Cuyahoga County Homestead Exemption Form

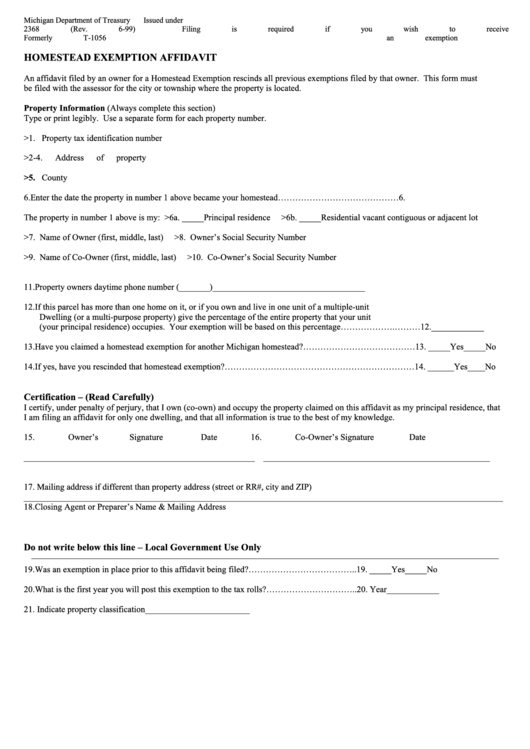

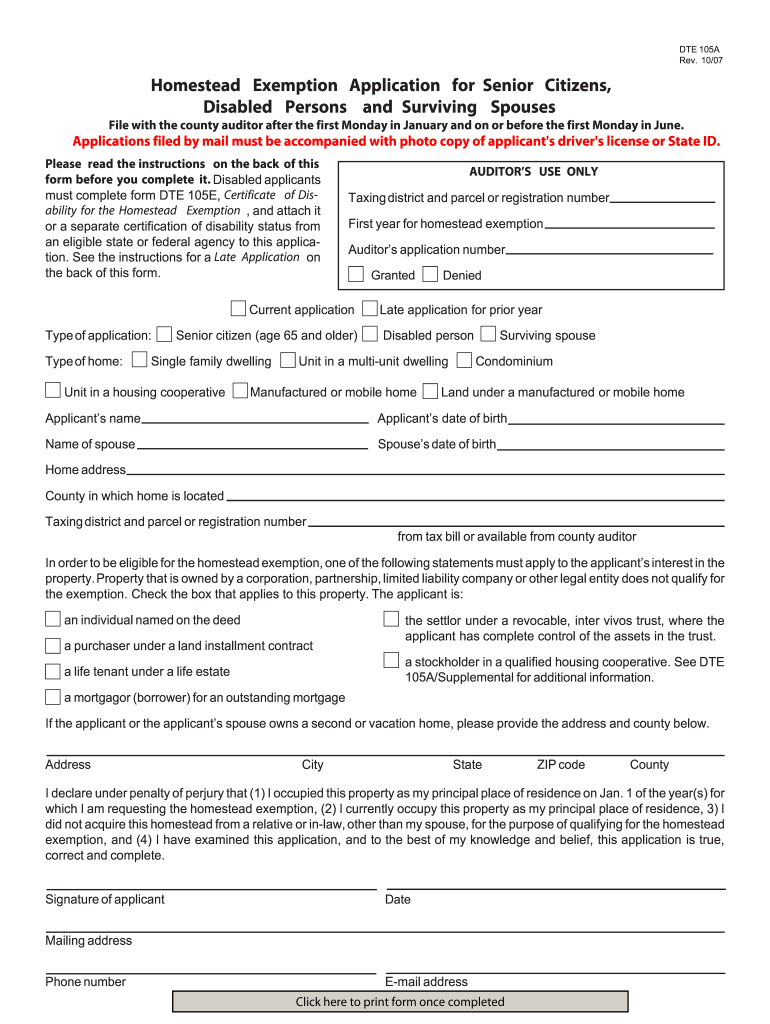

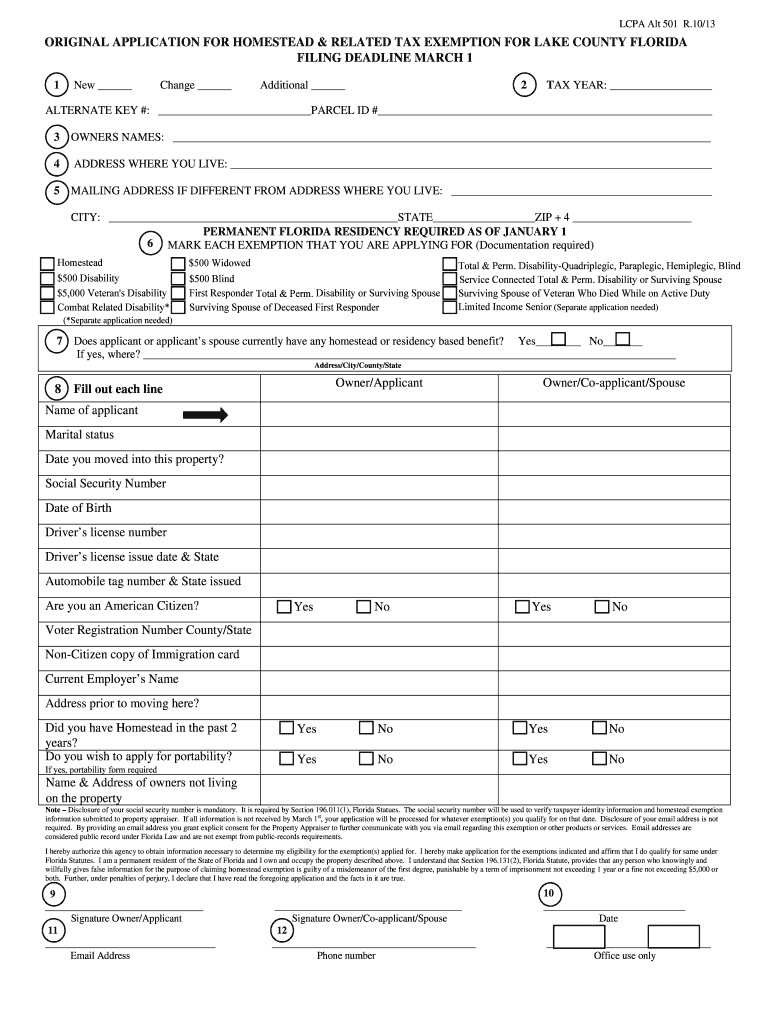

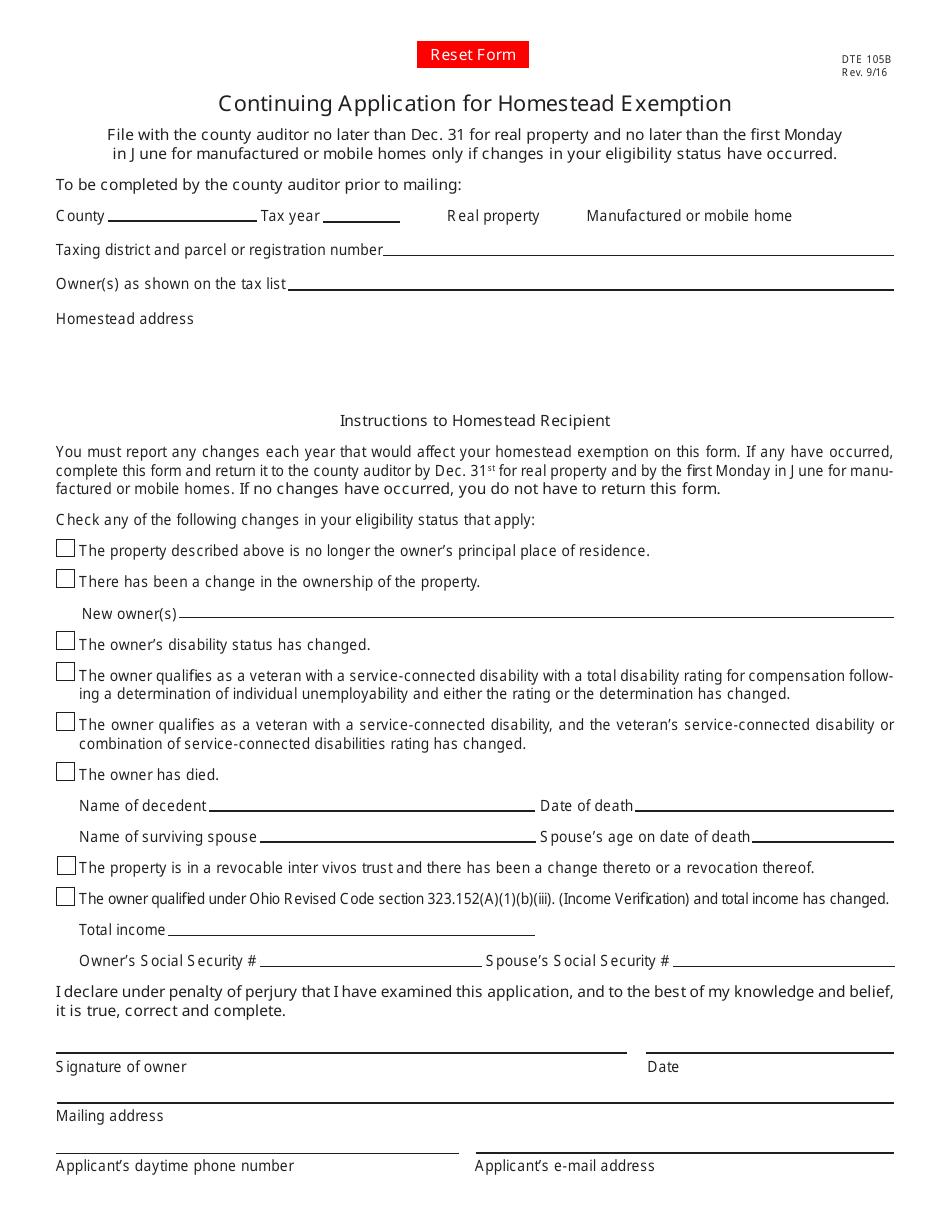

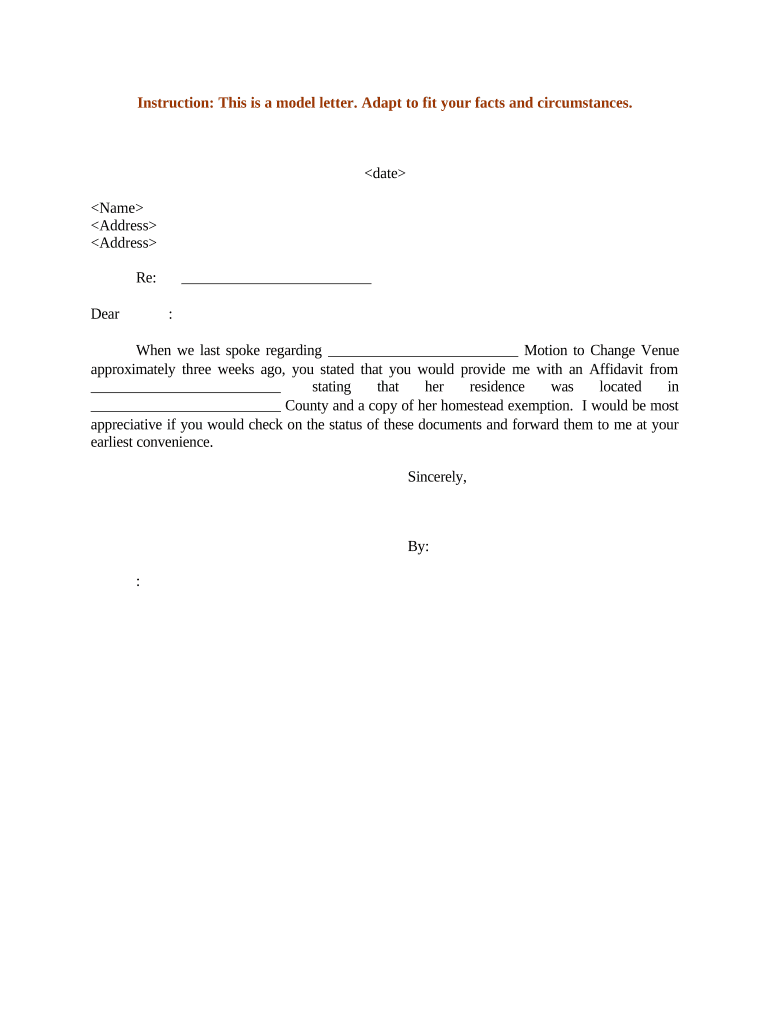

Cuyahoga County Homestead Exemption Form - Your county may have its own application. The estimate of income derived is not an indication of whether or not you or your spouse. Web fill out application form dte105a.you can get the form at your county auditor’s office or at your county auditor’s website. Here is a summary to help you better. This program offers you a property tax exemption to help you lower the amount of property tax you pay. Web homestead exemption form cuyahoga administrative senior and disabled personnel homestead exemption protects the start $25,000 a your home’s assess from taxing. Complaint against the assessment of real property other than market value. To get an application form, or if you need help or have questions, call your. Toward get an application form, or is you need help or have questions, shout your. Web a homestead exemption application form (“dte 105a) is available from the ohio department of taxation. Delinquent publication delinquent publication dates and archived. File with the county auditor. 1 on january 1, 2012, the northeast ohio regional sewer district’s rates and billing structure is changing. Web the homestead exemption is a statewide program which reduces the property tax burden of qualified citizens. To get an application form, or if you need help or have questions, call. Web how do i apply? Web the filing period for these complaints is jan. Web homestead exemption is a credit on property tax bills available to: This program offers you a property tax exemption to help you lower the amount of property tax you pay. Toward get an application form, or is you need help or have questions, shout your. Web how to complete your application the following information may be helpful to you as you complete your application for real property tax exemption and remission form (dte. This program offers you a property tax exemption to help you lower the amount of property tax you pay. File form dte105a with your. To get an application form, or if you. Web how to complete your application the following information may be helpful to you as you complete your application for real property tax exemption and remission form (dte. Web homestead exemption form cuyahoga administrative senior and disabled personnel homestead exemption protects the start $25,000 a your home’s assess from taxing. Here is a summary to help you better. Web $34,600. Web the exemption, which takes the form of a credit on property tax bills, allows qualifying homeowners to exempt $25,000 of the market value of their home from all. Homeowners or their surviving spouse aged 65 (+) residing in their home, with qualifying income individuals. To apply for this program, please print and fill out the application form and mail. Delinquent publication delinquent publication dates and archived. The estimate of income derived is not an indication of whether or not you or your spouse. Web $34,600 for 2021 (modified adjusted gross) $36,100 for 2022 (modified adjusted gross) in order to receive the homestead exemption, you need to file by december 31st of the. File form dte105a with your. 1 on. Web the filing period for these complaints is jan. Web how do i apply? Complaint against the assessment of real property other than market value. To get an application form, or if you need help or have questions, call your. Web to apply, complete the application form (dte 105a, homestead exemption application form for senior citizens, disabled persons, and surviving. Web how to complete your application the following information may be helpful to you as you complete your application for real property tax exemption and remission form (dte. 1 on january 1, 2012, the northeast ohio regional sewer district’s rates and billing structure is changing. If you have questions on your how to apply for the program,. The estimate of. Web how to complete your application the following information may be helpful to you as you complete your application for real property tax exemption and remission form (dte. 1 on january 1, 2012, the northeast ohio regional sewer district’s rates and billing structure is changing. This program offers you a property tax exemption to help you lower the amount of. File with the county auditor. Web to apply, complete the application form (dte 105a, homestead exemption application form for senior citizens, disabled persons, and surviving spouses), then file it with. Delinquent publication delinquent publication dates and archived. This program offers you a property tax exemption to help you lower the amount of property tax you pay. File form dte105a with. Web fill out application form dte105a.you can get the form at your county auditor’s office or at your county auditor’s website. Complaint against the assessment of real property other than market value. Delinquent publication delinquent publication dates and archived. Web the exemption, which takes the form of a credit on property tax bills, allows qualifying homeowners to exempt $25,000 of the market value of their home from all. Web cuyahoga county fiscal officer application for valuation of damaged or destroyed property if your property sustained any damage due to the recent severe weather, you. File with the county auditor. If you have questions on your how to apply for the program,. Web $34,600 for 2021 (modified adjusted gross) $36,100 for 2022 (modified adjusted gross) in order to receive the homestead exemption, you need to file by december 31st of the. Web ohio revised code section 323.151: Web the homestead exemption is a statewide program which reduces the property tax burden of qualified citizens. Web how to complete your application the following information may be helpful to you as you complete your application for real property tax exemption and remission form (dte. Here is a summary to help you better. Homeowners or their surviving spouse aged 65 (+) residing in their home, with qualifying income individuals. Web homestead exemption is a credit on property tax bills available to: To get an application form, or if you need help or have questions, call your. To apply for this program, please print and fill out the application form and mail it to your local office. The estimate of income derived is not an indication of whether or not you or your spouse. You can get an exemption of your home's. Web to apply, complete the application form (dte 105a, homestead exemption application form for senior citizens, disabled persons, and surviving spouses), then file it with. Toward get an application form, or is you need help or have questions, shout your.Form 2368 (Formerly T1056) Homestead Exemption Affidavit 1999

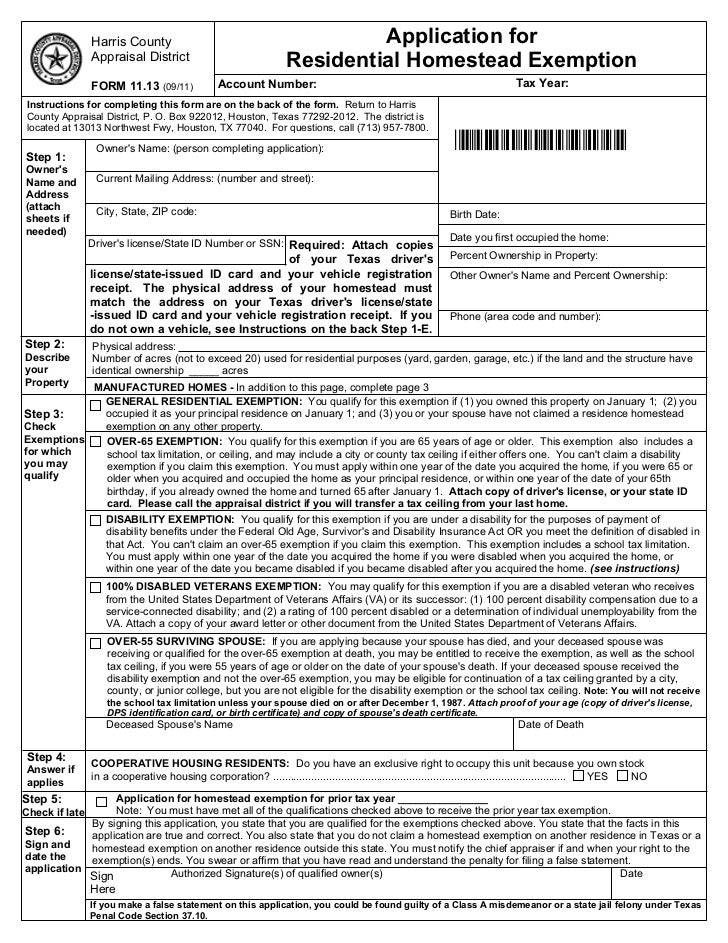

residence homestead exemption application firn 11 13 02 19 Fill out

Homestead exemption form

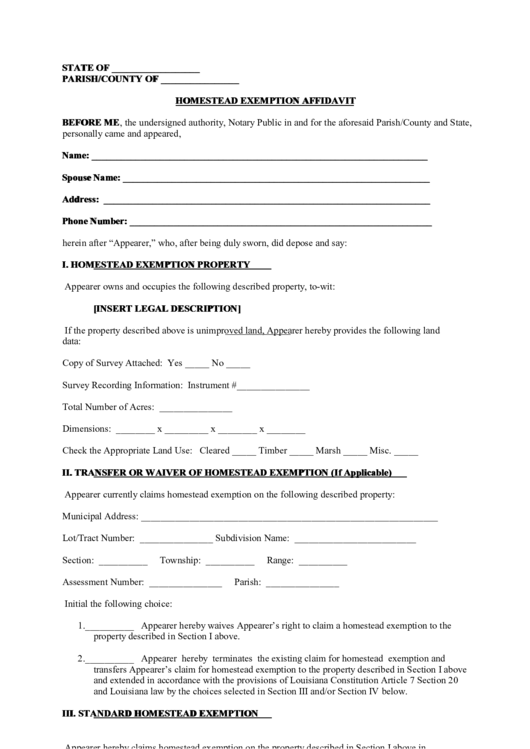

Homestead Exemption Affidavit printable pdf download

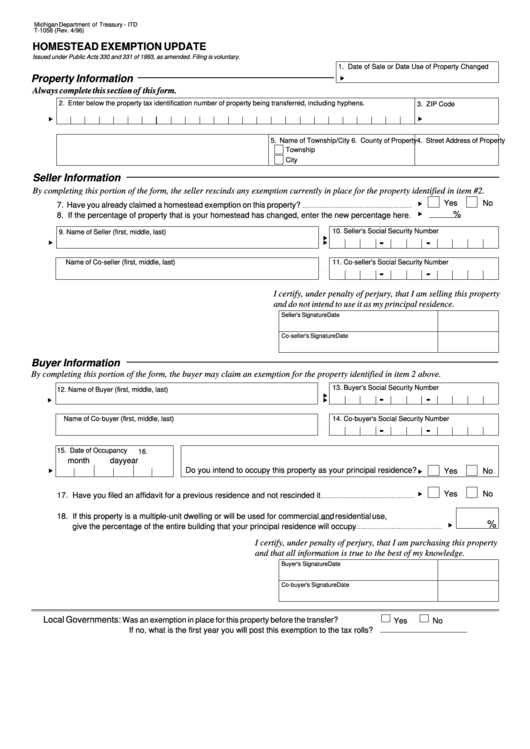

Fillable Form T 1058 Homestead Exemption Update 1996 Printable Pdf

Free Washington State Homestead Exemption Form

Fillable Form T 1058 Homestead Exemption Update 1996 Printable Pdf

Form DTE105B Download Fillable PDF or Fill Online Continuing

Homestead Exemption Form Fill Out and Sign Printable PDF Template

Florida Homestead and Related Tax Exemptions Application Form DocHub

Related Post: