What Happens If I Don't File Form 8958

What Happens If I Don't File Form 8958 - Web the form 8958 is only used when filing as married filing separate (mfs). Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community. File your taxes, your way. Form 8958 **say thanks by clicking the thumb icon in a post. The form 8958 essentially reconciles the difference between what employers (and other. Web if you file separate returns, you and your spouse must each report half of your combined community income and deductions in addition to your separate income and deductions. Most state programs available in january; Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. You can use the irs interactive tool if you are not sure which filing status to choose. Web has anyone ever been penalized for not completing a form 8958 when filing married separately? Form 8958 **say thanks by clicking the thumb icon in a post. Web the irs rejects a federal electronic file if form 8958 is not completed for married filing separate returns residing in a community property state. The form 8958 essentially reconciles the difference between what employers (and other. You can use the irs interactive tool if you are not. Browse for the example of completed form 8958. Web up to $40 cash back the deadline to file form 8958 in 2023 is typically on april 18th, which is the usual deadline for filing federal income tax returns. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with. You can use the irs interactive tool if you are not sure which filing status to choose. Web if you file separate returns, you and your spouse must each report half of your combined community income and deductions in addition to your separate income and deductions. Web up to $40 cash back the deadline to file form 8958 in 2023. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. If you are required to file. The form 8958 essentially reconciles the difference between what employers (and other. Web if you can file as unmarried select the filing status that you qualify for.. The form 8958 essentially reconciles the difference between what employers (and other. If you file separate returns, you and your spouse each must attach your form 8958 to your form 1040 if a taxpayer wants to. Browse for the example of completed form 8958. Web use this form to determine the allocation of tax amounts between married filing separate spouses. Web up to $40 cash back the deadline to file form 8958 in 2023 is typically on april 18th, which is the usual deadline for filing federal income tax returns. If you file separate returns, you and your spouse each must attach your form 8958 to your form 1040 if a taxpayer wants to. Web has anyone ever been penalized. Web the irs rejects a federal electronic file if form 8958 is not completed for married filing separate returns residing in a community property state. Web if you can file as unmarried select the filing status that you qualify for. Web the downside is you might not find out about rules like form 8958 / community property. Form 8958 **say. The form 8958 essentially reconciles the difference between what employers (and other. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web the form 8958 is only used when filing as married filing separate (mfs). Web you only. File your taxes, your way. Web the downside is you might not find out about rules like form 8958 / community property. If you are required to file. Most state programs available in january; Web if you can file as unmarried select the filing status that you qualify for. We have never filled out 8958 forms w/the associated calculations for the last ~4 years. Web for instructions on how to complete form 8958, please check the link: The form 8958 essentially reconciles the difference between what employers (and other. Form 8958 **say thanks by clicking the thumb icon in a post. However, it is always recommended. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web the downside is you might not find out about rules like form 8958 / community property. Most state programs available in january; Send out signed what happens if i don't file form 8958 or print it. Web up to $40 cash back the deadline to file form 8958 in 2023 is typically on april 18th, which is the usual deadline for filing federal income tax returns. If you file separate returns, you and your spouse each must attach your form 8958 to your form 1040 if a taxpayer wants to. Web for instructions on how to complete form 8958, please check the link: Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. We have never filled out 8958 forms w/the associated calculations for the last ~4 years. Web has anyone ever been penalized for not completing a form 8958 when filing married separately? Form 8958 **say thanks by clicking the thumb icon in a post. I was not aware of this form previously, as my wife and i have been. Web the irs rejects a federal electronic file if form 8958 is not completed for married filing separate returns residing in a community property state. File your taxes, your way. However, it is always recommended. Web if you file separate returns, you and your spouse must each report half of your combined community income and deductions in addition to your separate income and deductions. Web if you can file as unmarried select the filing status that you qualify for. Web the form 8958 is only used when filing as married filing separate (mfs).What Happens If you don't file form 2290?

What Happens if You Don't File Taxes?

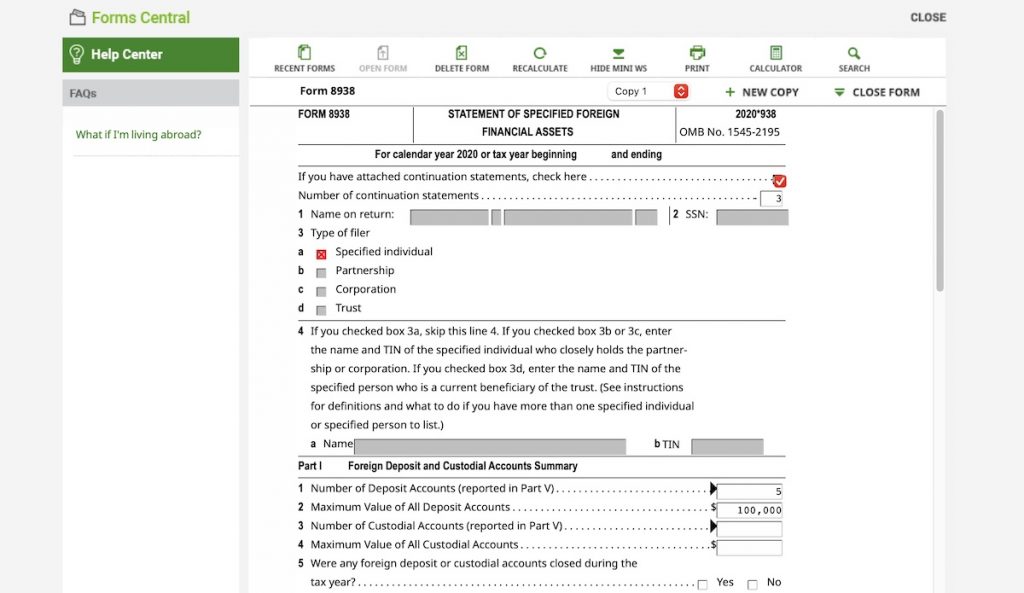

What Is An IRS Form 8938? (2023)

What Happens If You Don't File Taxes? A Guide CentSai

non filing of tax return consequences Emilee Whitehurst

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Fillable Form 8958 Allocation Of Tax Amounts Between Certain

Form 8958 Example Fill Out and Sign Printable PDF Template signNow

Form 8958 Allocation of Tax Amounts between Certain Individuals in

2018 Form IRS 4868 Fill Online, Printable, Fillable, Blank pdfFiller

Related Post:

:max_bytes(150000):strip_icc()/when-you-haven-t-filed-tax-returns-in-a-few-years-3193355-c6f6b92413334c7284aecb6b2162b900.png)