What Tax Form Does A Us Citizen Living Abroad File

What Tax Form Does A Us Citizen Living Abroad File - Web this means that as an american living abroad, you will need to file a us federal tax return this year if your total income in 2022—regardless of where the income was earned (and. However, there are additional forms and schedules that. Web do us citizens living abroad have to file us taxes? Web that means an expatriate making $75,000 overseas would pay no taxes, although they still must file irs form 1040 and claim the exclusion. All us citizens, including those living abroad, who earn more than the standard deduction amount. Web you can request an additional extension by filing form 4868. Expat tax return as an american or dual citizen living overseas. Web october 25, 2022 resource center filing the u.s. Citizen or green card holder living abroad, the tax filing process is similar to filing a return if you are in the u.s. Web a common question you may have is “does a us citizen living abroad file a 1040 or 1040nr?” the answer is, it depends. Web the irs’s main publication for citizens and resident aliens abroad is publication 54, tax guide for u.s. Web internal revenue code section 7701 (a) (30) for the definition of a u.s. How does living abroad mitigate your us tax? Web home file international taxpayers u.s. Citizen or resident living or traveling outside the united states, you generally are required. Even though you no longer reside in the. Web if you are a u.s. Web top frequently asked questions for u.s. All us citizens, including those living abroad, who earn more than the standard deduction amount. Web as a us citizen living abroad, you need to make sure that you have the correct paperwork for tax reporting. Web if you are a u.s. Citizen living and working outside of the united states for many years. If you are a nonresident alien, you will file. Web you file form 2555 to claim the foreign earned income exclusion and/or the foreign housing exclusion or deduction. All us citizens, including those living abroad, who earn more than the standard deduction. Expat’s guide to state taxes while living abroad at a glance do expats pay state taxes? Citizen or resident living or traveling outside the united states, you generally are required to file income tax returns, estate tax returns, and gift tax returns and pay estimated tax in the same way as those residing in the united states. You have 4. Us citizens living abroad receive an extra two months to file their irs tax return, until june 15. Helping clients with foreign income tax forms for u.s. You have 4 important deadlines to remember if you are filing u.s. Ad streamlined sales tax (sst) model 1 program makes it easier to comply with sales tax laws. Citizens and resident aliens. If you are a nonresident alien, you will file. You may need to provide form 2555 for the foreign. Web are you filing u.s. Web this means that as an american living abroad, you will need to file a us federal tax return this year if your total income in 2022—regardless of where the income was earned (and. Aliens and. Ad streamlined sales tax (sst) model 1 program makes it easier to comply with sales tax laws. Citizens and resident aliens abroad extensions of time to file u.s. If you qualify as an american citizen residing. Citizens and resident aliens abroad. Web irs filing dates for us citizens living abroad. Web irs filing dates for us citizens living abroad. Expat’s guide to state taxes while living abroad at a glance do expats pay state taxes? You may need to provide form 2555 for the foreign. Web you file form 2555 to claim the foreign earned income exclusion and/or the foreign housing exclusion or deduction. If you are a nonresident alien,. Helping clients with foreign income tax forms for u.s. Citizens and resident aliens abroad extensions of time to file u.s. File your return using the appropriate address for your. If you are a nonresident alien, you will file. You have 4 important deadlines to remember if you are filing u.s. However, there are additional forms and schedules that. Web top frequently asked questions for u.s. Citizen and resident aliens living abroad should know their tax obligations. Web internal revenue code section 7701 (a) (30) for the definition of a u.s. Web a common question you may have is “does a us citizen living abroad file a 1040 or 1040nr?” the. Learn from the irs about filing a. All us citizens, including those living abroad, who earn more than the standard deduction amount. Web as a us citizen living abroad, you need to make sure that you have the correct paperwork for tax reporting. Web internal revenue code section 7701 (a) (30) for the definition of a u.s. Citizens and resident aliens abroad. Web home file international taxpayers u.s. You have 4 important deadlines to remember if you are filing u.s. Helping clients with foreign income tax forms for u.s. Web top frequently asked questions for u.s. Citizens living abroad typically use form 1040, the same form used by taxpayers in the united states. Web generally, united states citizens get taxed on their worldwide income regardless of where they reside, so a u.s. If you are a nonresident alien, you will file. Aliens and citizens living abroad general faqs 1. Citizen living abroad may be responsible for paying taxes if they. File your return using the appropriate address for your. Web a common question you may have is “does a us citizen living abroad file a 1040 or 1040nr?” the answer is, it depends. Citizens and resident aliens abroad extensions of time to file u.s. Outsource your compliance responsibilities to a certified service provider with model 1. Citizen and resident aliens living abroad should know their tax obligations. Web you can request an additional extension by filing form 4868.Why Does The Us Tax Citizens Living Abroad Latest News Update

Tax Filing Deadline Us Citizens Living Abroad TAXP

Publication 54 (2020), Tax Guide for U.S. Citizens and Resident Aliens

Do you have to file U.S. expat tax return as American living abroad?

Taxes for US citizens living abroad your 2023 guide Wise

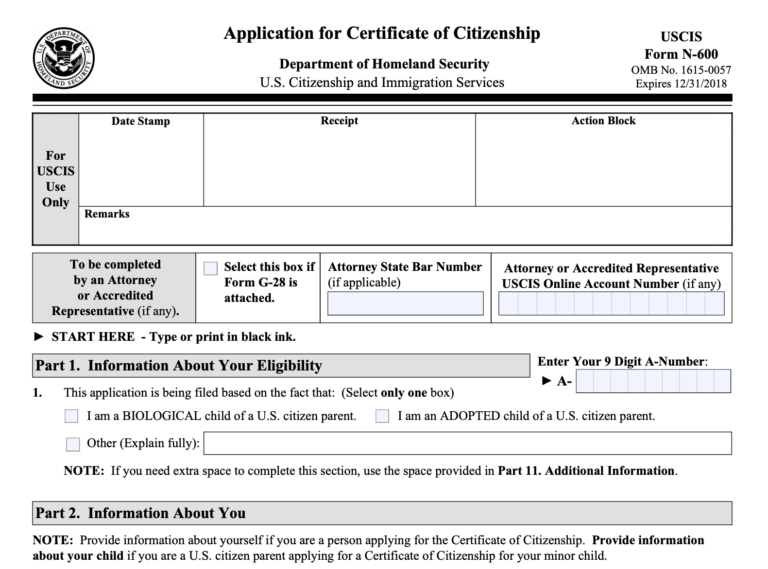

Form N600, Explained Boundless

Completing Form 1040 The Face of your Tax Return US Expat Taxes

Do US Citizens Living Abroad Need to File Taxes?

Guide On US Tax for US Citizens Living Abroad Important USA

IRS Form W8 « TaxExpatriation

Related Post: