Virginia State Tax Form

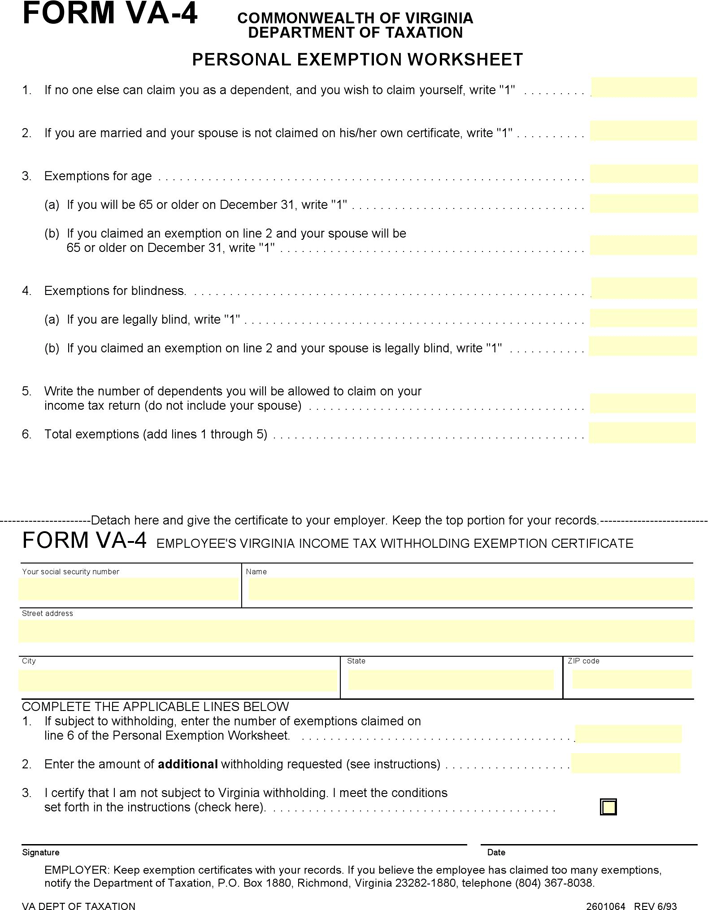

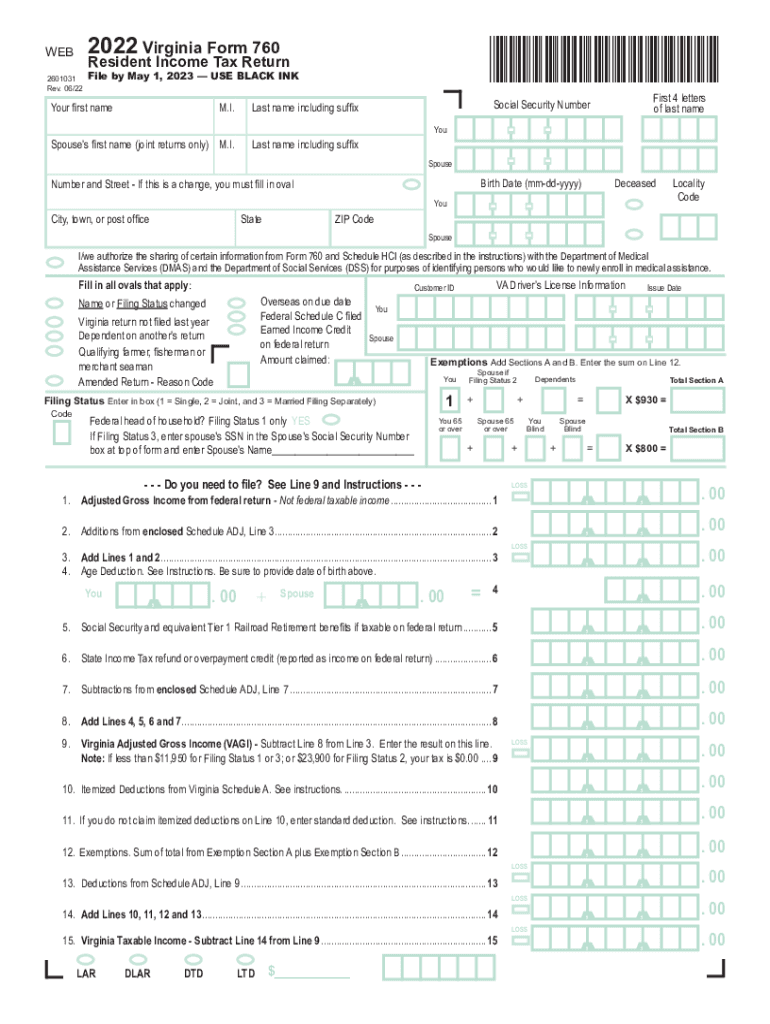

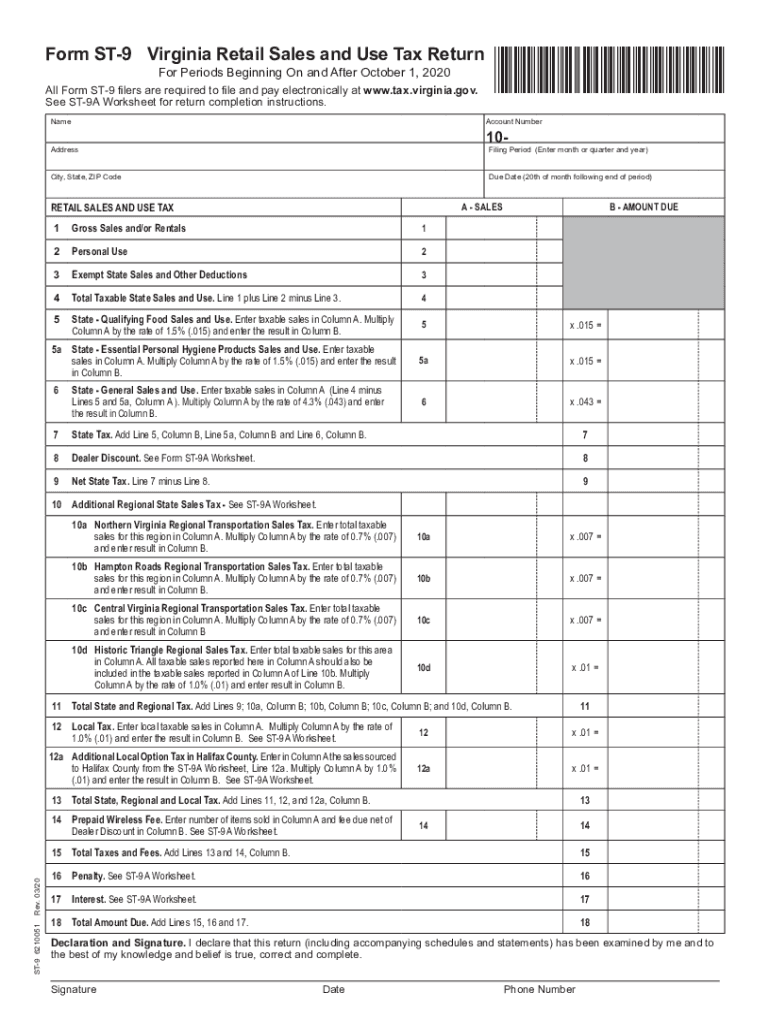

Virginia State Tax Form - 1546001745 at present, virginia tax does not support international ach transactions (iat). Web find forms & instructions by category. Virginia state income tax brackets and income tax rates depend on taxable income and residency. Web individual tax return form 1040 instructions; Explore these zero income tax states. Corporation and pass through entity tax. For joint filers, the standard deduction in the. You can complete the forms with the help of. Web 86 rows virginia has a state income tax that ranges between 2% and 5.75%, which is administered by the virginia department of taxation. Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. No fees, max refund guaranteed. Name is required on this line; Request for taxpayer identification number (tin) and certification form. City, state, and zip code. Web virginia state income tax rates are 2%, 3%, 5% and 5.75%. Federal is always free, va state tax filing only $14.99. Corporation and pass through entity tax. No fees, max refund guaranteed. Name is required on this line; Web individual tax return form 1040 instructions; Virginia tax individual online account application. Request for taxpayer identification number (tin) and certification form. Deduction you are claiming on the virginia return, enter zero on. Click iat notice to review the. File & pay state taxes online with eforms department of taxation. 07/21 your first name m.i. File & pay state taxes online with eforms department of taxation. Virginia tax individual online account application. Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. Web individual tax return form 1040 instructions; Web 86 rows virginia has a state income tax that ranges between 2% and 5.75%, which is administered by the virginia department of taxation. Web the state and local income tax from virginia schedule a, line 5a (not to exceed $10,000 or $5,000 if married. File by may 1, 2023 — use black ink. Your withholding is subject to review. For joint filers, the standard deduction in the. Virginia department of taxation, p.o. Choose avalara sales tax rate tables by state or look up individual rates by address. Click iat notice to review the. Learn more about states' sales, property & locality taxes. Corporation and pass through entity tax. Ad free avalara tools include monthly rate table downloads and a sales tax rate calculator. Learn more about states' sales, property & locality taxes. Request for taxpayer identification number (tin) and certification form. Web the virginia tax forms are listed by tax year below and all va back taxes for previous years would have. Web file your state tax return department of taxation. Web virginia form 760 *va0760122888* resident income tax return. Ad free 2022 federal tax return. Web virginia state income tax rates are 2%, 3%, 5% and 5.75%. You can complete the forms with the help of. Ad free 2022 federal tax return. Your withholding is subject to review by the. File & pay state taxes online with eforms department of taxation. You can complete the forms with the help of. Choose avalara sales tax rate tables by state or look up individual rates by address. Explore these zero income tax states. Pay a tax bill department of taxation. 1546001745 at present, virginia tax does not support international ach transactions (iat). Time’s up for millions of americans: Web the state and local income tax from virginia schedule a, line 5a (not to exceed $10,000 or $5,000 if married. Requester’s name and address (optional) 7. Virginia state income tax brackets and income tax rates depend on taxable income and residency. You can complete the forms with the help of. Explore these zero income tax states. Deduction you are claiming on the virginia return, enter zero on. Request for taxpayer identification number (tin) and certification form. Time’s up for millions of americans: Web the state and local income tax from virginia schedule a, line 5a (not to exceed $10,000 or $5,000 if married. Ad free 2022 federal tax return. Click iat notice to review the. Name is required on this line; Federal is always free, va state tax filing only $14.99. 1546001745 at present, virginia tax does not support international ach transactions (iat). City, state, and zip code. Web the new budget temporarily increases the virginia standard deduction for the 2024 and 2025 tax years. This field will be computed for you. Web the virginia tax forms are listed by tax year below and all va back taxes for previous years would have to be mailed in. Web individual tax return form 1040 instructions; Web virginia form 760 *va0760122888* resident income tax return. Web virginia state income tax rates are 2%, 3%, 5% and 5.75%.State Tax Withholding Forms Template Free Download Speedy Template

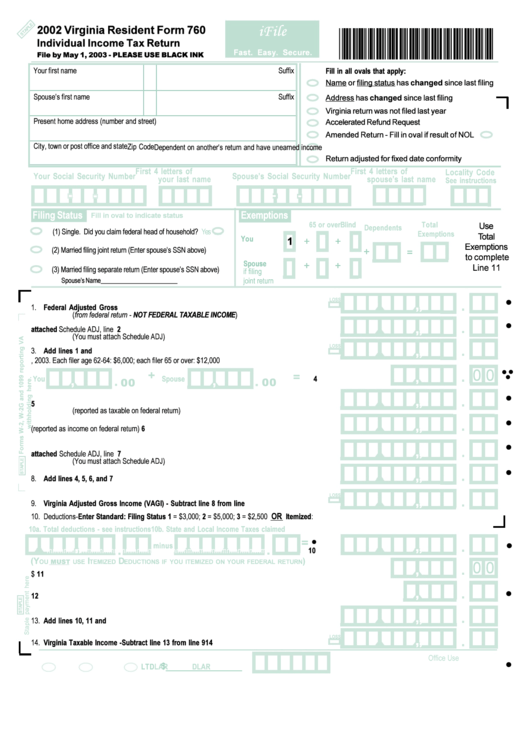

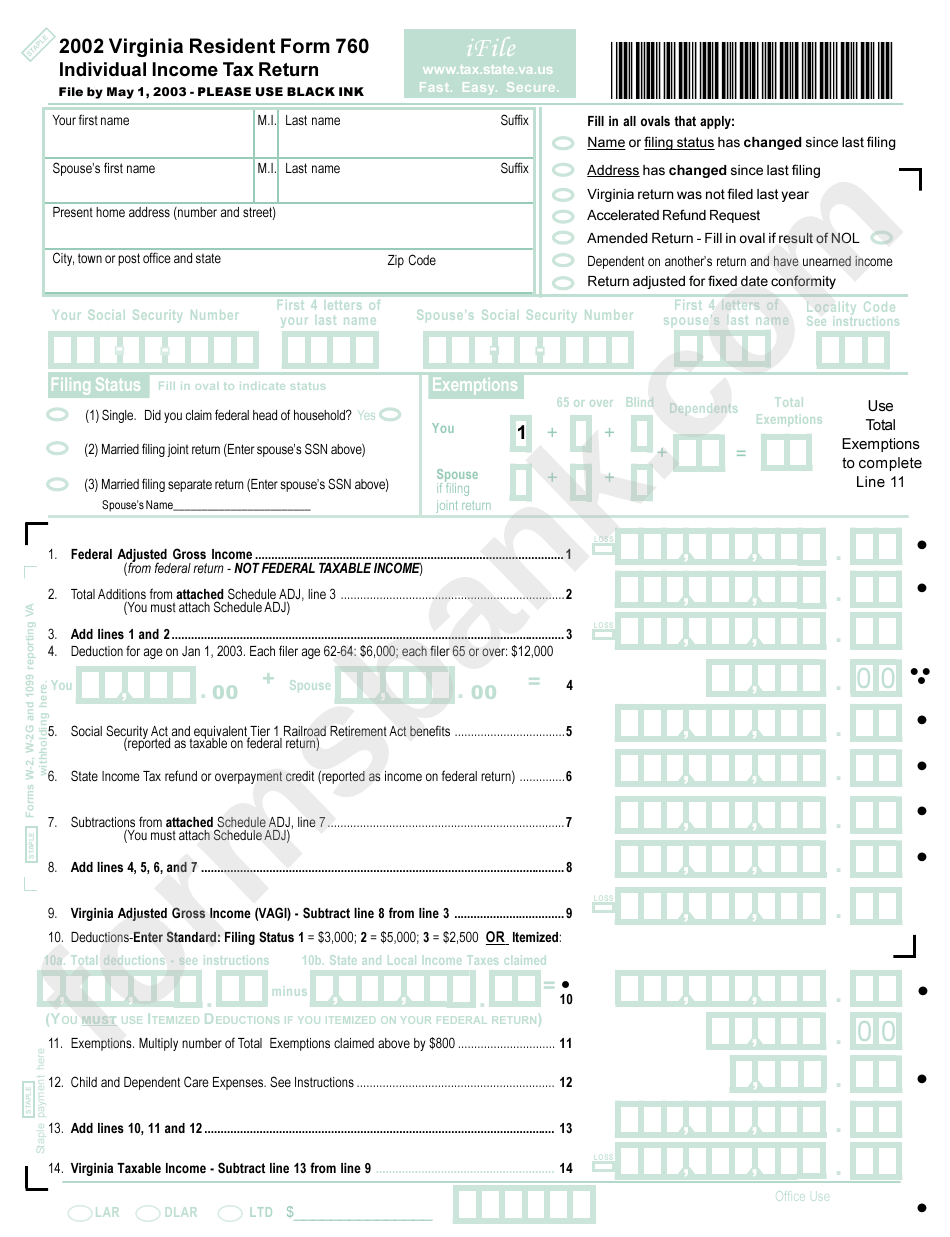

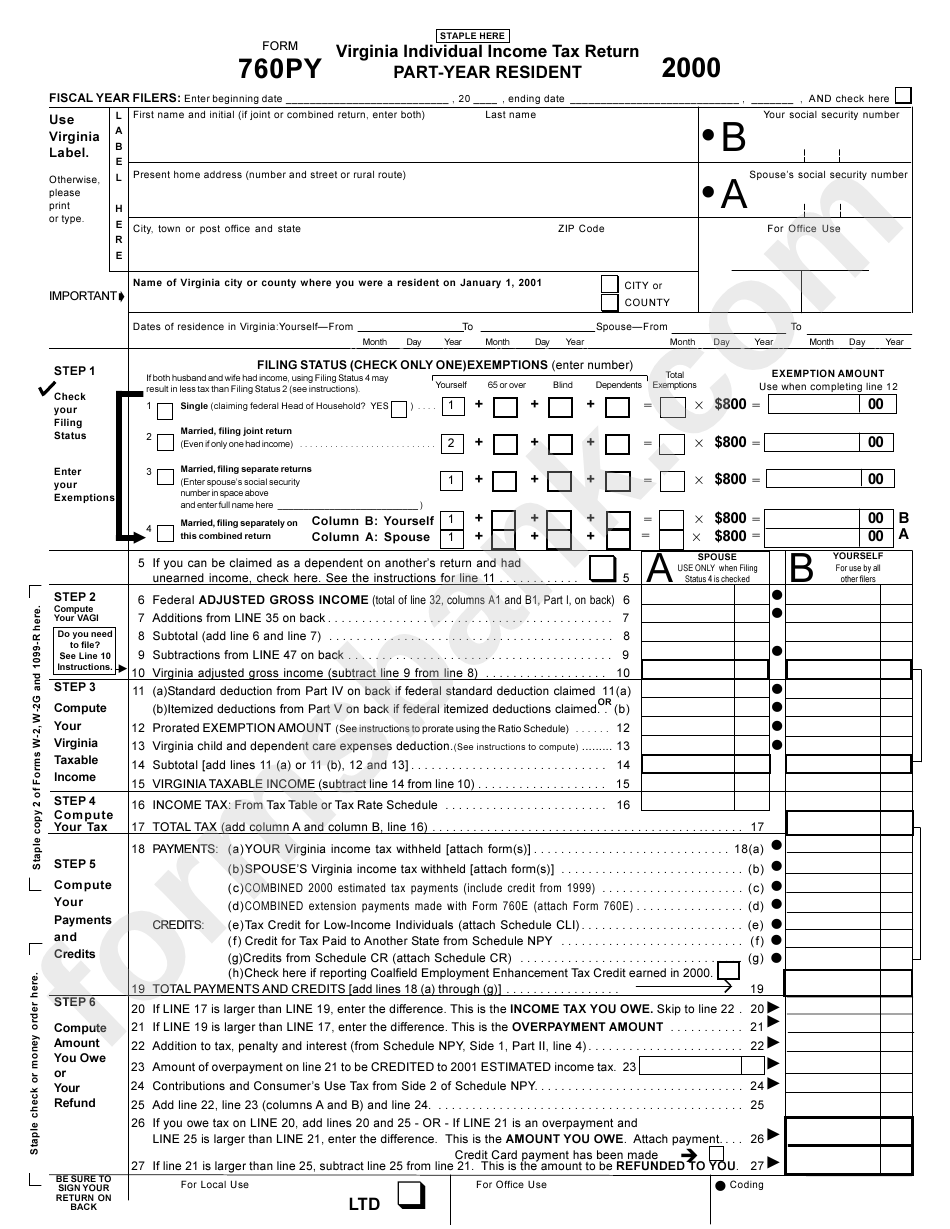

Virginia Resident Form 760 Individual Tax Return 2002

Virginia Resident Form 760 Individual Tax Return 2002

Virginia State 760 Form Fill Out and Sign Printable PDF Template

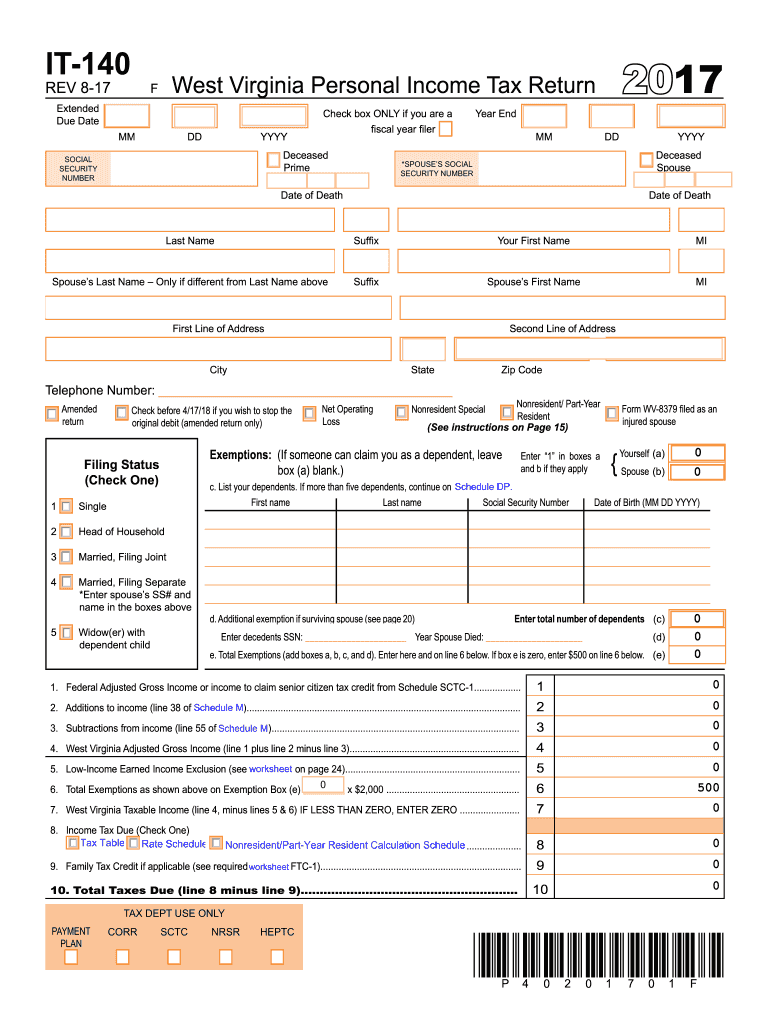

Wv state tax form 2015 Fill out & sign online DocHub

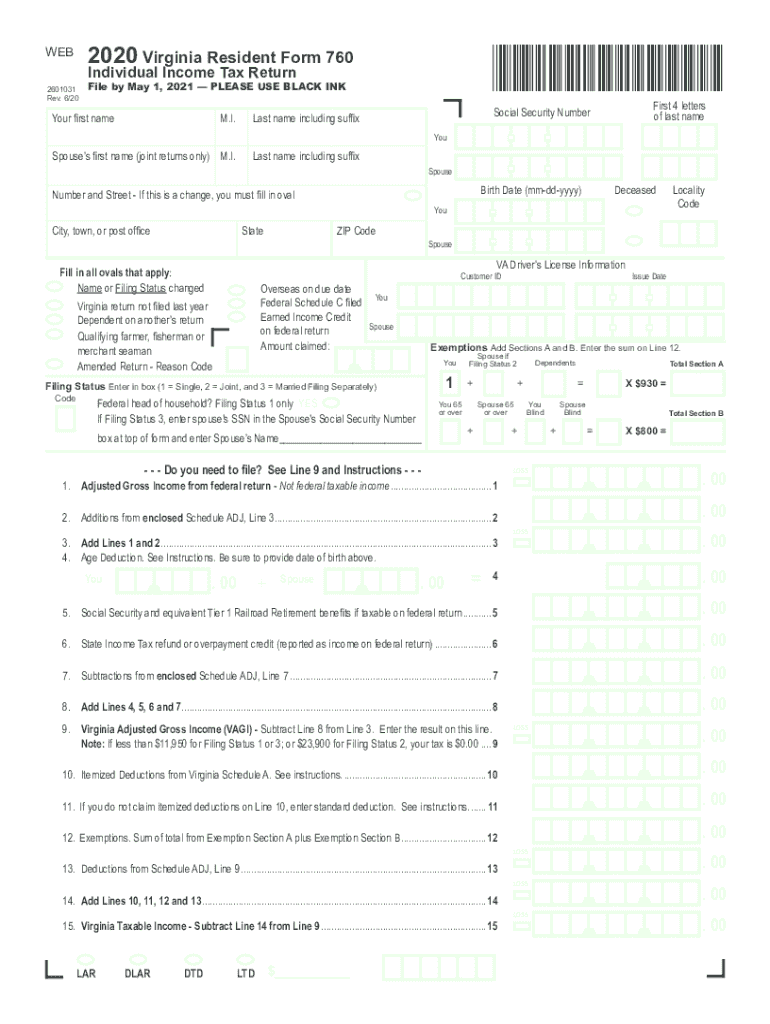

Draft 2022 Virginia Resident Form 760 Individual Tax Return

Free Printable Virginia State Tax Forms Printable Form 2023

Virginia State Tax Forms 2021 Printable Printable Form 2023

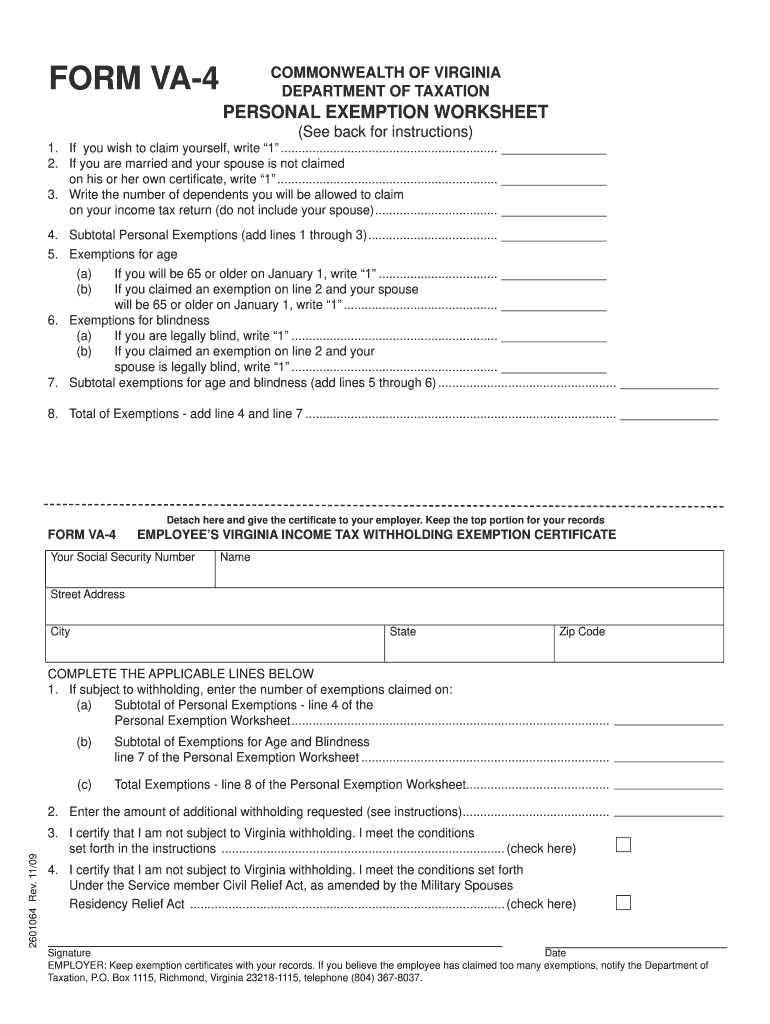

Va 4 State Tax Form Fillable Fill Out and Sign Printable PDF Template

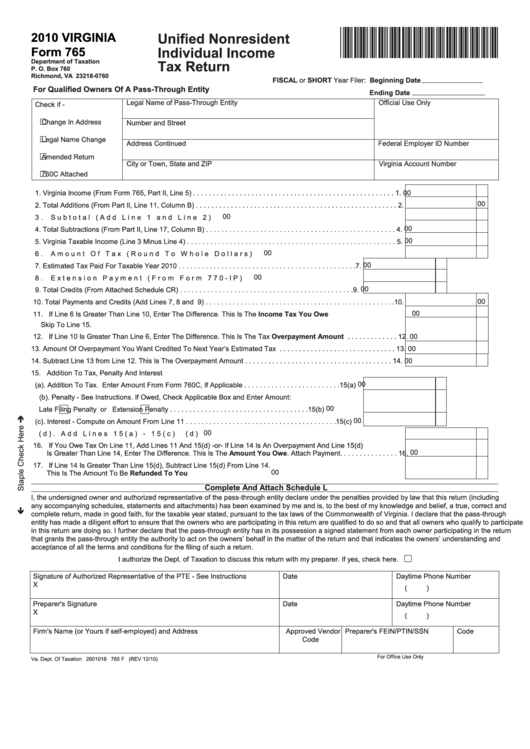

Virginia Form 765 Unified Nonresident Individual Tax Return

Related Post: