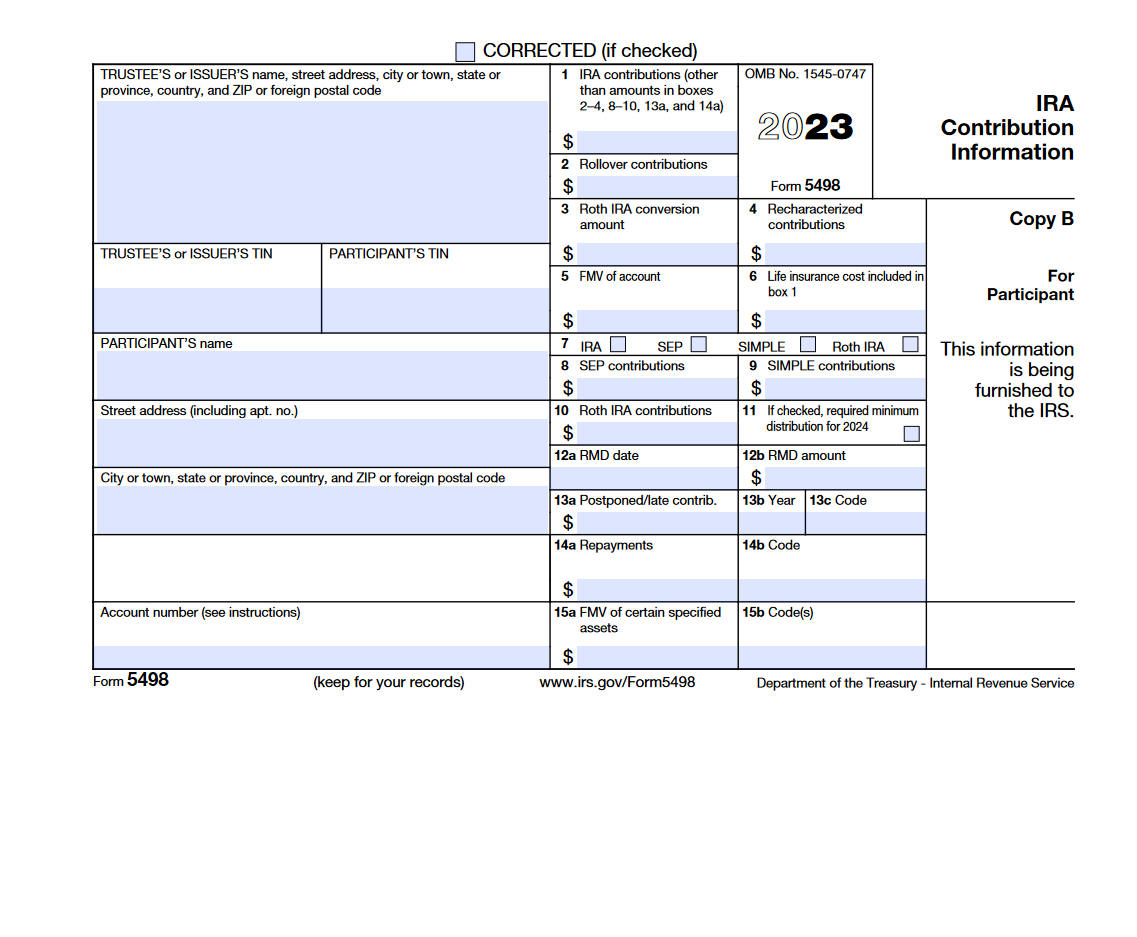

Vanguard Form 5498

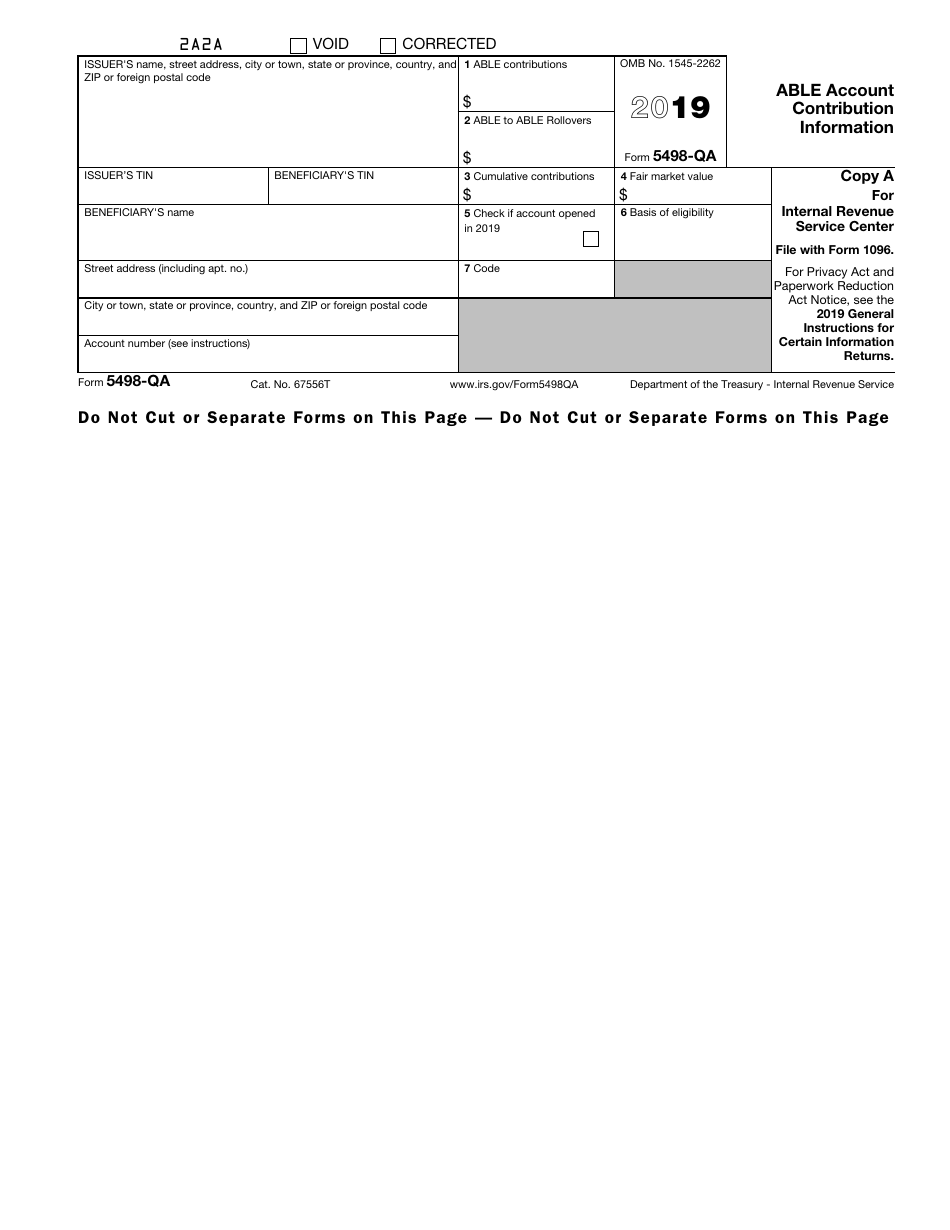

Vanguard Form 5498 - Use this process to authorize the deposit, transfer, or sale of stocks or bonds for which vanguard has received certificates that are either unsigned. Use this process to abandon/remove securities from your. Web all recharacterizations are reportable, but aren’t taxable, when you file. Web there are several other forms you might receive from vanguard. Web also includes information about vanguard brokerage services. Ad discover how a vanguard simplified employee pension ira can benefit your business today. Weekdays, 8 am − 10 pm (et) view directory. Find out when tax forms for your iras are available. Learn more about ira recharacterizations. Web irrevocable stock or bond power. Web “each year vanguard sends me form 5498 showing the amount i contributed to my roth. Learn more about ira recharacterizations. Use this process to abandon/remove securities from your. Complete, edit or print tax forms instantly. Web form 5498 tells you the fair market value of all the investments in your ira account. Web you will also receive a 5498 from vanguard confirming that a rollover took place. If your ira is not a roth ira, the irs requires you to begin withdrawing money. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Here. Is there any reason to keep these? Web irrevocable stock or bond power. Form 5498 is provided to clients and filed with the irs in may for informational purposes only. Web form 5498 reports the contribution. Here are the most common. Web a vanguard agent told me that vanguard does not send out form 5498s if there were no relevant transactions like contributions made to an ira, for that tax year. Upload, modify or create forms. Weekdays, 8 am − 10 pm (et) view directory. Complete, edit or print tax forms instantly. Web the information on form 5498 is submitted to. Learn more about ira recharacterizations. Brokerage assets are held by vanguard brokerage. Web you must report your 2020 irs contributions on your 2020 tax return. File this form for each. Because you can make a 2020 contribution as late. Web irrevocable stock or bond power. Web form 5498 reports the contribution. Brokerage assets are held by vanguard brokerage. Weekdays, 8 am − 10 pm (et) view directory. Ad discover how a vanguard simplified employee pension ira can benefit your business today. Web irrevocable stock or bond power. Web “each year vanguard sends me form 5498 showing the amount i contributed to my roth. Use this process to abandon/remove securities from your. Weekdays, 8 am − 10 pm (et) view directory. Web you must report your 2020 irs contributions on your 2020 tax return. Form 5498, which includes information about transactions in traditional iras,. Use information from your own records. Vanguard will send you and the irs the following two forms: Here are the most common. Web vanguard funds not held in a brokerage account are held by the vanguard group, inc., and are not protected by sipc. Web you must report your 2020 irs contributions on your 2020 tax return. Web “each year vanguard sends me form 5498 showing the amount i contributed to my roth. Weekdays, 8 am − 10 pm (et) view directory. Learn more about ira recharacterizations. Web also includes information about vanguard brokerage services. Brokerage assets are held by vanguard brokerage. Web you will also receive a 5498 from vanguard confirming that a rollover took place. Because you can make a 2020 contribution as late. Web you must report your 2020 irs contributions on your 2020 tax return. Web all recharacterizations are reportable, but aren’t taxable, when you file. Here are the most common. Web a vanguard agent told me that vanguard does not send out form 5498s if there were no relevant transactions like contributions made to an ira, for that tax year. Is there any reason to keep these? Find answers to common questions about irs form 5498, including why you received this form and. Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. File this form for each. Upload, modify or create forms. Complete, edit or print tax forms instantly. Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. Try it for free now! Web you must report your 2020 irs contributions on your 2020 tax return. Web form 5498 reports the contribution. Ad discover how a vanguard simplified employee pension ira can benefit your business today. Learn more about ira recharacterizations. Web “each year vanguard sends me form 5498 showing the amount i contributed to my roth. Because you can make a 2020 contribution as late. Brokerage assets are held by vanguard brokerage. Find out when tax forms for your iras are available. It also reports whether you rolled money over from another. Web all recharacterizations are reportable, but aren’t taxable, when you file.IRS Form 5498QA Download Fillable PDF or Fill Online Able Account

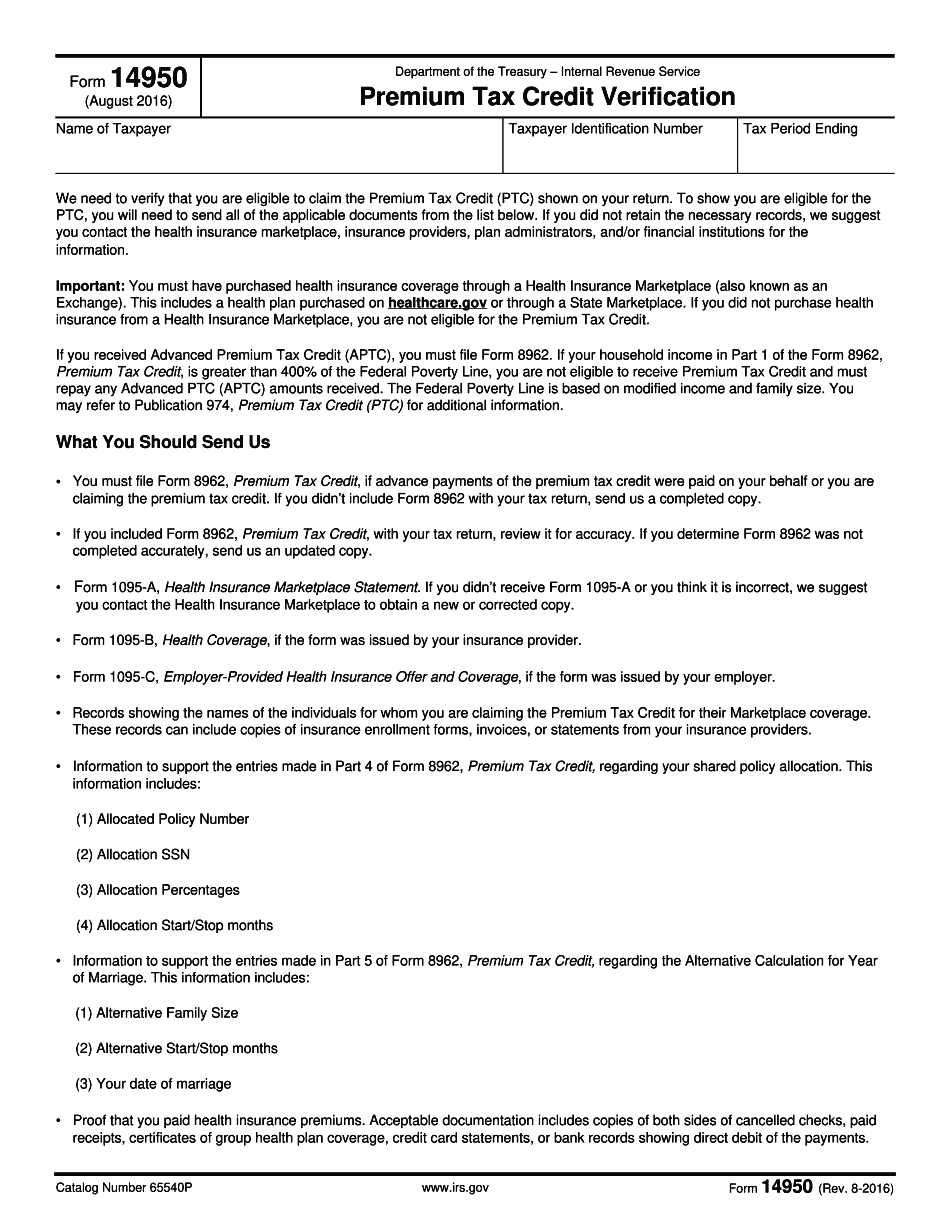

Instructions for Form 5498ESA (2023) IRS Fill Online, Printable

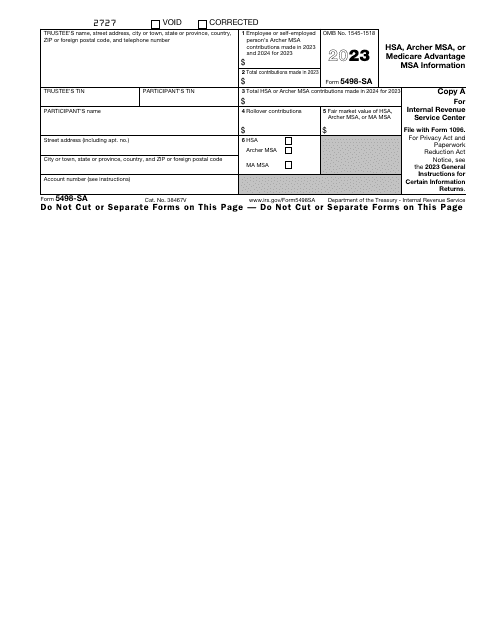

IRS Form 5498SA Download Fillable PDF or Fill Online Hsa, Archer Msa

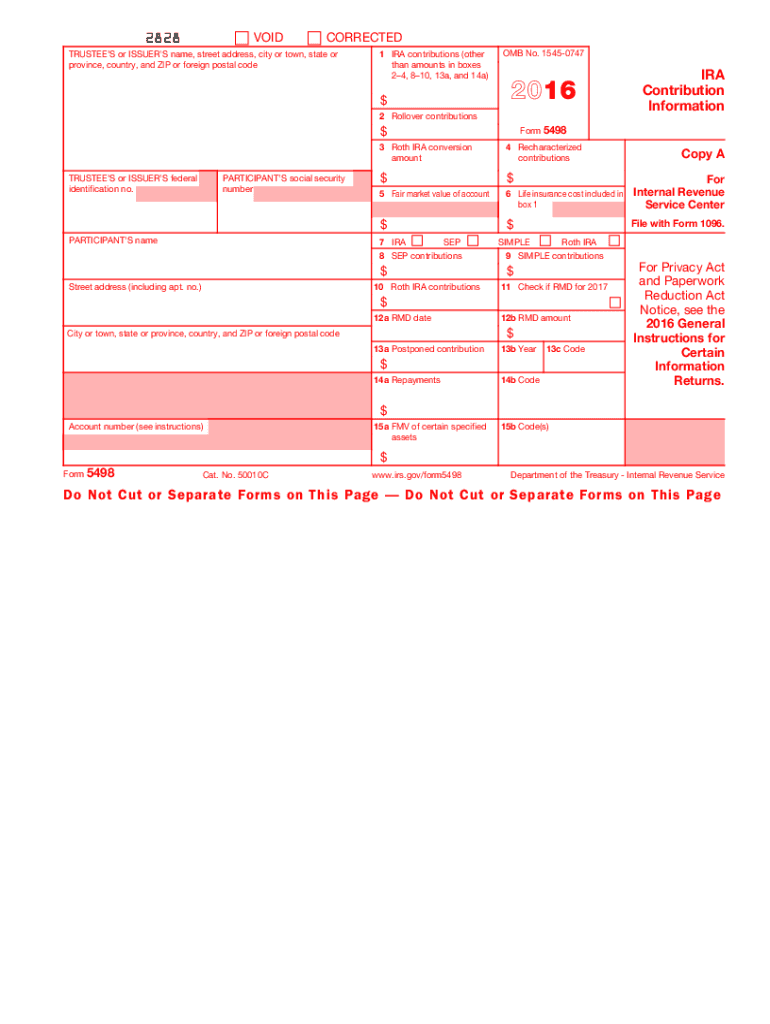

2016 Form IRS 5498 Fill Online, Printable, Fillable, Blank pdfFiller

IRS Form 5498 IRA Contribution Information

401k Rollover Form 5498 Universal Network

2019 Form IRS 5498Fill Online, Printable, Fillable, Blank pdfFiller

401k Rollover Form 5498 Universal Network

IRS Form 5498. IRA Contribution Information Forms Docs 2023

Form 5498SA HSA, Archer MSA, or Medicare Advantage MSA Information

Related Post:

:max_bytes(150000):strip_icc()/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)