Virginia Form 502 Ptet

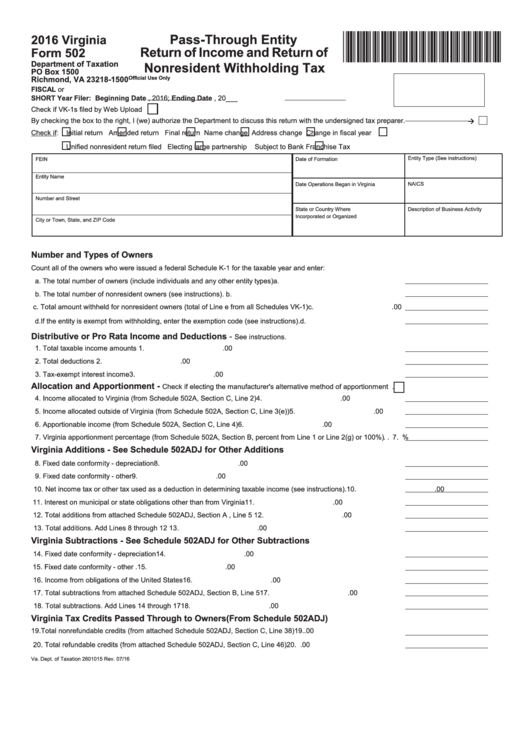

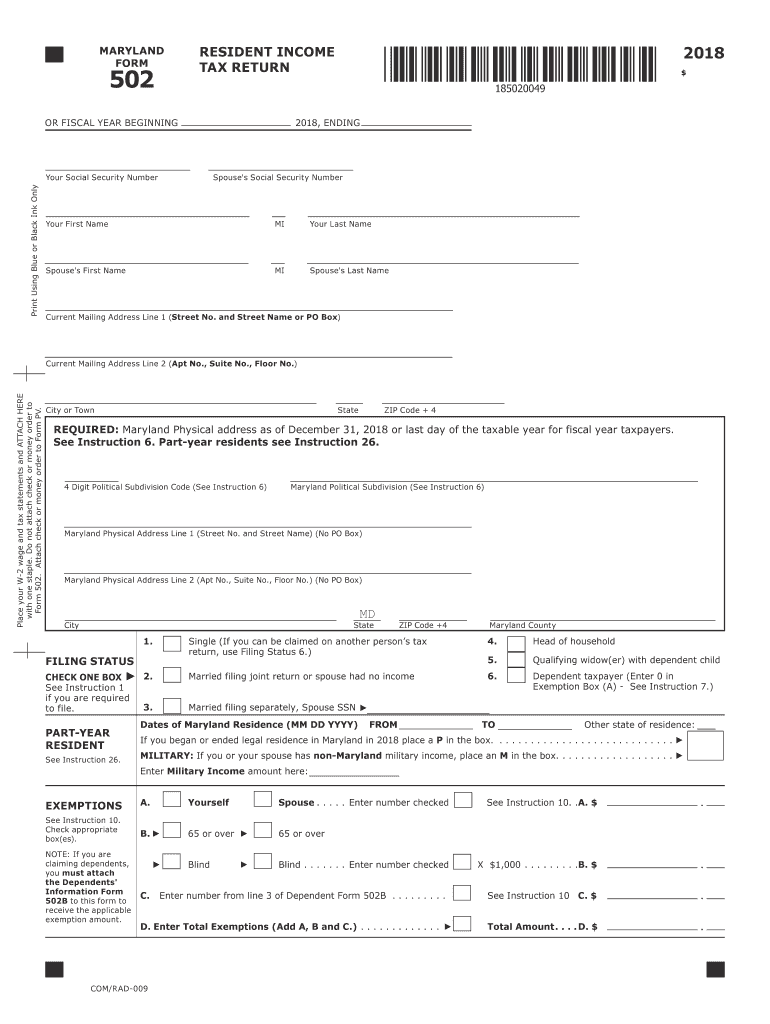

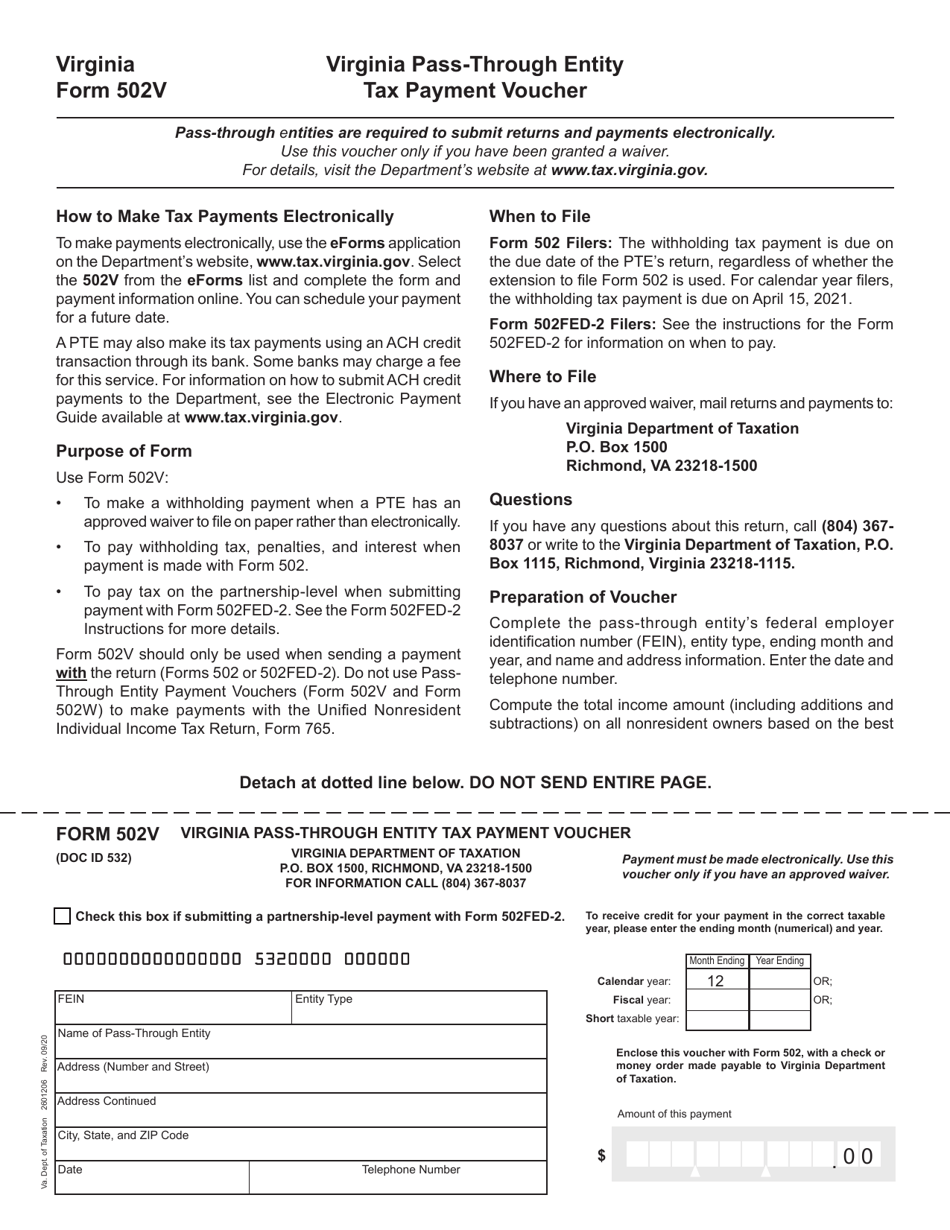

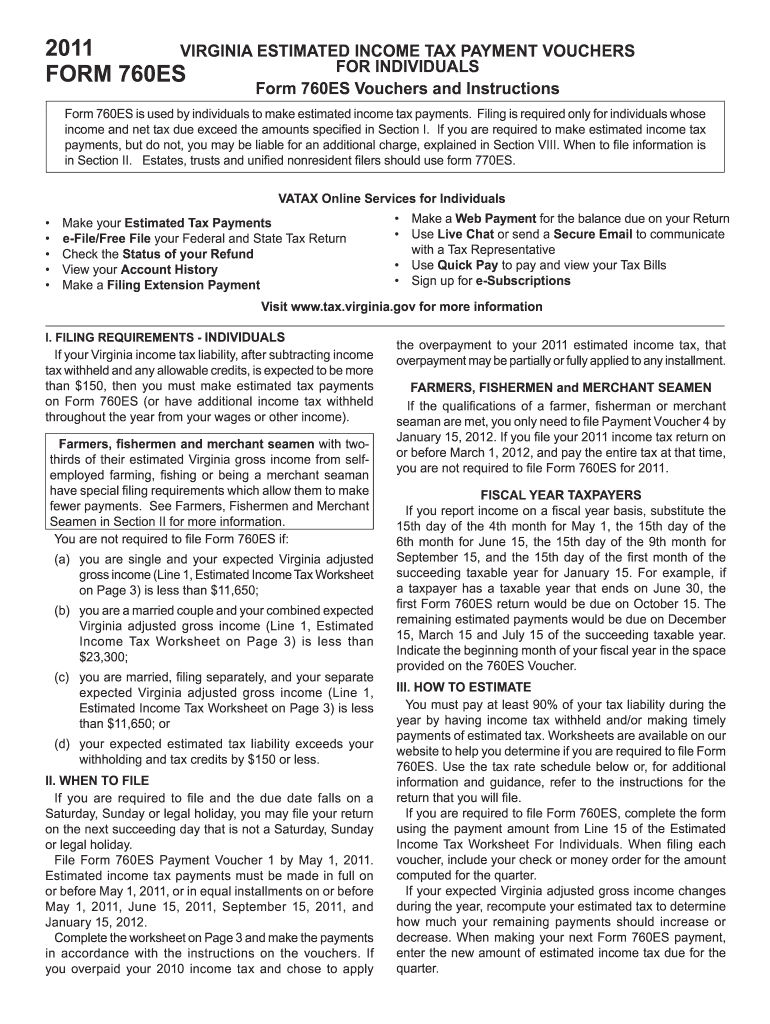

Virginia Form 502 Ptet - Get ready for tax season deadlines by completing any required tax forms today. Web s corporations, partnerships, and limited liability companies. Today this issue was resolved with an intuit technician. Get ready for tax season deadlines by completing any required tax forms today. Web interview form virginia > va2, box 110. Passes $14,000 virginia credit through to owner. Web no additional virginia tax liability due to $14,000 credit. (1) during tax year 2022, filing form 502v and submitting a. Web there are four ways for a qualifying pte to elect to pay the pte tax (ptet) for the tax year, including: Ad download or email va form 502 & more fillable forms, register and subscribe now! Web with the return (forms 502). Complete, edit or print tax forms instantly. Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident owners subject to the withholding. Ad download or email va form 502 & more fillable forms, register and subscribe now! (1) during tax year 2022, filing form. Web interview form virginia > va2, box 110. Web with the return (forms 502). Web there are four ways for a qualifying pte to elect to pay the pte tax (ptet) for the tax year, including: For more information, write to: Not filed contact us 502v. In part ii of the va 502. Web there are four ways for a qualifying pte to elect to pay the pte tax (ptet) for the tax year, including: Complete, edit or print tax forms instantly. Web instead, the electing pte may file form 502ptet to request a refund of any ptet estimated tax payments it made. Not filed contact. • to make a withholding payment when a pte has an approved waiver to file on paper rather than electronically. Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident owners subject to the withholding. See form 502ptet instructions for information on how to allocate ptet credits. Ad download or. Web there are four ways for a qualifying pte to elect to pay the pte tax (ptet) for the tax year, including: Get ready for tax season deadlines by completing any required tax forms today. Web with the return (forms 502). How to make the election? To make a withholding payment when a pte has an approved waiver to file. Web no additional virginia tax liability due to $14,000 credit. Virginia department of taxation, tax. Complete, edit or print tax forms instantly. In part ii of the va 502. Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident owners subject to the withholding. Complete, edit or print tax forms instantly. Ad download or email va form 502 & more fillable forms, register and subscribe now! How to make the election? Virginia department of taxation, tax. Get ready for tax season deadlines by completing any required tax forms today. Today this issue was resolved with an intuit technician. Get ready for tax season deadlines by completing any required tax forms today. Ad download or email va form 502 & more fillable forms, register and subscribe now! Web there are four ways for a qualifying pte to elect to pay the pte tax (ptet) for the tax year, including: In. For more information, write to: Web the virginia form 502ptet is a new form for the 2022 tax year. Web interview form virginia > va2, box 110. For taxable years beginning on and after january 1, 2021, but before. • to make a withholding payment when a pte has an approved waiver to file on paper rather than electronically. See form 502ptet instructions for information on how to allocate ptet credits. Virginia department of taxation, tax. Not filed contact us 502v. Complete, edit or print tax forms instantly. To make a withholding payment when a pte has an approved waiver to file on paper rather than electronically to make a withholding payment prior to filing. (1) during tax year 2022, filing form 502v and submitting a. Get ready for tax season deadlines by completing any required tax forms today. Web there are four ways for a qualifying pte to elect to pay the pte tax (ptet) for the tax year, including: Today this issue was resolved with an intuit technician. Get ready for tax season deadlines by completing any required tax forms today. See form 502ptet instructions for information on how to allocate ptet credits. Web instead, the electing pte may file form 502ptet to request a refund of any ptet estimated tax payments it made. Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident owners subject to the withholding. In part ii of the va 502. For more information, write to: For taxable years beginning on and after january 1, 2021, but before. • to make a withholding payment when a pte has an approved waiver to file on paper rather than electronically. Ad download or email va form 502 & more fillable forms, register and subscribe now! Web no additional virginia tax liability due to $14,000 credit. Web s corporations, partnerships, and limited liability companies. Passes $14,000 virginia credit through to owner. Not filed contact us 502v. Complete, edit or print tax forms instantly. Web with the return (forms 502). Virginia department of taxation, tax.Md 502 instructions 2018 Fill out & sign online DocHub

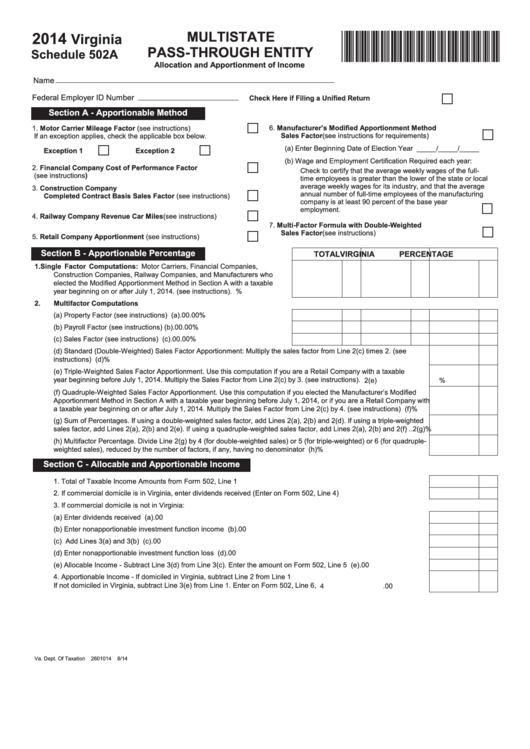

Fillable Virginia Schedule 502a Multistate PassThrough Entity 2014

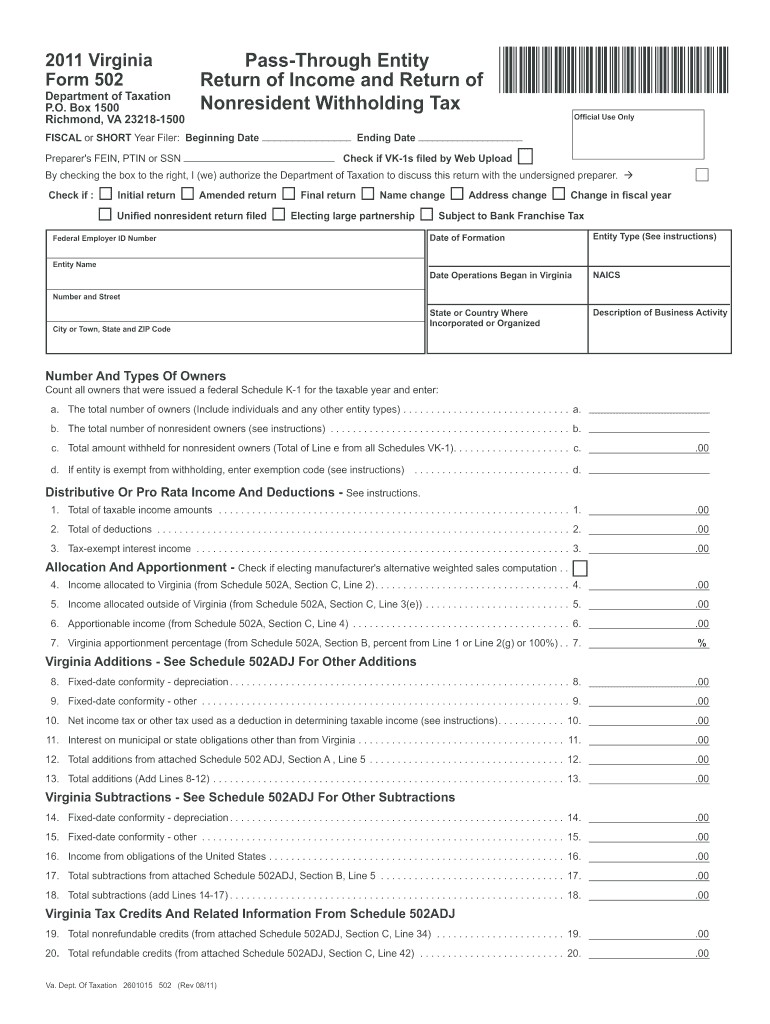

Virginia Form 502 Fill Out and Sign Printable PDF Template signNow

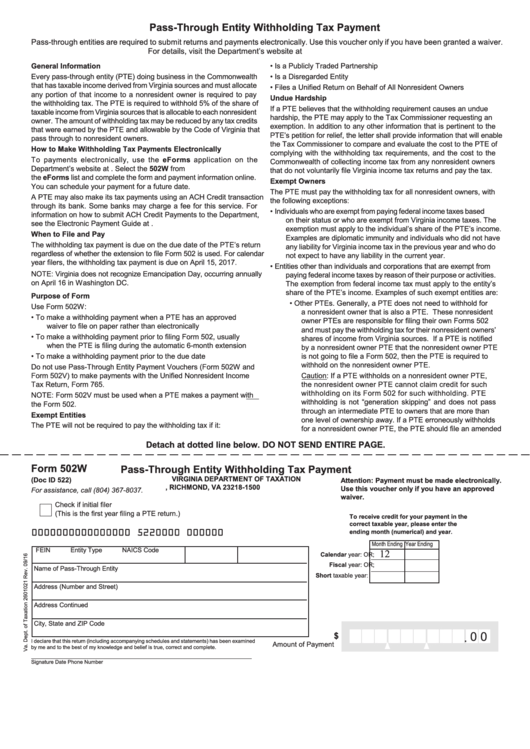

Fillable 502w Virginia Department Of Taxation printable pdf download

Fillable Virginia Form 502 PassThrough Entity Return Of And

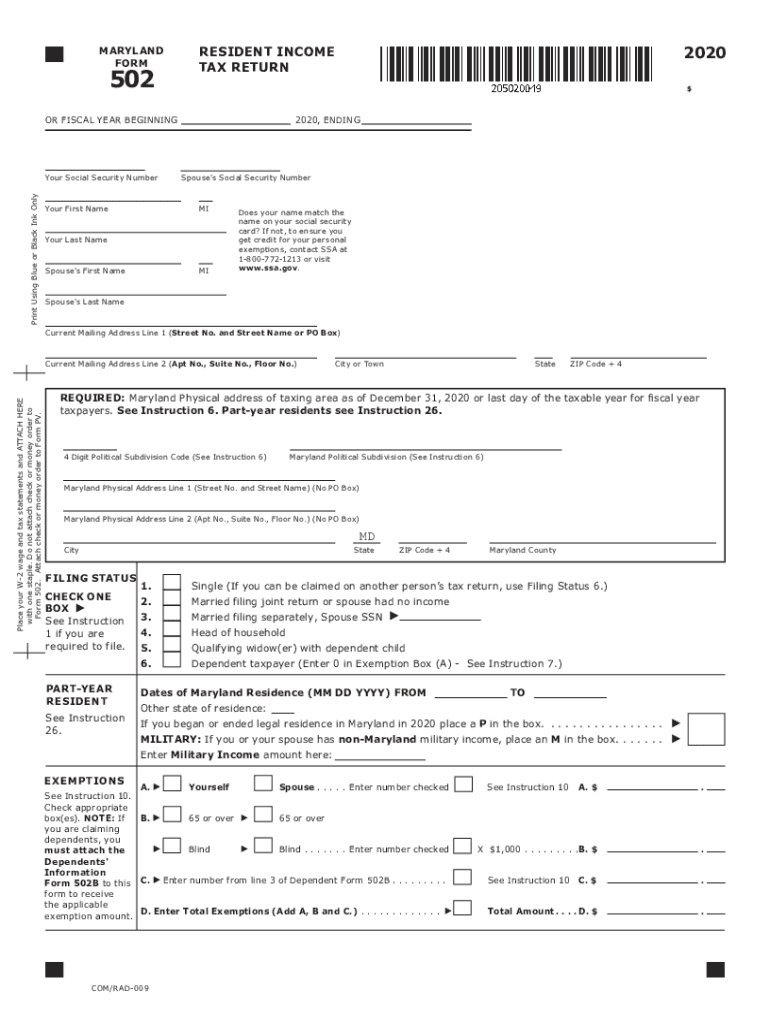

Md 502 instructions 2018 Fill out & sign online DocHub

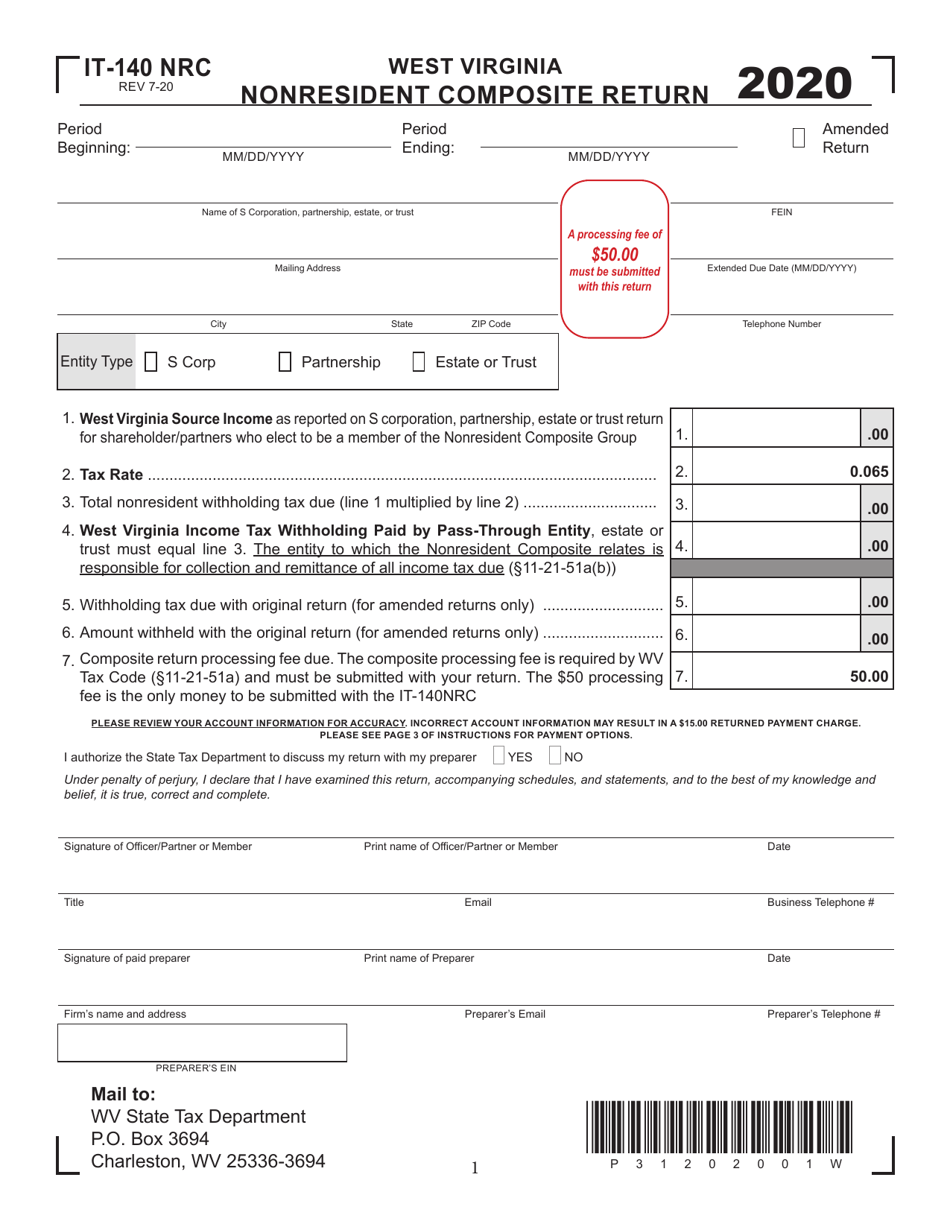

Form IT140 NRC Download Printable PDF or Fill Online West Virginia

Form 502V Download Fillable PDF or Fill Online Virginia PassThrough

Virginia Form Tax Fill Out and Sign Printable PDF Template signNow

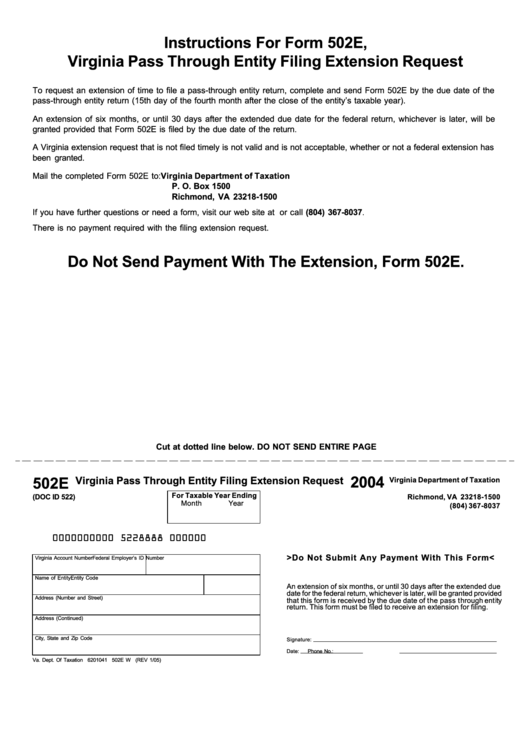

Form 502e Virginia Pass Through Entity Filing Extension Request

Related Post: