What Does The W-2 Form Tell You Everfi

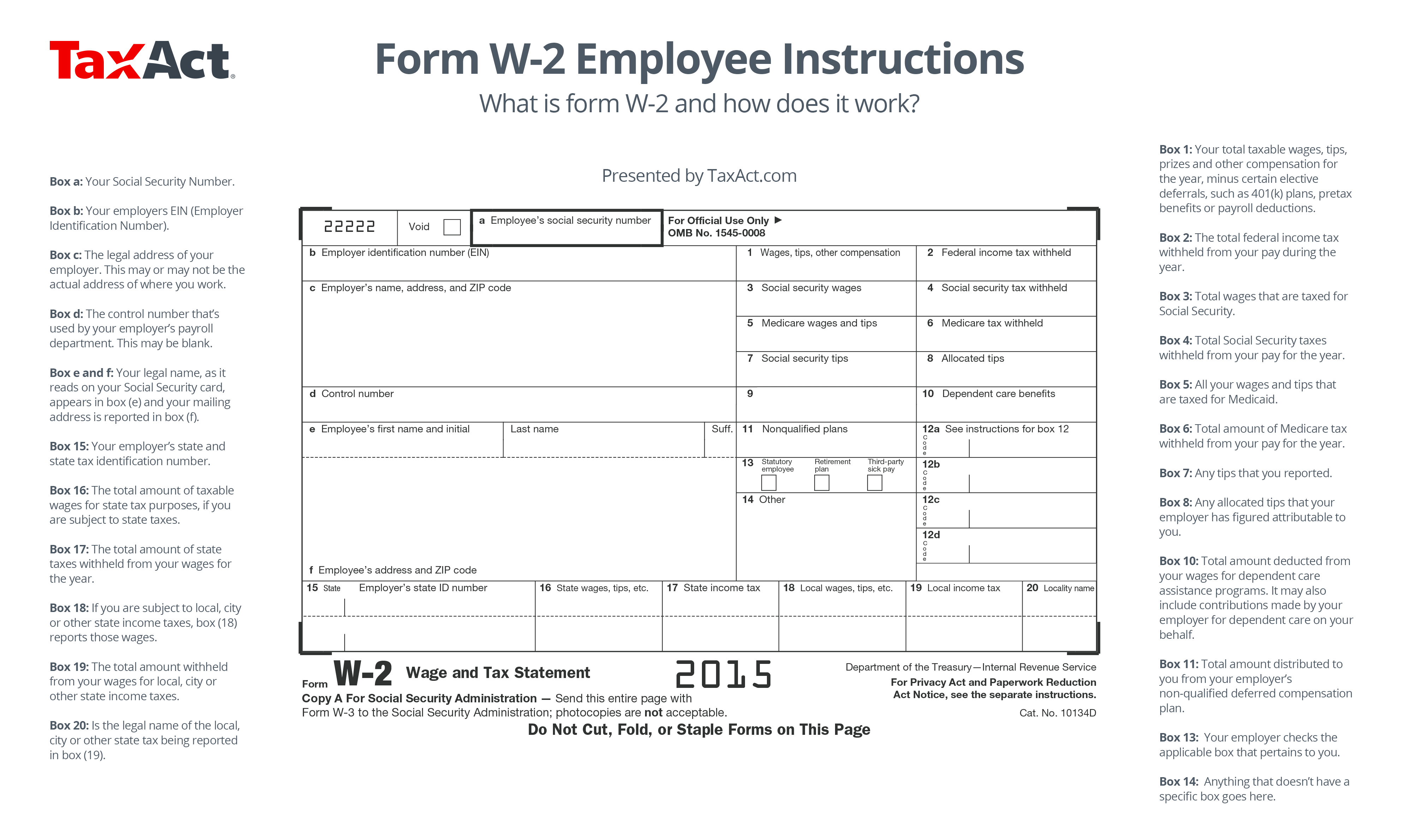

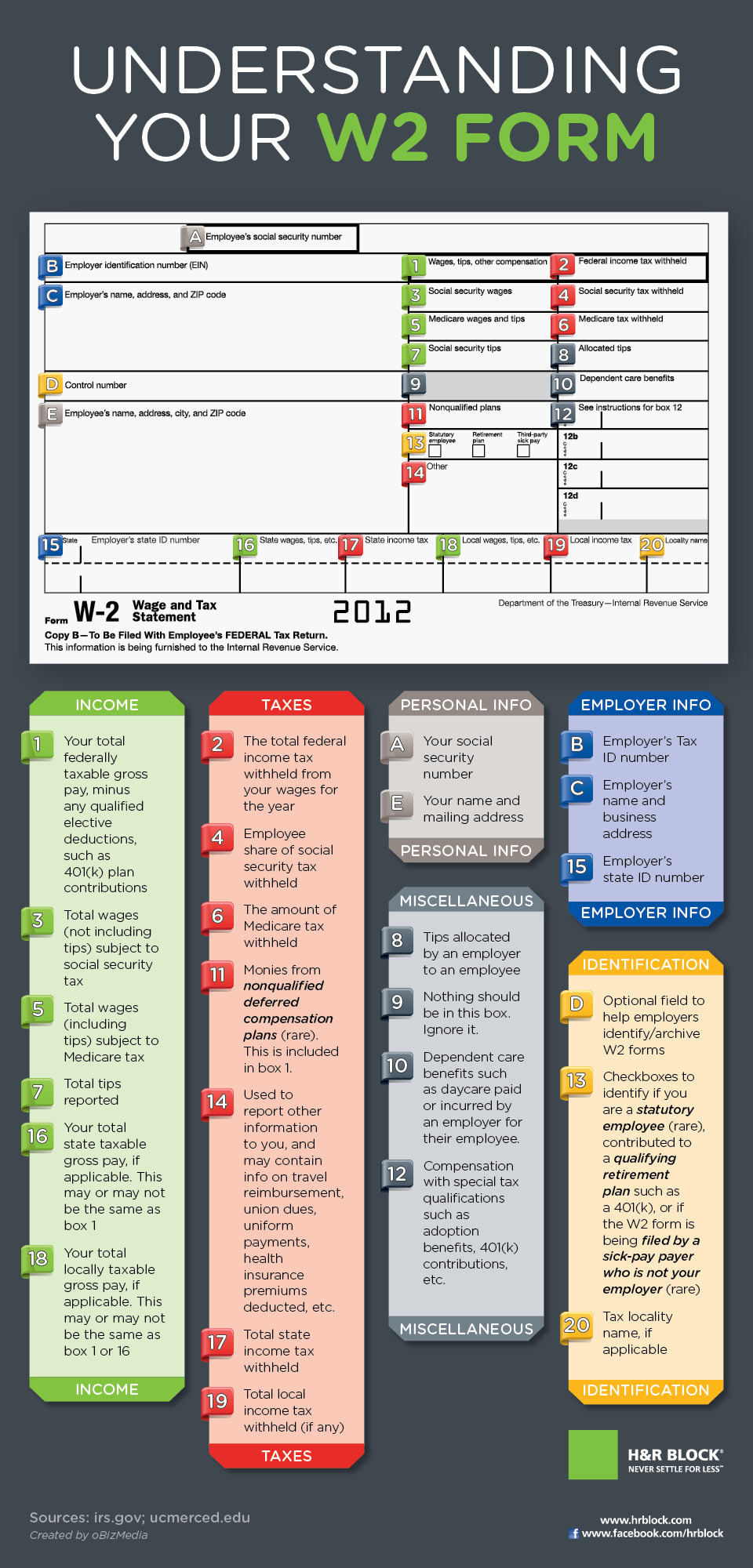

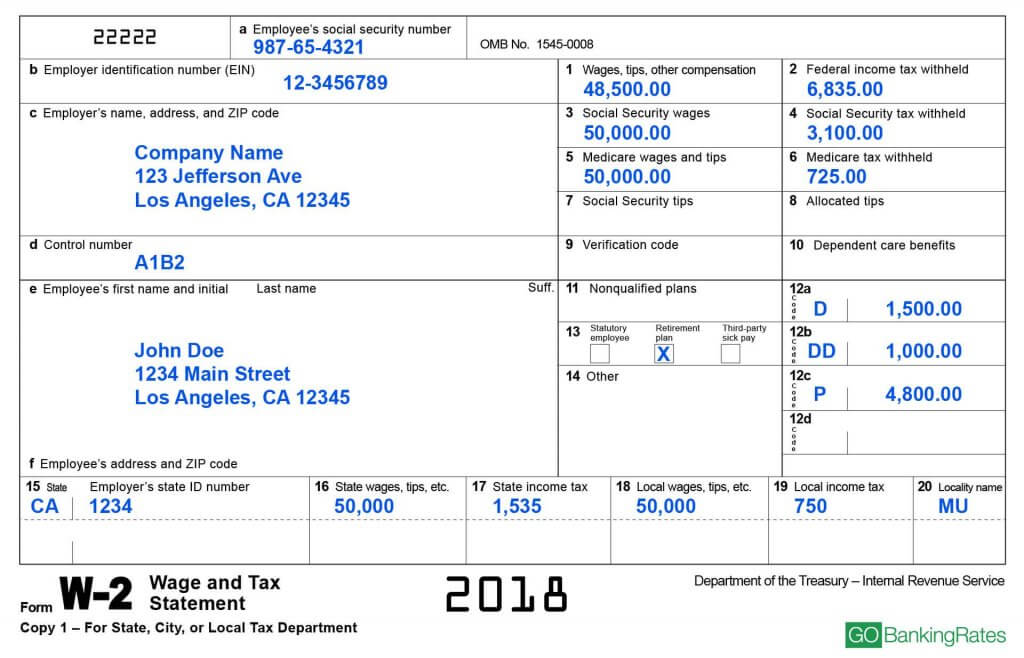

What Does The W-2 Form Tell You Everfi - Web learn how to calculate and fill in the amounts required on form 1040 from everfi module two: We should aim to withhold ____% of our tax. Web a w2 form, also known as the wage and tax statement, is a tax form that an employer fills out for each of their employees. At the end of the year, your employer. It also gives the social security administration (ssa) and the internal. Copy b—to be filed with employee’s federal tax return. These numbers help you and the irs. How much taxes you've paid in the last year based on how much you've earned. This information is being furnished to the internal revenue. How much you've earned and how much taxes you've paid in the last year. When to file your tax return. How much taxes you've paid in the last year based on how much you've earned. Which of the following statements is. A federal tax form filled out by an employee to indicate the amount that. At the end of the year, your employer. Which of the following statements is. This information is being furnished to the internal revenue. Web what does a w 2 form tell you everfi. When to file your tax return. At the end of the year, your employer. It also gives the social security administration (ssa) and the internal. How much you've earned and how much taxes you've paid in the last year. They pay for things like keeping a strong military, they fund public education, and build roads. Web a w2 form, also known as the wage and tax statement, is a tax form that an employer. Which of the following statements is true about taxes? This information is being furnished to the internal revenue. How much you've earned and how much taxes you've paid in the last year. This form determines how much money withheld from your wages for tax purposes. The w2 form reports an employee’s annual wages and. It also gives the social security administration (ssa) and the internal. The w2 form reports an employee’s annual wages and. Copy b—to be filed with employee’s federal tax return. How much you've earned and how much taxes you've paid in the last year. These numbers help you and the irs. How much you've earned and how much taxes you've paid in the last year. Copy b—to be filed with employee’s federal tax return. This form determines how much money withheld from your wages for tax purposes. Web what does a w 2 form tell you everfi. It also gives the social security administration (ssa) and the internal. We should aim to withhold ____% of our tax. When to file your tax return. Web a w2 form, also known as the wage and tax statement, is a tax form that an employer fills out for each of their employees. This form determines how much money withheld from your wages for tax purposes. How much taxes you've paid in. How much taxes you've paid in the last year based on how much you've earned. How much taxes you've paid in the last year based on how much you've earned. Web a w2 form, also known as the wage and tax statement, is a tax form that an employer fills out for each of their employees. Which of the following. How much taxes you've paid in the last year based on how much you've earned. Web learn how to calculate and fill in the amounts required on form 1040 from everfi module two: A federal tax form filled out by an employee to indicate the amount that. Which of the following statements is. It also gives the social security administration. Web about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features nfl sunday ticket press copyright. They pay for things like keeping a strong military, they fund public education, and build roads. A federal tax form filled out by an employee to indicate the amount that. These numbers help you and. Copy b—to be filed with employee’s federal tax return. Web what does a w 2 form tell you everfi. This information is being furnished to the internal revenue. Web a w2 form, also known as the wage and tax statement, is a tax form that an employer fills out for each of their employees. When to file your tax return. Web about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features nfl sunday ticket press copyright. This form determines how much money withheld from your wages for tax purposes. How much you've earned and how much taxes you've paid in the last year. How much taxes you've paid in the last year based on how much you've earned. The w2 form reports an employee’s annual wages and. John’s school vs osei tutu shs vs opoku ware school At the end of the year, your employer. A federal tax form filled out by an employee to indicate the amount that. We should aim to withhold ____% of our tax. Web learn how to calculate and fill in the amounts required on form 1040 from everfi module two: They pay for things like keeping a strong military, they fund public education, and build roads. You will use this to fill out your tax return standard deduction an amount of. Which of the following statements is. How much taxes you've paid in the last year based on how much you've earned. Which of the following statements is true about taxes?How to Fill Out Form W2 Detailed Guide for Employers

What Is Form W2? An Employer's Guide to the W2 Tax Form Gusto

What Is W2 Form and How Does It Work? TaxAct Blog

Form W2 Easy to Understand Tax Guidelines 2020

An Employer’s Guide to Easily Completing a W2 Form Gift CPAs

The Complete Guide To The W2 Form Visual.ly

What is an IRS Form W2 Federal W2 Form for 2022 Tax Year

Everything You Need to Know About Your W2 Form GOBankingRates

Form W2 Everything You Ever Wanted To Know

How To Fill Out a W2 Form? A Guide to the IRS Form W2 Ageras

Related Post: