Form 8867 Purpose

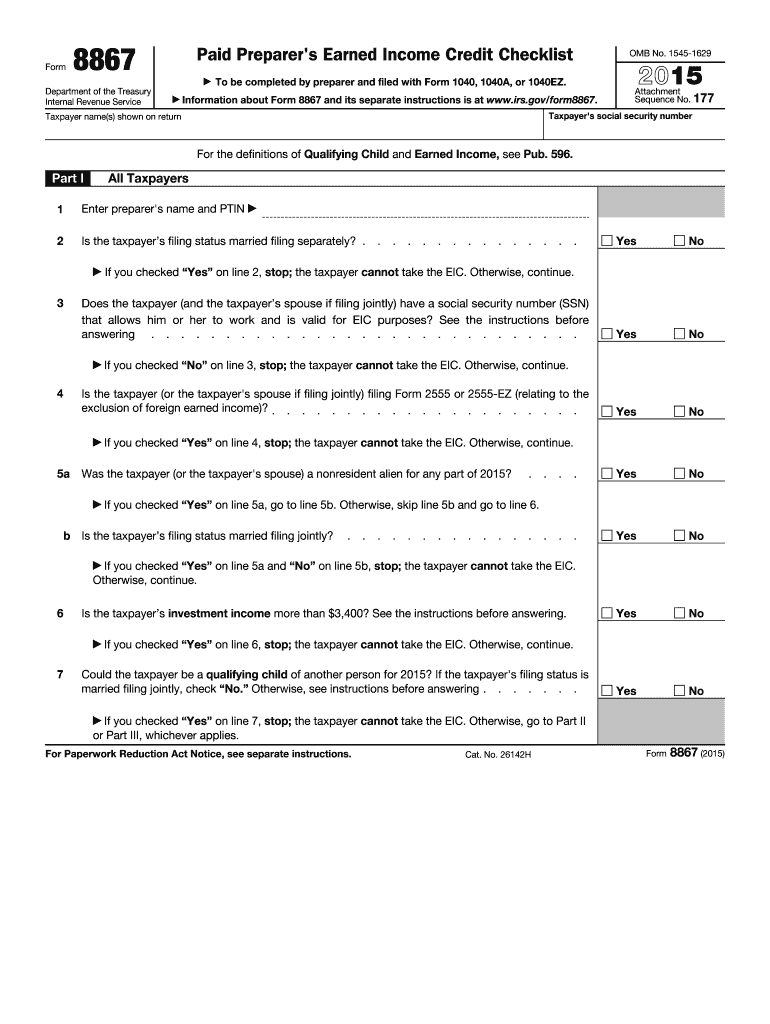

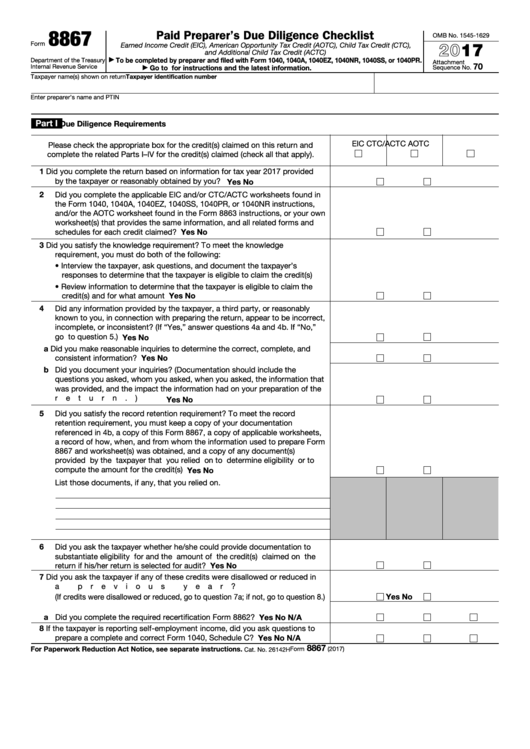

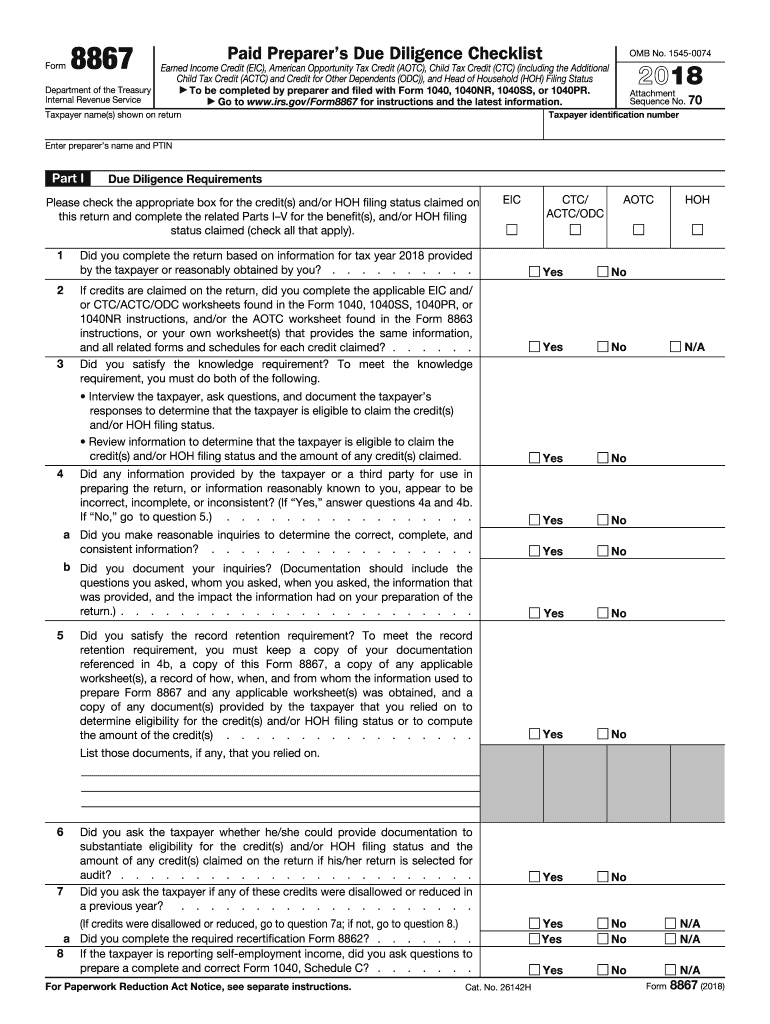

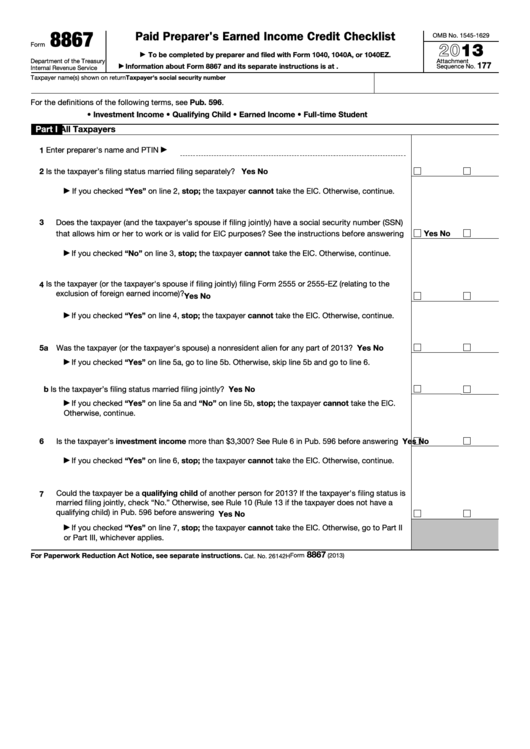

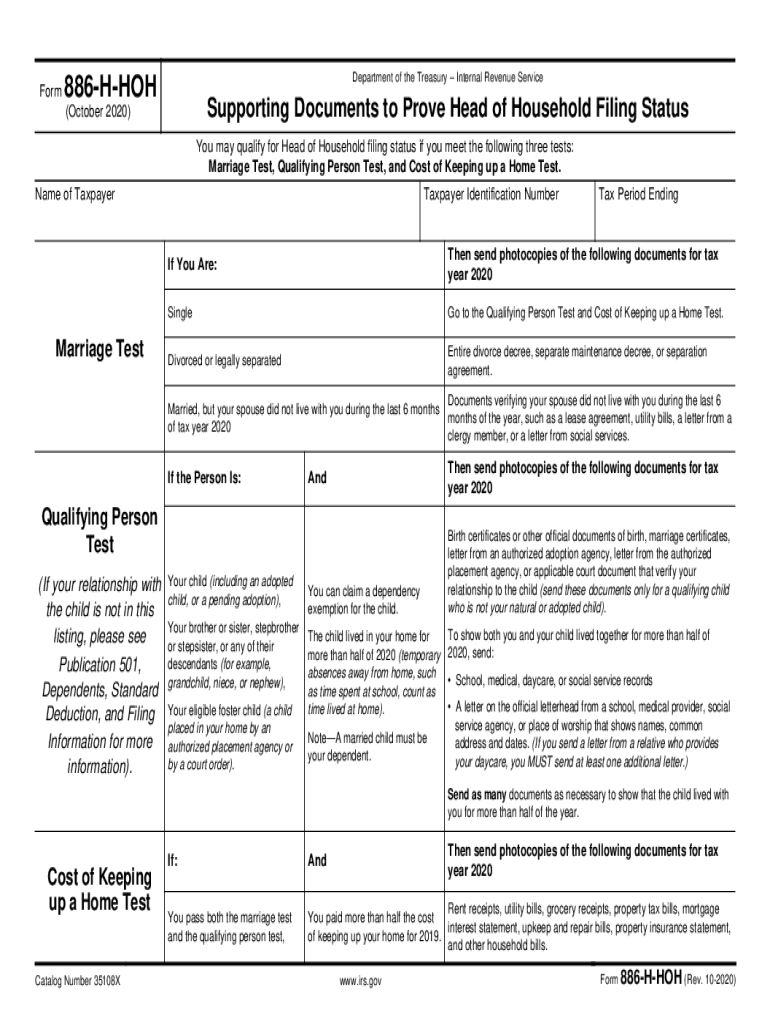

Form 8867 Purpose - You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Grab exciting offers and discounts on an array of products from popular brands. A preparer complies with the. Web what is the purpose of form 8867; Web form 8867 completed by a as a nonsigning preparer must be provided to b to be filed along with t’s return. Use this screen to enter information to complete form 8867, paid preparer’s due diligence checklist. The preparer can inquire about possible documents the client may have or can get to support claiming the children for. Get ready for tax season deadlines by completing any required tax forms today. Form 8867 must be filed with the return. Paid preparers of federal income tax returns or claims involving the earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc),. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Officials say the group and its iranian backers tried to exploit israeli political divisions and derail historic negotiations among saudi arabia, israel and. Web the purpose of the form is to ensure that the practitioner has considered all applicable eligibility criteria for certain tax. Web keep a copy of the completed form 8867. Complete, edit or print tax forms instantly. Use this screen to enter information to complete form 8867, paid preparer’s due diligence checklist. December 2021) department of the treasury internal revenue service. Under the final regulations promulgated under section 6695 on november 5, 2018, completing form 8867 (based on information. Web keep a copy of the completed form 8867. Web about form 8867, paid preparer's due diligence checklist. Paid tax return preparers are required to exercise. The form 8867 completed by b as the signing preparer should also be. Go to www.irs.gov/form8867 for instructions and the latest information. Specific due diligence actions must be performed when preparing. Web due diligence required. This problem has been solved! Web the purpose of form 8867 is to ensure that the tax preparer has considered all applicable eic eligibility requirements for each prepared tax return. To document my compliance with due diligence requirements for head of household filing status, the. Officials say the group and its iranian backers tried to exploit israeli political divisions and derail historic negotiations among saudi arabia, israel and. Paid preparer’s due diligence checklist. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Web form 8867 completed by a as a nonsigning preparer must be provided to b to. Specific due diligence actions must be performed when preparing. Web due diligence required. Officials say the group and its iranian backers tried to exploit israeli political divisions and derail historic negotiations among saudi arabia, israel and. Web up to $40 cash back irs 8867 form. Paid preparer due diligence requirements. Web up to $40 cash back irs 8867 form. This problem has been solved! The irs will revise form 8867 only when necessary. The paid preparer's due diligence checklist is completed and filed with forms 1040, 1040a, 1040ez, 1040nr, 1040ss, 1040pr. Use this screen to enter information to complete form 8867, paid preparer’s due diligence checklist. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Web the purpose of the form is to ensure that the practitioner has considered all applicable eligibility criteria for certain tax credits for each return prepared, such. Ad access irs tax forms. Paid preparer due diligence requirements. Web future revisions of form 8867. Form 8867 covers the eic, the ctc/actc/odc, the aotc, and/or hoh filing status. The irs will revise form 8867 only when necessary. Get ready for tax season deadlines by completing any required tax forms today. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. To document my compliance with due diligence requirements for. Specific due diligence actions must be performed when preparing. Grab exciting offers and discounts on an array of products from popular brands. Web form 8867 paid preparer's earned income credit (eic) checklist. Web you must complete form 8867 and meet the other due diligence requirements described later in purpose of form. The form 8867 completed by b as the signing. Form 8867 covers the eic, the ctc/actc/odc, the aotc, and/or hoh filing status. Ad access irs tax forms. Web about form 8867, paid preparer's due diligence checklist. You should check the boxes corresponding to all benefits actually. The paid preparer's due diligence checklist is completed and filed with forms 1040, 1040a, 1040ez, 1040nr, 1040ss, 1040pr. Web keep a copy of the completed form 8867. Paid tax return preparers are required to exercise. Web up to $40 cash back irs 8867 form. Form 8867 must be filed with the return. Web you must complete form 8867 and meet the other due diligence requirements described later in purpose of form. Grab exciting offers and discounts on an array of products from popular brands. Complete, edit or print tax forms instantly. Officials say the group and its iranian backers tried to exploit israeli political divisions and derail historic negotiations among saudi arabia, israel and. Web must i use form 8867 as part of the due diligence process? Web form 8867 completed by a as a nonsigning preparer must be provided to b to be filed along with t’s return. Under the final regulations promulgated under section 6695 on november 5, 2018, completing form 8867 (based on information. Web the purpose of form 8867 is to ensure that the tax preparer has considered all applicable eic eligibility requirements for each prepared tax return. Ad get deals and low prices on taxation forms at amazon. The form 8867 completed by b as the signing preparer should also be. Paid preparers of federal income tax returns or claims involving the earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc),.Form 8867 Fill Out and Sign Printable PDF Template signNow

8867 Paid Preparers Due Diligence Checklist IRS Tax Forms Fill and

Fillable Form 8867 Paid Preparer'S Earned Credit Checklist

Form 8867 Fill out & sign online DocHub

Fillable Form 8867 Paid Preparer'S Earned Credit Checklist

Form 8867 Paid Preparer`s Due Diligence Checklist Editorial Stock Photo

Instructions for Form 8867 11Internal Revenue Service Fill Out and

Fill Free fillable Form 8867 2019 Paid Preparer’s Due Diligence

Paid Preparer's Due Diligence Checklist Form 8867 YouTube

Form 8867 Paid Preparer's Earned Credit Checklist (2014) Free

Related Post: