What Is Subpart F Income On Form 5471

What Is Subpart F Income On Form 5471 - Web what is form 5471? Person who disposes of sufficient stock in the foreign corporation to reduce its interest to less than the stock ownership requirement. Form 5471, schedule i, total of lines 1 through 4. Persons with respect to certain foreign corporations, is an information statement. Upload, modify or create forms. Web determination of subpart f income and section 956 inclusions, the. This approach is based on the principles underlying the united states’. Shareholder line 1 enter u.s. Web the form 5471 and its schedules are used to satisfy the reporting requirements of internal revenue code sections 6038 and 6046. Web these new lines request various types of subpart f income of the cfc. Web subpart f income definition explains a type of deferred tax on the income of shareholders of a controlled foreign corporation (cfc) after they have received these dividends. Whether or not a taxpayer is required to. Web what is subpart f income? Shareholder line 1 enter u.s. Web share of subpart f income or tested items from a cfc. Complete, edit or print tax forms instantly. Form 5471, schedule i, total of lines 1 through 4. Person who disposes of sufficient stock in the foreign corporation to reduce its interest to less than the stock ownership requirement. Web subpart f income of u.s. Required to file form 5471 to report interests in certain foreign corporations where they. Web the subpart f tax regime is used to ensure that certain passive income and other income generated from controlled foreign corporations is taxed in the us. Web subpart f income of u.s. Required to file form 5471 to report interests in certain foreign corporations where they. The subpart f income provisions eliminate deferral of us tax on some categories. Web share of subpart f income or tested items from a cfc. Shareholder line 1 enter u.s. Web determination of subpart f income and section 956 inclusions, the. Web these new lines request various types of subpart f income of the cfc. Web schedule i is completed with a form 5471 to disclose the u.s. Form 5471, officially called the information return of u.s. Ad download or email irs 5471 & more fillable forms, register and subscribe now! Ad get ready for tax season deadlines by completing any required tax forms today. Persons with respect to certain foreign corporations, is an information statement. Web what is subpart f income? Shareholder’s subpart f income from 2023 u.s. Try it for free now! Subpart f income will likely end up as taxable income to the u.s. This approach is based on the principles underlying the united states’. Also, information pertaining to hovering deficits is no longer reported in column (d). Web schedule i is completed with a form 5471 to disclose the u.s. Form 5471, schedule i, total of lines 1 through 4. Try it for free now! Web the subpart f tax regime is used to ensure that certain passive income and other income generated from controlled foreign corporations is taxed in the us. New line 1c requests subpart. Upload, modify or create forms. Form 5471, schedule i, total of lines 1 through 4. Persons with respect to certain foreign corporations, is an information statement. Web these new lines request various types of subpart f income of the cfc. Shareholder's allocation of subpart f income from the cfc. Shareholder line 1 enter u.s. Persons with respect to certain foreign corporations go to www.irs.gov/form5471 for instructions and the latest information. Persons with respect to certain foreign corporations, is an information statement. Shareholder's allocation of subpart f income from the cfc. Web the form 5471 and its schedules are used to satisfy the reporting requirements of internal revenue code sections. Schedule i is completed alongside w. Web what is subpart f income? Web several types of income are labelled by the irs as subpart f income. Also, line 3 has been reworded. Person who disposes of sufficient stock in the foreign corporation to reduce its interest to less than the stock ownership requirement. Whether or not a taxpayer is required to. Web the subpart f tax regime is used to ensure that certain passive income and other income generated from controlled foreign corporations is taxed in the us. Web subpart f income definition explains a type of deferred tax on the income of shareholders of a controlled foreign corporation (cfc) after they have received these dividends. Web pertaining to subpart f income, tested income, and residual income, respectively. Ad download or email irs 5471 & more fillable forms, register and subscribe now! Ad get ready for tax season deadlines by completing any required tax forms today. The old line 3 language has been deleted to reflect p.l. The subpart f income provisions eliminate deferral of us tax on some categories of foreign income by taxing certain us persons currently on their pro rata share of such income earned by their controlled foreign corporations (cfcs). Persons with respect to certain foreign corporations, is an information statement. Web subpart f income of u.s. Persons with respect to certain foreign corporations go to www.irs.gov/form5471 for instructions and the latest information. Web what is subpart f income? Subpart f income rules have been around since the 1960s and are designed to prevent u.s. If the cfc’s revenue consists of subpart f income, a portion of that income may have to be recognized as a deemed dividend. Schedule i is completed alongside w. Web several types of income are labelled by the irs as subpart f income. Web what is form 5471? Form 5471, schedule i, total of lines 1 through 4. This approach is based on the principles underlying the united states’. Person who disposes of sufficient stock in the foreign corporation to reduce its interest to less than the stock ownership requirement.Editable IRS Form 5471 2018 2019 Create A Digital Sample in PDF

FORM 5471 SUBPART F FOREIGN TAX PLANNING YouTube

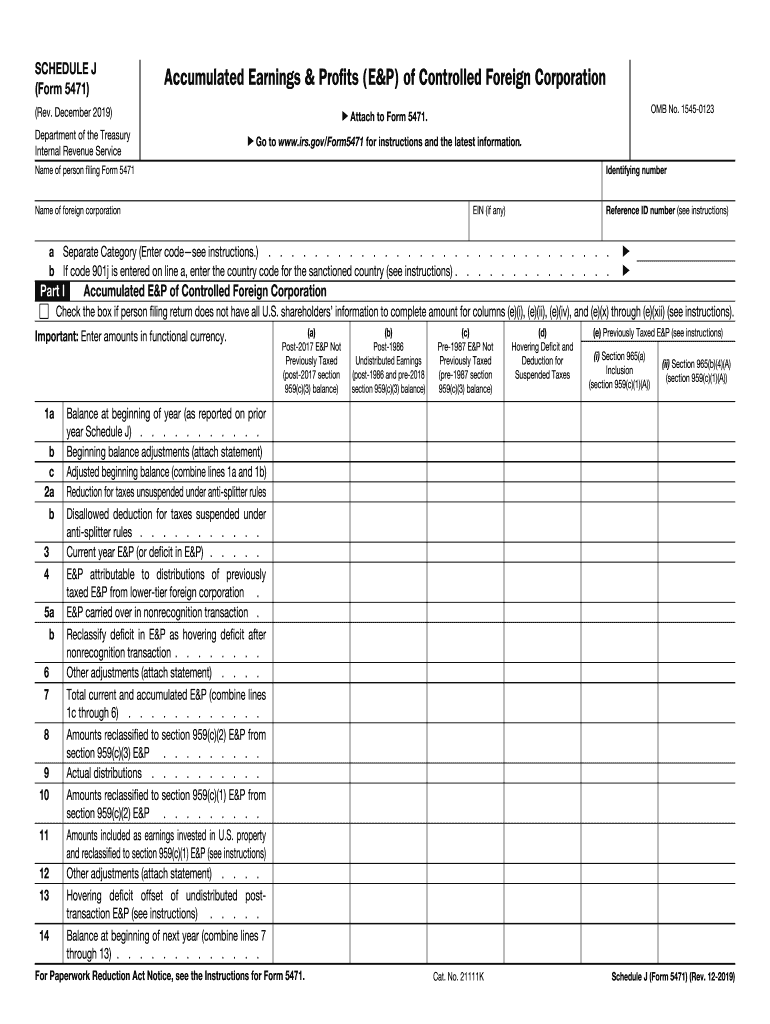

Form 5471 schedule j Fill out & sign online DocHub

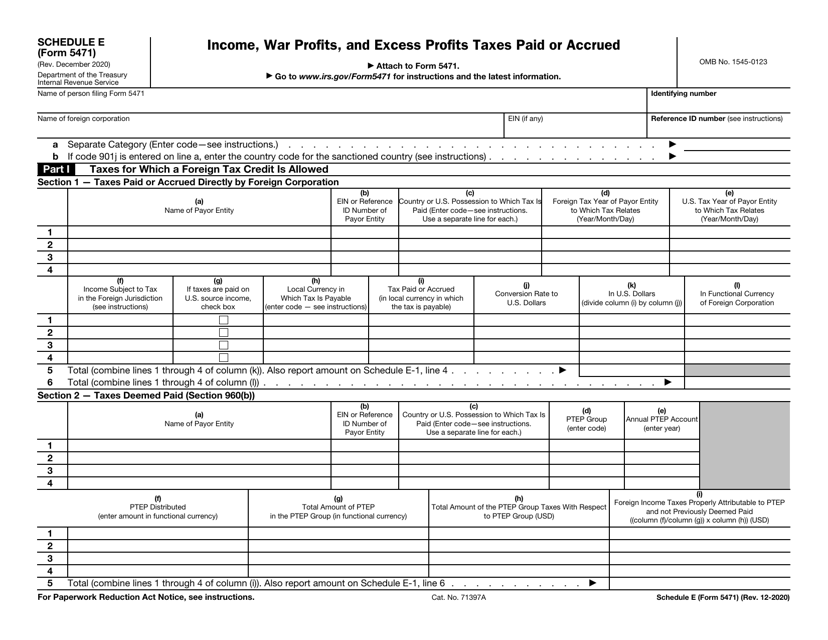

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Substantial Compliance Form 5471 HTJ Tax

2002 HTML Instructions for Form 5471,

Schedule C Statement IRS Form 5471 YouTube

IRS Issues Updated New Form 5471 What's New?

Schedule I Summary of Shareholder IRS Form 5471 YouTube

Schedule Q CFC by Groups IRS Form 5471 YouTube

Related Post: