What Is Ero On Tax Form

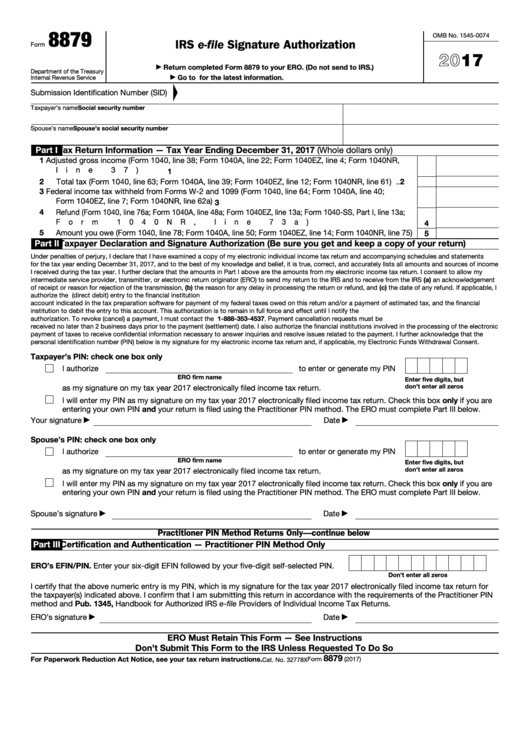

What Is Ero On Tax Form - What is irs form 9325? Web an ero on a tax form is a document that certifies the accuracy, authenticity, and validity of an electronically submitted tax return. Web if you paid a tax prep fee for someone to help you file your tax return, then your tax preparer is most likely your ero as well. In many cases, the ero also prepares. Ad uslegalforms.com has been visited by 100k+ users in the past month Adjust the amounts of credits claimed in the claimed column in part i. For form 1040, the ero name is shown on form 8879 as the signature. Web also — business owners who have been notified they are under audit can send the withdrawal request to the assigned examiner or respond to the audit notice if no. Ero must obtain and retain completed form. Form 8879 is the declaration document and. Web an ero on a tax form is a document that certifies the accuracy, authenticity, and validity of an electronically submitted tax return. Ad uslegalforms.com has been visited by 100k+ users in the past month Web certain businesses are designated as an electronic return originator, or ero, meaning that they are specifically licensed by the irs to file tax returns.. Web an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. Officially, the ero is the person. Web an ero on a tax form is a document that certifies the accuracy, authenticity, and validity of an electronically submitted tax return. Pass an irs suitability check. An electronic return originator (ero). Web an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. Web certain businesses are designated as an electronic return originator, or ero, meaning that they are specifically licensed by the irs to file tax returns. January 2021) department of the treasury internal revenue service. Web an ero on a. In many cases, the ero also. In many cases, the ero also prepares. Taxpayers, who currently use forms 8878 or 8879 to sign electronic forms 1040 federal tax returns or filing extensions, can. Ero must obtain and retain completed form. Web the electronic return originator, ero, is a person or business that originates federal income tax returns electronically for the. Web tax preparation means the completion of the forms and schedules needed to compute and report the tax. In many cases, the ero also prepares. An electronic return originator (ero) pin is a numeric representation of the preparer's. What is ero on tax. January 2021) department of the treasury internal revenue service. Pass an irs suitability check. Web also — business owners who have been notified they are under audit can send the withdrawal request to the assigned examiner or respond to the audit notice if no. For form 1040, the ero name is shown on form 8879 as the signature. Web what is ero on tax form 8879? Tax returns can. Web if you paid a tax prep fee for someone to help you file your tax return, then your tax preparer is most likely your ero as well. Ero must obtain and retain completed form. Web also — business owners who have been notified they are under audit can send the withdrawal request to the assigned examiner or respond to. Web solved•by intuit•61•updated february 10, 2023. Officially, the ero is the person. In many cases, the ero also prepares. Ero must obtain and retain completed form. Web the electronic return originator, ero, is a person or business that originates federal income tax returns electronically for the internal revenue. Web what is ero on tax form 8879? An electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. For form 1040, the ero name is shown on form 8879 as the signature. Taxpayers, who currently use forms 8878 or 8879 to sign electronic forms 1040 federal tax returns or filing. Web also — business owners who have been notified they are under audit can send the withdrawal request to the assigned examiner or respond to the audit notice if no. Officially, the ero is the person. Form 8879 is the declaration document and. Web solved•by intuit•61•updated february 10, 2023. Web if you paid a tax prep fee for someone to. In many cases, the ero also. See the note below from. Web tax preparation means the completion of the forms and schedules needed to compute and report the tax. An electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. Taxpayers, who currently use forms 8878 or 8879 to sign electronic forms 1040 federal tax returns or filing extensions, can. Web what is ero on tax form 8879? Web the ero is the person or firm who collects the actual return from the taxpayer or preparer for the purpose of electronically filing it with the irs. Form 8879 is the declaration document and. January 2021) department of the treasury internal revenue service. Web certain businesses are designated as an electronic return originator, or ero, meaning that they are specifically licensed by the irs to file tax returns. Pass an irs suitability check. Web completing all of the forms and schedules needed to compute and report the tax is known as ero. What is irs form 9325? Web an ero on a tax form is a document that certifies the accuracy, authenticity, and validity of an electronically submitted tax return. Ad uslegalforms.com has been visited by 100k+ users in the past month Web an electronic return originator (ero) is a business which is authorized to electronically submit a tax return to the irs. What is ero on tax. Web also — business owners who have been notified they are under audit can send the withdrawal request to the assigned examiner or respond to the audit notice if no. Officially, the ero is the person. Web solved•by intuit•61•updated february 10, 2023.IRS Form 941 Payroll Taxes errors late payroll taxes

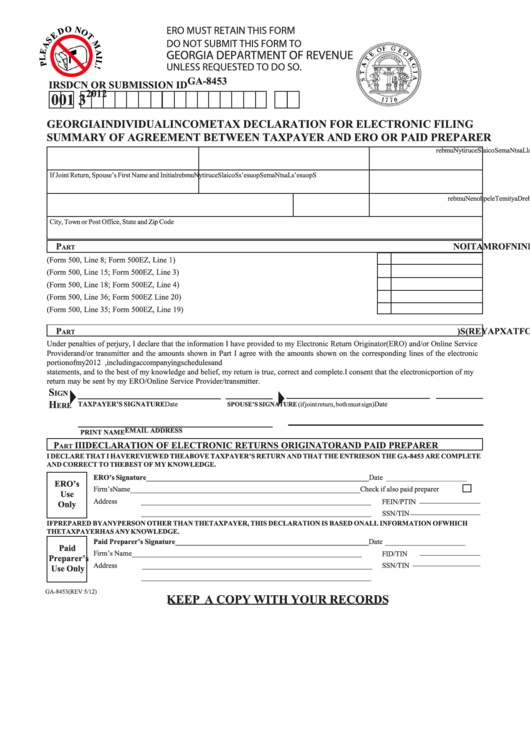

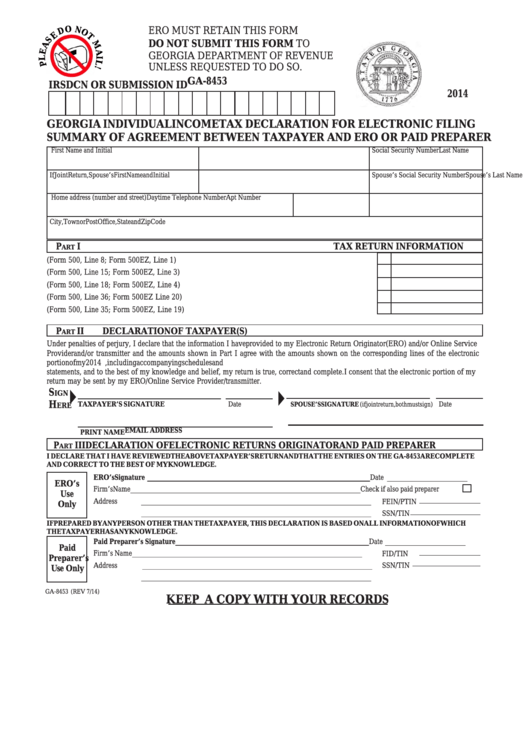

Fillable Form Ga8453 Individual Tax Declaration For

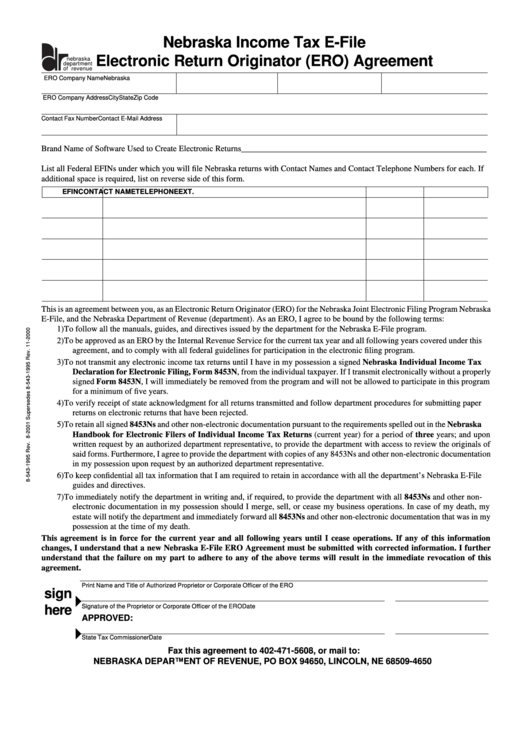

Form 85431999 Nebraska Tax EFile Electronic Return

How to manually add ERO information in the EF Originators database in

Form 8878A IRS EFile Electronic Funds Withdrawal Authorization for

ERO eFiling 94x Completing Form 8879EMP (DAS)

form 8879eo 2018 Fill Online, Printable, Fillable Blank form8879

ERO eFiling 94X Completing Form 8879EMP (CWU)

Fillable Form Ga8453 Individual Tax Declaration For

Fillable Form 8879 Irs E File Signature Authorization 2017 Free Nude

Related Post:

.jpg)