Ca Form 592-Pte

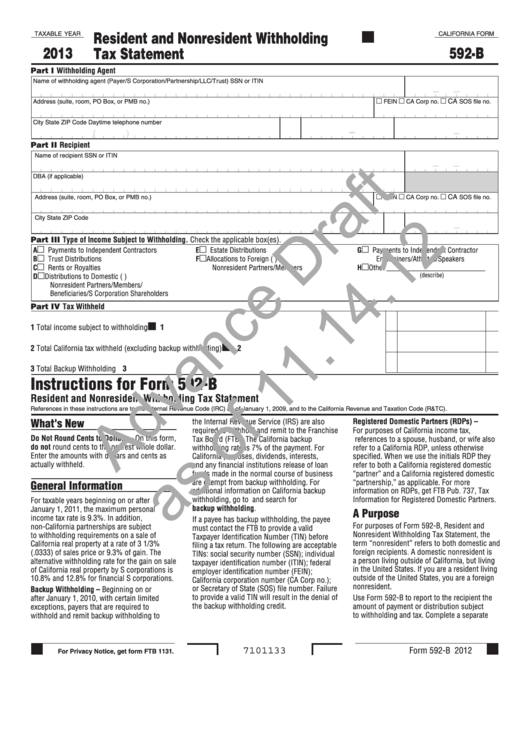

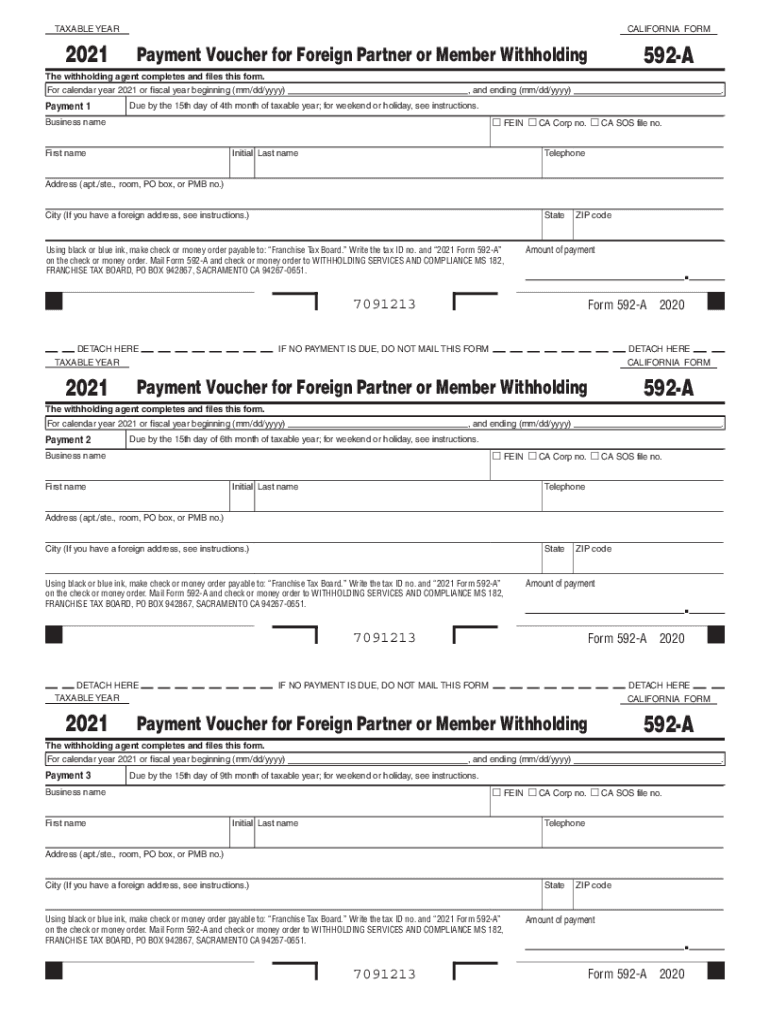

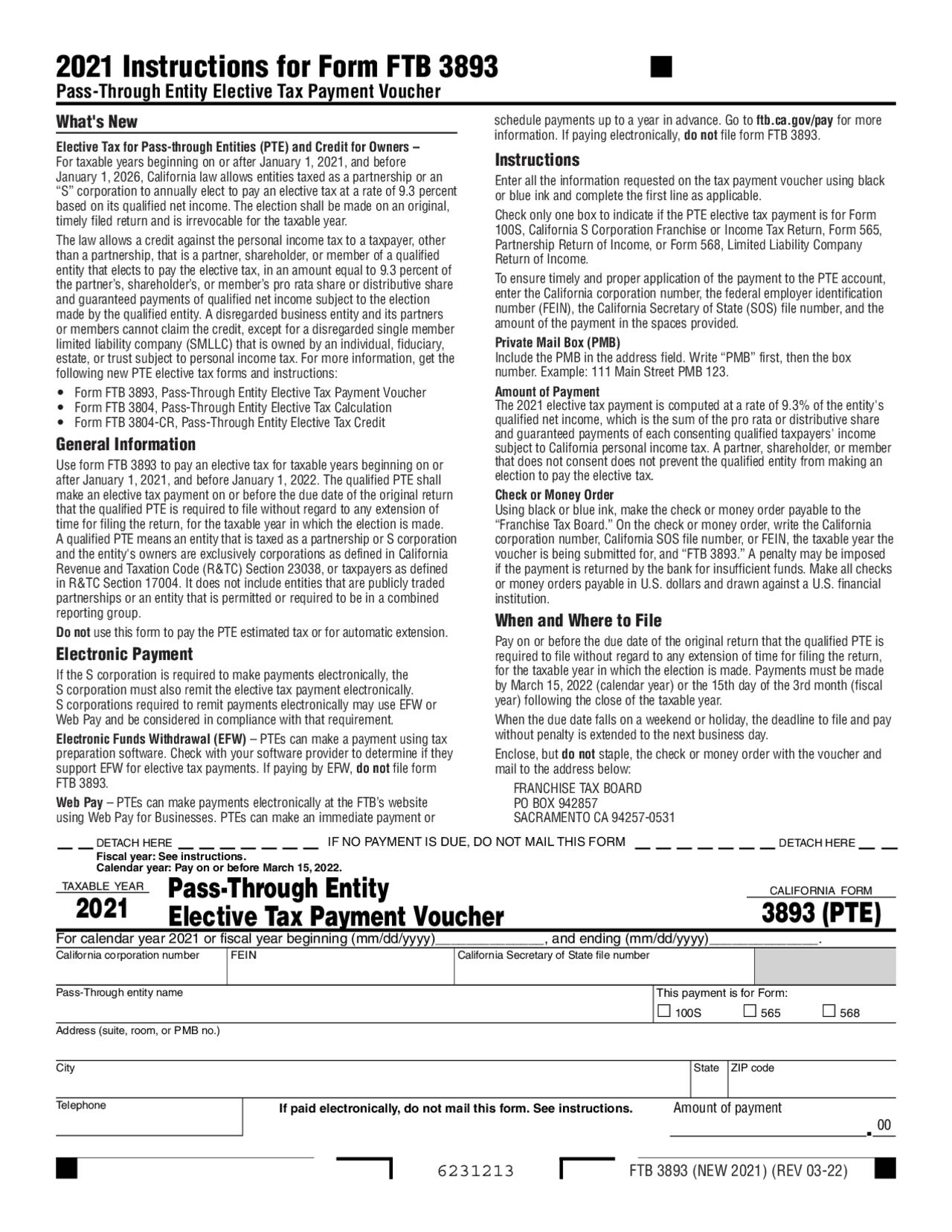

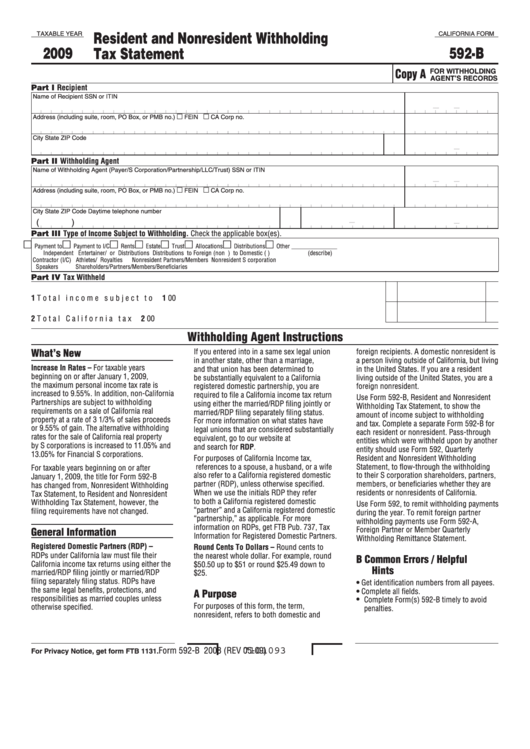

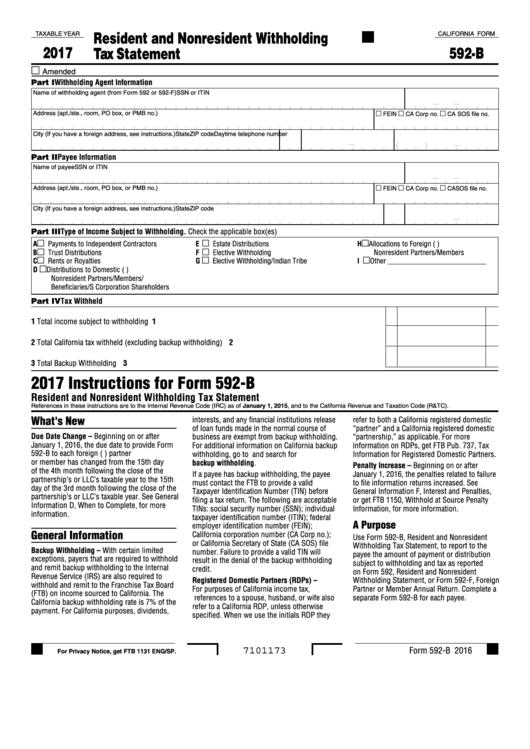

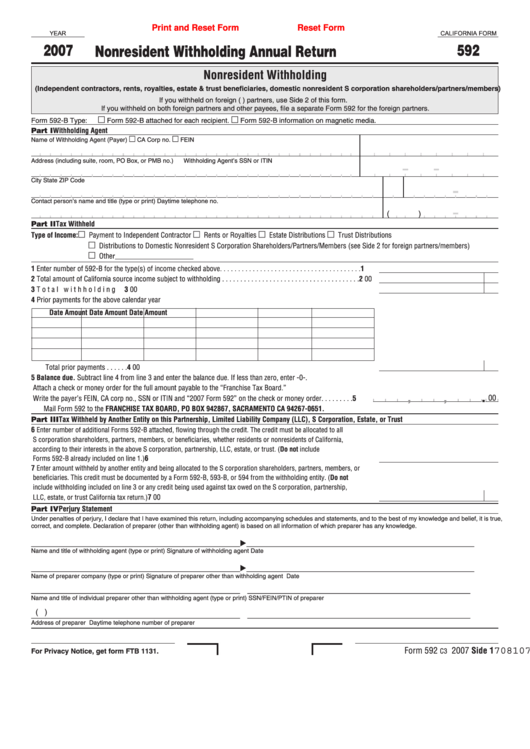

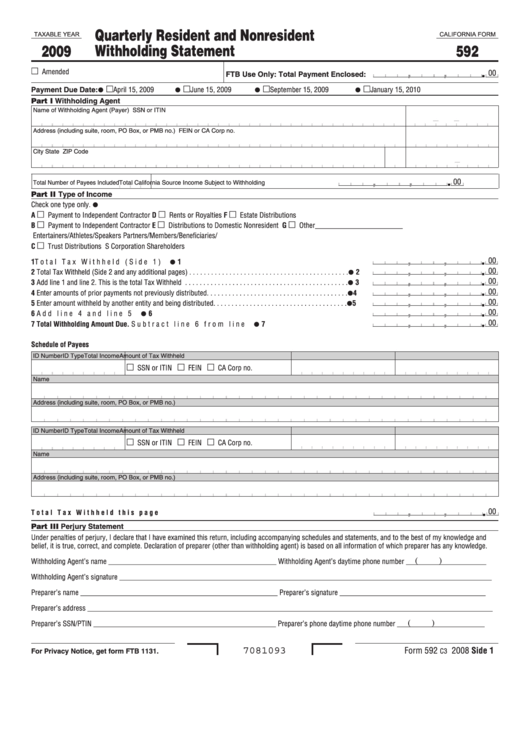

Ca Form 592-Pte - Web whether or not to elect into the california pte tax regime. Verify the state of california is active in the return; To explain the factors which are creating delays for 2021 state of california forms. To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested. Go to interview form k. Web form 592, resident and nonresident withholding statement can be added to the return by marking the 592 withholding checkbox in file > client properties > california tab. Either state form 565 or 568 should be generated. Either state form 565 or 568 should be. Web california > other information: Bookkeeper did as she has always done, which is to file the 592 and submit the funds. Web whether or not to elect into the california pte tax regime. Web form 592, resident and nonresident withholding statement can be added to the return by marking the 592 withholding checkbox in file > client properties > california tab. Web california enacted ab 150 on july 16, 2021, allowing eligible businesses to elect into a pte tax as a. Bookkeeper did as she has always done, which is to file the 592 and submit the funds. Go to interview form k. Verify the state of california is active in the return; Verify the state of california is active in the return; Four separate payment vouchers by default for the client to spread out the. Web whether or not to elect into the california pte tax regime. Web california enacted ab 150 on july 16, 2021, allowing eligible businesses to elect into a pte tax as a workaround to the $10,000 limitation on the federal itemized deduction for state. Either state form 565 or 568 should be generated. To explain the factors which are creating. Four separate payment vouchers by default for the client to spread out the. Verify the state of california is active in the return; Web california enacted ab 150 on july 16, 2021, allowing eligible businesses to elect into a pte tax as a workaround to the $10,000 limitation on the federal itemized deduction for state. Web form 592, resident and. Verify the state of california is active in the return; Bookkeeper did as she has always done, which is to file the 592 and submit the funds. Four separate payment vouchers by default for the client to spread out the. Web california enacted ab 150 on july 16, 2021, allowing eligible businesses to elect into a pte tax as a. A pte is generally an entity that passes its. Four separate payment vouchers by default for the client to spread out the. Verify the state of california is active in the return; Verify the state of california is active in the return; Web form 592, resident and nonresident withholding statement can be added to the return by marking the 592. Web california > other information: Go to interview form k. To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested. Either state form 565 or 568 should be. Four separate payment vouchers by default for the client to spread out the. Verify the state of california is active in the return; Four separate payment vouchers by default for the client to spread out the. Verify the state of california is active in the return; Either state form 565 or 568 should be generated. Web form 592, resident and nonresident withholding statement can be added to the return by marking the 592. Either state form 565 or 568 should be. To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested. Verify the state of california is active in the return; Web whether or not to elect into the california pte tax regime. Verify the state of california is active in the return; A pte is generally an entity that passes its. Web california > other information: Bookkeeper did as she has always done, which is to file the 592 and submit the funds. Four separate payment vouchers by default for the client to spread out the. Web form 592, resident and nonresident withholding statement can be added to the return by marking. Verify the state of california is active in the return; Either state form 565 or 568 should be generated. Web whether or not to elect into the california pte tax regime. Verify the state of california is active in the return; To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested. Go to interview form k. Web california enacted ab 150 on july 16, 2021, allowing eligible businesses to elect into a pte tax as a workaround to the $10,000 limitation on the federal itemized deduction for state. To explain the factors which are creating delays for 2021 state of california forms. Four separate payment vouchers by default for the client to spread out the. Either state form 565 or 568 should be. A pte is generally an entity that passes its. Web form 592, resident and nonresident withholding statement can be added to the return by marking the 592 withholding checkbox in file > client properties > california tab. Bookkeeper did as she has always done, which is to file the 592 and submit the funds. Web california > other information:California Form 592B Draft Resident And Nonresident Withholding Tax

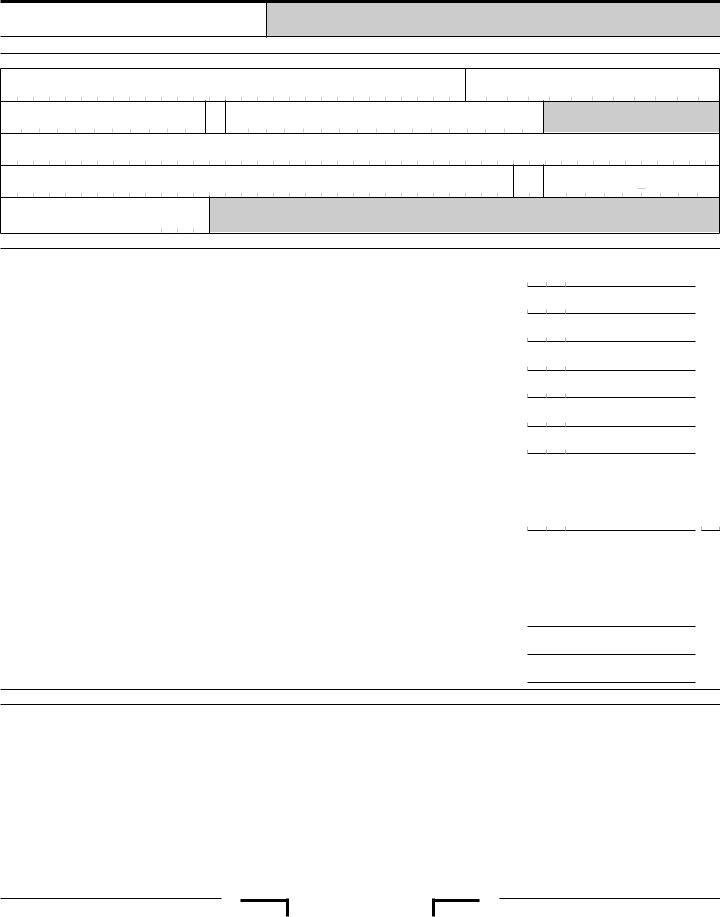

California Form 592 F ≡ Fill Out Printable PDF Forms Online

Form 592 Pte Fill Online, Printable, Fillable, Blank pdfFiller

California 592 A Fill Out and Sign Printable PDF Template signNow

2021 Instructions for Form 3893, PassThrough Entity Elective

2021 Form CA FTB 592F Fill Online, Printable, Fillable, Blank pdfFiller

Fillable California Form 592B Resident And Nonresident Withholding

Form 592 Fillable Printable Forms Free Online

California Form 592 Nonresident Withholding Annual Return 2007

Fillable California Form 592 Quarterly Resident And Nonresident

Related Post: