What Is A Stock Block On Form 7203

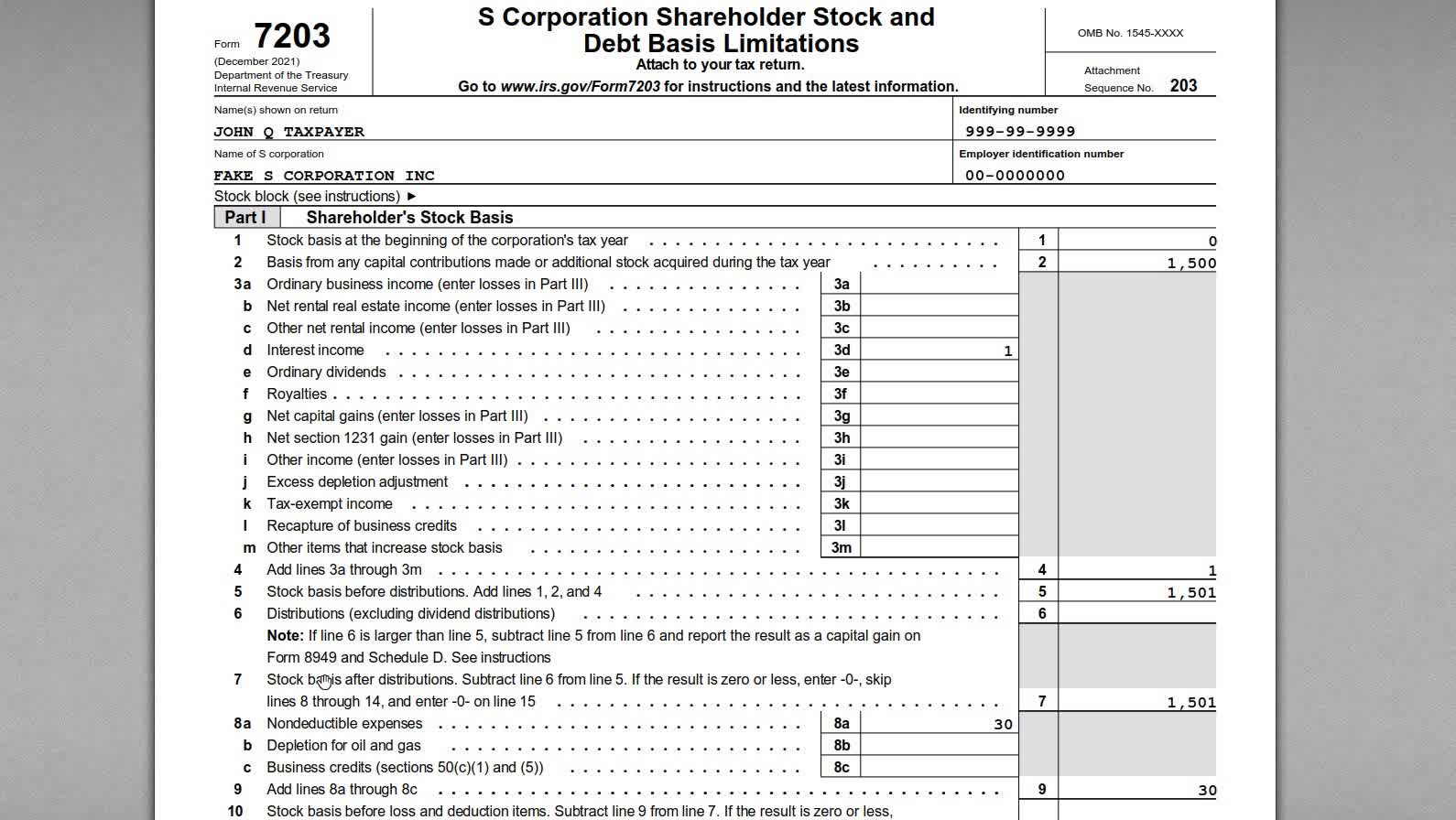

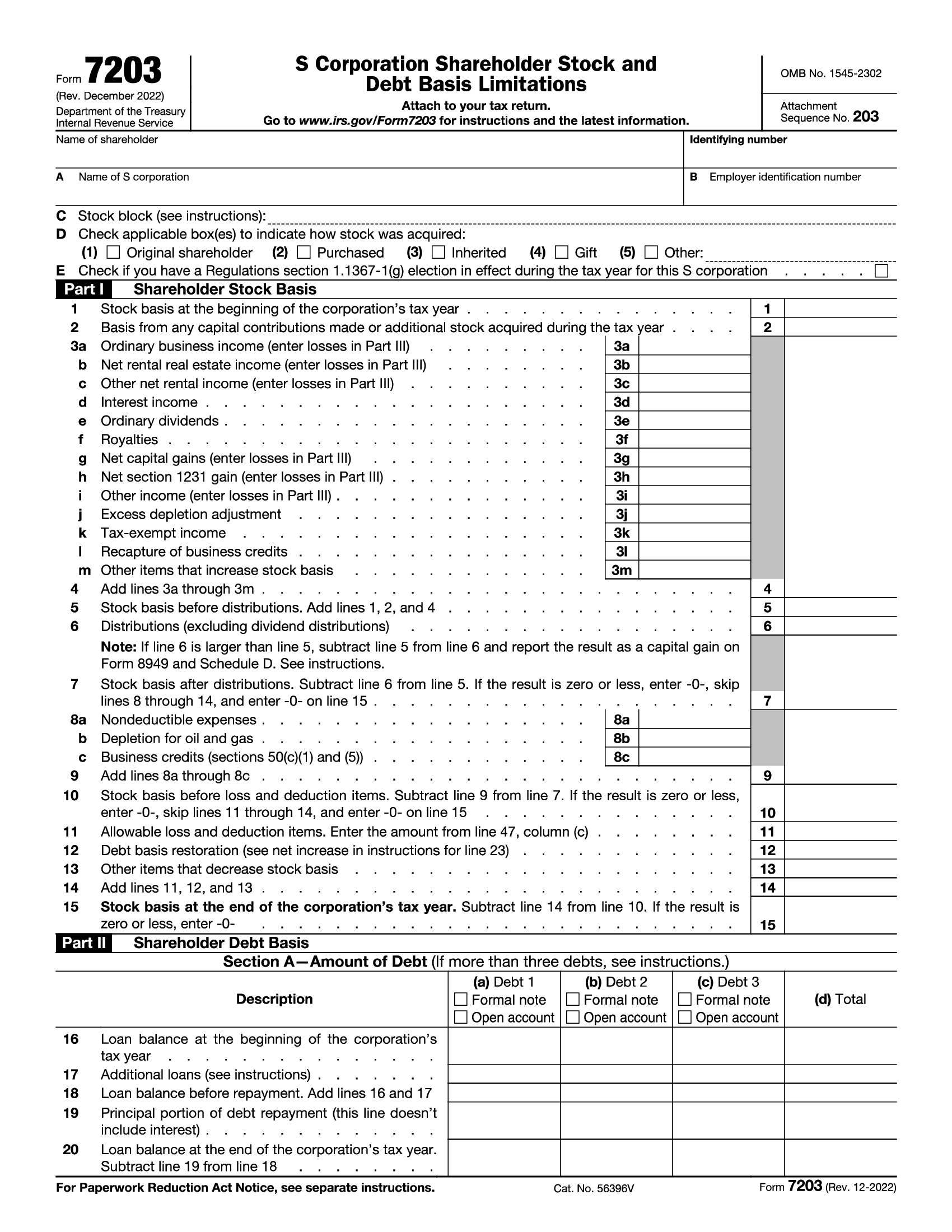

What Is A Stock Block On Form 7203 - You will enter 1 for the stock block if you have only purchased 1 block of stocks. Web what is form 7203? Web 1 day agoyes, macroeconomic headwinds have negatively affected this fintech company's growth numbers. Form 7203, s corporation shareholder stock and debt basis limitations, is used by the s corporation shareholder to calculate and report their stock and debt basis. How do i clear ef messages 5486 and 5851? Block still has some serious potential. Web stock block (see instructions). For instance, if you purchase 100 shares on day 1 then purchase 100 more. This form is required to be. Web a stock block is a specifically identifiable block of stock that either has a different stock basis compared to other shares of stock or a different holding period. Web stock block (see instructions): S corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s. Block still has some serious potential. Web 1 day agoyes, macroeconomic headwinds have negatively affected this fintech company's growth numbers. Web other items that increase stock basis for line 3m. Irs form 7203 is a tax form used to report the basis of your shares in an s corporation. Web page last reviewed or updated: Web using form 7203, john can track the basis of each stock block separately directly on his income tax return. Web other items that increase stock basis for line 3m. Web you must complete and. Web stock block (see instructions). Web stock block (see instructions): You will enter 1 for the stock block if you have only purchased 1 block of stocks. Web form 7203 is filed by s corporation shareholders who: Web since shareholder stock basis in an s corporation changes every year, it must be computed every year. Web in the case of a partial stock sale or partial stock redemption, shareholders should file more than one form 7203 and indicate which period it covers. Web the stock block on form 7203 is to identify your shares so you can keep track. Form 7203, s corporation shareholder stock and debt basis limitations, is used by the s corporation. Web since shareholder stock basis in an s corporation changes every year, it must be computed every year. Irs form 7203 is a tax form used to report the basis of your shares in an s corporation. Other code sections might also cause a reduction in s. Web a separate form 7203 is needed for each block of stock if. Web you must complete and file form 7203 if you’re an s corporation shareholder and you: Web in the case of a partial stock sale or partial stock redemption, shareholders should file more than one form 7203 and indicate which period it covers. Check applicable box(es) to indicate how stock was acquired: Block still has some serious potential. Web stock. Web other items that increase stock basis for line 3m. Stock basis at the beginning of the corporation’s tax year. (1) original shareholder (2) purchased (3) inherited (4) gift (5) other: Form 7203, s corporation shareholder stock and debt basis limitations, is used by the s corporation shareholder to calculate and report their stock and debt basis. Web the stock. (1) original shareholder (2) purchased (3) inherited (4) gift (5) other: Other items that decrease stock basis for line 13. Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a. You use either number or a description such as 100 shares of abc corp. Are claiming a deduction for their share of an aggregate. S corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s. Other items that decrease stock basis for line 13. This form helps you calculate the adjusted basis of your. (1) original shareholder (2) purchased (3) inherited (4) gift (5) other: Web the stock block on form 7203 is to identify your shares. Shareholder stock basis part i of form 7203 addresses adjustments to stock basis as provided under section 1367. Web what is form 7203? For instance, if you purchase 100 shares on day 1 then purchase 100 more. Other code sections might also cause a reduction in s. Stock basis at the beginning of the corporation’s tax year. Part i shareholder stock basis. Business credits (sections 50(c)(1) and (5)) for line 8c. Web since shareholder stock basis in an s corporation changes every year, it must be computed every year. Web stock block (see instructions): Form 7203, s corporation shareholder stock and debt basis limitations,. In 2022, john decides to sell 50 shares of company a stock. Web you must complete and file form 7203 if you’re an s corporation shareholder and you: You will enter 1 for the stock block if you have only purchased 1 block of stocks. Web what is form 7203? Are claiming a deduction for their share of an aggregate loss from an s corporation (including an aggregate loss not. Web in the case of a partial stock sale or partial stock redemption, shareholders should file more than one form 7203 and indicate which period it covers. Other code sections might also cause a reduction in s. Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a. Stock basis at the beginning of the corporation’s tax year. Other items that decrease stock basis for line 13. Web 1 day agoyes, macroeconomic headwinds have negatively affected this fintech company's growth numbers. Web stock block (see instructions). Block still has some serious potential. Check applicable box(es) to indicate how stock was acquired: A separate form 7203 is needed for each spouse.How to Complete IRS Form 7203 S Corporation Shareholder Basis

IRS Form 7203 Multiple Blocks of S Corporation Stock YouTube

Form7203PartI PBMares

More Basis Disclosures This Year for S corporation Shareholders Need

Form 7203 S Corporation Shareholder Stock and Debt Basis Limitations

IRS Form 7203 S Corporation Losses Allowed with Stock & Debt Basis

IRS Form 7203. S Corporation Shareholder Stock and Debt Basis

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Related Post: