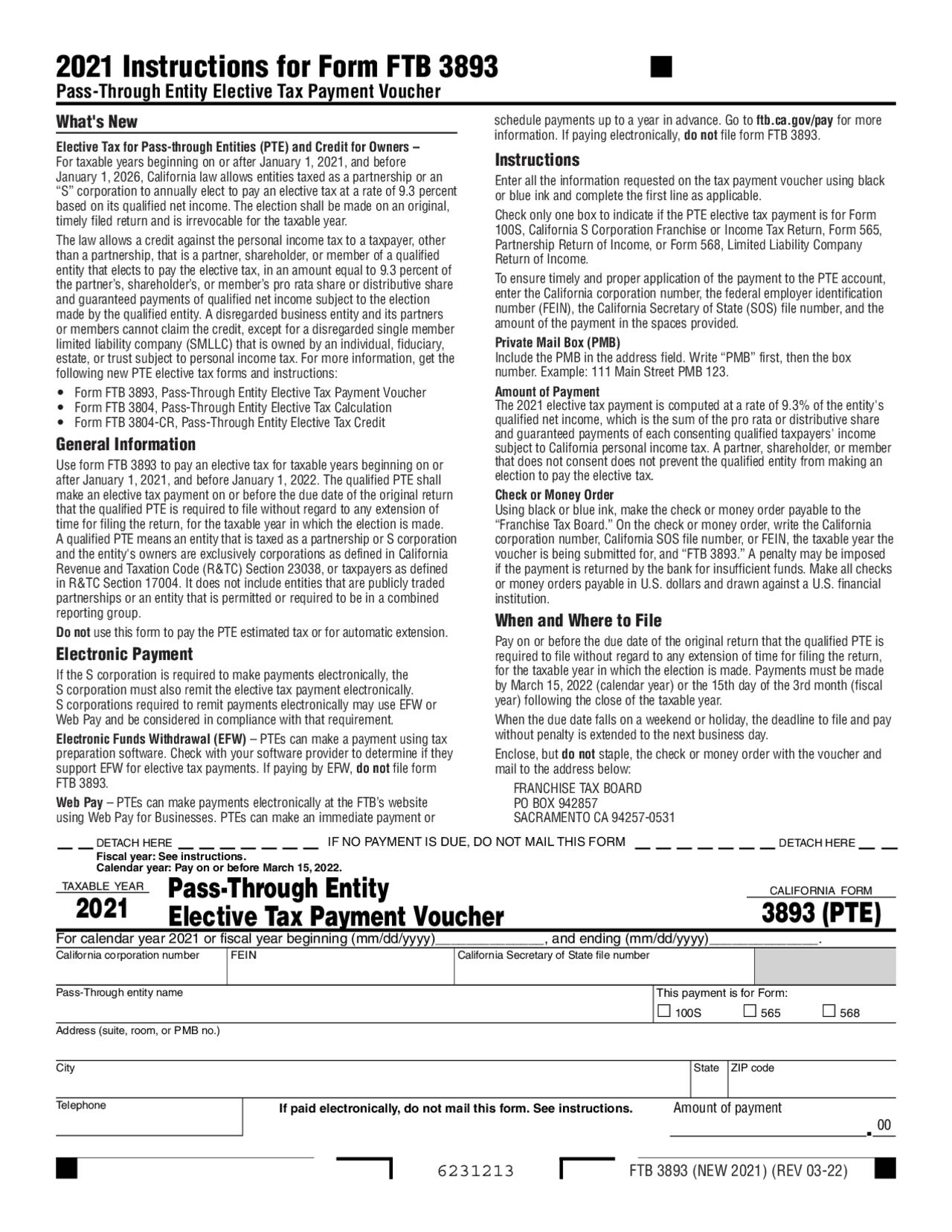

California Form 3893

California Form 3893 - Or form 568, line 9); Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it to us. However, the instructions to for ftb 3893 indicate that the qualified entity can make a payment through electronic funds withdrawal. How is the tax calculated?. Prepare and populate california form 3804 and / or form 3893 in a partnership return using worksheet view. Prepare and populate california form 3804 and / or form 3893 in an s corporation return using interview forms view. Make a copy of this form for your records. Inform the ftb within 60 days if the terms of the installment sale, promissory note, or payment schedule. See instructions attached to voucher for more information. Web the full amount of pte tax will print on the “amount paid with form ftb 3893” line (form 565, line 30; Prepare and populate california form 3804 and / or form 3893 in a partnership return using worksheet view. If an entity does not make that first payment by june 15, it may not make the election for that tax year. Use a separate form 593 to report the amount withheld from each seller. Prepare and populate california form 3804 and. However, the instructions to for ftb 3893 indicate that the qualified entity can make a payment through electronic funds withdrawal. Taxable year 2018 real estate withholding tax statement california form 593 business name ssn or itin fein ca corp no. Qualified entities can use the following tax form to. 2021 instructions for form ftb 3893. Web to make a payment. A list of items being revised due to sb 113 is available on our forms and publications page at ftb.ca.gov. Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). Taxable year 2018 real estate withholding tax statement california form 593 business name ssn or itin fein ca corp. How is the tax calculated?. See instructions attached to voucher for more information. Or form 568, line 9); Ptes taxed as a partnership or an “s” corporation may elect to pay. Prepare and populate california form 3804 and / or form 3893 in an s corporation return using interview forms view. Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it to us. If an entity does not make that first payment by june 15, it may not make the election for that tax year. Use form 593 to report real estate withholding on sales. Prepare and populate california form 3804 and / or form 3893 in a partnership return using worksheet view. However, the instructions to for ftb 3893 indicate that the qualified entity can make a payment through electronic funds withdrawal. Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s. However, the instructions to for ftb 3893 indicate that the qualified entity can make a payment through electronic funds withdrawal. Make a copy of this form for your records. Inform the ftb within 60 days if the terms of the installment sale, promissory note, or payment schedule. Qualified entities can use the following tax form to. And the 3893 (pmt). Web the california franchise tax board dec. See instructions attached to voucher for more information. However, the instructions to for ftb 3893 indicate that the qualified entity can make a payment through electronic funds withdrawal. A list of items being revised due to sb 113 is available on our forms and publications page at ftb.ca.gov. Web partnerships and s corporations. Web the california franchise tax board dec. Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it to us. And the 3893 (pmt) will print, showing only the amount of pte tax not previously paid. Alternatively, the pte elective tax payment. A list of. We anticipate the revised form 3893 will be available march 7, 2022. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. A list of items being revised due to sb 113 is available on our forms and publications page at ftb.ca.gov. Web the full. We anticipate the revised form 3893 will be available march 7, 2022. Web the full amount of pte tax will print on the “amount paid with form ftb 3893” line (form 565, line 30; Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it to us. Web real estate escrow person (reep) instructions. 2021 instructions for form ftb 3893. Web use form ftb 3893 to pay an elective tax for taxable years beginning on or after january 1, 2021, and before january 1, 2022. Alternatively, the pte elective tax payment. How is the tax calculated?. For calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. Web the california franchise tax board dec. However, the instructions to for ftb 3893 indicate that the qualified entity can make a payment through electronic funds withdrawal. Prepare and populate california form 3804 and / or form 3893 in an s corporation return using interview forms view. Inform the ftb within 60 days if the terms of the installment sale, promissory note, or payment schedule. Use a separate form 593 to report the amount withheld from each seller. Qualified entities can use the following tax form to. See instructions attached to voucher for more information. And the 3893 (pmt) will print, showing only the amount of pte tax not previously paid. Taxable year 2018 real estate withholding tax statement california form 593 business name ssn or itin fein ca corp no. A list of items being revised due to sb 113 is available on our forms and publications page at ftb.ca.gov. Make a copy of this form for your records.2021 Instructions for Form 3893, PassThrough Entity Elective

2023 Form 3893 Printable Forms Free Online

CA CDPH 283 B 2011 Fill and Sign Printable Template Online US Legal

2002 ca form 199 Fill out & sign online DocHub

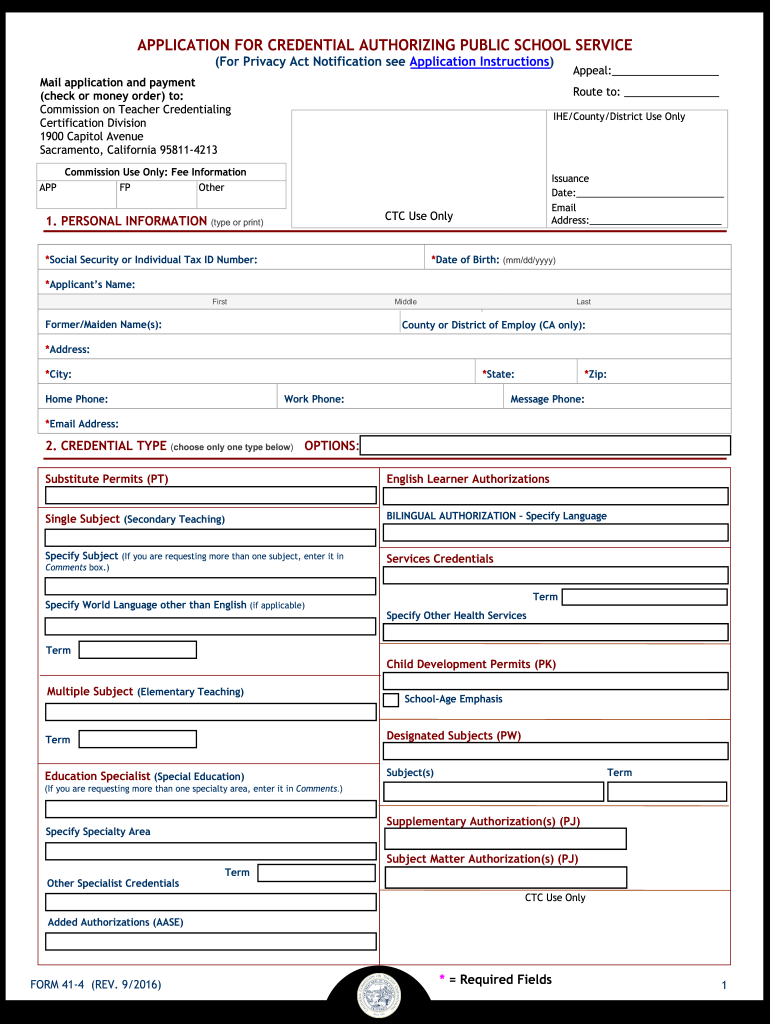

2016 CA Form 414 Fill Online, Printable, Fillable, Blank pdfFiller

Ca tax rate schedule 2017 Fill out & sign online DocHub

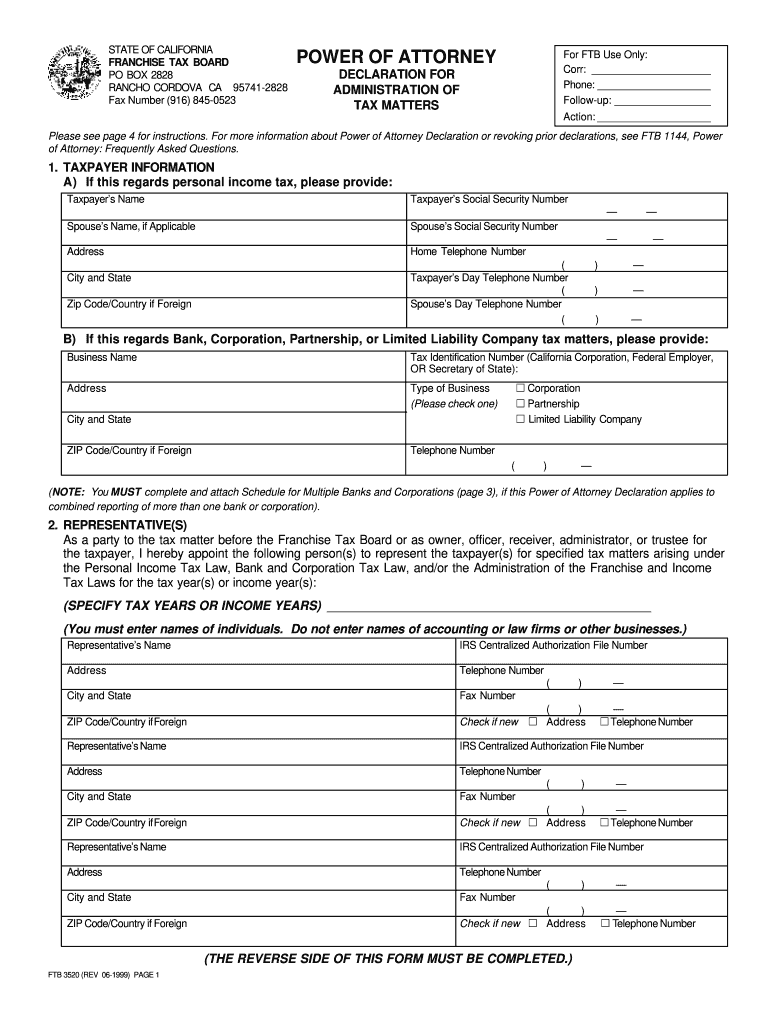

Ftb fax number Fill out & sign online DocHub

California DMV Form REG 262 Etsy

Ata Chapters And Subchapters Pdf Merge lasopapromotions

Ca Form 3893 Voucher VOUCHERSOF

Related Post: