What Is Form 13873-E

What Is Form 13873-E - Any version of irs form 13873 that clearly states that the form is provided to the. (2) an incomplete (i.e., a request that cannot be processed due to missing or. Irs has no record of a tax return. Web page last reviewed or updated: Use the box on form 13873 series. Web the announcement also explains form 13873, which students or parents might receive when requesting documents from the irs. There are several versions of irs form 13873 (e.g. Each company participating in the express service must complete form 13803, ives application form pdf, to enroll in the ives program. Web when sending a form 13873 series letter for other issues and the only signature issue is an unchecked attestation box, do not send form 14643. Web the fee will apply regardless of whether (1) a duplicate request for a return transcript is submitted; Any version of irs form 13873 that clearly states that the form is. Web the fee will apply regardless of whether (1) a duplicate request for a return transcript is submitted; Web there are several versions of irs form 13873 (e.g. (2) an incomplete (i.e., a request that cannot be processed due to missing or. Any version of irs form. A business activity code b product or product line c check the applicable box to. The irs income verification express service (ives) lets taxpayers authorize mortgage lenders, banks, and others to. Web web any version of irs form 13873 that clearly states that the form is provided to the individual as verification of nonfiling or that states that the irs. Web to do so, file one form 8873 entering only your name and identifying number at the top of the form. Any version of irs form 13873 that clearly states that the form is provided to the. What is irs form 13873 e? There are several versions of irs form 13873 (e.g. Also check box (1) (b) of line 5c. Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying foreign trade income. Web if you are an alien individual, file form 8843 to explain the basis of your claim that you can exclude days present in the united states for purposes of the. Also check box (1) (b) of line 5c. You. Attach a tabular schedule to the partially. Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying foreign trade income. You can file form 8822 informing the irs of your new address. Web taxfiler an irs form 13873. Each company participating in the express service must complete form 13803, ives application form pdf,. A business activity code b product or product line c check the applicable box to. Web to do so, file one form 8873 entering only your name and identifying number at the top of the form. Any version of irs form 13873 that clearly states that the form is provided to the individual as. Web sale and leasing income method. Web to do so, file one form 8873 entering only your name and identifying number at the top of the form. Attach a tabular schedule to the partially. Web there are several versions of irs form 13873 (e.g. You can file form 8822 informing the irs of your new address. Also check box (1) (b) of line 5c. Web taxfiler an irs form 13873. Web there are several versions of irs form 13873 (e.g. Web web any version of irs form 13873 that clearly states that the form is provided to the individual as verification of nonfiling or that states that the irs has no record of a tax. Web june 3, 2019 5:09 pm. Web the announcement. Each company participating in the express service must complete form 13803, ives application form pdf, to enroll in the ives program. Qualifying foreign trade income generally, qualifying. The irs income verification express service (ives) lets taxpayers authorize mortgage lenders, banks, and others to. Web if you are an alien individual, file form 8843 to explain the basis of your claim. The irs income verification express service (ives) lets taxpayers authorize mortgage lenders, banks, and others to. Irs has no record of a tax return. Web there are several versions of irs form 13873 (e.g. Web if you are an alien individual, file form 8843 to explain the basis of your claim that you can exclude days present in the united. Web the fee will apply regardless of whether (1) a duplicate request for a return transcript is submitted; There are several versions of irs form 13873 (e.g. Web june 3, 2019 5:09 pm. Any version of irs form 13873 that clearly states that the form is provided to the individual as. You can file form 8822 informing the irs of your new address. Web to do so, file one form 8873 entering only your name and identifying number at the top of the form. Attach a tabular schedule to the partially. What is irs form 13873 e? Web sale and leasing income method (i.e., line 44 equals line 45), complete only lines 5a and 5c(1). Irs has no record of a tax return. Any version of irs form 13873 that clearly states that the form is provided to the. Each company participating in the express service must complete form 13803, ives application form pdf, to enroll in the ives program. Web if you are an alien individual, file form 8843 to explain the basis of your claim that you can exclude days present in the united states for purposes of the. Web web any version of irs form 13873 that clearly states that the form is provided to the individual as verification of nonfiling or that states that the irs has no record of a tax. Use the box on form 13873 series. Web taxfiler an irs form 13873. Web then uses form 8873 to calculate its exclusion from income for extraterritorial income that is qualifying foreign trade income. A business activity code b product or product line c check the applicable box to. Web page last reviewed or updated: The irs income verification express service (ives) lets taxpayers authorize mortgage lenders, banks, and others to.Form 1310 Instructions Claiming a Refund on Behalf of a Deceased

form 13873t Fill Online, Printable, Fillable Blank

Irss forms tewspartners

U s individual tax return forms instructions & tax table (f1040a

BIR Form 1701 Download

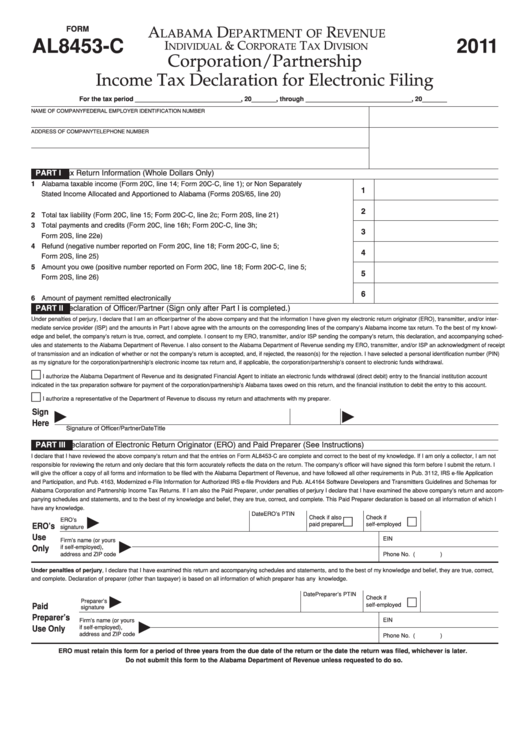

13 Alabama Al8453 Forms And Templates free to download in PDF

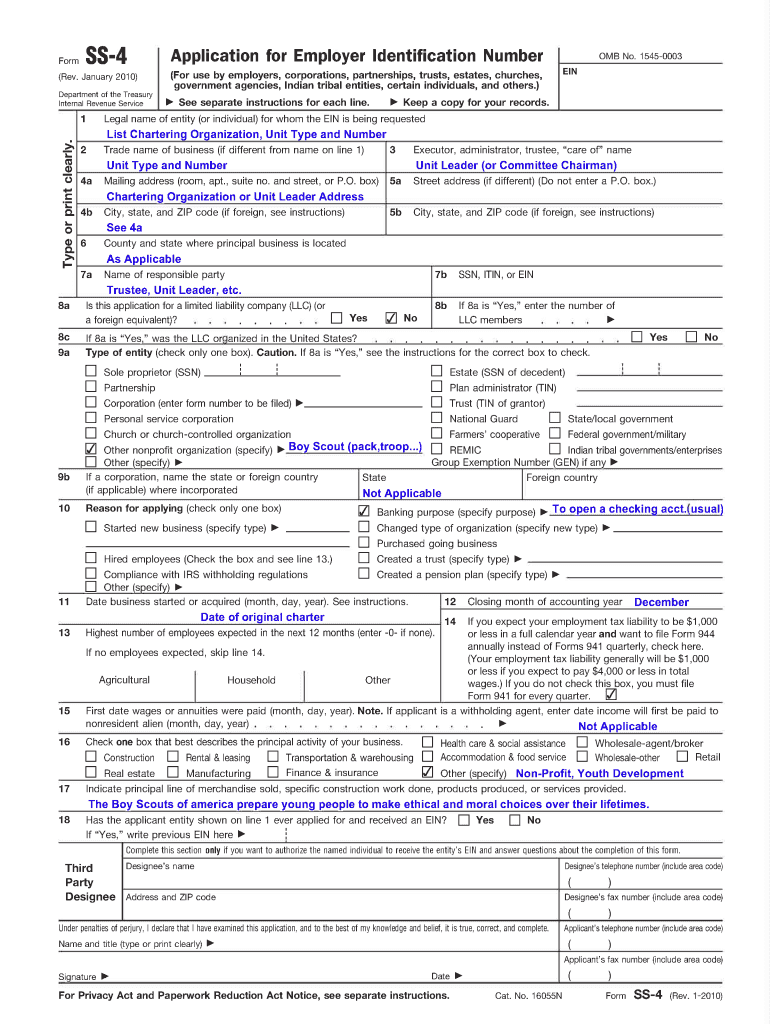

Form Ss 4 Fill and Sign Printable Template Online US Legal Forms

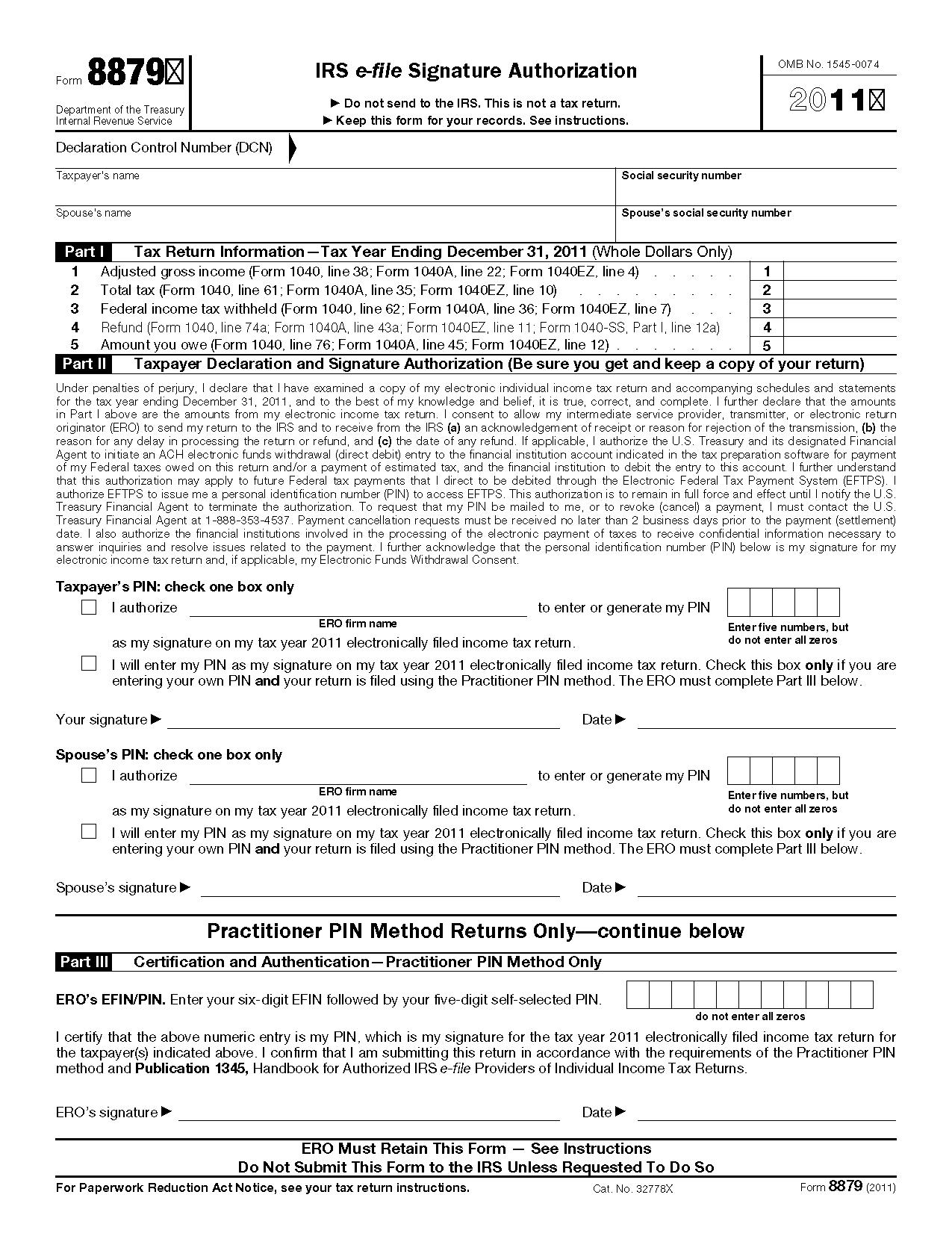

IRS E File Signature Authorization For Form 1040 1040 Form Printable

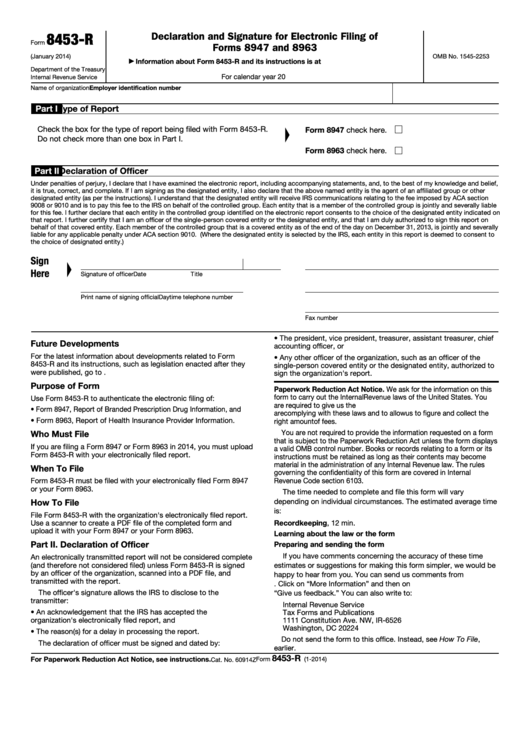

Fillable Form 8453R Declaration And Signature For Electronic Filing

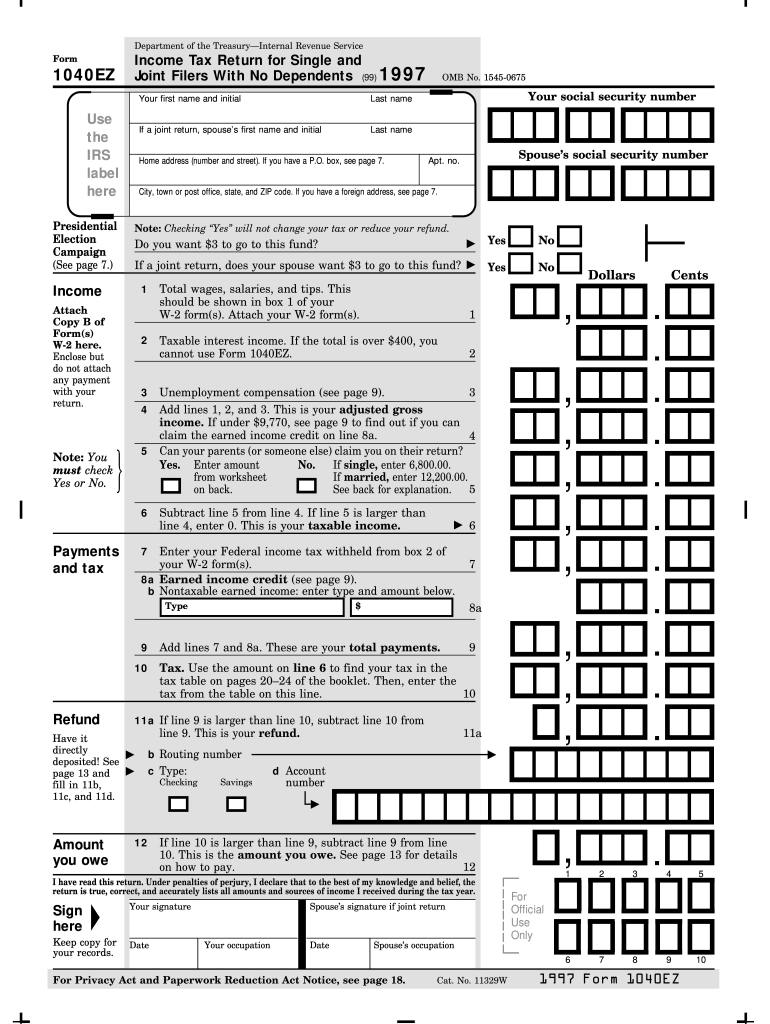

1997 1040 Ez Form 1997 Fill and Sign Printable Template Online US

Related Post: