What Is A 2210 Tax Form

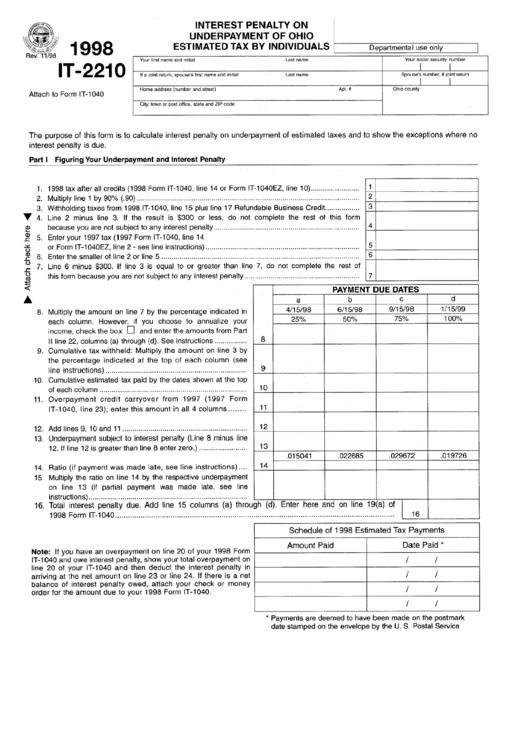

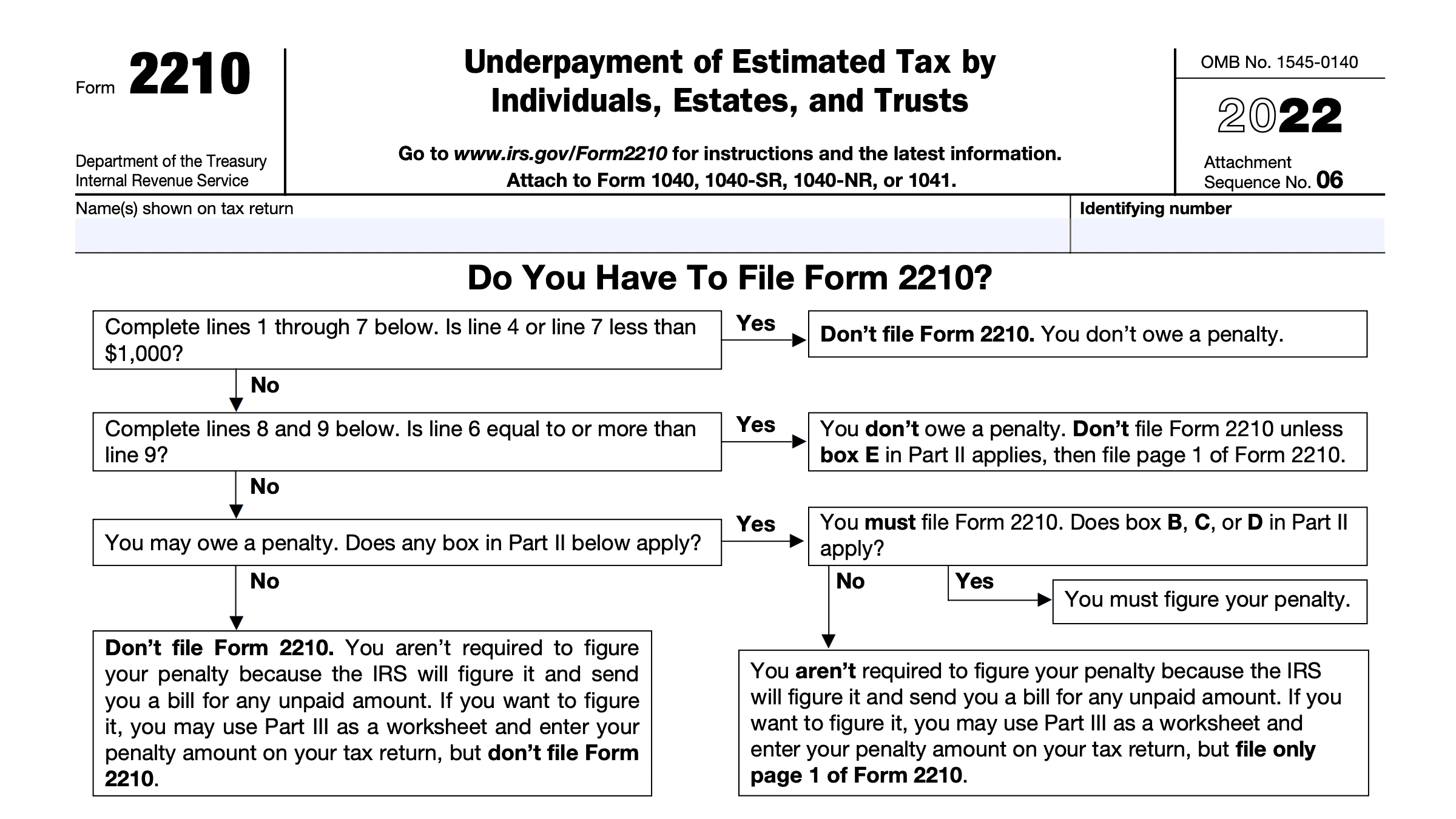

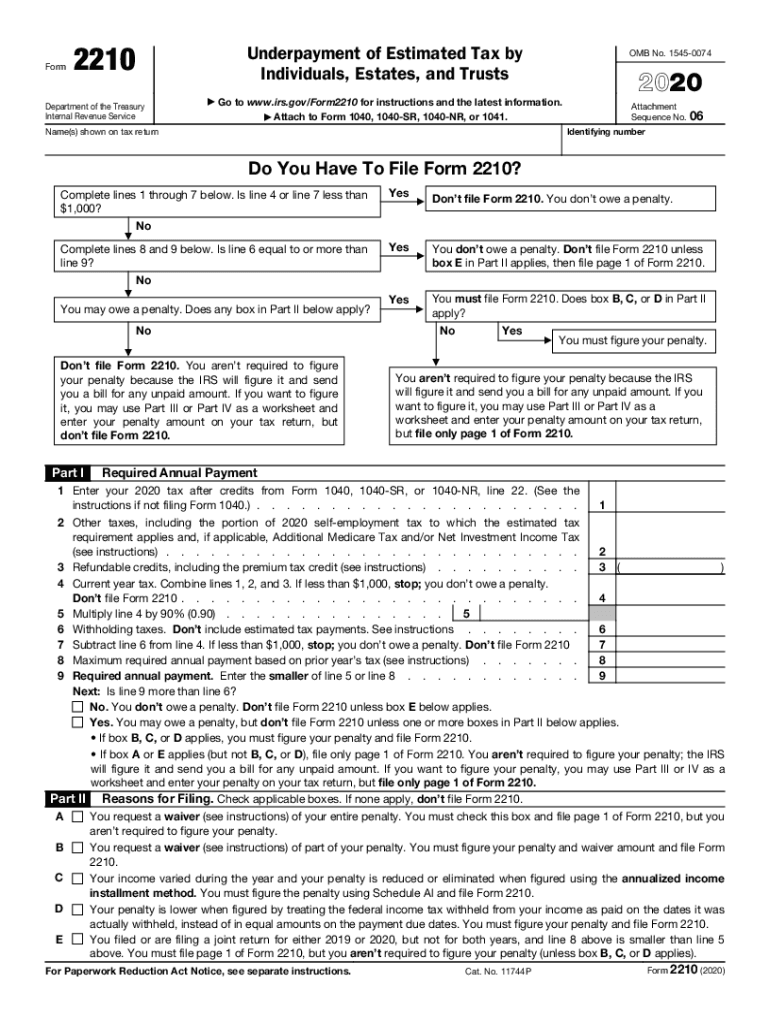

What Is A 2210 Tax Form - If you’re filing an income tax return and haven’t paid enough in income taxes throughout the tax year, you may be filling out irs form. Web a taxpayer will incur a penalty if the amount of his estimated tax payment fails to reach the “safe harbor payments”: The form doesn't always have to be. Form 2210 is used to calculate a penalty when the taxpayer has underpaid on their estimated taxes (quarterly es vouchers). You may need this form if: The amount on line 4 of your 2210 form last year would be the same as the amount on line 24 of your. Underpayment of estimated tax by individuals, estates, and trusts. Web form 2210 is a federal individual income tax form. Irs form 2210(underpayment of estimated tax by individuals, estates, and trusts) calculates the. This is done either through withholdings from your. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. While everyone living in the. Department of the treasury internal revenue service. The form doesn't always have to be. This is most common with self. How do i complete form 2210 within the program? Web instructions for form 2210. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty. While everyone living in the. Underpayment of estimated tax by individuals, estates, and trusts. Estimate how much you could potentially save in just a matter of minutes. This is most common with self. Web what is form 2210? While everyone living in the. Web instructions for form 2210. Web instructions for form 2210 (2022) underpayment of estimated tax by individuals, estates, and trusts. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. Web form 2210 is a federal individual income tax form. Your income varies during the year. If you’re filing an income tax return and haven’t paid enough in income. You may not have had to file form 2210 last year. Web for what is form 2210 used? Note the delete form button at the bottom of the screen. While everyone living in the. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Web yes, you could download the form 2210 from the irs website and use it as a guide to make your entries into turbotax when it is available for efile after 2/24. Section references are to the internal revenue code unless otherwise. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for. If you’re filing an income tax return and haven’t paid enough in income taxes throughout the tax year, you may be filling out irs form. You may need this form if: Estimate how much you could potentially save in just a matter of minutes. Web for what is form 2210 used? Web yes, you could download the form 2210 from. Web what is form 2210? Estimate how much you could potentially save in just a matter of minutes. This is done either through withholdings from your. The form doesn't always have to be. Web instructions for form 2210. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty. How do i complete form 2210 within the program? Web what is form 2210? Ad if you owe more than $5,000 in back taxes tax advocates can help you. Underpayment of estimated tax by individuals, estates, and trusts. Underpayment of estimated tax by individuals, estates, and trusts. Underpayment of estimated tax by individuals, estates and trusts. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. The irs requires that you pay the taxes you owe throughout the year. Web form 2210 is typically used by taxpayers when they owe more than $1,000 to the irs on their federal tax return. Web form 2210 is a federal individual income tax form. Underpayment of estimated tax by individuals, estates, and trusts. Web instructions for form 2210. Web instructions for form 2210 (2022) underpayment of estimated tax by individuals, estates, and trusts. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. Department of the treasury internal revenue service. Section references are to the internal revenue code unless otherwise. Calculate over 1,500 tax planning strategies automatically and save tens of thousands You may need this form if: While everyone living in the. Department of the treasury internal revenue service. Underpayment of estimated tax by individuals, estates and trusts. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. Note the delete form button at the bottom of the screen. The irs requires that you pay the taxes you owe throughout the year. Web a taxpayer will incur a penalty if the amount of his estimated tax payment fails to reach the “safe harbor payments”: Your income varies during the year. Irs form 2210(underpayment of estimated tax by individuals, estates, and trusts) calculates the. Go to view (at the top), choose forms, and select the desired form.Fillable Form It2210 Interest Penalty On Underpayment Of Ohio

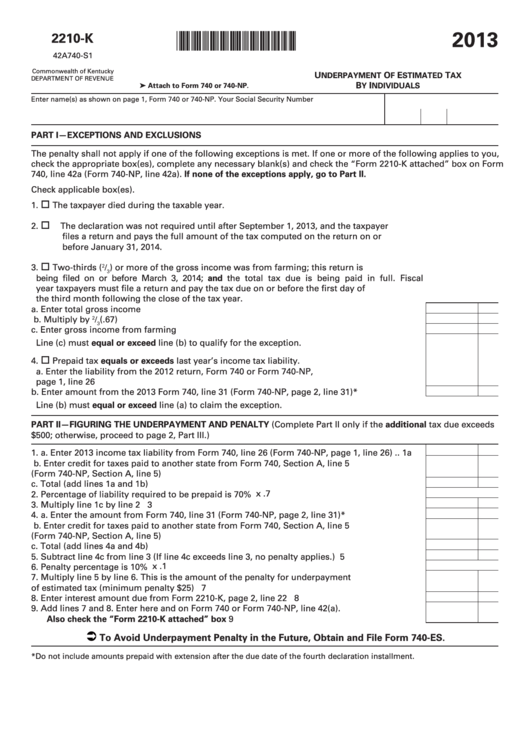

Fillable Form 2210K Underpayment Of Estimated Tax By Individuals

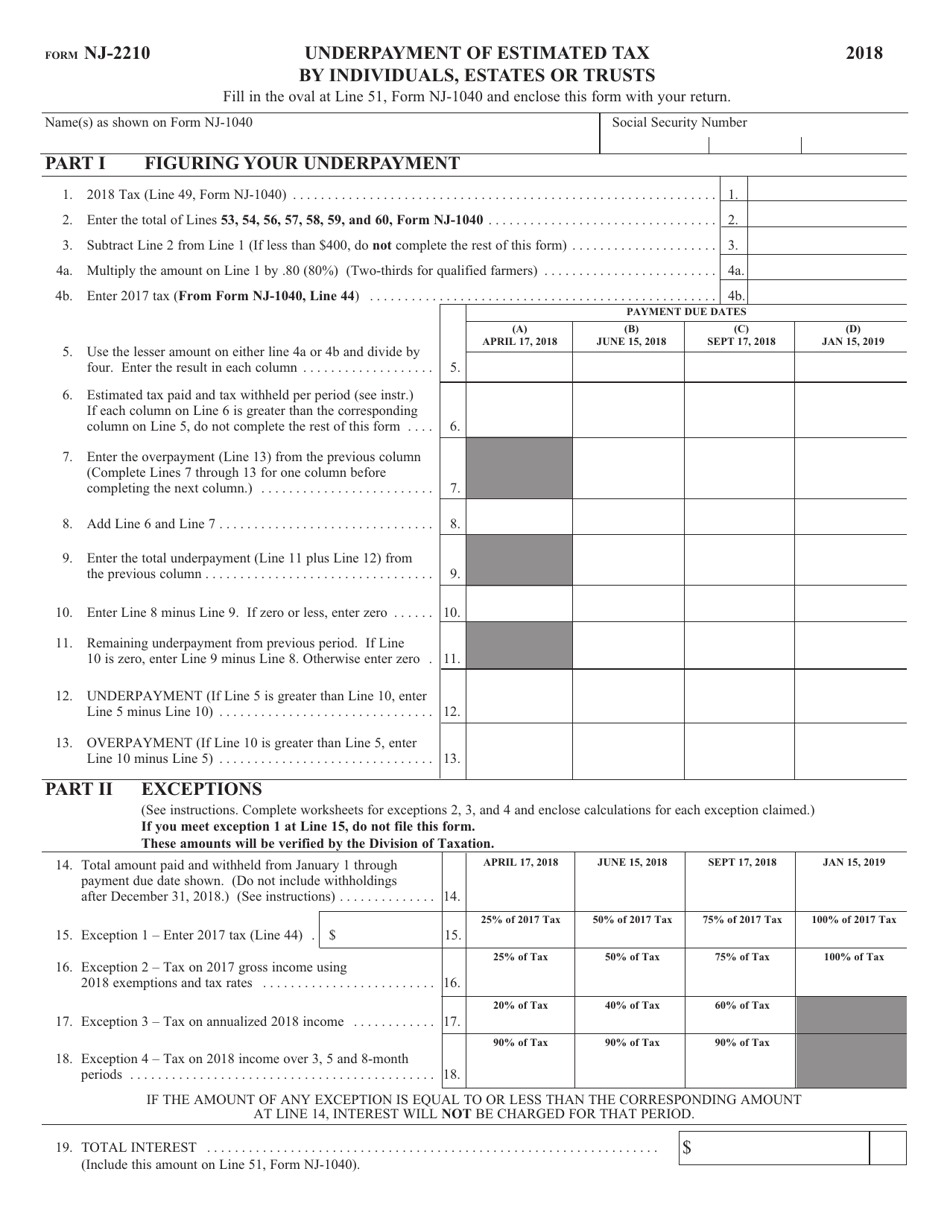

Form NJ2210 Download Fillable PDF or Fill Online Underpayment of

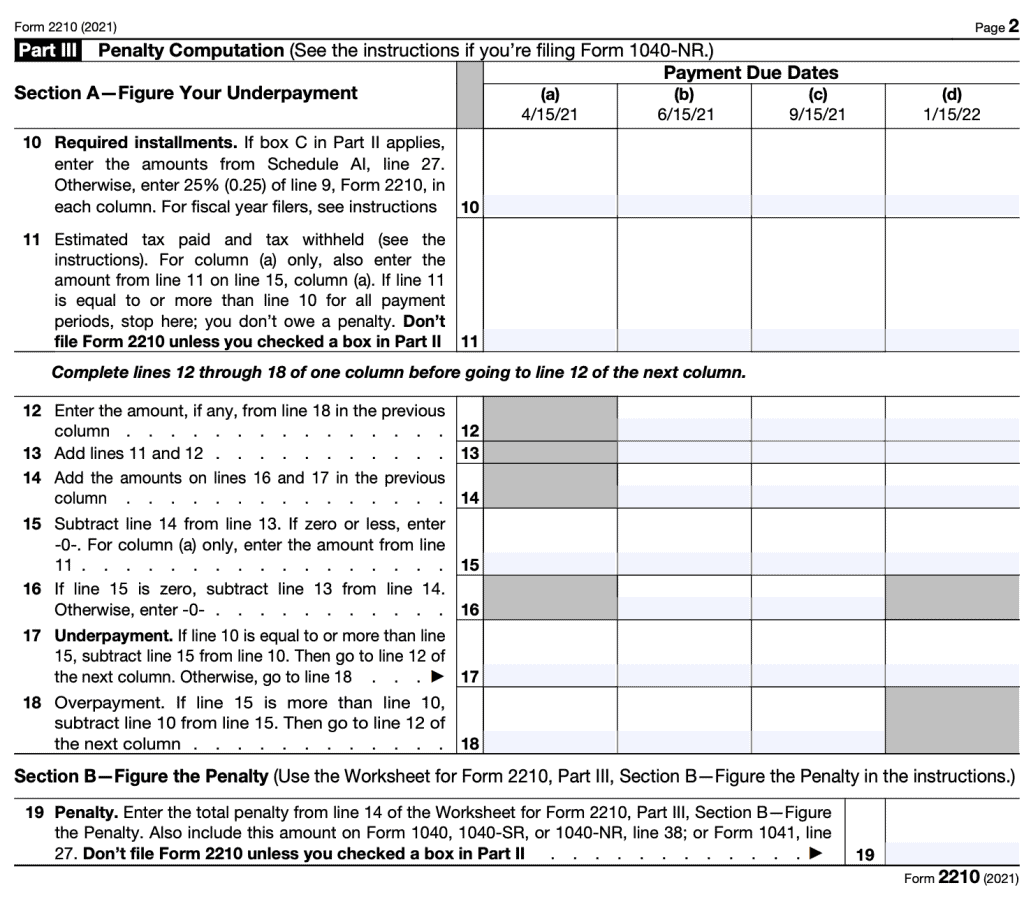

IRS Form 2210 A Guide to Underpayment of Tax

2210 Form 2022 2023

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

IRS Form 2210 Instructions Underpayment of Estimated Tax

Instructions For Form 2210 Underpayment Of Estimated Tax By

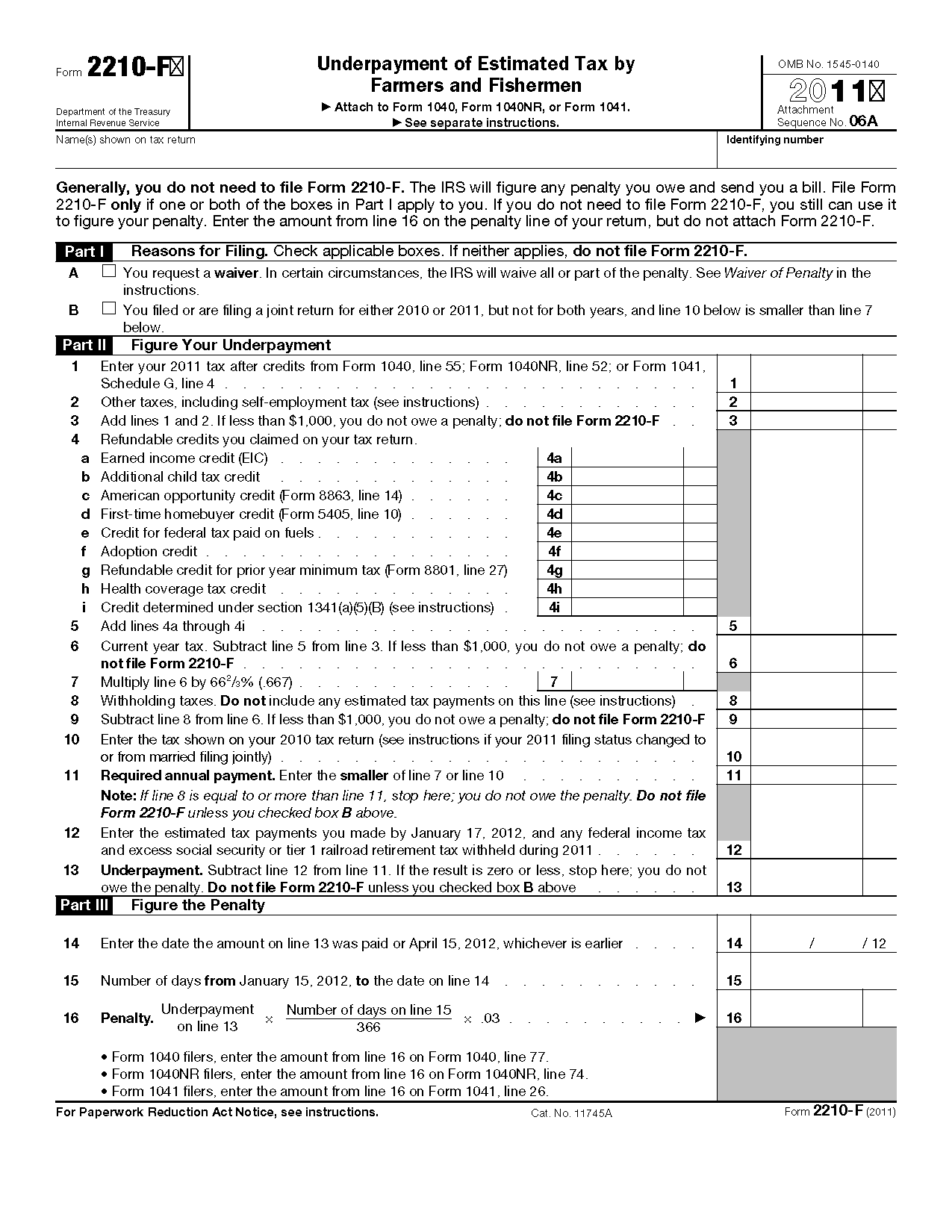

Form 2210 F Underpayment Of Estimated Tax By Farmers And 1040 Form

IRS 2210 2020 Fill out Tax Template Online US Legal Forms

Related Post: