What Is Form 480.6C

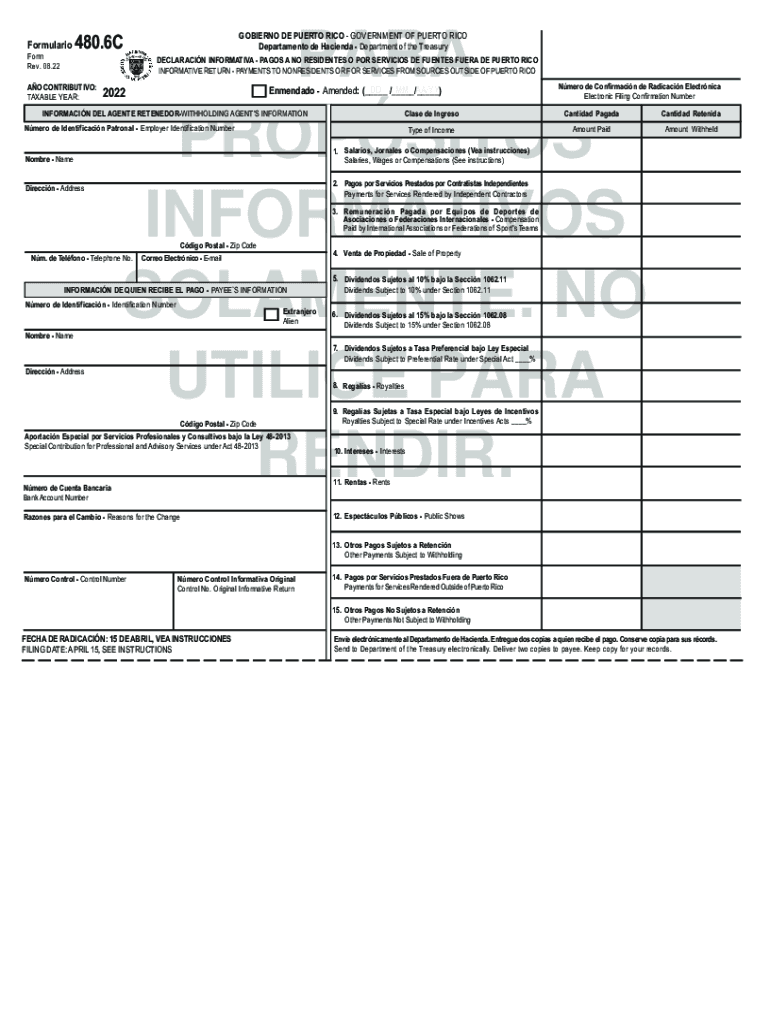

What Is Form 480.6C - Web puerto rico form 480.6c for dividends and taxes withheld within an ira. Us resident sold house in puerto rico, received form 480.6c showing house sale +tax withheld for non resident. Web it depends.480.6c is a form issued in puerto rico for dividends and taxes withheld within an ira. Dividends earned in traditional iras are not taxed when they are paid or reinvested,. Web payment processing entities must file this informative return to report annually the total amount of payments processed and credited to the participating merchant. Addition or elimination of certain areas. Tax return reporting income from worldwide sources. Web in contracting for the services of any person under this section, the secretary shall utilize private collection contractors and debt collection centers on the schedule required under. It covers investment income that has been subject to puerto rico source withholding. It covers investment income that has been subject to puerto rico source withholding. Is this reported on 1040 & Web payment processing entities must file this informative return to report annually the total amount of payments processed and credited to the participating merchant. Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. According to awesome turbo tax agent johnb5677, he states.. Web it depends.480.6c is a form issued in puerto rico for dividends and taxes withheld within an ira. Report that income when you file your return Web payment processing entities must file this informative return to report annually the total amount of payments processed and credited to the participating merchant. Is this reported on 1040 & It covers investment income. Upon the hearing, if it appears after consideration of all objections. Addition or elimination of certain areas. Dividends earned in traditional iras are not taxed when they are paid or reinvested,. Generally, you can claim a foreign tax credit for income taxes paid to puerto rico on the puerto rico income that is. It covers investment income that has been. According to awesome turbo tax agent johnb5677, he states. Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web puerto rico form 480.6c for dividends and taxes withheld within an ira. It covers investment income that has been subject to puerto rico source withholding. File now gvp2614 level. Web puerto rico form 480.6c for dividends and taxes withheld within an ira. Web prepare el formulario 480.6c por cada individuo o fiduciario no residente o extranjero no residente y por cada corporación o so ciedad extranjera no dedicada a industria o. Us resident sold house in puerto rico, received form 480.6c showing house sale +tax withheld for non resident.. Web puerto rico form 480.6c for dividends and taxes withheld within an ira. Tax return reporting income from worldwide sources. According to awesome turbo tax agent johnb5677, he states. Upon the hearing, if it appears after consideration of all objections. Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment. Web puerto rico form 480.6c for dividends and taxes withheld within an ira. Web it depends.480.6c is a form issued in puerto rico for dividends and taxes withheld within an ira. It covers investment income that has been subject to puerto rico source withholding. Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses. File now gvp2614 level 3 i provided service for a company in puerto rico and just. Dividends earned in traditional iras are not taxed when they are paid or reinvested,. Web in contracting for the services of any person under this section, the secretary shall utilize private collection contractors and debt collection centers on the schedule required under. Addition or. Web prepare el formulario 480.6c por cada individuo o fiduciario no residente o extranjero no residente y por cada corporación o so ciedad extranjera no dedicada a industria o. Web puerto rico form 480.6c for dividends and taxes withheld within an ira. Web in contracting for the services of any person under this section, the secretary shall utilize private collection. Generally, you can claim a foreign tax credit for income taxes paid to puerto rico on the puerto rico income that is. Web payment processing entities must file this informative return to report annually the total amount of payments processed and credited to the participating merchant. Web it depends.480.6c is a form issued in puerto rico for dividends and taxes. Web payment processing entities must file this informative return to report annually the total amount of payments processed and credited to the participating merchant. Web it depends.480.6c is a form issued in puerto rico for dividends and taxes withheld within an ira. According to awesome turbo tax agent johnb5677, he states. It covers investment income that has been subject to puerto rico source withholding. Is this reported on 1040 & Tax return reporting income from worldwide sources. File now gvp2614 level 3 i provided service for a company in puerto rico and just. Dividends earned in traditional iras are not taxed when they are paid or reinvested,. Web puerto rico form 480.6c for dividends and taxes withheld within an ira. Web in contracting for the services of any person under this section, the secretary shall utilize private collection contractors and debt collection centers on the schedule required under. It covers investment income that has been subject to puerto rico source withholding. Web prepare el formulario 480.6c por cada individuo o fiduciario no residente o extranjero no residente y por cada corporación o so ciedad extranjera no dedicada a industria o. Generally, you can claim a foreign tax credit for income taxes paid to puerto rico on the puerto rico income that is. Addition or elimination of certain areas. It covers investment income that has been subject to puerto rico source withholding. Report that income when you file your return Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Upon the hearing, if it appears after consideration of all objections. Us resident sold house in puerto rico, received form 480.6c showing house sale +tax withheld for non resident.480.7C 2019 Public Documents 1099 Pro Wiki

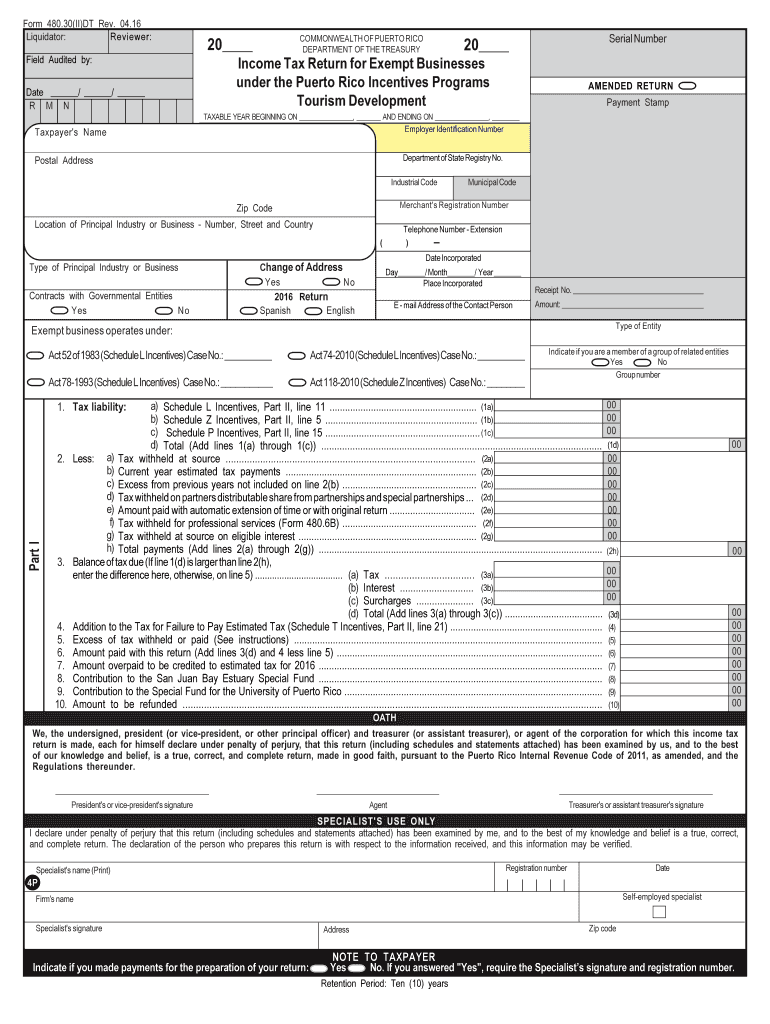

20192023 PR Form 480.20(U) Fill Online, Printable, Fillable, Blank

puerto rico form 480 20 instructions 2018 Fill out & sign online DocHub

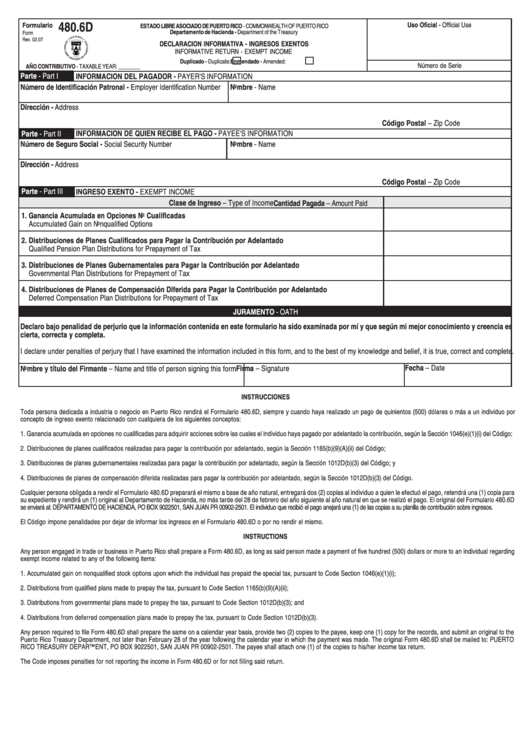

Form 480.6d Informative Return Exempt Puerto Rico

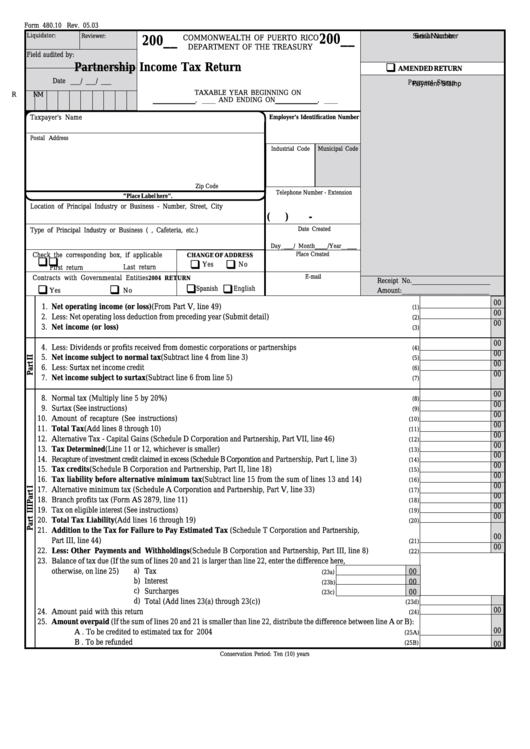

Form 480.10 Partnership Tax Return printable pdf download

2022 Form PR 480.6C Fill Online, Printable, Fillable, Blank pdfFiller

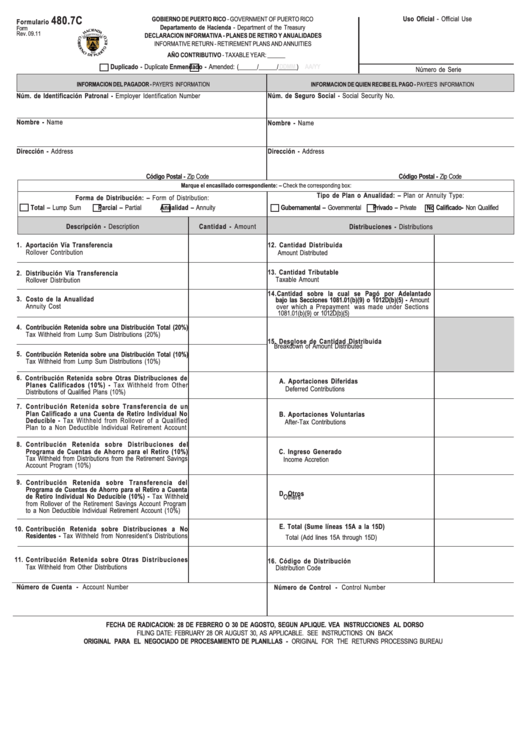

Form 480.7c Informative Return Retirement Plans And Annuities

Table Structure for Informative Returns data

Form 480 6c Instructions Fill Out and Sign Printable PDF Template

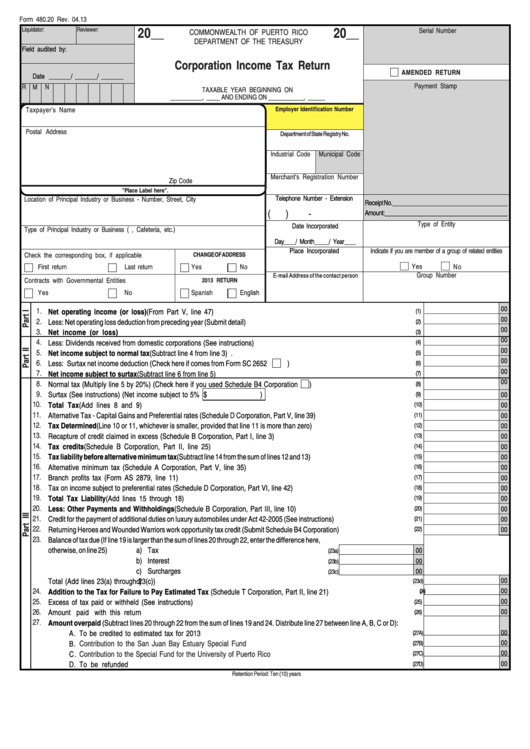

Form 480.20 Corporation Tax Return 2013 printable pdf download

Related Post: